Deferred revenue, often termed unearned revenue, is a critical accounting concept that can significantly impact a company's financial statements and overall financial health.

Managing deferred revenue correctly ensures compliance with accounting principles and provides an accurate financial picture for businesses offering subscription services, retainers, or advance payments.

However, navigating the complexities of deferred revenue can be challenging, as it requires recognizing revenue at the right time. Therefore, in this blog, we will explore fundamental aspects of deferred revenue, including its necessity in accounting, practical examples, and the effect on financial statements, to help you understand how to manage and record it effectively.

Why Do Companies Record Deferred Revenue in The Philippines?

In the Philippines, as in other countries, companies record deferred revenue to properly reflect their financial position when receiving payments in advance for goods or services. This accounting practice ensures accurate reporting of income and liabilities, aligning with financial regulations and standards.

Here are key reasons why companies record deferred revenue in the Philippines -

1. Compliance with Accounting Standards

Deferred revenue is recorded to comply with Philippine Financial Reporting Standards (PFRS), ensuring accurate financial reporting based on when the service or product is delivered.

2. Accurate Financial Position

By recording deferred revenue as a liability, companies accurately reflect their obligations, preventing overstatement of income and giving a clearer picture of their financial position.

3. Revenue Recognition Principle

It ensures compliance with the revenue recognition principle, which states that income should only be recorded when it is earned, not when cash is received.

4. Improved Financial Management

Deferred revenue helps businesses manage cash flow and project future income, ensuring they have the resources to fulfill obligations.

5. Transparency with Stakeholders

Accurate reporting of deferred revenue enhances transparency with investors, creditors, and other stakeholders, helping them assess the company’s proper financial health.

Also Read: Understanding Cash Flow Loans for Your Small Business in The Philippines

Deferred Revenue Examples in The Philippines

Deferred revenue occurs when companies in the Philippines receive payment for goods or services that will be provided at a later date. Here are typical examples of deferred revenue in different industries in the Philippines -

1. Subscription-Based Services

A company offering subscription-based services, like a streaming platform or gym membership, receives annual payments upfront. The company records the payment as deferred revenue and recognizes it gradually as the service is provided over the subscription period.

2. Educational Institutions

Private schools or universities may receive tuition fees for an entire semester at the start of the school year. The fees are recorded as deferred revenue, which is recognized as income throughout the academic period.

3. Software Companies

A software provider offering annual software licenses records the upfront payment as deferred revenue, recognizing it as yearly income as the customer continues to use the software.

4. Event Organizers

An event planning company may collect payments for a conference scheduled months in advance. The payment is recorded as deferred revenue until the event takes place, at which point it is recognized as revenue.

5. Airlines

An airline that sells flight tickets in advance will record the payment as deferred revenue until the flight is completed, at which point it becomes earned revenue.

Are you still unclear as to why businesses and individuals record deferred revenue? Check out this video. It clearly provides a comprehensive explanation of deferred revenue, including real-life examples and journal entries.

Also Read: How Much Down Payment Is Needed for a Small Business Loan?

How Does Deferred Revenue Affect Financial Statements

Deferred revenue significantly impacts the financial statements of both businesses and individuals, particularly in how it reflects income and liabilities. Here's how it affects financial reporting in the Philippines -

1. Balance Sheet

Deferred revenue is recorded as a liability on the balance sheet because it represents an obligation to provide goods or services in the future. It increases the company’s liabilities until the service is completed or the product is delivered.

2. Income Statement

As the goods or services are delivered over time, deferred revenue is gradually recognized as earned revenue on the income statement. Doing so ensures that income is reported in the period when the service or product is actually provided, following the revenue recognition principle.

3. Cash Flow Statement

Although the cash is received upfront, it is reflected in the operating activities section of the cash flow statement. However, it does not contribute to the net income until the deferred revenue is recognized as earned.

4. Financial Ratios

For businesses, deferred revenue can temporarily inflate liabilities, affecting financial ratios such as the current ratio or debt-to-equity ratio, potentially making the company appear more leveraged than it is.

5. Impacts on Taxation

The timing of revenue recognition impacts taxable income for individuals or businesses that receive deferred revenue. Deferred revenue delays taxation until the income is earned, helping companies to manage tax obligations more efficiently.

Also Read: Steps to Streamline and Improve Your Invoice Factoring Application

Simplify your financing with N90’s Fast Financing Solutions. Apply online in minutes and get potential approvals within 24 hours. Start now! Empower Your Business with additional funding to take it to the next level! Avail Today!

Influence of Deferred Revenue on Key Financial Ratios

Deferred revenue plays a significant role in how a company’s financial health is represented through critical financial ratios. It directly impacts financial statements' liabilities and revenue sections, altering essential metrics that investors and lenders in the Philippines use to assess a business.

Here, take a look at how deferred revenue influences vital financial ratios of businesses and individuals in the Philippines -

1. Current Ratio

Since deferred revenue is recorded as a current liability, it increases total liabilities, potentially lowering the current ratio. A lower ratio may indicate reduced short-term liquidity, even though the business has already received the cash.

2. Debt-to-Equity Ratio

An increase in deferred revenue raises total liabilities, inflating the debt-to-equity ratio. A higher ratio could make the business appear more leveraged even though the liability represents future obligations rather than traditional debt.

3. Working Capital

Deferred revenue, as part of current liabilities, reduces working capital, which may affect a company’s ability to meet short-term operational needs. This can make the business appear less liquid, even though the cash from deferred revenue is already in hand.

4. Profit Margin

Deferred revenue can temporarily understate revenue on the income statement since it is only recognized once the product or service is delivered. As the income is deferred to future periods, this may result in a lower profit margin in the short term.

5. Return on Assets

Since deferred revenue delays the recognition of income, it can reduce net income in the short term, thus lowering return on assets (ROA). However, once the revenue is recognized, ROA may improve.

Also Read: Understanding Non-Recourse Invoice Factoring in The Philippines

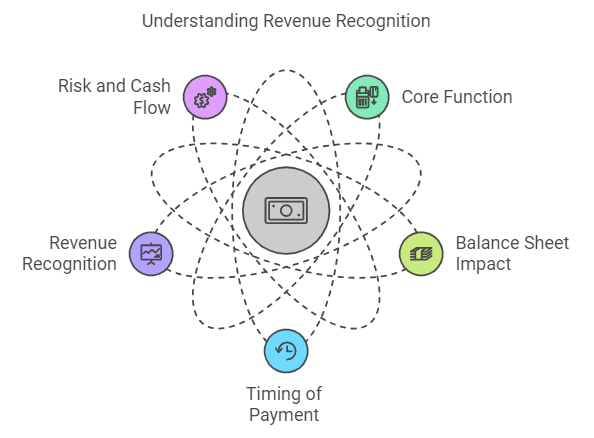

Crucial Differences Between Deferred Revenue vs. Accounts Receivable in The Philippines

Understanding the differences between deferred revenue and accounts receivable is vital to grasping the nuances of financial statements. Both concepts play pivotal roles in accounting, but they represent very different points in the revenue recognition timeline.

Here, take a look at the crucial differences between deferred revenue and accounts receivable in the context of the Philippines -

1. Core Function

Deferred revenue refers to payments a business has received in advance for goods or services that have yet to be delivered. It is a liability because the company still owes the customer the product or service.

In contrast, accounts receivable represent money owed to the business for goods or services already provided but still need to be paid for by the customer. It is considered an asset, as the company expects to receive cash in the future.

2. Balance Sheet Impact

Deferred revenue appears on the balance sheet under current liabilities, as it represents an obligation to deliver goods or services in the future. It increases liabilities and does not affect revenue until the service is performed.

On the other hand, accounts receivable are recorded under current assets on the balance sheet. They reflect cash the business expects to collect soon, contributing to its asset base.

3. Timing of Payment

In deferred revenue, the business receives payment before delivering the service or product, making it unearned revenue. The company holds the payment as a liability until the obligation is fulfilled.

With accounts receivable, the business delivers the product or service before receiving payment. The company waits for the customer to fulfill the payment obligation, making it an asset on the balance sheet.

4. Revenue Recognition

For deferred revenue, income is not recognized immediately upon receiving payment. Instead, revenue is recognized gradually as the company fulfills its obligations by delivering the goods or services.

In contrast, accounts receivable are created when the service or product is delivered, and the revenue is recognized immediately on the income statement, even if the payment has not yet been received.

5. Risk and Cash Flow

Deferred revenue provides immediate cash inflow, improving the business’s liquidity. However, it poses a risk regarding obligation, as the company must still deliver on its promises. Failure to do so could result in refund liabilities.

On the other hand, accounts receivable carry the risk of non-payment by the customer, which could affect cash flow. Collecting receivables on time is crucial for maintaining healthy liquidity.

For students struggling to differentiate between accounting terms, a Reddit discussion clarifies that deferred revenue occurs when cash is received before income is earned, classifying it as a liability. Read on to learn more.

Also Read: Basics of Business Funding Options for Small and Medium Businesses

How To Calculate Deferred Revenue in The Philippines

Calculating deferred revenue is essential for businesses that receive payments in advance for products or services that will be delivered in the future. The calculation involves identifying the amount of payment received upfront and determining the portion that has yet to be earned.

Here's a simple step-by-step guide to calculating deferred revenue for you or your business in the Philippines -

1. Identify the Total Payment Received

Determine the total amount of advance payment the business has received from customers for goods or services that have yet to be provided.

2. Determine the Service/Delivery Period

Identify the period over which the product or service will be delivered. Depending on the agreement, this could be monthly, quarterly, or annually.

3. Calculate the Portion of Revenue Earned

Calculate the revenue earned for services or products already delivered within the reporting period. For example, if a company receives PHP 120k for a 12-month service and one month has been completed, PHP 10k (120k ÷ 12) will be recognized as earned revenue.

4. Subtract Earned Revenue from Total Payment

Subtract the earned revenue from the total payment received to determine the amount of deferred revenue. For instance, if PHP 10k has been earned from the PHP 120k payment, the remaining PHP 110k is considered deferred revenue.

Conclusion

As this article has shown, deferred revenue plays a crucial role in maintaining accurate financial reporting for businesses in the Philippines. By recognizing payments received in advance as liabilities, companies ensure compliance with accounting standards and provide a transparent view of their financial obligations.

Moreover, by properly managing deferred revenue, Philippine businesses can clearly distinguish between earned and unearned income, thereby enhancing their ability to project future revenue, manage cash flow, and uphold trust with stakeholders.

Additionally, managing and tracking deferred revenue accurately is crucial for compliance and financial health, and one of the best ways to handle deferred revenue efficiently is by using automated accounting systems.

This is mainly because these systems can automate the tracking of deferred revenue, dramatically reducing the risk of errors associated with manual adjustments and ensuring your financial records are always up-to-date.

Frequently Asked Questions (FAQs)

1. What type of account is deferred revenue in accounting?

Deferred revenue is a liability account in accounting, as it represents payments received by a business for goods or services that have not yet been delivered or performed.

Since the business must provide the service or product in the future, deferred revenue is classified as a liability on the balance sheet until the revenue is earned and recognized.

2. What are the 3 statements of deferred revenue?

The 3 financial statements that reflect deferred revenue are as follows -

- Balance Sheet: Deferred revenue is listed as a liability, as it represents unearned income.

- Income Statement: Deferred revenue is recognized as earned revenue once the goods or services are delivered.

- Cash Flow Statement: Deferred revenue impacts the operating activities section, showing cash inflows from advance payments.

3. Is deferred expense debit or credit?

Deferred expense is initially recorded as a debit on the balance sheet under assets, as it represents a payment made for future benefits, such as prepaid rent or insurance.

Over time, as the expense is incurred, the deferred expense is credited, and the corresponding expense account is debited, gradually recognizing the cost on the income statement.

4. What is the main difference between unbilled revenue and deferred revenue?

The main difference between unbilled revenue and deferred revenue lies in timing and recognition. Unbilled revenue refers to revenue earned but not yet invoiced to the customer, recorded as an asset.

In contrast, deferred revenue is payment received in advance for goods or services yet to be provided, recorded as a liability until the service or product is delivered.