Securing financing is a critical step for many Philippine businesses looking to expand operations, purchase new equipment, or stabilize cash flow, and thankfully, existing business loans offer a practical solution for obtaining the necessary capital to achieve these goals.

However, going through the required processes to attain business loans can be quite complex for Filipino entrepreneurs, as each loan option comes with its own terms, requirements, benefits, and challenges.

So, to help businesses in the Philippines thrive, this article provides a comprehensive overview of how to finance an existing business through business loans. Here, we will outline the key steps, types of loans available, and important considerations to help business owners successfully secure the funding they require.

Importance of Different Loan Types And Loan Strategies For Philippine Businesses

Choosing the right type of loan and implementing the most effective loan strategies are essential for managing a business’s growth, addressing its financial challenges, and taking advantage of potential future business opportunities.

Currently, there are a variety of existing business loans available for Philippine businesses, such as working capital loans and long-term financing, which serve various purposes and come with distinct features, benefits, and considerations.

Hence, that is why they must understand all these options carefully before they approach them for their specific financing needs, whether that is for short-term cash flow management, equipment purchases, or business expansion.

Moreover, employing strategic approaches to loan management, such as optimizing loan terms, understanding repayment schedules, and aligning loan types with business goals, can potentially enhance their business’s financial stability and support its long-term success.

Here, take a look at the vital loan strategies and considerations which offer Philippine businesses valuable insight into the workings of the various loan financing options available to them -

1. Diverse Loan Types

The Philippine market offers a variety of loan products, each designed to cater to specific business needs. From short-term working capital loans to long-term equipment financing and real estate mortgages, understanding these options is crucial for selecting the right fit for your business.

2. Tailored Financial Solutions

Carefully analyze your business's financial goals and requirements to identify the loan type that best aligns with your objectives. It doesn’t matter whether you're taking the loan to expand operations, purchase new assets, or manage cash flow; a suitable loan can provide the necessary financial boost that your business requires.

3. Enhanced Business Growth

Access to appropriate financing can fuel a business’s growth and expansion plans as it can increase its market share and profitability by investing in new equipment, hiring additional staff, or acquiring new premises.

4. Eliminate Risks

Proper loan utilization can help businesses manage financial risks. For instance, a line of credit can serve as a safety net during economic downturns or unexpected expenses.

5. Improved Cash Flow

Businesses can maintain a healthy cash flow position by optimizing loan terms and repayment schedules. Doing so enables them to meet operational expenses, pay suppliers on time, and invest in additional business growth opportunities.

6. Building Creditworthiness

A consistent repayment history on business loans can positively impact your credit score because possessing a strong credit profile opens doors to more favorable loan terms and interest rates in the future.

7. Strategic Financial Planning

Developing a comprehensive loan strategy involves assessing your business's financial health, setting clear goals, and creating a repayment plan. This approach ensures that borrowed funds are used effectively and contribute to the long-term success of the business.

Also Read: Choosing the Right Business Loan for Your Company's Growth

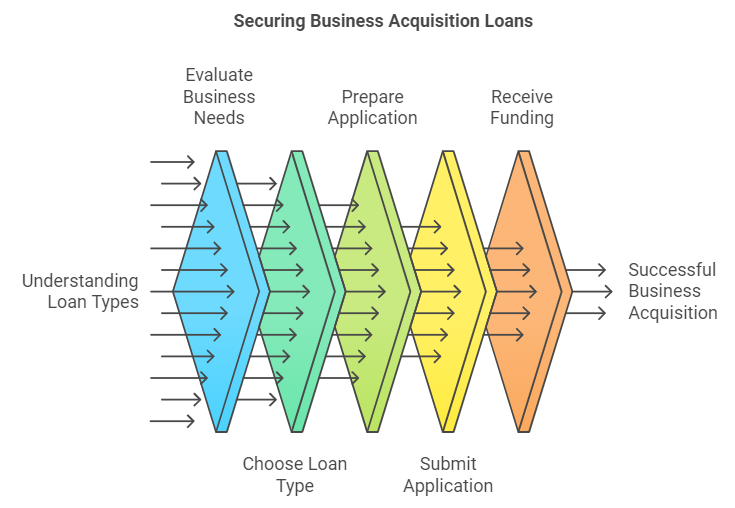

Securing Business Acquisition Loans in The Philippines - A Detailed Guide For Filipino Entrepreneurs

Acquiring an existing business loan can be a strategic move for Filipino entrepreneurs looking to expand their market share or diversify their portfolio. Whether you're a seasoned entrepreneur or someone just starting out, you must understand the intricacies of business acquisition loans to develop a successful venture.

That is why, in this section of the article, we will provide you with a comprehensive overview of business acquisition loans in the Philippines by outlining the various steps involved, key considerations to keep in mind, and essential tips to utilize to increase your chances of securing the necessary funding.

What Are Business Acquisitions Loans?

A business acquisition loan is a financial instrument designed to provide the capital necessary to purchase an existing business. This type of loan is specifically tailored to the unique needs of entrepreneurs looking to expand their operations through acquisition.

It covers the costs associated with the purchase, such as the purchase price, transaction fees, and working capital to integrate the acquired business. Essentially, a business acquisition loan is a financial tool that empowers individuals or businesses to acquire another company by providing the required funds.

Types of Business Acquisition Loans Available in The Philippines

1. Term Loans

Term loans provide a lump sum amount that is repaid with interest over a fixed period. They are suitable for acquiring businesses with stable cash flow and predictable revenue streams.

2. Lines of Credit

A line of credit provides flexible financing, allowing the borrower to access funds as needed up to a pre-approved limit. This option can be beneficial for acquiring businesses with fluctuating cash flow or when the exact acquisition costs are uncertain. Interest is typically charged only on the amount borrowed.

3. SBA Loans

Small Business Administration loans are government-backed loans that offer favorable terms, including lower interest rates and longer repayment periods. While not directly available in the Philippines, similar government-backed programs might exist, offering support to SMEs for business acquisitions.

4. Seller Financing

In some cases, the seller of the business may be willing to provide financing. This can be advantageous as it often comes with more flexible terms and potentially lower interest rates. However, it's essential to evaluate the terms and conditions of seller financing carefully before opting for it.

5. Asset-Based Lending

Asset-based lending involves using the assets of the target company as collateral for the loan. This option can be suitable for businesses with substantial assets, such as real estate or equipment. The loan amount is often based on the value of the collateral.

Also Read: How Does A Bridge Loan Work For a Small Business?

Transform Your Business with N90’s Fast Financing Solutions to keep your Philippine SME moving. Apply online and get started within minutes by getting approvals within 24 hours!

Using Personal Financing Options in The Philippines - Advantages And Disadvantages Of Utilizing Them

Personal financing options can be a lifeline for individuals facing financial challenges or seeking to achieve specific goals. In the Philippines, various personal loan products are already available that offer quick access to funds.

However, as good as these financing options sound, it is crucial for Philippine businesses to weigh their potential benefits and associated risks before making a decision.

Here, take a closer look at the advantages and disadvantages of utilizing personal financing options in the Philippines -

1. Personal Loans

Personal loans offer a lump sum amount that can be used for various purposes, such as debt consolidation, home improvements, or medical expenses. These loans typically have fixed interest rates and repayment terms, making budgeting easier.

However, in this type of loan interest rates can be higher compared to other loan types, and borrowers need to meet specific eligibility criteria before they can proceed with it.

2. Credit Cards

Credit cards provide a revolving line of credit that allows users to make purchases and pay them off over time. They offer convenience and reward points but come with high-interest rates if balances are carried over.

However, responsible usage is recommended to avoid getting stuck in a potential debt trap.

3. Salary Loans

Salary loans are short-term loans typically offered by employers or financial institutions based on a portion of an employee's salary. They provide quick access to cash but often come with high-interest rates and short repayment terms.

4. Pawn Loans

Pawn loans involve using personal belongings as collateral to obtain a loan. While they offer quick funds, interest rates are typically high, and borrowers risk losing their items if unable to repay. Hence, pawn loans should always be considered as last resort options due to their potential drawbacks.

5. Online Lending Platforms

Online lending platforms offer a convenient way to access loans through digital platforms. They often cater to individuals with limited credit history but may charge higher interest rates.

Philippine businesses are recommended to conduct a thorough background check of the online loan platforms. By doing so, businesses will not only choose a reputable platform but it will also give them the opportunity to understand the terms and conditions offered by them before availing.

Also Read: Startup Business Loans: How to Get Them for Your Business Needs

What is Seller Financing And How Does it Work in The Philippines

Seller financing, also known as owner financing, is an alternative financing method where the seller of a property or business provides the buyer with a loan to facilitate the purchase.

Instead of securing a traditional mortgage from a bank or financial institution, the buyer makes payments directly to the seller over an agreed-upon period. This arrangement can be beneficial for both parties, offering more flexible terms and quicker transactions.

Here, take a closer look at how seller financing works in the Philippines -

1. Agreement Negotiation

- Terms and Conditions: The buyer and seller negotiate the terms of the loan, including the purchase price, interest rate, repayment schedule, and any down payment. These terms are typically more flexible than those offered by traditional lenders.

- Promissory Note: A legally binding promissory note is created detailing the loan terms, repayment schedule, and consequences of default. This document serves as the official record of the agreement between the buyer and seller.

2. Down Payment

- Initial Payment: The buyer typically makes a down payment, which can be a percentage of the purchase price. This amount is negotiable and may vary depending on the agreement between the parties.

- Equity and Commitment: The down payment provides the seller with some immediate cash and demonstrates the buyer’s commitment to the purchase.

3. Repayment Schedule

- Regular Payments: The buyer agrees to make regular payments to the seller according to the negotiated schedule. These payments usually include both principal and interest.

- Balloon Payment: In some cases, the agreement may include a balloon payment, where a large portion of the loan balance is due at the end of the loan term.

4. Interest Rate

- Negotiated Rate: The interest rate on seller-financed loans is typically negotiated between the buyer and seller. It may be higher or lower than market rates, depending on the agreement.

- Fixed or Variable: The interest rate can be fixed or variable based on the terms agreed upon by both parties.

5. Title and Ownership

- Title Transfer: The title to the property or business may be transferred to the buyer immediately or after the loan is fully paid, depending on the terms of the agreement.

- Security Agreement: The seller may retain a security interest in the property until the loan is fully repaid, providing legal protection in case of default.

6. Legal Documentation

- Contractual Agreements: All terms and conditions are documented in a formal contract, which legal professionals should review to ensure compliance with Philippine laws.

- Notarization: To enhance the enforceability of the agreement, the contract and promissory note may be notarized.

7. Benefits for Buyers and Sellers

- For Buyers: Seller financing can provide easier access to financing, especially for those who may not qualify for traditional loans. It also offers more flexible terms and faster transaction processes.

- For Sellers: This financing method can attract more potential buyers, provide a steady income stream from interest payments, and potentially achieve a higher sale price.

Also Read: Explained: Typical Terms of Small Business Loans

Role of Private Equity and Venture Capital in Business Acquisitions in the Philippines

Private equity and venture capital play crucial roles in the Philippines financial ecosystem by providing capital, strategic guidance, and support to businesses at various stages of their growth.

In the Philippines, both Private Equity and Venture Capital firms are increasingly involved in business acquisitions, making growth possible and encouraging innovation. Here, take a look at how they are involved in the process -

Role of Private Equity in Business Acquisitions in The Philippines

1. Growth Capital

Private equity firms provide substantial growth capital to established companies looking to expand or restructure their businesses or enter new markets. This capital infusion helps businesses scale operations and enhance their competitive positioning in the marketplace.

2. Buyouts

Private equity firms often engage in buyouts, where they acquire a controlling interest in a company. These buyouts can be leveraged buyouts, where the acquisition is financed through a combination of equity and significant debt.

3. Strategic Partnerships

Through acquisitions, Private equity firms establish strategic partnerships, utilizing their network and expertise to drive operational improvements and strategic initiatives within the acquired business.

4. Exit Strategies

Private equity firms typically have defined exit strategies, aiming to sell their stake in the acquired business within a few years, often through initial public offerings, secondary sales to other investors, or strategic sales to larger corporations.

Role of Venture Capital in Business Acquisitions in The Philippines

1. Early-Stage Investments

Venture capital firms focus on early-stage companies with high growth potential. They provide seed and series A funding to startups, supporting their development and market entry.

2. Scalability and Innovation

Venture capital firms invest in innovative businesses and technologies that help them scale their productivity rapidly. Their capital and strategic guidance enable startups to refine their business models, enhance product development, and expand market reach.

3. Strategic Acquisitions

Venture capital-backed companies may engage in strategic acquisitions to enhance their capabilities, enter new markets, or eliminate competition. These types of firms often support these acquisitions to accelerate growth and achieve market dominance.

4. Mentorship and Networks

Venture capital firms offer more than just capital; they provide mentorship, industry expertise, and access to networks that are crucial for the growth and success of the businesses they invest in.

Opportunities And Challenges Faced by Private Equity And Venture Capital Firms in The Philippines

Challenges

- Regulatory Environment: Navigating through the regulatory landscape in the Philippines can be quite complex for Private Equity and Venture capital firms, as they are required to comply with various legal and regulatory requirements.

- Market Risks: Economic volatility, political instability, and market risks are some of the notable reasons that can potentially impact the success of acquisitions and the returns on investment for Private Equity and Venture Capital firms.

- Competition: Increased competition for high-potential businesses can drive up valuations, making it challenging to secure favorable deals for Philippine businesses.

Opportunities

- Untapped Markets: The Philippines offers numerous untapped markets and sectors with high growth potential that present numerous opportunities for Private Equity and Venture Capital firms to invest and drive development.

- Strategic Alliances: Forming strategic alliances with local firms and utilizing their market knowledge can enhance the overall success of acquisitions and investments.

- Innovation and Technology: Investing in emerging technologies and innovative business models presents significant opportunities for growth and competitive advantage.

Also Read: Applying for a Small Business Loan: 5 Steps to Get Approved

What is Application Process For Business Loan in Philippines - Step-By-Step Guide For Filipino Entrepreneurs

Securing a business loan can be a pivotal move for Filipino entrepreneurs looking to start, expand, or stabilize their businesses. Still, before they can do all that, they need to understand the application process to increase the chances of approval and to ensure that the loan aligns with your business goals.

Here, take a look at this step-by-step guide that walks you through the essential stages of applying for a business loan in the Philippines -

1. Assess Your Financial Needs

Before applying for a business loan, it’s crucial to determine the exact amount of funding your business requires and the specific purpose of the loan.

Whether you need capital for expansion, purchasing equipment, or managing cash flow, having a clear understanding of your financial needs helps in selecting the appropriate loan type and amount.

This assessment also ensures that you do not over-borrow or under-borrow, aligning the loan with your business objectives.

2. Prepare a Solid Business Plan

A comprehensive business plan is essential for convincing lenders of your business's viability and repayment capability.

Your business plan should include detailed financial projections, market analysis, business goals, and a clear explanation of how the loan will be used to achieve these goals.

Highlight your business's strengths, competitive advantages, and strategies for growth to demonstrate to lenders that you have a well-thought-out plan for success.

3. Check Your Credit Score

Lenders in the Philippines consider both your personal and business credit scores when evaluating your loan application. Obtain your credit report from major credit bureaus and review it for any inaccuracies or issues that could affect your creditworthiness.

A good credit score increases your chances of loan approval and may help you secure better terms and interest rates. If your credit score is low, take steps to improve it before applying for a loan.

4. Gather Required Documentation

Prepare all the necessary documents that lenders typically require for a business loan application. This includes your business registration documents, financial statements, tax returns, bank statements, and personal identification.

Having these documents organized and readily available can streamline the application process and demonstrate your preparedness to the lender, thereby increasing the likelihood of a smooth and quick approval process.

5. Research and Compare Lenders

Take the time to research various lenders, including traditional banks, credit unions, and online lenders, to find the best fit for your business needs. Moreover, compare interest rates, loan terms, fees, and eligibility requirements as well, to identify the most favorable loan options available.

Additionally, consider factors such as the lender’s reputation, customer service, and flexibility in loan terms since choosing the right lender can significantly impact your overall loan experience and financial outcomes.

6. Complete the Loan Application

Once you have selected a lender, fill out the loan application form carefully and provide accurate and detailed information. Ensure that all sections are completed correctly to avoid delays or rejections. Attach the required documentation and double-check everything before submission.

Going through the processes mentioned in this point is crucial as a thorough and well-prepared application can enhance your credibility and increase your chances of approval.

7. Submit the Application and Await Review

Submit your completed loan application along with all required documents to the chosen lender. After submission, the lender will review your application, which may include evaluating your business plan, financial health, credit history, and other relevant factors.

This review process can take several days to a few weeks, depending on the lender and the complexity of your application.

8. Respond to Follow-Up Requests

During the review process, the lender may request additional information or clarification on certain aspects of your application, so be prompt and responsive in providing the requested information to avoid delays.

Open communication and cooperation with the lender demonstrate your commitment and can potentially accelerate the approval process.

9. Review the Loan Offer

If your application is approved, the lender will provide a loan offer detailing the terms and conditions, including the interest rate, repayment schedule, and any fees.

Carefully review the offer to ensure it meets your needs and that you understand all the terms. If necessary, negotiate any terms that you feel are unfavorable before accepting the offer.

10. Accept the Loan and Disbursement of Funds

Once you agree to the loan terms, formally accept the offer by signing the loan agreement. The lender will then disburse the funds to your designated bank account.

Ensure that you use the loan proceeds as planned and outlined in your business plan to achieve the intended business goals and enhance your chances of success.

Conclusion

Financing an existing business through business loans can be a strategic move to fuel growth, enhance operations, and stabilize cash flow.

However, as we have seen in this article, before you can do that, you’ll need to understand the various loan types, prepare a comprehensive business plan, and go through the application process to secure the right type of funding for your business’s needs.

Moreover, you can increase your chances of approval and obtain favorable loan terms by fulfilling certain criteria like assessing your financial needs, researching and comparing lenders, and ensuring you comply with all mandatory requirements.

Ultimately, with the right kind of financing, your business can achieve its objectives, expand its reach, and build a foundation for long-term success. So, it is important always to compare interest rates and know about repayment terms and lender requirements to find the best type of loan to fit your business’s needs.

Frequently Asked Questions (FAQs)

1. How long are business loans?

Business loan terms vary widely depending on how they are used. For reference, short-term loans can last for as little as a few months, while long-term loans can extend up to 25 years.

The ideal term depends a lot on the loan type, business needs, and lender policies, and factors like loan amount and creditworthiness also influence the repayment period.

2. How do loan companies operate?

Loan companies operate by providing financial assistance to individuals and businesses by acquiring funds from various sources, including deposits, investments, and other financial markets.

When someone applies for a loan, the company assesses their creditworthiness and financial situation. If approved, they disburse the loan amount with agreed-upon interest rates and repayment terms.

The borrower then makes regular payments to repay the principal and interest over time. Loan companies generate profit through interest charges.

3. What is the life cycle of a business loan?

The life cycle of a business loan typically involves these stages:

- Application and Approval: The borrower submits a loan application, which the lender assesses to determine eligibility and loan terms.

- Fund Disbursement: Upon approval, the loan amount is transferred to the borrower's account.

- Repayment: The borrower makes regular payments to cover the principal and interest over the agreed-upon term.

- Loan Closure: The loan is considered closed when the final payment is made and the account is settled.

- Post-closure: This stage involves credit reporting and potential collection activities if necessary.

4. What is loan IQ?

Loan IQ is a comprehensive software platform used by financial institutions to manage their loan portfolios. It handles various loan lifecycle stages, from origination and servicing to trading and settlement.

Loan IQ aims to improve efficiency, reduce costs, and manage risks through automation and data consolidation.