In the Philippines, small businesses often find themselves in need of quick and reliable funding to fuel growth, manage cash flow, or seize new opportunities. Traditional bank loans, with their lengthy application processes and strict requirements, may not always be the ideal solution.

This is where alternative lending options come into play. These loan options offer a lifeline to small businesses that need capital without facing lengthy hurdles.

From peer-to-peer lending and crowdfunding to invoice financing and merchant cash advances, alternative lending provides a diverse array of financial products tailored to meet the unique needs of small enterprises.

Whether it's a startup looking to launch a new product, a retail store needing to stock up for the holiday season, or a service provider aiming to expand its team, alternative lending options enable small businesses to thrive in an increasingly competitive market.

Hence, in this article, we’ll be shedding some light on the numerous alternative financing options available for small businesses in the Philippines. By using these methods, Philippine businesses will be able to thrive and grow without any financial hiccups.

What is Alternative Lending, And What Are Its Key Characteristics

Alternative lending in the Philippines refers to non-traditional financing options available to individuals and businesses that may not qualify for conventional bank loans.

This financial innovation caters to the unique needs of various sectors by offering diverse lending solutions that are more accessible and flexible compared to traditional banking products.

In a country where many small and medium-sized enterprises (SMEs) and individuals find it challenging to secure bank loans due to stringent requirements and lengthy approval processes, alternative lending has become a vital resource for accessing much-needed capital.

Here’s a glimpse of the key characteristics of alternative lending -

1. Increased Access to Capital: Provides funding opportunities for businesses that may not qualify for traditional bank loans due to stringent requirements.

2. Faster Approval Processes: Offers quicker loan approvals and disbursements, enabling businesses to seize timely opportunities.

3. Flexible Terms: Provides more adaptable repayment terms and conditions tailored to the unique needs of small businesses.

4. Diverse Funding Options: Includes peer-to-peer lending, microfinance, online lending, and crowdfunding, giving businesses multiple avenues to secure capital.

5. Support for Underserved Markets: Helps businesses in rural or underserved areas access financial resources they might otherwise be unable to obtain.

6. Encourages Innovation: Empower startups and small enterprises to innovate and grow by providing necessary financial backing.

7. Promotes Financial Inclusion: Enhances access to financial services for all, contributing to broader economic development.

8. Risk Mitigation: Allows businesses to spread financial risk by diversifying their funding sources.

9. Boosts Economic Growth: Supports the overall economy by enabling small businesses to expand operations, create jobs, and contribute to GDP growth.

10. Community Development: Facilitates the growth of local businesses, which in turn can lead to improved community services and infrastructure development.

Also Read: Getting a Fast Loan in 15 Minutes in the Philippines

Types of Alternative Financing Options Available For Small Businesses in The Philippines

Small businesses in the Philippines often face significant challenges when trying to secure traditional bank loans due to strict requirements and lengthy approval processes.

However, to bridge this gap, a variety of alternative financing options have emerged, providing much-needed capital to fuel growth and innovation. These non-traditional funding sources offer more accessible, flexible, and faster solutions tailored to the unique needs of small enterprises.

From peer-to-peer lending and microfinance institutions to online lending platforms and crowdfunding, these alternative financing options are transforming the financial landscape for small businesses in the Philippines. They not only provide quick access to funds but also support financial inclusion by catering to underserved markets.

Here, take a closer look at all the different types of alternative financing options available for small businesses in the Philippines -

1. Peer-to-Peer Lending (P2P)

Peer-to-peer lending platforms connect small businesses directly with individual investors. These platforms facilitate loans without the need for traditional financial intermediaries, offering more flexible terms and faster approval processes.

P2P lending is ideal for businesses that may not meet the stringent requirements of traditional banks but still have a viable business plan and a good credit record.

2. Microfinance

Microfinance institutions provide small loans, savings, insurance, and other financial services to underserved and low-income entrepreneurs.

These institutions aim to promote financial inclusion by supporting small businesses and startups that lack access to conventional banking services.

Microfinance loans often come with lower interest rates and are designed to help businesses grow and become financially independent.

3. Online Lending Platforms

Online lending platforms offer a streamlined and convenient way for small businesses to access funds quickly. These platforms use technology to simplify the application and approval process, often providing loans within days.

Businesses can apply online, and decisions are based on a combination of creditworthiness and business performance metrics. This option is particularly useful for businesses needing rapid capital infusion.

4. Crowdfunding

Crowdfunding allows businesses to raise funds by collecting small amounts of money from a large number of people, usually via online platforms. There are various types of crowdfunding, including reward-based, equity-based, and debt-based.

This method not only provides necessary capital but also helps businesses build a community of supporters and potential customers.

5. Invoice Financing

Invoice financing enables businesses to borrow money against the amounts due from their customers. This option provides immediate cash flow by advancing funds based on outstanding invoices, helping businesses manage their working capital more effectively.

It’s particularly beneficial for businesses with long payment cycles or those experiencing cash flow gaps.

6. Merchant Cash Advances (MCA)

Merchant cash advances provide businesses with a lump sum of capital in exchange for a percentage of future credit card sales. This financing option is flexible and easy to obtain, as repayment is directly tied to sales volume.

MCAs are suitable for businesses with steady credit card transactions looking for quick access to funds without the constraints of fixed repayment schedules.

7. Asset-Based Financing

Asset-based financing involves securing a loan using the business’s assets as collateral, such as inventory, accounts receivable, or equipment. This type of financing is useful for businesses that may not have a strong credit history but have valuable assets.

It provides an alternative way to access capital while leveraging the existing assets of the business.

8. Revenue-Based Financing

Revenue-based financing offers capital in exchange for a percentage of future revenue. This model aligns the interests of the lender and the borrower, as repayments fluctuate with business performance.

It’s a viable option for businesses with strong revenue potential but lacking traditional collateral or credit history.

Also Read: Unlocking Capital for SMEs in the Philippines: A View of Modern Financing Options

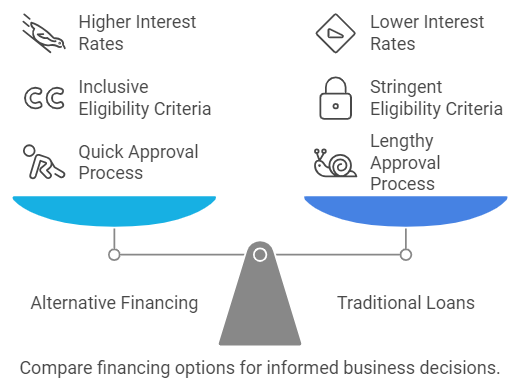

Alternative Financing Options Vs. Traditional Loan Options - Key Differences Between The Two Popular Lending Avenues

Choosing the right funding avenue has always been a crucial element for the growth and sustainability of businesses worldwide, and small businesses in the Philippines are no different. However, Filipino businesses, in particular, often find themselves at a crossroads when deciding between alternative financing options and traditional loan options.

Both avenues, alternative finance and traditional loans, offer distinct benefits and come with their own set of challenges. Hence, making the right decision is essential for business owners, but they’ll be able to do it only if they fully understand the key differences between them.

So, in this section of the article, we’ll take a closer look at the key differences between the two primary lending options available in the Philippines to give Filipino entrepreneurs a fair understanding of which loan option is best for them.

Here, take a look at the key differences between Alternative financing options and Traditional loan options in the Philippines -

1. Approval Process

Traditional loans from banks and credit unions typically involve a lengthy and rigorous approval process. Applicants must provide detailed financial statements, business plans, and personal credit histories, often resulting in a weeks-long wait for a decision.

This thorough scrutiny aims to minimize risk for the lender but can be a significant hurdle for small businesses needing quick access to capital.

In contrast, alternative financing options such as peer-to-peer lending and online loans streamline the approval process. These lenders can offer decisions within days or even hours by taking advantage of technology and simplified application procedures, thereby making them an attractive option for businesses seeking fast funding.

2. Eligibility Requirements

Eligibility for traditional loans often hinges on stringent criteria, including a strong credit score, substantial collateral, and a proven track record of profitability. These high barriers can exclude many small businesses, startups, and entrepreneurs from accessing necessary funds.

On the other hand, alternative financing options are typically more inclusive, with fewer requirements. Peer-to-peer lending platforms, for instance, consider a wider range of credit scores and often do not require collateral.

3. Interest Rates and Fees

Traditional loans generally offer lower interest rates compared to alternative financing options, reflecting the lower risk associated with these secured and well-vetted loans.

Banks can afford to provide competitive rates because they have extensive regulatory oversight and stable funding sources. On the other hand, Alternative financing, while more accessible, often comes with higher interest rates and fees.

The premium amount that is usually charged by alternate sources usually comes because of the increased risk their lenders take on and the speed at which these funds are provided.

4. Repayment Terms

Traditional loan repayment terms are usually long and fixed, spanning several years with regular monthly payments. This predictability can be beneficial for businesses that prefer stability and can manage long-term financial commitments.

Alternative financing options offer more flexible repayment terms, often tailored to the cash flow of the business. For instance, merchant cash advances are repaid through a percentage of daily credit card sales, aligning repayments with revenue.

5. Speed of Funding

The speed at which funds are disbursed is a critical difference between traditional loans and alternative financing. Traditional loans can take several weeks to months from application to disbursement, which can be impractical for urgent financial needs.

Conversely, alternative financing options excel in providing rapid access to capital. Online lenders and peer-to-peer platforms can often approve and release funds within a matter of days if not hours.

This quick turnaround can be crucial for businesses needing to capitalize on immediate opportunities or manage unexpected expenses, making alternative financing an ideal option for dynamic and fast-paced business environments.

6. Flexibility and Customization

Traditional loans are generally less flexible, with standardized products and terms that leave little room for customization based on individual business needs. Banks typically offer a fixed set of loan products, each with predefined terms and conditions.

Alternative financing, however, is characterized by its adaptability. Lenders in this space often provide customized solutions that can be tailored to specific business circumstances.

Also Read: Understanding Interest Rates and Fees for Business Loans in the Philippines

N90 offers fast financing to keep your Philippine SME moving. Apply online and get approvals within 24 hours! Transform Your Business with N90’s Fast Financing!

Advantages And Disadvantages of Alternative Financing Options Available in The Philippines

Small enterprises in the Philippines are increasingly turning to alternative financing options to meet their capital needs, and this is largely due to the fact that these non-traditional funding sources offer a range of benefits, from quicker access to funds to more flexible terms.

However, it must be noted that as good as they are, they also come with their own set of challenges and potential drawbacks, so businesses must carefully understand the numerous advantages and disadvantages of these alternative financing options before choosing either of them.

Here, to make the decision easier for small businesses in the Philippines, take a look at the pros and cons of alternative financing options available -

Advantages of Alternative Financing Options in The Philippines

1. Faster Access to Capital

Many alternative financing options, such as online lending platforms and peer-to-peer lending, offer quick approval processes and rapid disbursement of funds. This speed is crucial for businesses needing immediate capital to seize opportunities or address urgent financial needs.

2. More Flexible Requirements

Alternative financing often comes with more relaxed eligibility criteria compared to traditional bank loans. This flexibility allows businesses with less established credit histories or limited collateral to access the funding they might otherwise be denied.

3. Diverse Funding Sources

Alternative financing includes a variety of options, such as crowdfunding, microfinance, and invoice financing. This diversity provides businesses with multiple avenues to explore, each tailored to different needs and financial situations.

4. Improved Financial Inclusion

By offering services to underserved markets, alternative financing options promote financial inclusion. This helps small businesses and startups in rural or economically disadvantaged areas gain access to necessary capital.

5. Customizable Terms

Many alternative lenders provide flexible repayment terms and conditions, such as revenue-based repayments or asset-based loans. This adaptability allows businesses to align their financing with their specific cash flow patterns and operational needs.

Disadvantages of Alternative Financing Options in The Philippines

1. Higher Interest Rates

Alternative financing options often come with higher interest rates and fees compared to traditional bank loans. This premium compensates for the increased risk taken by lenders and can lead to higher overall borrowing costs for businesses.

2. Risk of Overborrowing

The ease of access to alternative financing might encourage some businesses to overborrow, leading to financial strain and potential repayment difficulties. Businesses need to assess their borrowing needs and capacity carefully.

3. Limited Regulation

Many alternative financing options, such as online lending platforms and P2P lending, operate in less regulated environments compared to traditional banks. This can lead to concerns about the credibility of lenders and the protection of borrower rights.

4. Potential for Fraud

The rise of online lending and crowdfunding platforms can expose businesses to risks of fraud or scams. It’s essential to conduct thorough due diligence to avoid engaging with unreliable or fraudulent lenders.

5. Impact on Credit Score

Some alternative financing options, particularly those involving frequent or high-cost borrowing, can negatively impact a business’s credit score. This can affect future borrowing opportunities and overall financial health.

Also Read: Top 5 Legit Online Loan Apps in the Philippines

How To Choose The Best Alternative Lending Option in The Philippines - Key Points To Consider Before Applying

Due to the emergence of alternative lending options, small businesses in the Philippines have access to a diverse range of financing options; however, selecting the most suitable option among them requires careful consideration.

So, to help businesses decide which alternative lending option is best for their specific needs, we will explore the key factors to consider when choosing the right alternative lending option.

By understanding your business needs, evaluating different lenders, and comparing terms and conditions, you can increase your chances of finding the perfect financing solution.

Here, take a look at the key factors to consider when applying for an alternative lending option in the Philippines -

1. Assess Your Funding Needs

Begin by evaluating the amount of capital you require and the purpose of the loan. Different alternative lending options cater to various funding needs, such as working capital, equipment purchases, or expansion.

2. Evaluate the Costs

Examine the interest rates, fees, and overall cost of borrowing associated with each alternative lending option. While some solutions offer quick access to capital, they may come with higher costs.

Compare these costs with your budget and financial projections to ensure the loan will be affordable and will not strain your finances.

3. Consider the Repayment Terms

Review the repayment terms and conditions of each financing option. Look for flexibility in payment schedules, such as daily or monthly repayments, and consider how they will fit with your business’s cash flow.

Choose an option that offers terms you can comfortably manage without risking your financial stability.

4. Check the Lender’s Credibility

Research the reputation and reliability of potential lenders. Verify their legitimacy, customer reviews, and regulatory compliance to avoid unreliable enterprises. A reputable lender will provide clear terms, transparent fees, and reliable customer service.

5. Understand the Application Process

Different alternative lending options have varying application processes. Some may require extensive documentation, while others offer streamlined, quick applications.

Choose a financing option that matches your ability to provide the necessary information and fits with your timeline for obtaining funds.

6. Review Eligibility Requirements

Compare the eligibility criteria for each lending option. Some alternatives, like peer-to-peer lending, may have more lenient requirements, while others might need specific qualifications or collateral.

7. Assess the Impact on Your Credit

Consider how the chosen lending option might affect your business’s credit score. Some alternative financing options, particularly those with frequent or high-cost borrowing, may impact your credit history.

8. Evaluate Additional Benefits

Some alternative lending options offer additional benefits, such as financial advice, business support, or networking opportunities. Assess whether these extras align with your business goals and could provide added value beyond just the loan itself.

9. Seek Professional Advice

Consult with financial advisors or mentors to gain insights into the best lending options for your business. Their expertise can help you navigate the complexities of alternative financing and make a well-informed decision based on your specific circumstances.

Also Read: Understanding Collateral Loans: Types, Pros, and Cons

Popular Sources Providing Alternative Financing Options in The Philippines

Alternative financing options have become a crucial lifeline for small businesses seeking capital, as traditional banking channels often present challenges such as strict requirements and lengthy approval processes.

Due to these reasons, many businesses are turning to innovative and accessible sources of funding since these alternative options not only offer diverse solutions but also cater to a wide range of financial needs, from immediate cash flow support to long-term growth capital.

Here, take a look at some of the top sources offering alternative financing to small businesses in the Philippines. From fintech platforms, microfinance institutions, online lending services, and crowdfunding campaigns to alternative investment platforms, we have got them all -

1. Fintech Platforms

- Kiva Philippines: A prominent player in the peer-to-peer lending space, Kiva connects small businesses with a global network of lenders. It provides low-interest loans with flexible terms, especially for underserved communities.

- Cashalo: This fintech platform offers quick personal and business loans with a user-friendly mobile application. Cashalo focuses on providing accessible credit to a wide range of borrowers.

2. Microfinance Institutions

- ASA Philippines Foundation: A leading microfinance institution, ASA offers small loans to entrepreneurs and small businesses, particularly in rural areas. Their services are tailored to support low-income individuals and communities.

- CARD MRI: The Center for Agriculture and Rural Development (CARD) offers a variety of microfinance products aimed at empowering small business owners and improving their financial inclusion.

3. Online Lending Platforms

- Loan Philippines: A digital platform that connects businesses with multiple lenders, offering a range of loan products. It streamlines the application process and provides quick access to funding.

- First Circle: This online lending platform provides unsecured loans to small businesses based on their revenue and financial health. It offers fast approval and flexible repayment terms.

4. Crowdfunding Platforms

- The Spark Project: A local crowdfunding platform that allows businesses to raise funds from individual backers in exchange for rewards or equity. It supports various projects, from startups to established enterprises.

- Sparks! Philippines: Another popular crowdfunding platform, Sparks! helps businesses and entrepreneurs connect with potential investors and supporters through online campaigns.

5. Alternative Investment Platforms

- Investree: This platform offers invoice financing and business loans through a digital interface, connecting businesses with institutional and retail investors. It provides fast and flexible funding solutions.

- BPI Direct BanKO: A subsidiary of the Bank of the Philippine Islands, BanKO offers microloans and financial products tailored for small businesses and startups, leveraging both traditional and digital channels.

Conclusion

As small businesses in the Philippines continue to navigate the complex and competitive landscape of business financing, numerous alternative lending options offer a vital resource for securing the capital they require to thrive and grow for the long term.

With their diverse range of solutions, ranging from peer-to-peer lending and microfinance to online platforms and crowdfunding, these non-traditional financing avenues provide Filipino entrepreneurs with much-needed flexibility, faster access to funds, and more inclusive opportunities compared to the ones offered by traditional banks.

While alternative lending options come with their own set of advantages and challenges, Filipino entrepreneurs can effectively address their funding requirements and support their business’s long-term success by carefully assessing their specific needs, evaluating their existing costs, and choosing the most suitable financing option.

However, they’ll only be able to do so if they embrace these modern financial tools to not only enhance their ability to seize new business opportunities but also to foster resilience and innovation in the dynamic world of small business.

Frequently Asked Questions (FAQs)

1. What is considered alternative lending?

Alternative lending refers to financial services provided by non-traditional financial institutions.

These lenders often use technology and data analytics to assess creditworthiness, allowing them to offer loans to individuals and businesses that might not qualify for traditional bank loans.

Alternative lending includes options like peer-to-peer lending, crowdfunding, invoice factoring, and merchant cash advances.

2. What is the best source for small business loans in the Philippines?

The best source for small business loans in the Philippines depends on several factors, including business size, creditworthiness, and loan amount.

While traditional banks like BPI, BDO, and Land Bank offer various options, alternative lenders and government-backed programs have gained prominence. Consider digital lenders like Tonik, Cashalo, and Tala for quick loans, and platforms like First Circle for revolving credit lines.

3. How do alternative lenders work?

Alternative lenders typically utilize technology to streamline the lending process and assess creditworthiness beyond traditional methods. They often focus on borrowers with limited credit history or those seeking quicker funding.

Unlike traditional banks, these lenders use data analytics to evaluate financial health and often offer shorter loan terms; hence, they might prioritize factors like cash flow and business performance over solely relying on credit scores.

4. Which loan is best for a startup business in the Philippines?

The best loan for a startup in the Philippines often depends on the business stage and funding needs. For early-stage startups with limited financial history, personal loans or credit cards might be accessible options, though they typically come with higher interest rates.

However, as the business grows, short-term loans or lines of credit can provide flexibility. For larger capital requirements or expansion, term loans or government-backed loans can be considered.