Choosing the right car financing option is an essential part of the car-buying process. It's not just about the make or model of the car; the method of payment plays a crucial role in your overall financial experience as well.

Buyers in the Philippines often face the tough decision between bank auto loans and dealer car financing, mainly because each comes with its own set of challenges and benefits. While bank loans may offer competitive rates, the approval process can be lengthy and strict. Alternatively, dealer financing provides convenience but often at the cost of higher interest rates.

Therefore, this comprehensive blog will provide you with a thorough understanding of bank car loan vs dealer financing Philippines by comparing their pros and cons, and key features. Doing so will help you decide which option suits you better in the context of the growing auto finance market in the Philippines. So, without further ado, let us jump right into the details.

What is Bank Financing or Bank Auto Loan?

A bank auto loan in the Philippines is a financing option that allows individuals to purchase a vehicle through a bank loan, repaid in monthly installments. This type of loan covers a significant portion of the vehicle’s cost, making it more affordable for buyers.

Essentially, a bank auto loan offers a practical and flexible way to finance a vehicle in the Philippines, with competitive terms that make vehicle ownership more accessible for the common individual.

Here are its key features:

1. Loan Amount

Banks generally finance up to 80% of the car’s value, while the borrower provides a down payment covering the rest. This reduces the upfront cost, making it easier to afford a new or used vehicle.

2. Flexible Loan Terms

Loan terms typically range from 12 to 60 months, allowing borrowers to choose a repayment period that suits their financial capacity. Longer terms result in lower monthly payments, though they may increase the total interest paid.

3. Competitive Interest Rates

Banks offer competitive interest rates, usually fixed for the loan term, which vary depending on the applicant’s credit profile, loan term, and market conditions. Fixed rates provide predictable payments, making budgeting easier.

4. Eligibility Requirements

Applicants need proof of income, valid identification, and good credit standing to qualify. Banks assess an applicant’s financial stability to ensure repayment ability, often requiring employment tenure or business stability.

5. Convenient Application Process

Many banks offer online application options for auto loans, streamlining the process and allowing applicants to apply from home. Loan approval typically takes a few days, depending on the bank’s requirements.

Also Read: Understanding Cash Flow Loans for Your Small Business in The Philippines

What is Dealer Financing?

Dealer financing is a vehicle financing option arranged directly through the car dealership, often in partnership with banks or finance companies. It allows buyers to secure a loan and purchase a vehicle in one seamless process at the dealership.

Dealer financing is a convenient, quick option for buyers seeking on-the-spot financing with potential promotional benefits, though it may come with slightly higher interest rates compared to direct bank loans.

Here are some of its key features:

1. One-Stop Convenience

Buyers can complete the financing and vehicle purchase at the dealership, saving time by eliminating the need to visit a bank. Dealership staff guide applicants through the financing process, making it simple and streamlined.

2. Promotional Offers

Dealerships often offer special promotions like low or zero interest rates, rebates, and flexible down payment options, especially for new cars. These incentives can reduce the overall cost of the loan, providing additional savings.

3. Flexible Loan Terms

Dealer financing typically provides a range of loan terms, often from 12 to 60 months. These flexible terms allow buyers to choose a monthly payment that fits their budget, with longer terms resulting in lower installments.

4. Fast Approval Process

Since dealer financing is handled on-site, approval can be faster compared to traditional bank loans. Some dealerships can even approve loans on the same day, making it ideal for buyers who need immediate vehicle access.

5. Limited Negotiation on Interest Rates

Interest rates in dealer financing may be higher than bank rates due to dealership markups. The dealership sets rates based on partnerships with banks, so rates may be less negotiable, especially compared to securing a loan independently through a bank.

6. Wide Range of Financing Partners

Dealerships often partner with multiple banks and finance companies, increasing the likelihood of finding a loan package tailored to the buyer’s credit profile and vehicle preference.

Also Read: How Much Down Payment Is Needed for a Small Business Loan?

Accelerate your Philippine SMEs' growth exponentially! Apply today for N90’s fast financing solutions and get potential loan approvals within 24 hours! Unleash your business’s full potential today! Get in touch with us to learn more.

Bank Auto Loan vs Dealer Car Financing in the Philippines - Crucial Differences Between The Two

Both bank auto loans and dealer car financing offer accessible options for purchasing a vehicle in the Philippines, but they have crucial differences that impact cost, flexibility, and convenience.

Here, take a look at some of those essential differences below:

1. Interest Rates

Bank auto loans usually offer lower, fixed interest rates compared to dealer financing. Banks tend to have more competitive rates as they don’t include dealership markups, resulting in lower overall loan costs.

Dealer financing rates can be higher due to these markups, especially if they’re arranged through third-party finance companies.

2. Convenience and Processing Speed

Dealer financing is often more convenient and faster, allowing buyers to handle both the loan and vehicle purchase at the dealership. Many dealerships can offer same-day loan approvals which are ideal for immediate purchases.

Bank loans, on the other hand, require additional steps, such as visiting a bank, which may take a few days for approval but are beneficial for those seeking lower rates.

3. Promotions and Incentives

Dealer financing frequently includes promotional offers like zero-down payment options, rebates, or low introductory rates, especially for new models. These incentives can make dealer financing attractive despite potentially higher rates.

Banks rarely offer such promotions, as they focus more on providing stable terms and long-term savings.

4. Loan Terms and Flexibility

Bank auto loans typically provide a range of terms, from 12 to 60 months, allowing borrowers to choose terms suited to their financial situation.

Dealer financing also offers term flexibility but may have specific restrictions tied to promotional deals, impacting the loan’s final cost if terms are adjusted.

5. Eligibility and Credit Requirements

Banks generally have stricter eligibility criteria, often requiring good credit scores, proof of stable income, and a longer application review. Dealer financing, in contrast, may be more lenient and work with third-party lenders who are open to a wider range of credit profiles, making it more accessible to buyers with limited credit.

6. Overall Cost

In the long run, bank loans usually lead to a lower total cost due to their lower interest rates and straightforward terms. While dealer financing provides convenience and potentially enticing offers, higher interest rates, and added fees can increase the overall cost. Buyers focused on long-term savings may find bank loans more advantageous.

Also Read: Steps to Streamline and Improve Your Invoice Factoring Application

How to Decide Which Option is Suitable For Your Financial Needs in The Philippines?

Choosing between a bank auto loan and dealer car financing in the Philippines depends on factors like budget, convenience, and long-term financial goals. Each option has distinct benefits, and the right choice depends on individual financial priorities.

Here’s a guide to help decide which option suits your needs better in the Philippines:

1. Consider Your Budget and Interest Rate Preferences

If your priority is lower monthly payments and long-term savings, a bank auto loan’s typically lower interest rates may be more suitable. Bank loans often lead to reduced overall costs.

However, if immediate cash flow is tight, dealer financing promotions, such as zero down payments, may better fit your current budget.

2. Evaluate Your Need for Convenience and Processing Speed

Dealer financing is the more convenient option if you’re looking to complete both the loan and purchase quickly in one place. Some dealerships offer same-day approvals, perfect for buyers who need immediate access to a vehicle.

If you have time for a slightly longer process, a bank loan might be worth the wait for lower rates.

3. Check Promotional Offers and Benefits

Dealer financing often includes exclusive promotions, like low introductory rates or cash rebates. These offers can reduce the initial cost and make the purchase more appealing.

However, ensure you understand the terms of these promotions, as they may lead to higher payments later on. Bank loans rarely offer promotions but provide stable rates and terms.

4. Assess Eligibility Criteria and Credit Standing

Banks typically have stricter credit and income requirements, ideal for those with good credit seeking the best rates. Dealer financing may be more flexible, catering to a wider credit range.

If you have limited credit or income history, dealer financing may be easier to obtain, though possibly at higher interest rates.

5. Factor in Your Long-Term Financial Goals

If long-term affordability is your goal, a bank loan’s lower interest rates and fixed terms could align with your financial plans. Dealer financing may suit short-term needs, especially with promotional perks, but may be more costly in the long run.

Consider your future plans to decide which option will better support financial stability.

Also Read: Understanding Non-Recourse Invoice Factoring in The Philippines

Do you need more clarity in deciding which financing option is best for you in the Philippines? Check out this video. It discusses the advantages and disadvantages of various car financing options, including bank and dealership loans, offering comprehensive guidance for potential car buyers in the Philippines.

Tips And Strategies For Securing a Bank Auto Loan or Dealer Financing in The Philippines

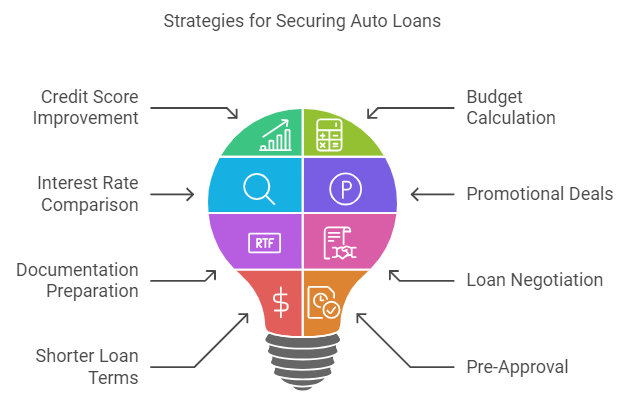

Securing a bank auto loan or dealer financing in the Philippines requires preparation to get the best terms, rates, and approvals. With the right strategies, you can improve your chances of obtaining a loan that suits your financial needs.

Here are essential tips and strategies for securing either an auto loan or dealer financing in the Philippines:

1. Check and Improve Your Credit Score

A strong credit score increases your chances of approval and secures better interest rates. Review your credit report before applying and address any discrepancies.

If possible, pay down existing debts to boost your score, making you a more favorable candidate for both bank and dealer financing.

2. Calculate Your Budget and Loan Affordability

Determine how much you can afford for a down payment, monthly installments, and the loan term. Being clear on your budget allows you to choose terms that won’t strain your finances. This financial preparation also helps you confidently negotiate with banks or dealerships.

3. Compare Interest Rates and Loan Terms

Shop around and compare interest rates and terms offered by various banks and dealerships. Even a slight difference in interest rates can impact your monthly payments and overall loan cost.

Choose an option that provides competitive rates without sacrificing terms that align with your budget.

4. Consider Promotional Deals for Dealer Financing

Dealerships frequently offer promotions, such as zero down payment or low introductory rates. Take advantage of these offers, but ensure you understand the terms and potential costs once the promotion ends.

Promotional deals can be beneficial but require careful consideration to avoid future financial surprises.

5. Prepare Necessary Documentation

Gather documents such as proof of income, valid identification, and other required paperwork in advance. Having these documents ready speeds up the application process and demonstrates your reliability as a borrower.

Moreover, it also helps avoid delays when you’re ready to make your purchase.

6. Negotiate Loan Terms and Conditions

Don’t be afraid to negotiate, especially with dealerships. You may be able to secure a lower interest rate, extended warranty, or other benefits. Even minor adjustments can lead to long-term savings.

Be prepared with research on current rates and have a clear idea of the terms you want.

7. Consider Shorter Loan Terms

While longer terms reduce monthly payments, shorter terms often save on interest over the life of the loan. If you can afford higher monthly installments, opt for a shorter loan term to reduce total loan costs, making it a smarter financial choice.

8. Get Pre-Approved When Possible

Some banks offer pre-approval, allowing you to determine your eligibility and loan amount before shopping. Pre-approval can also give you an edge in negotiations, as it shows dealerships that you’re a serious, qualified buyer ready to make a purchase.

Conclusion

In conclusion, choosing between bank and dealer financing depends on personal financial situation and preferences. This choice is deeply personal and should be approached with careful consideration and knowledge.

By closely examining both options, you'll enable yourself to make a sensible decision that aligns with your current financial standing and future aspirations. Thorough comparison and understanding of both options are crucial for making the right financial decision.

Lastly, in your journey to purchasing a car in the Philippines, remember that doing your homework pays off. Thoroughly weigh the pros and cons, and the key features, of both bank and dealer financing, and only consider options that match your needs and financial capabilities.

Frequently Asked Questions (FAQs)

1. Is it better to get a car loan from a bank or dealer in the Philippines?

In the Philippines, getting a car loan from a bank often provides lower interest rates and long-term savings, ideal for budget-conscious buyers. However, dealer financing offers convenience, faster approval, and promotional deals, such as zero down payments, making it attractive for immediate purchases.

Ultimately, the better choice depends on your priorities: affordability with a bank or convenience with a dealer.

2. Which Philippine bank is the best for car loans?

Several Philippine banks offer competitive car loan options. For instance, Metrobank provides interest rates starting at 4.63% with terms up to 60 months. BPI offers loans covering up to 85% of the vehicle price with flexible repayment terms.

Security Bank features quick approval times and free first-year car insurance. The best choice depends on your financial needs and preferences.

3. How long does a bank take to approve a car loan in the Philippines?

In the Philippines, banks typically take 3 to 5 banking days to approve a car loan application, provided all required documents are submitted accurately. Some banks, like PSBank, offer faster processing times, with approvals within 24 hours.

Approval durations can vary based on the bank's policies and the completeness of your application.

4. What is the minimum income for a car loan in the Philippines?

In the Philippines, the minimum monthly income required to qualify for a car loan typically ranges from PHP 30k to PHP 50k, depending on the lender's policies.

For instance, some banks may set the threshold at PHP 40k, while others might require a higher amount. It's essential to check with specific banks for their exact income requirements.