Securing the right financing is crucial for physicians looking to start or expand their medical practice in the Philippines. Fortunately, medical practice loans provide the necessary capital to purchase equipment, renovate clinics, or manage operational costs.

However, with various loan options available from banks, government programs, and specialized financial institutions, choosing the best loan can take time and effort. So, this guide aims to help physicians understand the key factors to consider and how to select the ideal financing solution to grow their medical practice successfully.

Additionally, to assist with their venture, this guide will also break down the types of medical practice loans available, the qualifications needed, and the practical uses for these funds to help you make an informed decision. So, without much ado, let us dive into all the relevant details.

What Are Medical Practice Loans?

Medical practice loans are specialized financing options designed to help physicians and healthcare providers establish, expand, or manage their medical practices. These loans provide capital for purchasing medical equipment, renovating clinics, covering operational expenses, or managing cash flow.

Offered by banks, financial institutions, or government programs, medical practice loans typically feature flexible terms and competitive interest rates tailored specifically to the needs of healthcare professionals in managing their practice and growth.

Also Read: Applying for a Maya Personal Loan

Importance of Small Business Loans for Physicians in the Philippines

Access to funding is critical for physicians in the Philippines as it allows them to establish, grow, and sustain their medical practices. Here are key reasons why funding is essential for Physicians in the Philippines -

1. Establishing a Medical Practice

Physicians need capital to start a practice, covering costs such as renting or purchasing a clinic, medical equipment, and furnishings.

2. Upgrading Medical Equipment

Advanced medical tools and technologies are crucial for providing high-quality care. Loans enable physicians to invest in the latest medical equipment.

3. Clinic Expansion and Renovation

Funding helps physicians expand their facilities to accommodate more patients, improve service, and enhance the clinic environment.

4. Managing Operational Expenses

Loans provide cash flow support to cover daily operating expenses like payroll, utilities, and supplies, ensuring uninterrupted service.

5. Keeping Pace with Industry Standards

Physicians need access to continuous education and technology to stay competitive. Funding helps physicians maintain high standards and adopt new healthcare practices.

Also Read: Difference Between Invoice Factoring and Invoice Discounting

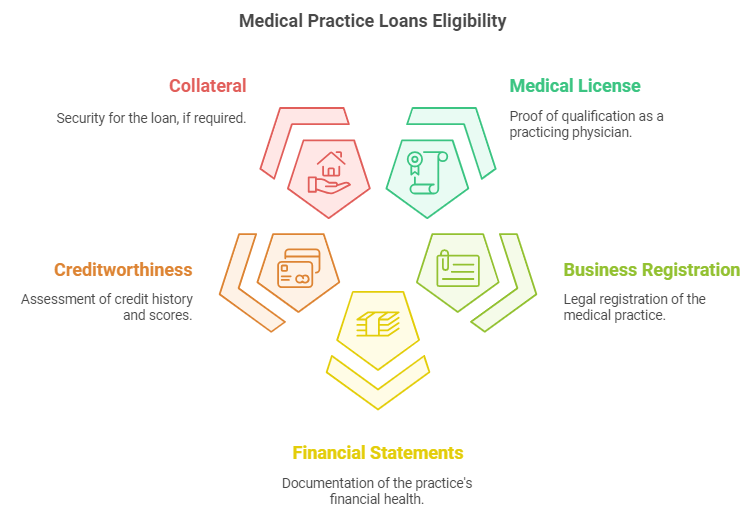

Eligibility Criteria For Medical Practice Loans For Physicians in Philippines

Physicians looking to apply for medical practice loans in the Philippines must meet specific eligibility criteria set by banks and financial institutions. These criteria ensure the applicant can manage and repay the loan responsibly.

Here, take a look at the mandatory eligibility criteria for medical practice loans for physicians in the Philippines -

1. Medical License

Applicants must demonstrate their qualification as practicing physicians by having a valid and active medical license issued by the Philippine Regulatory Commission (PRC).

2. Business Registration

The medical practice must be legally registered with the Department of Trade and Industry (DTI) or the Securities and Exchange Commission (SEC) for those with established clinics.

3. Financial Statements

Applicants may need to provide financial statements, including income statements and balance sheets, to prove the profitability and stability of their medical practice.

4. Creditworthiness

A good credit history is crucial for loan approval. Lenders will assess personal and business credit scores to determine eligibility and set interest rates.

5. Collateral (if required)

Some lenders may require collateral, such as real estate or equipment, to secure the loan, especially for more significant loan amounts. However, unsecured options are also available.

Also Read: How Invoice Factoring and Debtor Financing Can Improve Cash Flow

Types of Medical Practice Loans Available in The Philippines

Physicians must consider several types of medical practice loans when evaluating financing options. Each type offers different perks, so it is crucial to weigh them carefully.

Additionally, factors like repayment terms, qualification process, interest rates, and collateral requirements also play a significant role in choosing the right loan.

Here, take a look at the different types of medical practice loans available for physicians in the Philippines -

1. Secured Business Loans

Secured business loans are a standard financing option for physicians looking to establish or expand their medical practices in the Philippines. These loans require collateral, such as real estate, medical equipment, or other valuable assets, which the lender can claim if the borrower defaults.

Since the lender's risk is reduced, secured loans typically offer lower interest rates and higher loan amounts than unsecured options. This makes them ideal for physicians with significant assets who need substantial capital for major investments like clinic renovations or purchasing advanced medical equipment.

2. Unsecured Business Loans

Unsecured business loans provide funding without the need for collateral, making them accessible to physicians who may not have significant assets to pledge. These loans are based primarily on the borrower's creditworthiness, business performance, and financial history.

While unsecured loans offer greater flexibility and quicker approval times, they often have higher interest rates and lower loan amounts than secured loans.

This type of loan is suitable for physicians who require smaller amounts of capital for operational expenses, marketing efforts, or minor expansions without risking personal or business assets.

3. Government-Backed Loans

Government-backed loans are specifically designed to support small and medium-sized enterprises (SMEs), including medical practices, in the Philippines.

Programs like the Pondo sa Pagbabago at Pag-asenso (P3) Program offered by the Department of Trade and Industry (DTI) and SB Corp. provide loans with favorable terms, such as lower interest rates and extended repayment periods.

These loans aim to promote economic growth and inclusivity by making financing more accessible to healthcare professionals who might face challenges securing traditional bank loans.

4. Equipment Financing Loans

Equipment financing loans are tailored specifically for purchasing medical equipment and technology essential for running a modern medical practice.

These loans allow physicians to acquire necessary tools, such as diagnostic machines, surgical instruments, and electronic health record systems, without depleting their working capital. The equipment itself often serves as collateral, which can make the loan easier to obtain and provide more favorable terms.

Moreover, it is especially ideal for physicians who want to upgrade their facilities with the latest technology to improve patient care and operational efficiency.

5. Microfinance Loans

Microfinance loans cater to small-scale medical practices and startups that may not qualify for larger traditional loans. Microfinance institutions and some banks offer these loans with smaller amounts of capital and more flexible eligibility criteria.

Microfinance loans are particularly beneficial for solo practitioners or small clinics needing funds for initial setup costs, essential equipment, or immediate operational needs.

They often offer manageable repayment terms and lower interest rates, making them accessible to physicians in the early stages of their practice.

6. Franchise Financing Loans

Franchise financing loans are available for physicians interested in opening or expanding an established medical brand franchise. These loans cover the franchise's purchasing costs, including franchise fees, setup costs, and initial marketing expenses.

Lenders offering franchise financing often provide specialized terms that reflect the franchise's proven business model and support structure, reducing the perceived risk.

This type of loan is ideal for physicians who want to use the franchise's brand recognition and operational support to ensure a successful and scalable medical practice.

Also Read: Factoring and Invoice Discounting: Advantages and Disadvantages

Avail N90’s fast financing solutions are tailored to meet your Philippine SMEs' needs. Apply online and get potential loan approvals within 24 hours. Get the financial support your business needs today! Apply Now!

Top Medical Practice Loan Providers in the Philippines

Physicians in the Philippines seeking to establish or expand their medical practices have access to various loan providers offering specialized financing solutions.

These institutions understand the unique needs of healthcare professionals and provide tailored loan products to support the growth and sustainability of medical practices.

Here are some of the top medical practice loan providers in the Philippines -

1. BDO Unibank

BDO Unibank is one of the Philippines' most significant and reputable banks. It offers a range of loan products tailored for medical professionals. Its business loans provide flexible terms and competitive interest rates, ideal for purchasing medical equipment, renovating clinics, or expanding services.

BDO’s extensive branch network and robust customer support make it a preferred choice for physicians looking for reliable financing options.

2. BPI (Bank of the Philippine Islands)

BPI is renowned for its comprehensive financial services, including specialized loans for healthcare providers. Their SME Loans cater specifically to medical practitioners, offering funds for startup costs, equipment acquisition, and clinic expansion.

BPI emphasizes personalized service and competitive rates, ensuring physicians receive the financial support needed to maintain and grow their practices effectively.

3. Small Business Corporation (SB Corp.)

SB Corp. is a government-owned and controlled corporation that provides financing solutions to MSMEs, including medical practices. SB Corp. offers low-interest loans with flexible repayment terms through programs like the Pondo sa Pagbabago at Pag-asenso (P3) Program.

These loans are designed to support the establishment and expansion of medical clinics, making SB Corp. a valuable resource for physicians seeking affordable financing options.

4. Metrobank

Metrobank offers a variety of loan products suitable for medical professionals, including Business Loans and Equipment Financing. Their tailored solutions help physicians acquire essential medical equipment, renovate their facilities, or manage operational costs.

Metrobank is known for its competitive interest rates and flexible loan terms, providing physicians with the financial stability needed to enhance their practice’s capabilities and patient services.

5. Security Bank

Security Bank provides specialized financing options for healthcare providers through its Business Loans division. These loans are designed to meet the specific needs of medical practitioners, such as purchasing advanced medical equipment, expanding clinic space, or covering initial startup costs.

Security Bank emphasizes quick approval processes and personalized loan packages, making it easier for physicians to secure the necessary funds to grow their medical practices.

6. Philippine Veterans Bank

Philippine Veterans Bank offers dedicated loan products for medical professionals, focusing on supporting veterans and their families who are entering the healthcare sector.

Their Business Loans provide competitive rates and favorable terms for purchasing medical equipment, setting up clinics, or expanding existing practices.

With a commitment to serving the veteran community, Philippine Veterans Bank is an excellent option for physicians who qualify for their specialized loan programs.

7. UnionBank of the Philippines

UnionBank is known for its innovative banking solutions and digital banking services, making it a convenient choice for modern physicians. Their Business Loans offer flexible terms and competitive interest rates for purchasing medical equipment, renovating clinics, or funding operational expenses.

UnionBank’s user-friendly online application process and efficient loan approval system enable physicians to access the funds they need quickly and effortlessly.

Also Read: Understanding Accounts Receivable Factoring and How It Works

Essential Tips For a Physician To Consider For a Successful Application

Securing a medical practice loan is a pivotal step for physicians in the Philippines looking to establish or expand their healthcare facilities. However, the loan application process requires careful preparation and strategic planning to ensure success.

Here are essential tips physicians should consider when applying for a medical practice loan in the Philippines -

1. Develop a Comprehensive Business Plan

A well-crafted business plan is crucial when applying for a medical practice loan as it outlines your practice’s mission, services, target market, and competitive landscape. Include detailed financial projections, such as expected revenues, expenses, and cash flow forecasts.

2. Maintain Strong Financial Records

Lenders will closely examine your financial health to assess your ability to repay the loan. So, ensure that your financial statements, including income statements, balance sheets, and cash flow statements, are accurate and up-to-date.

3. Understand Your Credit Score

Your credit score plays a significant role in loan approval and the terms you may receive. Before applying, obtain your credit report and address any discrepancies or negative marks that could hinder your application.

A higher credit score can lead to better interest rates and more favorable loan terms. Typically, a credit score of 650 is an adequate score to target.

4. Choose the Right Type of Loan

Various types of loans are available for medical practices, each with its terms and conditions. Determine whether a secured loan, which requires collateral, or an unsecured loan, which does not, best suits your needs.

Consider government-backed loans, such as those offered by the Department of Trade and Industry (DTI) or Small Business Corporation (SB Corp.), which may provide favorable terms for healthcare professionals.

5. Prepare Necessary Documentation

Gathering all required documents in advance can streamline the loan application process. Lenders typically require proof of medical licensure, business registration, detailed financial statements, tax returns, and a comprehensive business plan.

Additionally, if you are applying for a secured loan, you should be prepared to provide personal financial information and details about any collateral.

6. Evaluate Loan Terms Carefully

When presented with loan offers, carefully evaluate the terms and conditions to ensure they align with your practice’s financial capabilities and growth plans. Pay close attention to interest rates, repayment schedules, and any fees associated with the loan.

Conclusion

Choosing the right medical practice loan is crucial for your practice's growth and success. This is because it's not a one-size-fits-all scenario; every practice has unique needs and financial situations. So, it is fair to say that attentively evaluating these specific needs is the first step in determining your best medical practice loan option in the Philippines.

Moreover, before you start the application process, ensure you understand the requirements and terms of the loan you are considering. This means knowing interest rates, repayment terms, and additional fees. Doing so will get you better loan interest rates and more lenient repayment terms.

Frequently Asked Questions (FAQs)

1. What is the law governing physicians in the Philippines?

Republic Act No. 2382, also known as the Philippine Medical Act of 1959, governs physicians in the Philippines.

This law regulates the practice of medicine in the country, including licensure requirements, standards for medical education, and ethical guidelines for physicians. It is enforced by the Professional Regulation Commission (PRC) through the Board of Medicine.

2. What credit score do I need for a medical practice loan in the Philippines?

In the Philippines, no universal minimum credit score is required for a medical practice loan, as it varies depending on the lender. However, most banks and financial institutions typically prefer applicants with a credit score of at least 650 to qualify for a loan.

3. Can I still apply for a medical practice loan as a nontraditional physician in the Philippines?

Yes, you can still apply for a medical practice loan as a nontraditional physician in the Philippines. While traditional physicians, such as MDs, often qualify easily, nontraditional practitioners, like those in alternative medicine, can also be eligible depending on the lender’s criteria.

4. Are there any limitations on what you can acquire with medical practice loans in the Philippines?

Yes, medical practice loans in the Philippines are limited in what they can purchase. Most lenders specify that the loan must be used for legitimate business-related expenses, such as purchasing medical equipment, clinic renovations, or operational costs.

Personal expenses or unrelated business investments are typically not allowed, and misuse of funds could result in penalties or loan recall.