Struggling with sluggish cash flow due to slow-paying customers can be a nightmare for business owners. Fortunately, invoice factoring offers a viable solution to this common problem by providing immediate access to cash through the sale of unpaid invoices to a third-party firm.

In this comprehensive guide, you'll learn about the intricacies of invoice factoring, from understanding its basic definition to exploring its advantages and disadvantages. This article also delves into the step-by-step process, eligibility criteria, and associated costs, empowering you to decide if this financing option is right for your business.

So, without any further delay, let's explore how invoice factoring can transform your financial operations and help you stay ahead in the competitive business landscape of the Philippines.

What is Invoice Factoring?

Invoice factoring is a type of business financing that can be a lifesaver for businesses struggling with cash flow issues, especially those plagued by slow-paying customers. Essentially, invoice factoring involves selling your unpaid invoices to a third-party company—known as a factoring company—in exchange for immediate cash.

This third-party firm advances a substantial portion of the invoice's value upfront and then collects payment from your customers.

This method of financing enables businesses to bypass the often lengthy wait times for customer payments, ranging anywhere from 30 to 90 days. Companies can instantly unlock the cash tied up in their invoices by utilizing invoice factoring. This timely access to funds can be critical for covering short-term expenses such as payroll, utilities, and inventory.

Invoice factoring not only improves cash flow but also reduces administrative burdens. Since the factoring company takes over the collection process, business owners can redirect their focus and resources to other important areas of their operation.

Moreover, it also enhances a business’s financial flexibility by enabling it to invest in growth opportunities or maintain smooth day-to-day operations without the stress of slow payments hanging over their heads.

Also Read: How to Finance an Existing Business: Guide to Business Loans

How Does Invoice Factoring Work in The Philippines?

Invoice factoring in the Philippines allows businesses to sell their unpaid invoices to a factoring company for immediate cash. This process helps businesses improve cash flow without waiting for customer payments.

Here's a simplified step-by-step explanation of how invoice factoring works in the Philippines -

1. Invoicing the Customer

First, your business provides a service or sells a product to a customer and sends an invoice outlining the payment terms, typically between 30 and 90 days.

2. Selling Outstanding Invoices

You sell these invoices to a factoring firm and sign an agreement outlining the advance rate and fees.

3. Application and Agreement Signing

Before the invoices can be sold, your business needs to apply for approval from the factoring company. This involves checking the creditworthiness of your customers and the nature of your invoices. Once approved, both parties sign an agreement to formalize the relationship.

4. Receiving Advance Payment

After the agreement, the factoring company advances 70% to 100% of the invoice value.

5. Final Payment

The customer pays the factoring company, deducts factoring fees, and sends you the remaining balance. The factoring fee is typically around 1% to 5%.

Also Read: Creating A Cash Flow Budget In 5 Steps

How To Apply For Invoice Factoring in The Philippines - Crucial Steps For Potential Borrowers To Follow

Invoice factoring is an effective way for businesses to access immediate cash by selling their unpaid invoices to a factoring company. For businesses in the Philippines, applying for invoice factoring involves a structured process to ensure they meet the criteria and secure funding quickly.

Here are the crucial steps to follow -

1. Evaluate Your Business’s Needs

Analyze your cash flow needs, customers' creditworthiness, and the volume of outstanding invoices to determine if invoice factoring is right for your business.

2. Choose a Reputable Factoring Company

Research and compare factoring companies in the Philippines. Look for transparent terms and fees and a company experienced in your industry.

3. Prepare Required Documentation

Gather necessary documents such as unpaid invoices, customer credit profiles, business registration, and financial statements. These documents will help the factor assess the risk and creditworthiness.

4. Submit Your Application

Apply directly to the factoring company with all relevant documents. Include details about your business and the invoices you want to factor in.

5. Review and Negotiate Terms

The factoring company will review your application and propose terms, including advance percentage, factoring fees, and repayment terms. Negotiate terms that best suit your business needs.

6. Receive Advance Payment

Once approved, the factor will advance a percentage, usually 80-90%, of the invoice value, providing immediate cash flow for your business.

7. Factor Collects Payments

The factor assumes responsibility for collecting payments directly from your customers, allowing you to focus on business operations rather than managing collections.

8. Receive Remaining Balance

After the factor collects the full payment from your customers, they will release the remaining balance to you, minus their service fees.

Also Read: Legalities and Operations of Online Lending in the Philippines

Advantages of Invoice Factoring in The Philippines

Invoice factoring offers Filipino businesses an effective way to improve cash flow, reduce administrative burdens, and maintain financial stability, making it an attractive financing solution in the dynamic economic environment of the Philippines.

Here, take a look at some of its advantages for Philippine businesses -

1. Immediate Cash Flow

Businesses receive quick access to cash, typically up to 80-90% of the invoice value, allowing them to cover operational expenses without waiting for customer payments.

2. No Additional Debt

Invoice factoring is not a loan, so businesses can improve liquidity without adding debt to their balance sheets.

3. Outsourced Collections

The factoring company takes over the responsibility of collecting payments, reducing the administrative burden on businesses.

4. Support for Businesses with Poor Credit

Approval is based on customer creditworthiness, making factoring accessible for businesses with limited or poor credit.

5. Flexible and Scalable Financing

As sales and invoices grow, businesses can access more funds, providing flexibility to meet their cash flow needs.

Do you need more clarity on how invoice factoring can help your Philippine business? Check out this Reddit post. Here, a user shared their positive experience working with a factoring company for several years by explaining the basics of the process.

Also Read: Understanding Cash Flow: Its Importance and How It Works in Business

Access Fast, Reliable Invoice Financing! Use N90's effective invoice financing options to get a cash advance on your receivables and focus on what matters—growing your business. Apply today and give your Philippine SME the quick funds it needs to flourish.

Disadvantages of Invoice Factoring in The Philippines

While invoice factoring provides fast cash when needed, there are significant drawbacks to consider. Here, take a look at some of the prominent ones below -

1. Higher Costs

Invoice factoring typically comes with higher fees than traditional loans, including service fees and interest rates, which can reduce overall profitability, especially for businesses with thin margins.

2. Impact on Customer Relationships

Since the factoring company handles collections, this may affect customer relationships. Clients may feel uneasy about dealing with a third party, potentially damaging trust and long-term relationships.

3. Eligibility Based on Customer Creditworthiness

Approval for invoice factoring is often dependent on the creditworthiness of your customers rather than the business itself. Your customer’s poor payment histories may affect your ability to secure factoring.

4. Loss of Control Over Collections

Factoring companies manage collections, meaning businesses lose control over how and when customers are approached for payments. The factor’s collection practices may not align with your company’s standards or values.

5. Perception of Financial Instability

Relying on invoice factoring can signal to customers and stakeholders that the business may have cash flow issues or financial instability, which could impact the business's reputation.

Also Read: 6 Steps to Apply and Get a Business Loan

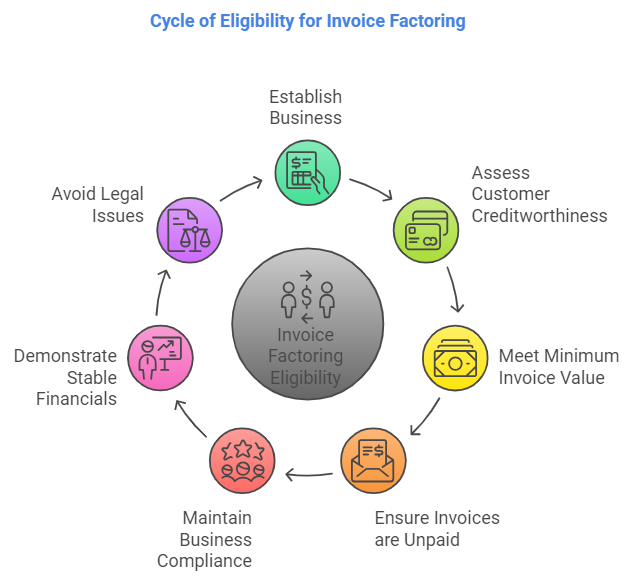

Eligibility Criteria For Invoice Factoring in The Philippines - Key Requirements Borrowers Need To Meet

Understanding the eligibility criteria for invoice factoring ensures a smooth application process, as it allows business owners to utilize their receivables efficiently for better cash flow.

However, businesses must meet specific eligibility criteria to avail themselves of invoice factoring in the Philippines. Here are some essential requirements borrowers need to fulfill -

1. Established Business With Invoices

The company must have a track record of generating business-to-business (B2B) invoices or business-to-government (B2G) transactions. The invoices should be for completed goods or services.

2. Creditworthy Customers

The creditworthiness of the customers is crucial. Factoring companies evaluate the customers' financial stability and payment reliability, as they are the ones responsible for paying the invoices.

3. Minimum Invoice Value

Some factoring companies require a minimum invoice value. Businesses must ensure that the total value of their invoices meets or exceeds the lender's minimum threshold.

4. Unpaid Invoices

Only unpaid invoices that are not pledged as collateral elsewhere are eligible. The invoices should not be overdue, and the payment terms should generally range from 30 to 90 days.

5. Registered and Compliant Business

The business must be legally registered in the Philippines and compliant with all relevant regulations, including tax filings and business licenses.

6. Stable Business Financials

While factoring primarily focuses on customer creditworthiness, businesses must also demonstrate stable financial operations. This ensures that the company can fulfill its obligations outside of invoice factoring.

7. No Major Legal Issues

Factoring companies typically avoid businesses involved in significant legal disputes or bankruptcy proceedings, as these pose a high risk for repayment and business continuity.

Also Read: Types and Methods of Inventory Management Systems with Examples

Potential Fees And Costs Associated with Invoice Factoring in Philippines

Understanding the associated costs is crucial when considering invoice factoring. The primary cost is the factoring fee, which usually ranges from 1% to 5% of the invoice value.

This fee can vary based on several factors, including your industry, the creditworthiness of your customers, and the volume of invoices you factor in.

Here, take a closer look at the potential fees and costs borrowers will have to incur when availing invoice factoring in the Philippines -

1. Factoring Fee

This is the primary cost of invoice factoring, usually ranging from 1% to 5% of the invoice value. The fee depends on factors such as your customer's creditworthiness, the size of the invoices, and the payment terms.

2. Service Fees

Some factoring companies charge additional service fees for administrative tasks such as processing invoices, maintaining records, and following up on collections. These can vary and may be either flat fees or a percentage of the total invoice amount.

3. Advance Fee

An advance fee may be charged when the factoring company advances a percentage of the invoice value upfront, typically 80-90%. This fee is based on the amount of cash advanced and the time before the customer receives the full payment.

4. Discount Rate

The discount rate refers to the interest applied to the advance, which is charged daily or monthly until the customer pays the invoice. If customers take longer to pay, this can add to the overall cost.

5. Late Payment Penalties

Some factoring companies impose late payment penalties if a customer is late in paying the invoice. These charges may increase the cost of the transaction, especially in recourse factoring, where the business is responsible for the debt if the customer defaults.

6. Due Diligence Fees

Factoring companies may charge for performing credit checks and background evaluations on the business’s customers. These fees are usually assessed upfront to determine the creditworthiness of the factored invoices.

7. Termination Fees

If a business signs a long-term factoring agreement and wishes to end the contract early, the factoring company may charge termination or exit fees. These fees can be significant, so it is important to review the contract terms before committing.

8. Invoice Verification Fees

Some factoring companies chartofverifying the authenticity and accuracy of the invoices submitted for factoring. This fee ensures the invoices are legitimate and comply with the factoring company’s requirements.

9. Minimum Volume Fees

Some factoring companies may require a minimum volume of invoices to be factored within a specific period. The company may charge a fee if a business fails to meet this minimum requirement.

What Impact Does Factoring Period Have on Invoice Factoring?

The time it takes for your customer to pay the invoice, known as the factoring period, also affects the cost. For instance, a factoring company might charge 2% for the first 30 days and an additional 0.5% for every 10 days the invoice remains unpaid.

Therefore, the longer your customer takes to pay, the higher the overall fee you will incur. So, it is a good idea to ensure that your customers make their payments to avoid paying unnecessary additional fees and costs.

Also Read: Understanding Positive Cash Flow: Meaning, Importance, and Strategies to Generate It

How To Choose The Right Factoring Company in The Philippines - Key Points For Borrowers To Remember

Selecting the right factoring company is one of the critical steps in the invoice factoring process. Not all factoring companies are created equal, and the terms and conditions they offer can vary widely.

Here are some key considerations to keep in mind when choosing -

1. Reputation and Track Record of The Company

Look for a factoring company with a strong reputation and proven experience in your industry. Research, review testimonials, and ask for referrals to ensure the company's track record of reliability and professionalism.

2. Fees and Pricing Structure

Compare fees, including factoring rates, service charges, and hidden costs. Understand the total cost of factoring and how it will affect your cash flow. Choose a company with transparent pricing and no hidden fees.

3. Advance Rate

Check the advance rate offered by the factoring company. Typically, companies offer 80-90% of the invoice value upfront. A higher advance rate means more immediate cash, so choose a factor that provides favorable terms based on your needs.

4. Customer Service and Communication

Excellent customer service is crucial, as the factoring company will handle collections from your customers. Ensure the company communicates clearly, handles disputes professionally, and aligns with your values in maintaining good customer relationships.

5. Industry Specialization

Some factoring companies specialize in specific industries, such as manufacturing, logistics, or construction. It is beneficial to choose a factor that understands your business and its particular invoicing cycles, customer payment trends, and cash flow needs.

6. Recourse vs. Non-recourse Factoring

Decide whether you want recourse factoring (where you’re responsible if your customers don’t pay) or non-recourse factoring (where the factor takes on the risk of non-payment). Choose a company that offers the level of risk protection you need.

7. Speed of Funding

Time is critical for improving cash flow. Choose a factoring company that offers fast approval and disbursement of funds, typically within 24-48 hours of invoice approval, to ensure your financial needs are met quickly.

8. Contract Terms and Flexibility

Review the contract terms carefully, including any long-term commitment or minimum factoring volume requirements. Choose a company that offers flexible terms that suit your business’s cash flow cycles and doesn’t lock you into rigid agreements.

9. Collection Practices

Since the factoring company will handle customer collections, ensure their collection practices are ethical and professional. This will help maintain positive customer relationships and protect your business’s reputation.

10. Transparency in Processes

Ensure the factoring company is transparent about the factoring process, including invoice submission, collection timelines, and the disbursement of remaining funds. Clear communication ensures there are no surprises during the factoring process.

Conclusion

As this comprehensive article has shown, invoice factoring is an effective financial tool that allows businesses in the Philippines to convert their unpaid invoices into immediate cash. It essentially allows businesses to stabilize their cash flow and effectively support their operations, but only if they understand how it works and meet its eligibility requirements.

It enables businesses to access up to 80-90% of the invoice value upfront by selling their receivables to a factoring company, providing them with much-needed cash flow to meet operational expenses. In the meantime, the factoring company collects payments directly from the customers, allowing businesses to focus on their growth rather than managing their collections.

However, to qualify for invoice factoring in the Philippines, Philippine businesses must have unpaid B2B or B2G invoices, creditworthy customers, and a legally compliant business structure.

Frequently Asked Questions (FAQs)

1. How does invoice factoring work?

Invoice factoring works by a business selling its unpaid invoices to a factoring company in exchange for immediate cash, typically 80-90% of the invoice value. The factoring company then collects payment directly from the customers.

Once the customer pays, the factor sends the remaining balance to the business minus a fee for their service to improve their cash flow.

2. What are the two types of invoice factoring?

The two main types of invoice factoring are -

- Recourse Factoring: In this type, the business is responsible if the customer fails to pay. If the customer defaults, the business must repay the factoring company.

- Non-Recourse Factoring: Here, the factoring company assumes the risk of non-payment. The business isn’t liable for the unpaid invoice if the customer defaults.

3. Who is eligible for invoice factoring in the Philippines?

In the Philippines, businesses eligible for invoice factoring must typically have unpaid B2B (business-to-business) or B2G (business-to-government) invoices. These businesses should have creditworthy customers, legally compliant operations, and a track record of delivering goods or services.

Startups, SMEs, or companies with limited credit history can qualify, as the critical factor is the customer's creditworthiness, not the business itself,

4. What is the interest rate for invoice factoring in the Philippines?

The interest rate for invoice factoring in the Philippines typically ranges from 1% to 5% of the invoice value, depending on factors such as the creditworthiness of the business's customers, the size of the invoices, and the payment terms.

Additional fees, such as service or administration costs, may also apply, influencing the overall cost of factoring.