Applying for loans can be distressing, especially when a bad credit history makes obtaining approval seem impossible. In the Philippines, bad credit loans are an essential financial tool that can help individuals who struggle with poor credit or lack a credit profile entirely.

While these loans can provide much-needed funds during emergencies, navigating the landscape of requirements and approval can be daunting. Therefore, this blog dives a bit deeper and explores all the intricacies regarding bad credit loans, offering insight into how one can improve their overall loan approval chances and what diverse loan options are at their disposal.

Moreover, apart from all the points mentioned above, we’ll also be taking a look at the causes of bad credit in the Philippines, as well as the challenges borrowers face when trying to secure a loan while possessing a bad credit score.

It is fair to say that by following the guidelines and tips mentioned in this article, aware borrowers like you can secure the financial support you need without falling into a vicious financial trap, even if you suffer from a bad credit history.

What Are Bad Credit Loans in The Philippines?

Bad credit loans are types of loans specifically designed for individuals with poor or low credit scores, typically below 600. These loans are offered by lenders who are willing to take on higher risk by providing financing to borrowers who may have a history of missed payments, defaults, or high levels of debt.

Since bad credit loans are considered riskier for lenders, they often come with higher interest rates and more stringent terms, such as shorter repayment periods or larger fees. Borrowers may need to provide collateral or agree to more strict repayment schedules.

Despite the higher costs involved, bad credit loans provide an opportunity for individuals to rebuild their credit scores by demonstrating responsible repayment behavior.

Also Read: Tax Treatment of Interest Expense on Corporate Borrowings in The Philippines

Potential Causes of Bad Credit For Borrowers in The Philippines

Bad credit in the Philippines can arise from a variety of factors that negatively affect a borrower’s credit history and score. These factors can make it more difficult for individuals to access loans or obtain favorable loan terms.

Here, take a look at some of the common potential causes of bad credit for borrowers in the Philippines:

1. Missed Payments

Consistently missing payments on loans, credit cards, or other financial obligations is one of the most common reasons for bad credit. Delays or defaults can have a long-lasting impact on a borrower’s credit score.

2. High Credit Utilization

Using a large portion of available credit (e.g., maxing out credit cards) can indicate financial instability and increase the risk for lenders, resulting in a lower credit score.

3. Defaulted Loans or Debt

Failing to repay loans or defaulting on debts, whether personal loans, car loans, or mortgages, significantly damages credit scores and makes it harder to access future financing.

4. Frequent Loan Applications

Applying for multiple loans or credit cards in a short period signals to lenders that the borrower may be facing financial distress. Multiple hard inquiries can negatively impact credit ratings.

5. Lack of Credit History

A limited or nonexistent credit history can also result in a low credit score. Without evidence of responsible credit management, lenders may be hesitant to offer credit or loans.

Also Read: Guidelines on the Loan Moratorium in the Philippines

Challenges of Having a Bad Credit History When Applying For a Loan in Philippines

Having a bad credit history in the Philippines presents significant challenges when applying for loans. This is mainly because lenders in general view individuals with poor credit as high-risk borrowers, which can lead to higher interest rates, stricter terms, or even loan rejections.

Here, take a closer look at some of the key challenges of applying for a loan in the Philippines while having a bad credit rating:

1. Higher Interest Rates

Lenders may charge higher interest rates to borrowers with bad credit to offset the increased risk. This means higher monthly repayments and total loan costs over time.

2. Loan Rejection

Many financial institutions in the Philippines may outright reject loan applications from individuals with poor credit histories, especially for unsecured loans, as they pose a higher risk of default.

3. Limited Loan Options

With a bad credit score, borrowers may have fewer loan options available to them. They may only be eligible for loans from high-risk lenders who charge exorbitant fees or offer unfavorable terms.

4. Stricter Loan Terms

If approved for a loan, borrowers with bad credit may face stricter terms, such as shorter repayment periods, larger collateral requirements, or higher down payments.

5. Collateral Requirement for Secured Loans

With a poor credit score, borrowers may be required to provide collateral for loans (such as a car or property) to secure the loan. This puts their assets at risk if they are unable to repay the loan.

6. Increased Scrutiny During the Application Process

Borrowers with bad credit may face more intense scrutiny and documentation requirements during the loan application process. Lenders may require a higher level of verification of income, employment, and other financial details.

Also Read: Pros and Cons of Top 5 Legit Online Loan Options in the Philippines

Benefits of Availing of Bad Credit Loans in The Philippines

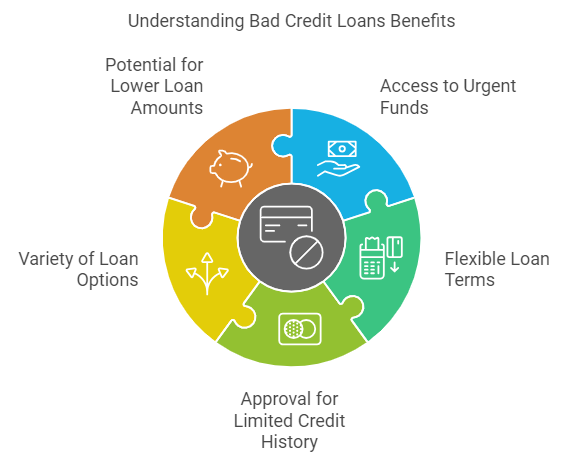

Availing of a bad credit loan in the Philippines can be a viable option for individuals with poor credit histories who need immediate financial assistance. While these loans come with certain risks, they also offer benefits that may help borrowers rebuild their credit scores and improve their financial situation.

Take a look at some of the crucial benefits of availing of bad credit loans for borrowers with a bad credit history in the Philippines:

1. Access to Urgent Funds

Bad credit loans provide access to much-needed funds, especially during emergencies when traditional loans may not be an option. This allows borrowers to address immediate financial needs despite their poor credit history.

2. Flexible Loan Terms

Some bad credit loans offer flexible repayment terms, including longer repayment periods or smaller monthly installments, making it easier for borrowers to manage their debt and avoid financial strain.

3. Approval for Borrowers with Limited Credit History

Bad credit loans may be a viable option for individuals who have limited or no credit history. Lenders are often more willing to approve these loans based on factors like income or employment rather than credit history alone.

4. Variety of Loan Options

Borrowers can choose from various types of bad credit loans, such as secured loans, payday loans, or personal loans, depending on their needs and the lender’s criteria. This flexibility allows individuals to find the right loan type for their financial situation.

5. Potential for Lower Loan Amounts

Bad credit loans typically offer smaller loan amounts, which may be easier for borrowers to repay compared to larger, traditional loans. This can help manage short-term financial issues without taking on excessive debt.

Also Read: Tala Loan App Legitimacy Discussion

N90’s fast financing solutions are designed for your success. Get the required business loans for your Philippine SME today! Apply today and receive loan approvals within 24 hours! Take your business to new heights with loans tailored to meet its needs.

How to Improve Your Chances of Getting Loans in The Philippines With a Bad Credit History

Getting a loan with a bad credit history can be difficult, but it’s not impossible. Lenders typically view borrowers with poor credit as higher risk, but there are several strategies you can adopt to improve your chances of approval.

Here’s a guide to help you navigate the loan process with a bad credit history in the Philippines:

1. Check and Improve Your Credit Score

Obtain a copy of your credit report to identify any discrepancies or errors. Dispute any inaccuracies with the credit bureaus to ensure your score reflects your actual financial situation.

Moreover, pay off outstanding debts, reduce credit card balances, and ensure that you make timely payments on current financial obligations to gradually improve your credit score.

2. Provide Collateral for Secured Loans

For secured loans, offer valuable assets such as your car or property as collateral. This provides the lender with assurance that they can recover their loan if you default, increasing your chances of approval.

3. Apply with a Co-Signer

If possible, apply with a co-signer who has a better credit history. The co-signer will be responsible for the loan in case you default, which can make lenders more willing to approve your application.

4. Consider a Smaller Loan Amount

Lenders may be more inclined to approve smaller loans since they represent less risk. Opting for a lower loan amount can improve your chances of securing a loan with bad credit.

5. Provide Proof of Stable Income

Lenders want to ensure you can repay the loan. Provide proof of a stable income, such as payslips, tax returns, or bank statements, to demonstrate your ability to meet monthly repayment obligations.

6. Lower Your Debt-to-Income Ratio

Pay off or reduce existing debts to lower your debt-to-income ratio. This shows lenders that you are financially responsible and can manage additional loan repayments.

7. Explore Lenders Specializing in Bad Credit Loans

Some financial institutions in the Philippines specialize in offering loans to individuals with bad credit. These lenders may have more flexible eligibility criteria and are more willing to work with borrowers who have poor credit histories.

8. Be Transparent About Your Financial Situation

If your bad credit history is due to specific circumstances (e.g., medical emergency, job loss), explain this to the lender. Transparency can help build trust and may increase your chances of approval.

9. Avoid Multiple Loan Applications

Repeatedly applying for loans in a short period can negatively impact your credit score. Lenders may see this as a sign of financial desperation, which can further reduce your chances of approval.

Also Read: What to Know Before Signing a Small Business Loan Agreement in The Philippines

Are you looking to apply for a loan in the Philippines but are having a tough time securing one due to your bad credit rating? Check out this video. It provides useful tips and strategies on how to increase your credit score in the Philippines, which can help you get approved for loans, even if you have a bad credit history or score.

Exploring Prominent Bad Credit Loan Providers in The Philippines

If you have a bad credit history and are struggling to secure a loan, there are still options available in the Philippines. Several financial institutions and online lenders cater to individuals with poor credit scores, offering various types of bad credit loans.

Here's a list of prominent bad credit loan providers in the Philippines:

1. Home Credit Philippines

Home Credit specializes in providing loans to individuals with bad credit through easy-to-qualify personal loans and in-store financing for electronics, appliances, and other consumer goods. It has a relatively lenient credit score requirement, and approval can happen quickly through its mobile app.

2. Cashalo

Cashalo offers quick, small loans to borrowers with bad credit. Loan amounts are typically low, making it more accessible to people who need immediate cash. The application process is entirely online, and approval can be done within hours.

3. LenddoEFL

LenddoEFL is a digital lender that uses social data and other non-traditional credit-scoring methods to evaluate applicants. This makes it a good option for individuals with bad credit or those with no formal credit history. It offers quick disbursement and online application.

4. Tala Philippines

Tala is an online lender that provides personal loans to people with bad credit. The app assesses the borrower's creditworthiness using alternative data, making it accessible to those with poor credit scores or no credit history. Loan amounts are small, with flexible repayment terms.

5. GLoan (GCash)

GLoan, powered by GCash, offers personal loans to individuals with a less-than-perfect credit score. The application is done via the GCash mobile app, and approval is quick, with funds disbursed directly to the borrower’s GCash wallet.

Also Read: Guide to Financing Your Small Business With Microloans in The Philippines

Role Fintech Plays in Assisting Borrowers to Acquire Loans While Possessing a Bad Credit History

Fintech has revolutionized the lending landscape by providing innovative solutions to borrowers, especially those with bad credit histories. By leveraging technology, fintech companies can offer faster, more accessible loan options to individuals who may have previously been excluded by traditional banks due to poor credit scores.

Here's how fintech platforms play a crucial role in helping potential borrowers to apply and secure bad credit loans in the Philippines:

1. Alternative Credit Scoring Models

Fintech platforms use alternative data, such as payment history for utilities, social media activity, and mobile phone data, to evaluate creditworthiness. This allows borrowers with bad credit scores to be assessed based on a broader range of financial behaviors, increasing their chances of loan approval.

2. Faster Loan Processing and Approval

Through automated systems and artificial intelligence (AI), fintech lenders can process loan applications quickly, reducing the approval time from days or weeks to just a few minutes. This is especially beneficial for borrowers in urgent need of funds, despite having bad credit.

3. Lower Qualification Barriers

Many fintech lenders have more lenient eligibility criteria compared to traditional banks, making it easier for individuals with poor credit histories to access loans. They often require less documentation and a lower minimum income, thus expanding access to credit for a wider audience.

4. Personalized Loan Offers

By using big data and AI, fintech platforms can tailor loan products to suit the individual needs of borrowers with bad credit. This includes offering smaller loan amounts, flexible repayment terms, and varying interest rates based on the borrower's risk profile, rather than relying on rigid credit score requirements.

5. Improved Financial Inclusion

Fintech has significantly improved financial inclusion by providing loan access to underserved or financially excluded groups. Borrowers in rural areas or those without traditional credit histories now have more options, helping bridge the gap between them and financial services.

Conclusion

In conclusion, while having a bad credit history in the Philippines can make securing a loan challenging, it is not an insurmountable obstacle. With the rise of fintech solutions and alternative lenders, borrowers with poor credit scores now have more options than ever before.

By thoroughly understanding the eligibility criteria of each loan they apply for, exploring alternative lending platforms, and taking steps actively to improve their overall creditworthiness, individuals can increase their chances of getting approved for a loan in the Philippines without any hassle.

Additionally, maintaining transparency with lenders, borrowing responsibly, and seeking guidance from financial advisors can help secure the financial support needed, even for those with less-than-ideal credit histories. Bad credit doesn’t have to be a permanent roadblock, and the growing range of loan options only offers more hope for those seeking a fresh financial start.