Philippine SMEs play a crucial role in the economy, but securing the necessary funding for their growth remains a significant challenge, especially in the country's competitive market. Hence, acquiring adequate financial support is imperative for small and medium enterprises, whether it's to kickstart their operations, purchase essential equipment, or invest in innovation.

So, to help Philippine businesses select the correct type of loan, this blog will explore the various funding options available to SMEs in the Philippines, guiding you through the pros and cons of each method.

From borrowing within your personal network to exploring traditional bank loans and alternative financing options, you'll discover the best fit to meet your business's unique needs and stages of development. So, without any more delays, let us get down to the options.

Business Funding Companies And Options Available For Philippine SMEs - A Brief Overview

SMEs need financial support to survive, thrive, and remain competitive. Moreover, SMEs need funds to start operations, purchase equipment, cover operational costs in tough times, and invest in new technologies.

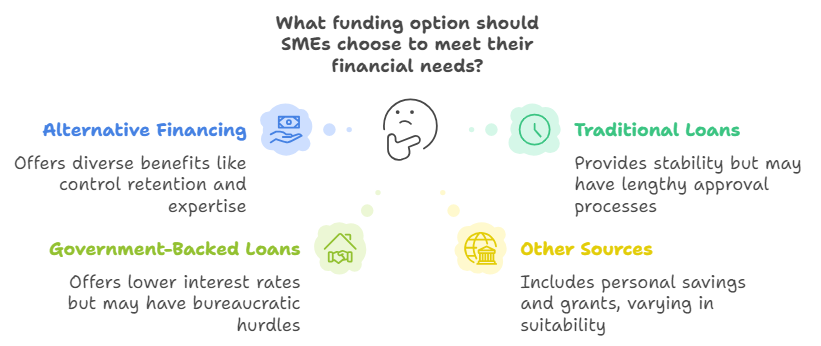

Fortunately, several potential funding options in the Philippines can help them achieve their business goals. They are as follows -

- Alternative Financing - This includes debt financing, crowdfunding, angel investors, and venture capitalists. Each of these comes with its own set of benefits. For example, debt financing allows SMEs to retain business control, while crowdfunding leverages the power of many small investments. Angel investors and venture capitalists often bring in not just money but also expertise and networks that can be invaluable for growth.

- Traditional and Government-Backed Loans—Banks offer loans and lines of credit, though they often require lengthy approvals. Institutions like SB Corp and DTI offer government-backed loans with lower interest rates.

- Other Sources - These include personal savings, private investors, business grants, credit cards, and peer-to-peer lending. Each source has its own dynamics and suitability depending on the SME’s specific situation and needs.

Also Read: Startup Funding and Angel Investors in the Philippines

Maximize your Philippine SME’s potential with N90’s quick financing solutions. Apply now for fast loans and get potential approvals within 24 hours! Amplify your business’s operations with N90’s quick and easy funding options. Get it today!

Top 11 Funding Options Available For SMEs in The Philippines

Choosing the right funding option depends on the business's financial needs, growth stage, and eligibility.

Here’s a brief overview of the top 11 funding options available to SMEs in the Philippines -

1. Bank Loans

Traditional bank loans are one of the most common ways for SMEs to access funding. Banks offer secured and unsecured loans, with secured loans requiring collateral like property or equipment. Loan terms can range from short-term working capital loans to long-term loans for expansion.

SMEs typically must provide a solid business plan, good credit history, financial statements, and sometimes collateral. However, the application process can be strict, and approval can take time.

2. Government Loans and Grants

The Philippine government offers various loan programs and grants to support SME growth through agencies like the Department of Trade and Industry (DTI) and Small Business Corporation (SB Corp).

These programs usually have favorable interest rates designed to encourage entrepreneurship, innovation, and local industry development. They are precious for SMEs with limited access to traditional financing.

Examples include the Pondo sa Pagbabago at Pag-Asenso (P3) Program, which provides low-interest loans to micro-enterprises.

3. Microfinance

Microfinance institutions (MFIs) usually provide small loans without requiring extensive collateral, making them ideal for SMEs with limited credit history or startups just beginning operations.

These loans often have more accessible application processes than traditional banks and are designed to help small businesses manage day-to-day operations or fund growth.

MFIs like CARD Bank and ASA Philippines are examples of microfinance institutions offering loans to small businesses nationwide.

4. Invoice Factoring

Invoice factoring is a financing solution where SMEs sell their unpaid invoices to a factoring company at a discount. The business receives immediate cash, usually 80-90% of the invoice value, while the factor collects the full payment from the customer.

This is particularly beneficial for businesses that offer extended payment terms to customers but need immediate cash flow to cover operational expenses. Factoring fees are involved, but it can provide quick access to working capital without adding debt to the business’s balance sheet.

5. Venture Capital

Venture capital (VC) is funding investors provide to high-potential startups or growing SMEs in exchange for equity or ownership stakes in the company. Venture capitalists typically invest in businesses with solid growth prospects, innovative products, or disruptive technologies.

While VC funding can bring significant financial resources, it often involves giving up partial company control and requires businesses to scale rapidly. In the Philippines, firms like Kickstart Ventures and Narra Ventures are prominent venture capital players.

Do you want to know why SMEs require funding and their primary role in the Philippine economy? Check out this video. It clearly explains why SMEs require financing, how it helps their operations, and their role in a nation’s economy.

6. Crowdfunding

Crowdfunding allows SMEs to raise small amounts of money from many individuals through online platforms like The Spark Project or GoGetFunding. This method suits businesses with compelling stories, unique products, or social impact missions.

Crowdfunding campaigns usually offer rewards, early product access, or equity in exchange for funding. They're also a great way to build a community around a business, but success depends heavily on effective marketing and outreach.

7. Angel Investors

Angel investors are wealthy individuals who provide capital to early-stage SMEs in exchange for equity or convertible debt. They offer funding and bring expertise, industry connections, and mentorship to help the business grow.

Angel investors are typically more flexible than venture capitalists and may invest smaller amounts, but they still expect a return on their investment. In the Philippines, angel investors often focus on tech startups or innovative ventures with high growth potential.

Do you want to know the impact of utilizing your personal savings on your SME and its long-term future? Check out this Reddit thread. Here, a user shared their experience funding their small business through personal savings. They emphasized the importance of self-financing to avoid the pitfalls associated with loans and credit.

8. Peer-to-Peer (P2P) Lending

P2P lending directly connects borrowers (SMEs) with individual lenders through online platforms like Acudeen or Lendio. It bypasses traditional banks and provides quicker access to funds, often with less rigid credit requirements.

Borrowers are typically assessed based on their creditworthiness, and loans can be used for various business purposes, such as working capital or expansion.

P2P lending offers flexibility in terms of loan amounts and repayment terms but may involve higher interest rates than traditional loans.

9. Equipment Financing

Equipment financing is a type of loan specifically for purchasing equipment, such as machinery, vehicles, or technology. The equipment itself acts as collateral, making this a secured loan option that is often easier to access than unsecured loans.

Equipment financing allows SMEs to acquire necessary tools for business growth without using up existing cash flow. Many banks and financing companies in the Philippines offer this service, often with favorable terms for equipment critical to business operations.

10. Trade Credit

Trade credit is when suppliers allow SMEs to purchase goods or services and defer payment until a later date, typically 30, 60, or 90 days. This form of short-term financing is especially helpful in managing cash flow, enabling businesses to continue operations while delaying supplier payments.

Trade credit doesn’t involve interest, but businesses must maintain good relationships with suppliers and meet payment terms to avoid penalties or strained supplier relationships.

11. Personal Savings

Utilizing personal savings for SMEs in the Philippines refers to business owners using their funds or personal savings to start or finance their businesses. This type of funding is often the first source of capital for many entrepreneurs as it involves minimal risk and no external debt obligations.

It’s a common initial funding strategy for small businesses in the Philippines before seeking external financing.

By doing so, business owners can maintain complete control of their enterprise without giving up equity or dealing with loan repayments by tapping into personal savings. Still, it can limit available capital, especially for more significant ventures.

Top 10 Business Funding Companies in The Philippines Providing Loans To SMEs

Various institutions offer small loan programs specifically designed to meet the financial needs of SMEs, whether for working capital, expansion, or operational expenses.

Essentially, these loans provide accessible funding options with minimal requirements, helping SMEs overcome financial hurdles and scale their businesses.

Here, look at some of the popular small loan providers available to SMEs in the Philippines -

1. Small Business Corporation (SB Corp)

Offers various loan programs such as P3 (Pondo sa Pagbabago at Pag-asenso) for micro and small enterprises.

2. Land Bank of the Philippines

Provides specialized SME loan programs, including working capital and expansion financing.

3. BDO SME Loan

Offers business loans for working capital, equipment purchases, and business expansion for SMEs.

4. BPI Business Loans

Offers business loans and credit lines tailored for SMEs to fund operations, expansion, or equipment.

5. UnionBank SME Business Loans

Provides flexible loans with simple requirements and quick processing for small businesses.

6. CARD SME Bank

They specialize in microfinance loans for small enterprises, offering easy access to credit and simple terms.

7. Tulay sa Pag-unlad, Inc. (TSPI)

As a microfinance institution, it offers micro and small enterprises small loans to support business growth.

8. Esquire Financing Inc.

Offers quick loans for SMEs with fast processing and minimal collateral requirements.

9. Asenso Credit

Provides micro and small businesses with flexible financing options for working capital and expansion.

10. Acudeen

Offers invoice factoring for SMEs, turning unpaid invoices into immediate cash, and providing a non-loan-based financing option.

Conclusion

As this article has comprehensively explained, access to diverse business funding options is crucial for SMEs to grow, manage cash flow, and invest in expansion opportunities in the Philippines. Without them, businesses will have difficulty navigating through the various financial challenges they might face.

So, whether through traditional bank loans, government programs, venture capital, or alternative financing like invoice factoring and P2P lending, these small business loan options will offer Philippine SMEs the flexibility and resources needed to thrive long-term and maintain their operations.

Additionally, to successfully apply for funding, businesses must clearly understand their financial needs, prepare solid business plans, and ensure they meet the lender’s eligibility criteria. Moreover, SMEs must secure the necessary capital to support their goals and ensure long-term sustainability by carefully selecting the right funding option to match their needs and presenting a solid case for approval.

Frequently Asked Questions (FAQs)

1. What are the criteria for small and medium enterprises in the Philippines?

In the Philippines, SMEs are classified based on asset size and number of employees. Here, take a look at how -

- A small enterprise has assets between PHP 3 million and PHP 15 million and employs 10 to 99 employees.

- As defined by the Department of Trade and Industry (DTI), a medium enterprise has assets between PHP 15 million and PHP 100 million and employs 100 to 199 employees.

2. What are the 5 primary business requirements in the Philippines?

To start a business in the Philippines, here are the five basic requirements -

- Business Name Registration: Register your business name with the Department of Trade and Industry (DTI) for sole proprietorships or the Securities and Exchange Commission (SEC) for partnerships and corporations.

- Barangay Clearance: Obtain a clearance from the local Barangay Office where the business will operate.

- Mayor’s Permit: Secure a Mayor's Permit or Business Permit from the local government unit (LGU).

- Tax Identification Number (TIN): Register your business with the Bureau of Internal Revenue (BIR) for taxation purposes.

- SSS, PhilHealth, and Pag-IBIG Registration: If hiring staff, register with government agencies for employee benefits and contributions.

3. What is the typical way a small business is funded?

A small business is typically funded through personal savings, followed by bank loans or microfinance loans. Many entrepreneurs also rely on family and friends for initial capital.

As the business grows, alternative options like invoice factoring, crowdfunding, or angel investors may be explored. Traditional bank loans remain the most common source of external funding.

4. What are the two main types of funding in the Philippines?

The two main types of funding in the Philippines are debt financing and equity financing. Debt financing involves borrowing money, typically through loans from banks, microfinance institutions, or alternative lenders, which must be repaid with interest.

Equity financing involves raising capital by selling ownership shares to investors, such as venture capitalists or angel investors, in exchange for a stake in the business.