For small businesses in the Philippines, managing working capital effectively is crucial for them to maintain smooth operations and achieve long-term success.

Hence, that is why properly understanding and managing it ensures that a business can not only effectively cover its short-term obligations but also look to invest in future growth opportunities and avoid new cash flow issues from arising in the future.

To give Philippine businesses a comprehensive view of what working capital is all about, in this article, we will explore the essential aspects of working capital, including its significance, management strategies, and impact on small business operations, to help drive your business forward.

What is Working Capital, And How To Calculate It?

Working capital is a financial metric that represents the difference between a company's current assets and current liabilities. It is a measure of a business's short-term liquidity and operational efficiency.

In essence, working capital indicates the amount of capital a business possesses which they can use to fund their day-to-day operations, pay short-term obligations, and also invest in immediate business needs.

Calculating working capital is a straightforward process that involves subtracting a company's current liabilities from its current assets. This financial metric helps assess a business’s short-term liquidity and operational efficiency.

Here’s how you can calculate working capital in the Philippines -

1. Identify Current Assets

First, gather information on your current assets. Current assets are resources that a business expects to convert into cash within a year and include elements such as cash and cash equivalents, accounts receivable, inventory, and short-term investments.

2. Identify Current Liabilities

Next, identify your current liabilities. Current liabilities are obligations that a business needs to settle within a year. These may include accounts payable, short-term loans, accrued expenses, and other short-term debts.

3. Calculate Total Current Assets

Sum up the value of all current assets. This total represents the business’s readily available monetary resources that it can use to meet short-term obligations and fund day-to-day operations.

4. Calculate Total Current Liabilities

Next, total the value of all current liabilities to find out about the business’s immediate financial obligations that must be paid off within the year. Doing so will give you a clear picture of the short-term financial commitments that the business needs to manage effectively.

5. Subtract Current Liabilities from Current Assets

Finally, subtract the total current liabilities from the total current assets to determine the working capital.

The formula is fairly straightforward and goes like this -

Total Current Assets − Total Current Liabilities = Working Capital

This result indicates the amount of capital available to fund the business’s day-to-day operations and short-term needs.

A Positive working capital suggests that the business has sufficient assets to cover its liabilities, whereas a negative working capital may indicate potential liquidity issues. This simple yet critical calculation helps businesses assess their financial health and operational efficiency.

Also Read: Understanding Collateral Loans: Types, Pros, and Cons

Importance of Working Capital For Philippine Businesses

For Philippine businesses, maintaining adequate working capital is essential not only for managing their day-to-day operations but also for enabling their growth, managing financial risks, and securing their long-term financial stability.

Here, take a look at why working capital is important for Philippine businesses in greater detail -

1. Ensuring Liquidity and Operational Efficiency

Working capital ensures that businesses have enough liquidity to meet their short-term obligations and maintain smooth operations.

In the Philippines, where market conditions can be quite unpredictable, having sufficient working capital allows businesses to handle day-to-day expenses such as salaries, rent, and utility bills without disruption.

2. Encouraging Growth and Expansion

Possessing adequate working capital provides businesses with the flexibility to take advantage of potential growth opportunities, invest in new projects, expand on existing product lines, or even enable them to enter new markets.

Having readily available funds is crucial for Philippine businesses, especially MSMEs, as this financial freedom can be the difference between them stagnating as a business or growing by scaling their operations, and increasing their market share.

3. Improving Supplier Relationships and Negotiation Power

Having ample working capital at their disposal allows businesses to manage their payables effectively and take advantage of early payment discounts offered by suppliers. This not only reduces costs but also strengthens supplier relationships.

Additionally, being a reliable payer in the Philippines can give your business an edge during negotiations to secure better terms and develop long-term partnerships that can prove to be extremely beneficial, especially during economic fluctuations.

4. Eliminating Financial Risks

Effective working capital management helps eliminate financial risks associated with cash flow shortages. In the Philippines, businesses often face delayed payments from customers, which can strain cash flow.

However, by effectively maintaining adequate working capital, they can possess a buffer against these delays to ensure they always have enough funds to continue their operations and avoid any kind of financial hurdles.

5. Enhancing Creditworthiness

Businesses with strong working capital positions are always viewed more favorably by banks and financial institutions as compared to others. This enhanced creditworthiness makes it easier for them to secure loans and other forms of financing on very favorable terms.

For Philippine businesses, especially those looking towards expansion, having a solid working capital base can open up additional funding opportunities for them to not only grow their businesses but also stabilize them for the long term.

6. Supporting Strategic Decision-Making

Having a clear understanding of working capital needs allows businesses to make informed financial decisions, including the ones related to inventory management, pricing strategies, and investment planning.

For businesses in the Philippines, where economic conditions and consumer behaviors change rapidly, being able to adapt and make timely decisions based on working capital positions is crucial for staying competitive and responsive to market demands.

Also Read: Top 5 Legit Online Loan Apps in the Philippines

Say goodbye to lengthy applications and hello to quick funding. Apply now for N90’s fast financing solutions and receive potential approvals within 24 hours. Level up your Philippine SME today!

What Are Factors That Affect Working Capital Needs of Businesses in Philippines?

Managing working capital effectively is vital for the financial health and operational efficiency of any business, and in the economic environment of the Philippines, various factors influence the working capital requirements of businesses.

These factors range from the nature and size of the business to external economic conditions and regulatory requirements.

Hence, understanding these factors is crucial for Philippine businesses as they not only ensure a business maintains sufficient liquidity to meet its short-term obligations, but also support them in expanding on ongoing operations.

Here, take a closer look at the key factors that affect the working capital needs of businesses in the Philippines -

1. Nature of Business

The type of business significantly impacts working capital needs. For instance, manufacturing companies generally require more working capital due to longer production cycles and higher inventory levels, while service-based businesses might need less working capital as they typically do not hold large inventories.

2. Business Size and Scale

Larger businesses with extensive operations usually need more working capital to manage their broader scope of activities. Conversely, smaller businesses may have lower working capital requirements but must manage their resources more strictly to ensure liquidity.

3. Operating Cycle

The length of the operating cycle, which is the time taken to convert raw materials into finished goods and then sell them for cash, directly affects working capital needs.

Due to this reason, businesses with longer operating cycles, such as those in manufacturing, need more working capital compared to those with shorter cycles, as they organically take longer to process, produce, and sell their products compared to other industries.

4. Sales Volume and Growth

Higher sales volumes and rapid business growth increase working capital requirements. This is primarily because businesses need to finance more inventory, manage higher accounts receivable, and ensure sufficient cash flow to support expanding operations.

5. Credit Terms

The credit terms offered to customers and received from suppliers play a crucial role in determining the working capital needs of a business.

Extended credit terms to customers can lead to higher accounts receivable, but in the process, it increases the need for working capital. Conversely, receiving favorable credit terms from suppliers can reduce working capital requirements, but in turn, it delays cash outflows.

6. Inventory Management

Effective inventory management can significantly impact working capital, as businesses that maintain high inventory levels to meet demand fluctuations need more working capital as compared to the ones that only maintain inventory based on actual customer demands.

So, it is fair to summarize that by implementing efficient inventory management practices, businesses can optimize their stock levels and reduce the need for excessive working capital.

7. Seasonal Variations

Seasonal fluctuations in sales and production affect working capital needs. This is primarily due to the fact that certain businesses in the Philippines, such as those in retail and tourism, may experience peak seasons that require higher working capital to manage the increased inventory and other operational costs during these periods.

8. Economic Conditions

The overall economic environment, including interest rates, inflation, and economic stability, directly influences the working capital needs of Philippine businesses.

For instance, during economic downturns, businesses might experience slower sales and longer receivable periods, which will automatically increase their need for more working capital to maintain their operations.

9. Market Competition

Competitive market conditions can affect a business’s pricing strategies and credit policies, which will directly influence its working capital requirements.

To counter this issue effectively, businesses may need to offer more favorable credit terms to attract more customers, thereby increasing accounts receivable and the need for additional working capital.

10. Regulatory Environment

The regulatory framework in the Philippines, including tax policies and compliance requirements, impacts the working capital needs of businesses.

This is because complying with regulations can lead the business to incur additional costs, which will not only indirectly affect its cash flow but also influence the overall working capital requirements of a business.

Also Read: Pros and Cons of Debt Consolidation in the Philippines

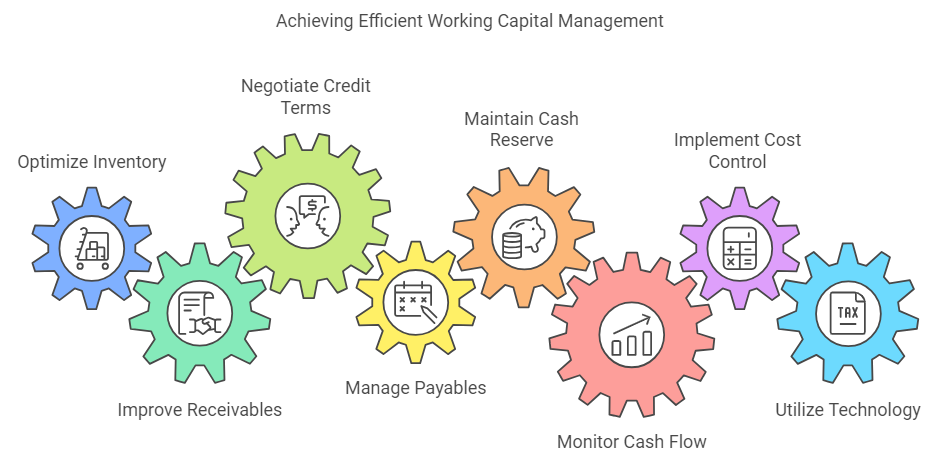

How To Manage Working Capital Efficiently in Philippines - Key Strategies For Philippine Businesses To Implement

Effective working capital management is essential for Philippine businesses to maintain liquidity and ensure smooth operation. It allows businesses to meet their short-term obligations, invest in growth opportunities, and navigate through financial challenges.

In this section of the article, we will explore some key strategies that Philippine businesses can implement to manage their working capital efficiently and achieve long-term financial stability.

Here, take a look at some of the effective strategies -

1. Optimize Inventory Management

Implementing efficient inventory management practices is essential for reducing excess stock and minimizing holding costs.

Businesses must utilize effective inventory management systems to track stock levels, forecast demand accurately, and automate reordering processes.

2. Improve Accounts Receivable Collection

Accelerating the collection of accounts receivable can significantly enhance cash flow. To do so, implement clear credit policies, offer early payment discounts, and use invoicing software to streamline billing processes.

One of the best ways to do this is by regularly following up with customers on outstanding invoices and considering using factoring services to convert receivables into immediate cash.

3. Negotiate Favorable Credit Terms with Suppliers

Working with suppliers to negotiate favorable credit terms can delay cash outflows and improve working capital, so always aim to extend payment terms without putting supplier relationships at risk.

Additionally, taking advantage of supplier discounts for early payments is also an effective strategy, but only if it reduces your costs and benefits your cash flow situation.

4. Manage Payables Efficiently

Strategically managing accounts payable helps maintain good relationships with suppliers while optimizing cash flow. Businesses can do this by scheduling payments to coincide with cash inflows and avoid late payment penalties.

Moreover, they can also prioritize paying invoices that offer early payment discounts and defer other payments as much as possible within agreed terms.

5. Maintain a Cash Reserve

Keeping a cash reserve is essential for Philippine businesses to manage unexpected expenses and maintain liquidity, so it is a good idea to establish an efficient cash reserve policy that aligns with their business needs and ensures they have enough buffer to handle unforeseen financial challenges.

6. Monitor Cash Flow Regularly

Regularly monitoring cash flow helps businesses identify potential issues early and take corrective actions as soon as possible. Utilize tools such as cash flow forecasts and financial dashboards to track inflows and outflows to ensure that your business can meet its short-term obligations efficiently.

7. Implement Cost Control Measures

Cost control is vital for improving working capital, so conduct regular reviews of operational expenses and identify areas where costs can be reduced without compromising business quality.

Implement lean management techniques and optimize business processes throughout the company to develop significant savings and improve its overall cash flow.

8. Utilize Short-Term Financing Options

Short-term financing options, such as lines of credit and working capital loans, can provide the necessary funds to bridge cash flow gaps, so evaluate various financing options available in the Philippines and choose the one that offers the most favorable terms and the lowest interest rates.

In this way you can easily support your working capital needs without adding any significant financial burden on your business and its operations.

9. Utilize Technology

Utilizing technology, such as accounting software and financial management tools, can enhance working capital management for Philippine businesses, as these tools provide real-time insights into financial performance, automate routine tasks, and improve accuracy in financial reporting.

10. Plan for Seasonality

Many businesses in the Philippines experience seasonal fluctuations in demand, so planning for seasonality is a good idea. It normally involves adjusting inventory levels and managing receivables and payables accordingly to ensure the business always has sufficient cash reserves at hand during peak seasons.

Also Read: What is a Business Loan, and How Does it Work?

Possible Challenges Faced By Philippine Business in Managing Their Working Capital

Managing working capital effectively is crucial for the sustainability and growth of Philippine businesses, but it comes with its own set of challenges.

Here, take at some of the possible challenges faced by Philippine businesses in managing their working capital -

1. Delayed Payments from Customers

One of the most common challenges Philippine businesses face is the delay in receiving payments from customers. Receiving payments late not only leads to cash flow issues, as businesses are unable to collect receivables in a timely manner, but it also disrupts their operations and hinders their ability to meet short-term financial obligations.

2. Fluctuating Market Demand

Seasonal variations and fluctuating market demands can create difficulties for Philippine businesses to manage inventory levels, as businesses may always find themselves either overstocked during low-demand periods or understocked during high-demand periods, both of which can strain their working capital.

3. High Inventory Costs

Maintaining high levels of inventory can tie up significant amounts of capital and increase storage costs. Hence, managing inventory efficiently is a challenge, especially when businesses need to carefully balance between wanting to meet customer demands and minimizing excess stock.

4. Access to Financing

Securing short-term financing can be challenging for many businesses in the Philippines, particularly for small and medium-sized enterprises. This limited access to affordable credit options can restrict a business’s ability to manage its working capital needs effectively.

5. Economic Instability

Economic fluctuations, such as inflation and currency volatility, can impact the cost of goods and services, making it difficult to predict and manage working capital requirements accurately.

Additionally, economic instability can also affect the consumer’s spending capabilities and adversely impact the overall revenue the business generates.

6. Supplier Credit Terms

Negotiating favorable credit terms with suppliers can be a challenge, especially for smaller businesses that may not have significant bargaining power. Hence, short credit terms from suppliers can increase the need for working capital to pay for supplies before the revenue is generated.

7. Operational Inefficiencies

Operations inefficiencies, such as delayed production cycles or inefficient supply chain management, can lead to increased working capital requirements. By streamlining operations and improving processes, businesses can manage working capital more effectively than before.

8. Regulatory Compliance

Compliance with local regulations and tax requirements can be time-consuming and costly. So, businesses need to set aside funds for tax payments and comply with regulatory standards. However, doing so will adversely affect the overall working capital available to them to handle other business needs.

9. Credit Risk Management

Managing the credit risk associated with extending credit to customers is a significant challenge. Philippine businesses must balance the need to offer credit to attract and retain customers with the added risk of non-payment, which can severely impact the cash flow and working capital available to them.

10. Technological Limitations

Limited access to advanced financial management tools and technology can hamper a business’s ability to monitor and manage working capital effectively.

Hence, investing in appropriate technology is a good idea as it will be crucial in accurately forecasting the finances of the business as well as help in efficiently managing the working capital available to them.

Conclusion

As this article thoroughly explains, understanding and managing working capital is vital for the success and sustainability of small businesses, as proper working capital management ensures that a business can not only meet its short-term obligations but also maintain smooth operations and seize future growth opportunities.

Additionally, small businesses can improve their liquidity and financial stability by carefully monitoring and optimizing components such as inventory, receivables, and payables.

Moreover, they can also look to implement strategic practices and take advantage of certain financial tools to help them effectively navigate through their working capital needs and achieve long-term success.

Hence, it is fair to conclude that apart from diligently addressing challenges specific to the Philippine market, such as fluctuating demand and access to additional financing options, Philippine businesses can further enhance their ability to manage working capital effectively without suffering from any adverse financial effects that may arise in the future.

Frequently Asked Questions (FAQs)

1. Why is working capital important for a small business?

Working capital is vital for small businesses as it funds daily operations. It covers expenses like inventory, payroll, rent, and utilities.

Sufficient working capital ensures smooth operations, prevents cash flow crises, and supports growth. It's a key indicator of a business's financial health and ability to meet short-term obligations.

2. What is the rule of thumb for working capital?

A common rule of thumb for working capital is a current ratio of 2:1. This means your current assets should always be double your current liabilities.

However, this ratio can vary based on industry and business model, as in many industries, a ratio between 1.5 and 2 is often considered healthy. Still, it's essential to analyze your specific business needs before making any drastic assumptions.

3. How to increase working capital?

To increase working capital, you should focus on -

- Improving cash flow: Accelerate invoice payments, negotiate better payment terms, and reduce expenses.

- Inventory management: Optimize stock levels to avoid excess or shortages.

- Efficient accounts receivable: Maintain clear payment terms, follow up on overdue invoices, and consider factoring.

- Debt management: Manage short-term debt effectively and explore refinancing options if needed.

- External financing: Consider loans, lines of credit, or investor funding as a last resort.

- Financial planning: Create a cash flow budget to anticipate needs and manage funds effectively.

4. How do you estimate working capital needs?

To estimate working capital efficiently, you will need to -

- Calculate current assets: Add up cash, accounts receivable, and inventory.

- Calculate current liabilities: Add up accounts payable, short-term loans, and accrued expenses.

- Determine working capital: Subtract current liabilities from current assets.

- Analyze industry benchmarks: Compare your ratio to industry standards.

- Consider growth plans: Factor in projected sales and expenses for future needs.

Create a cash flow budget: Forecast inflows and outflows to identify potential shortfalls.