Securing a business loan is a common challenge for entrepreneurs in the Philippines, especially when it comes to providing suitable collateral. Collateral is an asset that a borrower can pledge to a lender to secure a loan, minimize the lender's risk, and influence the loan's approval chances and terms offered.

Entrepreneurs often need help identifying the correct type of collateral to use, particularly if they lack substantial personal assets. So, to do precisely that, this blog will explore various types of collateral used in the Philippines, including real estate, business equipment, and more, to help them better navigate loan applications and improve their chances of securing favorable loan terms.

What Does Acquiring a Business Loan With Collateral in The Philippines Mean?

Collateral stands out as a crucial element when discussing securing business loans with collateral in the Philippines. A borrower offers collateral as an asset to a lender as security for a loan, and the lender has the right to seize and sell this asset if the borrower fails to repay. Individuals or small businesses with limited tangible assets particularly favor this method.

People commonly use real estate, vehicles, jewelry, and other valuable personal items as collateral. For instance, lots of real estate properties are a popular form of collateral. Banks like Landbank, PNB, and Chinabank frequently accept lots due to their tangible and easily assessable value.

The evaluation process looks at the property's location, developer, and commercial potential. Pawnshops frequently accept jewelry and other valuable items as collateral.

SMEs often leverage business assets like inventory, equipment, and real estate as collateral. A National Small Business Association study reveals that 83% of loan applications involved business assets as collateral. Lenders frequently accept vehicles like cars and motorcycles, as they can seize and sell them if the borrower defaults.

Are you still unsure about the role collateral plays in helping a Philippine business grow and thrive? Check out this videos. It explains clearly what collateral is and gives various examples of collaterals, such as real estate and equipment, which can help you understand what assets businesses can use to secure a loan they require.

Also Read: Understanding Collateral Loans: Types, Pros, and Cons

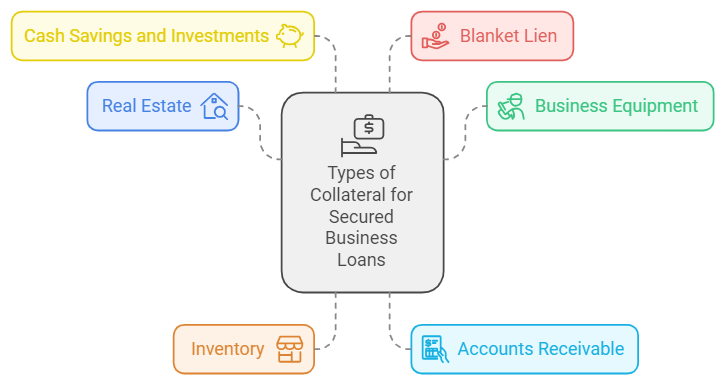

Types of Collateral Utilized To Get Secured Business Loans in The Philippines

Secured business loans are a popular financing option for many entrepreneurs in the Philippines as they provide access to capital by offering assets as collateral. Collateral serves as a security for lenders, reducing their risk and often leading to more favorable loan terms for borrowers.

However, the types of collateral used can vary widely, depending on the nature of the business and the loan amount needed, so it is best to enquire about the type of collateral accepted by a lender before approaching them.

Here, look at the different types of collateral commonly accepted in the Philippines. This will give Filipino business owners a better chance to prepare for and secure the financing they need to grow and sustain their operations -

1. Real Estate Collateral

Simply put, real estate collateral involves using properties, such as homes, commercial buildings, or land, as a guarantee to lenders. Lenders favor real estate because it typically holds high value and has a lower risk of depreciation than other assets.

When using real estate collateral, a borrower pledges a piece of property they own to secure a loan. This can include personal homes, commercial buildings, and land plots. Lenders often find this form of collateral appealing because of its tangible value.

Benefits of Using Real Estate as Collateral

- High Value: Real estate is generally high, allowing for more significant loan amounts. The tangible nature of property makes it easier for lenders to assess its worth, providing a solid foundation for the loan.

- Ease of Sale: Property is relatively easy to sell in case of default. Its high demand and robust market make it a liquid asset, often leading to quicker recovery of funds for the lender.

- Stability: Despite market fluctuations, real estate tends to be a stable and appreciating asset in the long run. This reduces the risk for lenders and provides peace of mind for borrowers.

Drawbacks of Using Real Estate as Collateral

- Market Fluctuations: Real estate values can be subject to market downturns. For example, the Green Street CPPI reported that property values decreased by an average of 22% in 2023, with specific sectors like offices and multifamily properties seeing 35% and 30% decline, respectively.

- Variable Interest Rates and Terms: Secured loans using real estate can come with variable interest rates that might change over the loan term. This can make financial planning more challenging for borrowers.

- Additional Collateral Requirements: Some lenders may ask for additional collateral or guarantees beyond the real estate itself, adding complexity to the loan agreement.

Also Read: Improving Efficiency in Finance Business Processes

2. Business Equipment Collateral

When businesses need to secure a loan, they often look to their own assets to obtain the necessary funds. One of the most common assets leveraged is business equipment. This includes everything from printers and copy machines to computers and heavy machinery, all of which play crucial roles in business operations.

Business equipment collateral involves using equipment and machinery owned by the business to secure a loan. This type of collateral can range broadly: think of the delivery trucks used for logistics, the HVAC systems in commercial buildings, or even specialized medical or restaurant equipment.

These assets serve as a security blanket for the lender, reassuring them that there's tangible value to recoup if the borrower defaults on the loan.

Benefits of Using Business Equipment as Collateral

- Simplifying Loan Qualification: One significant advantage is that equipment financing tends to be more accessible than unsecured loans. Lenders are primarily interested in the worth of the equipment rather than solely focusing on the business’s cash flow or credit score. This can be particularly beneficial for newer companies that may not yet have established solid financial credentials.

- Lower Risk for Lenders: With business equipment acting as collateral, the lender's risk is significantly mitigated. Should the borrower default, the lender can seize and sell the equipment to recover losses. This reduced risk often translates to easier loan approval and better loan terms for the borrower.

- More Flexible Loan Options: Lenders often offer loans secured by equipment with more favorable and flexible terms, such as extended repayment periods. Requiring less burdensome documentation than unsecured loans, these loans considerably streamline the application process.

- Securing Larger Loan Amounts: Since the loan amount is tied directly to the equipment's value, businesses sometimes secure higher funding than unsecured loans. It’s a straightforward calculation: the more valuable the equipment, the larger the loan one might secure.

Drawbacks of Using Business Equipment as Collateral

- Decreasing Equipment Value: One downside is that business equipment tends to depreciate over time, affecting the loan-to-value ratio and the amount of funding a business can secure. Lenders might hesitate to offer large sums if they expect the equipment's value to diminish significantly.

- Lender Selectivity: Not all equipment is welcomed with open arms. Some assets might be difficult to liquidate, making lenders hesitant to accept them as collateral. For instance, highly specialized machinery might be challenging to resell, posing a risk for the lender.

- Potential Loss of Essential Equipment: Defaulting on a loan secured by business equipment means the business will lose these critical assets. A construction company, for example, could only be protected if it loses its excavators or bulldozers.

- Maintenance and Condition: The borrower must maintain the equipment in good condition to retain its value and ensure it serves well as collateral. Neglecting upkeep can reduce the collateral's value and potentially lead to complications with the loan.

- Possibility of Over-collateralization: In some cases, lenders may require businesses to pledge more equipment than the actual loan amount. Over-collateralization can endanger additional assets, increasing the stakes if the loan defaults.

3. Inventory Collateral

Businesses frequently look towards their inventory when seeking collateral for secured loans. Inventory collateral refers to using unsold goods from a business's stock as a guarantee to the lender. If the borrower defaults on the loan, the lender can seize and sell the inventory to recoup their losses. This mechanism is highly prevalent among retail businesses and those with significant goods on hand.

Inventory collateral involves pledging your business's physical goods that have yet to sell as security for a loan. Businesses that depend heavily on their stock, such as retailers, wholesalers, and manufacturers, find this type of collateral particularly effective.

In this case, the lender assesses the value of the inventory and determines, based on the collateral’s valuation, how much of a loan they can provide.

Benefits of Using Inventory as Collateral

- Leveraging Current Stock: One significant benefit of using inventory collateral is that you can leverage the assets you already have. This means that even if your business has little real estate or large equipment, you can still secure a loan using what it does have—inventory.

- Improving Cash Flow: Using inventory as collateral can provide the necessary cash flow to purchase more stock, cover operational costs, or invest in business expansion. This is a quick way to convert your stocked items into financial capital.

- Standard Industry Practice: According to the National Small Business Association, using inventory as collateral is common, appearing in 83% of loan applications. This indicates that lenders and borrowers are familiar with and generally comfortable with this type of collateral.

Drawbacks of Using Inventory as Collateral

- Valuation Fluctuations: Inventory value can fluctuate significantly. Seasonal items, perishable goods, and trends can dramatically impact the assessed value. Depreciating or obsolete inventory can affect your borrowing capacity and put the loan at risk.

- Risk of Default: If the business cannot repay the loan, losing inventory means losing the very means of generating revenue. This can create a vicious cycle of debt and loss for a business dependent on its stock.

- Startup Challenges: Securing loans using inventory as collateral can be particularly challenging for startups. Despite having strong personal credit and other assets, lenders often prefer businesses with an established operational history.

Say goodbye to lengthy loan applications and hello to quick funding for your Philippine SME. Apply now for N90 Fast Financing Solutions and receive potential approvals within 24 hours! N90: Your Partner in Rapid Business Financing! Avail Today!

4. Accounts Receivable Collateral

Accounts receivable collateral involves using a company's outstanding invoices as security for a secured business loan. A business uses these invoices to represent the money expected from its clients, and also allows the lender to seize these payments if they fail to repay the loan.

Firms with a steady stream of clients and regular invoices often find this method especially useful.

Benefits of Using Accounts Receivable as Collateral

- Access to Quick Funding: Utilizing accounts receivable allows businesses to access cash quickly based on their outstanding invoices. This can be particularly useful for managing cash flow gaps or covering immediate operational expenses without waiting for customers to pay their invoices.

- Preserve Ownership: Unlike equity financing, using accounts receivable as collateral does not require giving up ownership or control of the business. This allows owners to retain complete control while still obtaining the necessary funds.

- Improved Cash Flow: By converting receivables into immediate cash, businesses can improve their cash flow, ensuring they have the necessary liquidity to meet short-term obligations, invest in growth opportunities, or handle unexpected expenses.

Drawbacks of Using Accounts Receivable as Collateral

- High Costs: Financing secured by accounts receivable often comes with higher interest rates and fees than traditional loans. These costs can affect your profits, especially if your margins are already thin.

- Impact on Customer Relationships: When a lender takes control of your accounts receivable, they may contact your customers directly for payment. This can strain customer relationships, primarily if the lender aggressively collects payments.

- Dependency on Invoice Collection: The availability of funds depends on the timely collection of invoices. If customers delay payments or default, it can reduce the amount you can borrow and create additional cash flow challenges.

Also Read: Benefits and Disadvantages of Small Business Loans

5. Cash Savings and Investments Collateral

Cash savings and investments are common ways businesses secure loans. They involve pledging your cash assets or investment accounts, like stocks and bonds, to the lender. If the loan is not repaid, the lender can access these assets to cover the loan.

When you use cash savings and investment assets as collateral, you allow the lender to claim them. For example, funds in a business savings account or investments like stocks, bonds, or mutual funds can be pledged. This gives the lender a safety net; if you default, they can liquidate these assets to recover the owed amount.

Benefits of Using Cash Savings and Investments as Collateral

- Lower Interest Rates: Lenders often offer better interest rates because these assets are low-risk.

- Higher Approval Rates: The liquid nature of these assets makes loan approval more likely, especially for businesses with steady cash flow but limited other assets.

- Flexibility: Businesses can leverage existing cash and investments rather than scrambling for new tangible assets like real estate.

Drawbacks of Using Cash Savings and Investments as Collateral

- Market Fluctuations: Investments such as stocks and bonds are subject to market volatility. A downturn could decrease the value of your collateral, requiring you to pledge additional assets or face higher loan terms.

- Opportunity Cost: When you use cash savings as collateral, those funds can't be used for other opportunities like expansions or emergencies, tying up your liquidity.

- Loss of Assets: Defaulting could result in the loss of your valuable cash savings or investments, which could be devastating for your business.

6. Blanket Lien Collateral

When securing a business loan, one of the more encompassing forms of collateral is the blanket lien. But what exactly is a blanket lien, and how does it work? A blanket lien is a legal claim that allows the lender to seize multiple assets if the loan is not repaid.

Unlike a specific lien, which only covers particular assets like equipment or real estate, a blanket lien gives a lender the right to claim any business assets in the event of a default. This could include inventory, accounts receivable, and any other business assets.

Benefits of Using Blanket Liens as Collateral

- Increased Loan Approval Likelihood: By offering a blanket lien, businesses may increase their chances of securing a loan, even if they still need significant individual assets to pledge. Lenders view blanket liens as reducing risk, making them more willing to approve the loan.

- Access to Larger Loan Amounts: Since a blanket lien covers all of the borrower’s assets, lenders may be willing to provide more significant loan amounts than loans secured by specific assets. This can benefit businesses needing substantial capital for expansion or other essential investments.

- Simplified Collateral Management: With a blanket lien, businesses do not have to negotiate or track multiple liens on different assets. This simplifies the collateral management process, making it easier for the borrower to manage the loan and its associated obligations.

Drawbacks of Using Blanket Liens as Collateral

- Risk of Losing All Assets: If the business defaults on the loan, the lender has the right to seize all of the company’s assets covered under the blanket lien. This could result in the total loss of the business’s assets, potentially leading to bankruptcy.

- Limited Flexibility for Future Financing: A blanket lien can limit the business’s ability to secure additional financing, as all assets are already pledged to the initial lender. This can make it difficult to obtain further credit or negotiate with other lenders in the future.

- Potential for Strained Lender Relations: The extensive control that a blanket lien gives the lender over the borrower’s assets can lead to strained relationships if the lender exercises this control, especially if the business faces financial difficulties.

Conclusion

After exploring the plethora of collateral options for securing business loans, with the help of this comprehensive article, it is safe to say that now we have a better understanding of the intricate nuances related to each type of collateral option available for businesses in the Philippines.

Each type presents unique advantages and challenges, from tangible assets like real estate and equipment to more liquid options like cash reserves and securities. So, it is important for borrowers to consider several key factors that come into play when selecting the most appropriate collateral like the liquidity of the asset, because lenders favor assets that can be swiftly converted to cash if needed.

Additionally, they must also be aware of the devaluation potential of certain collaterals, as these types of assets lose their value over time, presenting genuine risk for the lenders. Therefore, it is a good idea to draft loan documents against these types of collaterals for future reference.

Finally, understanding lender requirements is vital as well, since different lenders have varying criteria for acceptable collateral. Being aware of certain criteria beforehand will put borrowers in a better position from the outset to secure the type of loan they require.

Frequently Asked Questions (FAQs)

1. What is most commonly used for collateral with secured loans?

The most commonly used collateral for secured loans includes the following -

- Real estate: Houses, apartments, and commercial properties are frequently used as collateral for mortgages and real estate loans.

- Vehicles: Cars, trucks, motorcycles, and boats can be used as collateral for auto loans and boat loans.

- Investments: Stocks, bonds, and other investments can be used as collateral for certain types of loans, such as margin loans.

- Inventory: Businesses often use their inventory as collateral for loans to finance operations or purchase additional inventory.

- Equipment: Machinery, tools, and other business equipment can be used as collateral for business loans.

2. What banks in the Philippines offer collateral loans?

Many banks in the Philippines offer collateral loans. Some of the central banks that provide these loans include -

- BPI (Bank of the Philippine Islands)

- Metrobank

- UnionBank

- Security Bank

- Land Bank of the Philippines

3. Can you use stocks as collateral for a loan in the Philippines?

Yes, you can use stocks as collateral for a loan in the Philippines. This type of loan is often referred to as a margin loan. However, the specific requirements and terms may vary depending on the lender, so check them out before selecting one.

4. How many types of secured loans are there in the Philippines?

There are several types of secured loans in the Philippines, each with its own specific collateral requirements and terms.

Some common types include the following -

- Real estate mortgage loans: Secured by real estate property.

- Vehicle loans: Secured by a vehicle.

- Inventory loans: Secured by a business's inventory.

- Equipment loans: Secured by business equipment.

- Margin loans: Secured by stocks or other securities.