Applying for and securing a loan can be daunting, especially for teachers juggling numerous responsibilities inside and outside the classroom. Matching a loan product to specific needs and constraints is crucial for Department of Education (DepEd) employees.

EastWest Bank's Teacher Loan is a solution specifically designed to meet educators' financial requirements. From competitive interest rates and fast processing times to flexible loan amounts and automatic payroll deductions, teachers can find a reliable partner in EastWest Bank to handle their financial needs seamlessly.

In this blog, we will detail why EastWest Bank is the preferred choice for teacher loans in the Philippines and the steps they need to take to secure one. So, without any further delay, let us jump right into all the details.

Why Choose EastWest Bank for Your Teacher Loan in The Philippines?

Teachers have specific needs and constraints when it comes to securing a loan. Fortunately, EastWest Bank understands these and offers a tailored solution with its Teacher Loan.

Here are the reasons why EastWest Bank stands out:

1. Competitive Interest Rates

EastWest Bank offers highly competitive interest rates, starting as low as 7.5% per annum for terms of up to 5 years. For shorter terms, monthly rates start at 1.49%.

2. Fast and Convenient Processing

Time is crucial, especially for teachers managing multiple responsibilities. EastWest Bank processes loans quickly and conveniently, requiring minimal documentation.

Typically, applicants complete the process within 5 to 7 banking days, and EastWest Bank releases funds within an additional 2 to 4 banking days. In some cases, approvals can happen within a day if all required documents are ready.

3. No Co-Maker Needed for DepEd Employees

An exclusive advantage for Department of Education (DepEd) employees is the ability to apply without a co-maker. This reduces hassle and speeds up loan approval.

4. Automatic Payroll Deduction

Automatic payroll deductions simplify repayments, ensuring timely payments.

5. Flexible Loan Amounts

Teachers can access loans from PHP 25k to PHP 1 million. This flexibility covers various needs, such as personal expenditures, professional development, or emergencies.

6. Buy-Out Option

EastWest Bank offers a buy-out option for consolidating existing loans. This helps educators manage debts more efficiently and potentially secure better terms, easing financial stress.

Do you want to know more? Here, check out this video. It outlines the requirements and benefits of the Teachers' Loan at EastWest Rural Bank in the Philippines.

Also Read: 10 Strategies to Increase Your Business Cash Flow

EastWest Bank Loan Table For Teachers in 2024

In 2024, EastWest Bank continues to provide tailored financial solutions for educators through its Teacher Loan Program, and the loan table outlines the different options available.

The various options include loanable amounts, interest rates, and repayment periods, allowing teachers to choose the best loan plan suited to their financial needs.

The Eastwest Bank loan table for teachers in the Philippines is as follows. In this table, we have provided the initial loan amount, the net proceeds, the monthly loan amortization for the period of 12 to 60 months -

Also Read: Fast Business Loans for Quick Cash in 2024

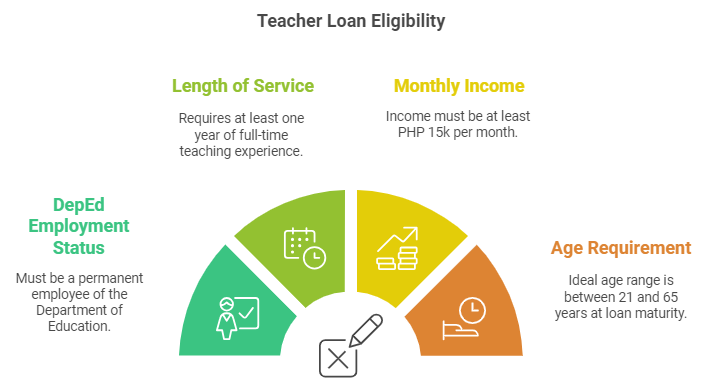

Teacher Loan Eligibility Criteria in The Philippines - Key Points To Remember Before Applying

To qualify for an EastWest Bank Teachers Salary Loan, you must meet some straightforward requirements.

Here, take a look at some of the mandatory requirements that you must qualify for before applying for a teacher loan from Eastwest Bank in the Philippines -

1. DepEd Employment Status

First, you must be a teacher in the Philippines, specifically a permanent Department of Education (DepEd) employee. The bank relies on the automatic payroll deduction system to ensure loan repayments, so your employment status is a critical factor.

2. Minimum Length of Service Requirement

You must be a full-time teacher with at least one year of experience. This requirement helps you and the bank feel confident about your financial stability and ability to manage loan repayments.

3. Monthly Income Criteria

Regarding finances, your loan amount cannot exceed six times your monthly salary. The minimum gross monthly income required is PHP 15k, amounting to an annual income of at least PHP 180k. This built-in measure ensures you don’t borrow more than you can handle.

4. Age Requirement

While there isn't a strict age criterion mentioned, it's generally best to be between 21 and 65 years old when your loan matures. This range aims to ensure a stable financial situation, making it easier to manage your loan.

Also Read: Quick Cash Loans without Collateral in the Philippines

Accessible online applications and fast approvals within 24 hours! Apply today and keep your Philippine SME’s momentum going with N90’s Fast Financing Solutions. Apply now!

Documentary Requirements For a Teacher Loan at Eastwest Bank in The Philippines

When you're ready to apply for a teacher loan with EastWest Bank, you must gather a few essential documents. You provide these documents to verify your identity, income, and employment status, which are crucial for EastWest Bank's assessment.

Here’s a simple breakdown of what you'll need -

- Two Valid Government-Issued IDs: These can include your DepEd ID, PRC ID, or any other government-recognized identification. Ensure these IDs are current and not expired.

- One Month Latest Original Payslip: This should be from the most recent payroll period. Your payslip verifies your income and ensures you have a stable financial situation.

- Photocopy of Appointment or Service Record: This document confirms your employment status and tenure with the Department of Education, which helps the bank assess the stability of your job.

Additional Requirements for New Applicants

When applying for a loan with EastWest Bank as a new applicant, it's essential to know the additional requirements that help streamline the application process. You must provide two 2x2 ID pictures as one of the requirements.

This might seem like a small step, but these ID pictures ensure your loan application is verified and processed smoothly.

Why are 2x2 ID Pictures Necessary?

- Verification: The 2x2 ID pictures help the bank verify your identity, ensuring the loan is issued to the correct person.

- Security: EastWest Bank uses these pictures to prevent fraudulent activities, protecting both you and the bank from potential risks.

- Record Keeping: EastWest Bank maintains a record of your ID pictures for future reference, simplifying the loan process and ensuring the correct logging of your application details.

Tips for Providing 2x2 ID Pictures

To ensure a smooth application process, it’s essential to follow these picture guidelines -

1. Use Recent Photos

Your 2x2 ID pictures should be recent, ideally taken within the last six months, to accurately reflect your current appearance.

2. Ensure Clarity

The photos should be clear and legible, free from any damage or blemishes that could cause issues during the verification process.

3. Correct Size

Make sure the pictures are exactly 2x2 inches. Incorrect sizes can delay the processing of your loan application.

4. Quality Matters

Use high-quality photos with a plain, neutral background to avoid any potential complications during verification.

Also Read: Businesses That Fall Under MSME Sector

Eastwest Bank’s Loan Consolidation Offer - Buy-out Requirements

EastWest Bank’s loan consolidation or buy-out offer allows individuals to consolidate their existing loans into one, easing debt management and possibly lowering monthly payments.

Here are the typical requirements for availing of the loan buy-out -

1. Statement of Account (SOA) from Previous Loan Provider

One of the critical documents you’ll need is the Statement of Account (SOA) from your previous loan provider. You provide this document to give EastWest Bank a clear picture of your existing loan terms.

It includes details about the following aspects -

- Outstanding balance

- Interest rates

- Payment history

2. Completed Application Form

Submit a filled-out application form, which can be obtained from the bank or downloaded from their website.

3. Valid Government-issued ID

Provide at least one valid ID, such as a passport, driver's license, or UMID.

4. Proof of Income

Recent payslips and a Certificate of Employment (COE) are required for salaried individuals. Self-employed individuals must submit business permits, bank statements, and tax documents.

5. Existing Loan Statements

Provide billing statements or loan certificates from the current lending institutions to verify the outstanding balance of the loans to be consolidated.

6. Good Credit Standing

To qualify for the buy-out program, applicants should have a good credit score and be in good standing with their current lenders.

Using this information, EastWest Bank evaluates your current financial situation and proposes a more favorable consolidation plan. This could mean lower interest rates and more manageable monthly payments.

Also Read: Types of Collateral for Secured Business Loans

Eastwest Bank Application Process For a Teacher Loan in Philippines

Applying for a loan as a teacher with EastWest Bank is straightforward if you follow a few key steps.

Here, check out the steps involved when applying for a teacher loan at Eastwest Bank in the Philippines -

1. Visit Your Nearest EastWest Bank Branch

Start by going to the nearest EastWest Bank branch. If you need help determining the closest branch, you can find this information on their website or by checking their social media pages.

2. Gather Information Online

Research loan requirements online before visiting the branch to ensure you’re well-prepared.

3. Fill Out the Application Form

You can download the application form from EastWest Bank's website or obtain a physical copy at the branch. Complete it accurately, as incomplete forms can lead to delays.

You must provide your full name, address, contact information, identification details, employer information, salary, and length of employment.

4. Submit All Required Documents

Have the necessary documentation ready. Typically, you'll need -

- The latest two months' original payslips.

- Two valid government-issued IDs.

- A photocopy of your appointment letter or service record.

- Two 2x2 ID pictures.

- Any additional requirements for new applicants as specified by the bank.

Also Read: Getting a Small Business Loan in The Philippines

Essential Aspects To Remember When Applying For a Teacher Loan in Philippines

When taking out a loan, especially as a teacher with EastWest Bank, there are critical factors to consider to ensure your financial well-being.

Here’s what you need to keep in mind -

1. Understand the Loan Terms and Conditions

Before you submit the loan application, make sure you understand the terms. This includes learning about the interest rate, which EastWest Bank sets at 2.5% per annum for a salary loan.

Also, pay attention to the repayment term, which can range from 12 to 60 months, and check for any fees associated with the loan. Understanding these terms helps you make an informed decision and avoid any unpleasant surprises.

2. Calculate Monthly Repayments and Ensure Affordability

Financial planning is crucial. Use the loan table provided by EastWest Bank to calculate your monthly repayments based on your loan amount and repayment term. This will help you ensure that the repayments comfortably fit within your budget.

Remember that the monthly repayments should be at a level that doesn’t cause undue financial strain.

3. Borrow Only What Is Needed and Can Be Repaid

It’s tempting to borrow more when a loan is readily available, but it’s wise to borrow only the amount you truly need.

4. Maintain Good Credit Standing by Avoiding Late Payments

Timely repayments are crucial in maintaining a good credit score, which can impact your ability to secure future loans. Late payments not only attract fees but can also damage your credit standing. Be diligent in making your timely payments to keep a clean credit record.

Conclusion

EastWest Bank’s loan offerings for teachers provide a reliable and flexible financial solution tailored specifically to educators' needs. With competitive interest rates, flexible repayment terms, and easy application processes, teachers can access the funds they need for personal or professional purposes without excessive financial strain.

The loan table helps educators choose the best loan options that fit their financial capacity, ensuring manageable monthly payments and responsible borrowing. EastWest Bank’s teacher loan program empowers educators to achieve their financial goals with convenience and peace of mind.

However, as good as it all sounds, Eastwest Banks has a few eligibility criteria that potential borrowers must remember to satisfy if they want their loan applications to be successful.

Furthermore, they must also provide essential information and documents to prove their eligibility at the time of application. Doing so will give them a hassle-free loan application process.

Frequently Asked Questions (FAQs)

1. How much is the loan for teachers in the Philippines?

In the Philippines, teacher loans typically range from PHP 20k to PHP 1 million, depending on the lender and the teacher’s financial capacity.

Institutions like EastWest Bank, Pag-IBIG Fund, and GSIS offer specific loan programs for teachers.

2. What is the loanable amount in EastWest Bank?

The loanable amount with EastWest Bank typically ranges from PHP 25k to PHP 3 million, depending on the borrower's financial capacity, credit standing, and the specific loan product applied for.

Moreover, for personal loans and specialized programs like teacher loans, the loan amount is based on income and repayment ability, and flexible terms of 12 months to 60 months are offered to meet the borrowers' various financial needs.

3. What is the interest rate for the Eastwest DepEd loan?

The interest rate for EastWest Bank’s DepEd loan typically starts at around 7.5% per annum for a 5-year loan term, but it may vary based on the borrower's profile, loan amount, and repayment term.

4. Can a teacher apply for a loan in the Philippines?

Yes, teachers in the Philippines can apply for loans from various financial institutions, including banks like EastWest Bank and LandBank and government agencies like GSIS and Pag-IBIG Fund.

These institutions offer specialized loan programs tailored for educators. They offer competitive interest rates starting at 7.5% per annum, flexible repayment terms of 12 to 60 months, and easy application processes to help teachers manage their personal or professional financial needs.