What drives the growth of digital banks in the Philippines, and can they achieve sustainable profitability in a competitive market? Digital banks are transforming the banking industry in the Philippines by offering convenient, fully online services tailored to satisfy the modern financial needs of Filipinos.

These institutions, licensed by the Bangko Sentral ng Pilipinas (BSP), focus on accessibility, efficiency, and innovative technology. However, as digital banks gain traction, questions arise about their profitability and the challenges of establishment in a competitive financial landscape.

Therefore, in this article, we will dive deeper and take a look at how digital banks operate in the Philippines, their path to profitability, and what it takes to establish and sustain a successful digital banking venture.

Additionally, we'll also explore in detail how these institutions are tailoring their strategies to thrive in a competitive and regulated market while meeting the country’s growing appetite for digital solutions and the potential challenges they face while doing so.

Overview of Digital Banks And Their Efficiency in The Philippines Financial Ecosystem

The concept of digital banks has rapidly gained traction in the Philippines, ever since the Bangko Sentral ng Pilipinas (BSP) officially incorporated them into the financial ecosystem in 2020.

Digital banks in the Philippines are reshaping the financial landscape by offering fully online banking services, prioritizing convenience, accessibility, and cost-efficiency. With no physical branches, these banks make use of technology to deliver faster and more flexible financial solutions.

Here’s an overview of digital banks and their efficiency in the Philippines in greater detail:

1. Fully Digital Operations

Digital banks operate entirely online, allowing customers to open accounts, apply for loans, and perform transactions through mobile apps or websites. This eliminates the need for physical visits, saving time and effort for users.

2. Cost Efficiency

With no overhead costs for maintaining branches, digital banks can offer lower fees, higher interest rates on deposits, and competitive loan terms. This affordability appeals to the underbanked and underserved markets.

3. Financial Inclusion

Digital banks promote financial inclusion by reaching underserved and unbanked populations, especially in rural areas. Customers can open accounts with minimal requirements and access banking services remotely.

4. 24/7 Accessibility

Unlike traditional banks, digital banks provide round-the-clock services. Customers can perform transactions, pay bills, or manage finances anytime, enhancing convenience and efficiency.

5. Innovative Features

Digital banks offer advanced features such as real-time payments, savings automation, and seamless integration with e-wallets. These innovations cater to the evolving needs of modern consumers, making banking more user-friendly.

6. Data-Driven Personalization

By utilizing customer data, digital banks offer personalized financial products and recommendations, improving customer satisfaction and loyalty. This data-driven approach enhances the overall banking experience for individuals and businesses alike in the Philippines.

Also Read: Legal Considerations in Employee Loan Policy in The Philippines

Regulatory Environment and Establishment of Digital Banks in Philippines

The regulatory environment for digital banks in the Philippines is designed to promote innovation while ensuring financial stability and consumer protection. Governed by the Bangko Sentral ng Pilipinas (BSP), these regulations establish a detailed framework for the establishment and operation of digital banks in the Philippines.

Here, take a look at the key aspects that play a crucial role in setting up the regulatory environment for digital banks to function efficiently in the Philippines:

1. BSP Licensing Framework

The BSP requires prospective digital banks to obtain a digital banking license. Applicants must demonstrate financial soundness, technological capabilities, and a sustainable business model. The licensing process ensures only qualified institutions can operate as digital banks.

2. Capitalization Requirements

Digital banks in the Philippines must maintain a minimum capitalization of PHP 1 billion to ensure financial stability. This requirement enables trust and safeguards consumers by ensuring that banks have sufficient financial resources to meet operational needs and obligations.

3. Defined Business Model

The BSP mandates that digital banks must offer primarily digital banking services, with no physical branches. This model encourages innovation while emphasizing cost-efficiency and technology-driven operations.

4. Compliance with Consumer Protection Regulations

Digital banks are required to comply with consumer protection guidelines, including transparency in fees, data privacy under the Data Privacy Act, and effective dispute resolution mechanisms, to ensure the safety and trust of their customers.

5. Risk Management and Cybersecurity

Establishing in-depth risk management and cybersecurity protocols is mandatory. Digital banks must implement advanced technology to prevent fraud, cyberattacks, and unauthorized access, ensuring a secure banking environment.

6. Regular Reporting and Supervision

Digital banks are subject to regular reporting requirements and BSP supervision. This includes submitting financial performance reports, compliance audits, and risk management assessments to maintain operational transparency and accountability.

7. Focus on Financial Inclusion

The regulatory framework encourages digital banks to support financial inclusion by providing accessible and affordable banking services to underserved populations, particularly in rural areas.

8. Limitations on Foreign Ownership

While foreign entities can invest in digital banks, they must comply with the 60%-40% ownership rule favoring Filipino ownership for locally incorporated banks, ensuring national interest is upheld.

Also Read: Bank Auto Loan vs Dealer Car Financing in the Philippines: Which is Better?

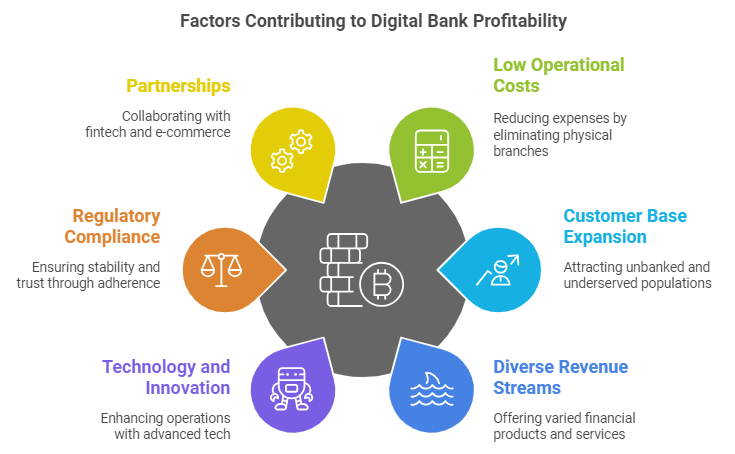

Profitability Factors For Digital Banks in The Philippines

Digital banks in the Philippines offer numerous tech-driven financial solutions to individuals and businesses alike but achieving profitability in this competitive market is also pivotal for them. So to do so, they are required to address specific key factors such as operational efficiency, customer acquisition, and regulatory compliance.

Here, take an elaborate look at the primary factors that influence the profitability of digital banks in the Philippines:

1. Low Operational Costs

With no physical branches, digital banks reduce overhead costs significantly. This allows them to allocate resources toward technology and customer acquisition, ultimately enhancing their overall profitability by minimizing operational expenses.

2. Customer Base Expansion

Digital banks focus on acquiring a large customer base, particularly from the unbanked and underserved populations. By offering accessible, user-friendly services, they drive account openings and transactions, generating revenue through fees and interest.

3. Diverse Revenue Streams

Beyond traditional banking services, digital banks generate income through other value-added offerings as well like personal loans, investment platforms, and financial advisory services. Diversification helps increase revenue while catering to varying customer needs.

4. Technology and Innovation

Investing in advanced technologies, such as AI and machine learning, enables digital banks to optimize operations, enhance customer experiences, and manage risks more effectively. This efficiency boosts customer retention and reduces overall operating costs.

5. Regulatory Compliance

Complying with the Bangko Sentral ng Pilipinas (BSP) regulations ensures the operational stability of digital banks while also building trust. Regulatory compliance protects digital banks from penalties and strengthens their reputation, contributing to long-term profitability.

6. Partnerships and Ecosystem Integration

Collaborations with fintech companies, payment platforms, and e-commerce businesses expand service offerings and improve customer engagement. Integrating into broader financial ecosystems allows digital banks to increase transaction volume and revenue.

7. Data Monetization and Personalization

Utilizing customer data to offer personalized financial products enhances user satisfaction and loyalty. Data-driven insights also enable digital banks to identify profitable opportunities, such as tailored loans or investment products.

8. Efficient Risk Management

Digital banks rely on robust algorithms to assess creditworthiness and minimize defaults. Effective risk management reduces losses and ensures sustainable lending practices, which are critical to profitability.

Are you looking for more details regarding the profitability of digital banks operating in the Philippines and their overall impact on the country’s economy? Check out this video. It not only discusses the profitability of digital banks in the Philippines but also explores the perspective of BSP on non-profitable digital banks.

Also Read: SSS Salary Loan Application Online Guide in The Philippines

Make your business goals a reality with N90’s fast financing solutions. Apply now for a quick loan and get potential approvals within 24 hours. Get immediate funding for your Philippine SME to help it grow today! Avail Today!

Challenges in Availing Digital Banking Solutions in The Philippines

While digital banking in the Philippines offers convenience and financial inclusion, there are challenges that users face when availing of these solutions, such as limited internet access, lack of digital literacy, and security concerns that hinder widespread adoption.

Here, take a closer look at the primary challenges individuals and businesses face in availing digital banking solutions in the Philippines:

1. Limited Internet and Mobile Connectivity

Many rural areas in the Philippines have poor internet connectivity, making it difficult for users to access digital banking platforms. Without stable connections, users experience transaction delays or are unable to use services altogether, reducing digital banking accessibility.

2. Low Digital Literacy

A significant portion of the population lacks the skills to navigate digital banking apps or platforms. Older individuals and those with limited exposure to technology face difficulties in performing basic tasks, such as opening accounts or transferring funds.

3. Security and Fraud Concerns

Fear of cyberattacks, phishing scams, and account breaches discourages users from adopting digital banking. While banks implement security measures, many users remain skeptical about the safety of their money and personal data in digital environments.

4. Regulatory and Compliance Challenges

Digital banks must comply with Bangko Sentral ng Pilipinas (BSP) regulations, which can be complex and time-consuming. Due to this, some users might even face delays or restrictions due to verification requirements or policies aimed at preventing fraud and money laundering.

5. Inadequate Financial Inclusion Awareness

Many Filipinos, especially in remote areas, are unaware of the benefits and availability of digital banking. This lack of awareness leads to underutilization of services that could otherwise enhance their financial access and literacy.

6. Technical Glitches and Downtime

Users often encounter technical issues such as app crashes, slow processing times, or system maintenance. These problems disrupt transactions and reduce trust in digital banking solutions, especially for those reliant on timely access to their funds.

7. High Initial Adaptation Costs

For some users, the costs of smartphones or devices required to access digital banking services are prohibitive. This financial barrier limits the reach of digital banking among the economically disadvantaged.

8. Lack of Personalized Customer Support

Unlike traditional banks, digital banking often lacks in-person customer support, making it difficult for users to resolve issues. Automated help desks and chatbots may not provide sufficient assistance for complex queries and frustrating users.

Also Read: How to Repay a CIMB Bank Loan Online in The Philippines

Prominent Players in The Philippine Digital Banking Scene

The Philippine digital banking landscape has evolved significantly, with several key players offering innovative financial solutions to meet the diverse needs of consumers. Here, check out some prominent banks in the Philippines offering efficient and safe digital banking solutions to individuals and businesses alike:

1. Maya Bank

Formerly known as PayMaya, Maya Bank offers a comprehensive digital banking experience, including savings accounts with interest rates ranging from 3.5% to 14% per annum. It combines a secure wallet with banking services, allowing users to save, grow, and invest their money.

2. UnionDigital Bank

A subsidiary of UnionBank, UnionDigital provides digital banking services with interest rates between 3% and 4% per annum. It focuses on delivering seamless financial solutions through its digital platform.

3. GoTyme Bank

A joint venture between the Gokongwei Group and Singapore-based Tyme, GoTyme Bank offers a 4% per annum interest rate on savings. It aims to provide secure and easy onboarding through both an app and digital kiosks located throughout the mall and retail footprint of the Gokongwei group.

4. Tonik Bank

Tonik is the first all-digital bank in Southeast Asia, offering interest rates of up to 6% per annum on time deposits. It provides a range of financial products, including deposits, payments, debit cards, and loans, all accessible through its mobile app.

5. UNOBank

UNOBank offers interest rates of 4.25% per annum for its UNOReady account and up to 6.5% per annum for its UNOBoost account. It utilizes an AI-powered platform to deliver personalized banking services to its customers.

6. Overseas Filipino Bank (OFBank)

A digital bank under the Land Bank of the Philippines, OFBank provides interest rates ranging from 1% to 4% per annum. It caters primarily to Overseas Filipino Workers (OFWs), offering services tailored to their unique financial needs.

Also Read: Happy Cash Loan App in The Philippines: An In-Depth Analysis

Future Prospects of Digital Banking in Philippines

The future of digital banking in the Philippines looks promising as the industry continues to grow, primarily driven by increasing consumer demand, technological advancements, and regulatory support.

Here, check out the key factors that will play a pivotal role in enhancing the digital banking landscape in the Philippines:

1. Increased Financial Inclusion

Digital banks are set to bridge the financial gap for the unbanked and underserved populations, particularly in rural areas. By providing accessible banking services through mobile platforms, they can enable more Filipinos to participate in the country’s economy.

2. Adoption of Advanced Technologies

Emerging technologies like artificial intelligence, blockchain, and machine learning will drive the evolution of digital banking. These technologies can enhance personalized banking experiences, streamline operations, and improve risk management.

3. Expanding Payment Ecosystems

The rise of cashless payments and e-wallet integrations will boost digital banking. Partnerships between digital banks, fintech companies, and e-commerce platforms will create a more interconnected financial ecosystem, offering seamless transactions and value-added services.

4. Enhanced Customer Experience

Digital banks will continue to prioritize user-centric services by making use of data analytics for personalized recommendations, faster approvals, and real-time support. This focus on customer experience will increase user engagement and loyalty.

5. Competitive Interest Rates and Products

As competition intensifies, digital banks are expected to offer more attractive interest rates on savings and loans, as well as innovative financial products like micro-loans and investment platforms tailored to diverse consumer needs.

6. Regulatory Advancements

Supportive regulatory frameworks from the Bangko Sentral ng Pilipinas (BSP) will pave the way for further innovation in the digital banking space. Moreover, updates to compliance requirements and policies will ensure stability while encouraging growth and innovation.

7. Potential for Market Consolidation

As the sector matures, mergers and acquisitions among digital banks and fintech companies may occur, leading to stronger, more scalable institutions. This consolidation will enhance the efficiency of the services provided and also broaden their market reach.

8. Global Integration

Digital banks in the Philippines have the potential to integrate into international payment systems, enabling cross-border transactions and remittances. This global outlook will attract more overseas Filipinos and international clients.

Conclusion

Digital banks in the Philippines represent a transformative force in the country’s financial sector, offering innovative, accessible, and cost-efficient solutions to modern banking challenges. With features such as fully digital operations, competitive interest rates, and 24/7 accessibility, they cater to a growing tech-savvy population while addressing the financial inclusion gap for the unbanked and underserved.

However, challenges such as limited internet connectivity, low digital literacy, and consumer trust issues remain barriers to widespread adoption. Digital banks must address these issues through targeted education campaigns, advanced security measures, and partnerships to improve accessibility.

Looking ahead, the prospects for digital banking in the Philippines are bright. Emerging technologies like AI, blockchain, and machine learning promise to enhance operations and customer experience. Moreover, expanding payment ecosystems and potential global integrations will further position digital banks as key players in the Philippine financial sector.

Frequently Asked Questions (FAQs)

1. What is the leading digital bank in the Philippines?

Maya Bank is a leading digital bank in the Philippines, offering comprehensive financial services through its mobile platform. As of June 2024, it held the highest asset value among digital banks in the country, totaling approximately PHP 38.11 billion.

Maya Bank provides high-interest savings accounts, seamless transactions, and a user-friendly interface, contributing to its prominence in the Philippine digital banking sector.

2. How do digital banks make a profit?

Digital banks make profits through various revenue streams, including interest from loans and credit products, fees from transactions or fund transfers, and service charges for premium features.

Moreover, they also earn through partnerships with e-commerce platforms and fintech companies, data monetization, and investments. With lower operational costs due to branchless models, they maximize efficiency while offering competitive financial solutions.

3. What is the major challenge the banking industry faces in the Philippines?

The major challenge the banking industry in the Philippines faces is financial inclusion. A significant portion of the population remains unbanked or underserved due to limited access to traditional banking services, particularly in rural areas.

Factors such as inadequate infrastructure, low digital literacy, and economic inequality hinder the industry's ability to extend services to all Filipinos effectively.

4. Are digital banks in the Philippines approved by BSP?

Yes, digital banks in the Philippines are approved and regulated by the Bangko Sentral ng Pilipinas (BSP). As of August 2024, the BSP has authorized 6 digital banks to operate in the country, including Maya Bank, UnionDigital Bank, and GoTyme Bank.

The BSP plans to grant licenses to 4 more digital banks starting January 2025.