Cash flow management is a critical concern for businesses of all sizes, and finding the right strategy can make all the difference. Two popular methods to address cash flow challenges are invoice factoring and invoice discounting.

These financial tools allow businesses to improve cash flow by leveraging their outstanding invoices. While both options provide immediate access to working capital, they function differently and have their own advantages and disadvantages that Philippine businesses need to be aware of.

Hence, in this blog, we'll provide you with all there is to know about invoice factoring and invoice discounting, including their benefits and drawbacks and how to choose between them based on your business needs and industry specifics. So, without further ado, let us get down to it.

Overview of Invoice Factoring and Invoice Discounting - What Are They And What Do They Do?

Invoice factoring and invoice discounting are two widely used methods for improving business cash flow. Although both revolve around outstanding invoices, they function quite differently.

Here, take a look at what they are all about -

Invoice Factoring

Invoice factoring is a financial arrangement in which a business sells its unpaid invoices (accounts receivable) to a third-party company called a factor at a discounted rate.

The factoring company provides the business with immediate cash, typically up to 80-90% of the invoice value, and takes responsibility for collecting customer payments. Once the customer pays the invoice, the factoring company forwards the remaining balance to the business minus fees.

This method helps businesses improve cash flow by receiving funds without waiting for customers to settle their invoices. It allows them to manage operations and cover expenses more efficiently.

Invoice Discounting

Invoice discounting is a financing method where a business uses its unpaid invoices (accounts receivable) as collateral to secure a loan or line of credit from a lender.

Unlike factoring, where the lender takes over the responsibility of collecting payments, invoice discounting involves the business retaining control over customer relationships and collecting payments directly from its customers.

The lender provides a percentage, usually 80-90% of the invoice value, upfront. Once the business collects the payments, it repays the loan and any interest or fees charged by the lender. Invoice discounting allows companies to maintain confidentiality while improving cash flow and meeting immediate financial needs.

Are you still unclear on what makes these two financial tools different? Check out this video. It examines the differences between factoring and invoice discounting, explaining their types and providing more details.

Also Read: Types and Methods of Inventory Management Systems with Examples

Advantages And Disadvantages of Invoice Factoring

Invoice factoring is a popular financing option that helps businesses convert their outstanding receivables into immediate cash by selling them to a factoring company. While this method can provide much-needed liquidity and improve cash flow, it also comes with certain drawbacks.

Here, take a look at the potential advantages of invoice financing in the Philippines -

Advantages of Invoice Financing

1. Immediate Cash Flow Improvement

Invoice factoring provides businesses with immediate access to cash by selling their outstanding invoices to a factoring company. Instead of waiting for customers to pay, the business receives up to 90% of the invoice value upfront, helping them cover operational costs, manage payroll, and invest in growth opportunities without cash flow delays.

This can particularly benefit businesses with extended payment terms or seasonal fluctuations.

2. No Additional Debt

Unlike traditional loans, invoice factoring is not considered debt. By factoring invoices, businesses avoid taking on additional liabilities or loan obligations. The company simply sells its invoices, collecting payments directly from customers.

This helps businesses improve liquidity without affecting their balance sheets or increasing their debt load.

3. Flexible Financing

Invoice factoring grows with your business. As your sales increase and more invoices are issued, the amount of available funding also increases.

This scalability makes invoice factoring a flexible solution that adapts to your company’s needs, particularly during periods of rapid growth or high demand. You do not need to renegotiate terms or constantly reapply for financing.

4. Outsource Collections

When businesses sell their invoices to a factoring company, the responsibility of collecting customer payments shifts to the factor. This reduces the administrative burden on the business, allowing it to focus on core operations rather than chasing overdue payments.

5. Improved Credit Management

Factoring companies often evaluate a business's customers' creditworthiness before purchasing invoices. Working with creditworthy customers can indirectly help enterprises improve their credit management practices.

6. Support For Businesses With Poor Credit

Since invoice factoring is based on the creditworthiness of the business's customers, companies with poor credit or limited credit history can still access funds.

This makes factoring an excellent option for startups or companies struggling to qualify for traditional loans due to a lack of financial history or credit challenges.

7. Faster Growth Potential

By unlocking cash tied up in receivables, businesses can fund expansion initiatives like hiring more staff, purchasing inventory, or investing in marketing without waiting for customer payments.

This quicker access to working capital enables businesses to seize growth opportunities as they arise, positioning them for faster scaling and increased competitiveness in the market.

8. No Collateral Required

Invoice factoring is typically an unsecured financing option, meaning businesses don’t need to pledge physical assets like property or equipment as collateral.

The invoices themselves serve as collateral, which is especially beneficial for small companies lacking substantial assets to secure a traditional loan.

Also Read: Understanding Working Capital: How to Calculate and its Importance

Disadvantages of Invoice Factoring

Just as invoice factoring has advantages, it also comes with several drawbacks that businesses should be aware of before committing. While factoring can help with immediate cash flow needs, it’s crucial to recognize its potential downsides.

Here, take a look at the possible disadvantages of invoice factoring in the Philippines -

1. Higher Cost Compared to Traditional Financing

Invoice factoring typically involves higher costs compared to traditional loans. Factoring companies charge a fee, usually between 1% and 5% of the invoice value, depending on factors such as the customer's creditworthiness and the time it takes to pay the invoice.

These fees can add up, especially for businesses with low margins, making it more expensive than bank loans or lines of credit, which generally have lower interest rates.

2. Impact on Profit Margins

Since factoring companies charge a percentage of the invoice value as their fee, this reduces the overall revenue that the business receives from each sale.

This can be particularly damaging for companies with already thin profit margins, as the cost of factoring eats into profitability.

3. Loss of Control Over Customer Relationships

When a business factors its invoices, the factoring company often takes over the collection of payments. This can lead to concerns about how the factor will interact with the business's customers.

Some customers may view the involvement of a third party in collections as a sign of financial instability or may not respond well to the factor’s collection practices, which could harm long-term customer relationships.

4. Eligibility Depends on Customer Creditworthiness

Invoice factoring approval is primarily based on the creditworthiness of the business's customers, not the business itself. If a business has customers with poor credit or a history of late payments, factoring companies may be reluctant to purchase those invoices or may offer unfavorable terms.

This can limit the effectiveness of factoring for businesses that primarily deal with customers with less-than-stellar credit histories.

5. Potential for Customer Confusion

Customers may need to become more familiar with invoice factoring. They could become confused or concerned when they receive communication from the factoring company rather than the business they deal with directly.

This confusion may lead to payment delays, damage to the business’s reputation, or strained customer relationships, especially if the customer perceives the factoring arrangement as a sign of financial trouble.

6. Limited Funding Potential

Invoice factoring is directly tied to a business’s accounts receivable value. If the company has few or irregular invoices, the funding available through factoring may be limited.

Additionally, some invoices may not be eligible for factoring, further restricting the business’s ability to access the funds it needs. This means factoring may not always provide sufficient capital for businesses facing extensive or ongoing cash flow needs.

7. Long-Term Costs Can Accumulate

Explanation: While factoring can provide immediate cash flow, relying on it long-term can become expensive. If a business continuously factors its invoices, the recurring fees can become a significant ongoing cost, potentially outweighing the benefits of fast cash.

Businesses that frequently use factoring may find that it affects their profitability over time, making it less sustainable as a long-term financing solution.

8. Perceived Financial Weakness

Factoring invoices can sometimes be perceived as a sign that a business is facing financial difficulties, indicating a need for immediate cash flow.

Customers, investors, and other stakeholders may view factoring negatively, believing that the industry needs more working capital or has issues with its cash flow management.

Look at this Reddit thread to learn more about the disadvantages of invoice factoring. One user advises small business owners to avoid factoring and merchant cash advances, comparing them to payday loans due to their high costs and risks.

Also Read: Easy Business Loans and Financing Options for Small Businesses and Startups

Ready to grow your Philippine SME? Apply now for N90’s fast financing solutions and get the funds you need to realize your business dreams! Get potential loan approvals within 24 hours to propel your business to new heights and reach new milestones.

Advantages And Disadvantages of Invoice Discounting in Philippines

Invoice discounting is a financing method that allows businesses to borrow against their unpaid invoices, using them as collateral to access immediate cash. This approach helps improve cash flow without waiting for customers to settle their accounts.

While invoice discounting offers flexibility and control over collections, it also has downsides. Here, take a look at the potential advantages of invoice discounting in the Philippines -

Advantages of Invoice Discounting

1. Immediate Cash Flow

Invoice discounting gives businesses quick access to cash by borrowing against their outstanding invoices. Instead of waiting for customers to pay, companies can unlock up to 80-90% of the invoice value, giving them immediate working capital to cover operational expenses, invest in growth, or manage cash flow gaps.

2. Maintain Control Over Customer Relationships

Unlike invoice factoring, where the factoring company takes over the collection process, invoice discounting allows businesses to retain complete control over their customer relationships. The business remains responsible for collecting customer payments, meaning clients must know the financing arrangement.

This ensures that customer relationships and trust remain unaffected, which is essential for long-term business relationships.

3. Flexible Financing

Invoice discounting grows with your business, making it a flexible funding source. As your sales and receivables increase, so does your access to capital. This scalability allows companies to access more funding as their operations expand without renegotiating terms.

Additionally, since invoice discounting is based on receivables, it provides flexibility in financing compared to more rigid loan structures.

4. No Additional Collateral Required

Invoice discounting is an unsecured form of financing, meaning businesses do not need to pledge assets such as property or equipment as collateral. The invoices themselves serve as collateral, which is especially beneficial for small and medium-sized businesses that may lack substantial assets to secure traditional loans.

This also reduces the company's risk, as it avoids tying up physical assets in financing arrangements.

5. Improved Cash Flow Management

Businesses can improve their cash flow management by converting unpaid invoices into immediate cash. This allows them to meet short-term obligations, such as paying suppliers or employees, without worrying about delayed customer payments.

Moreover, improved cash flow ensures smoother operations, helps avoid late payment penalties, and positions the business to seize growth opportunities without being held back by cash constraints.

6. Enhances Financial Flexibility Without Debt

Unlike traditional loans, invoice discounting is not considered a new debt. Businesses borrow against their receivables, meaning it does not appear as additional debt on their balance sheets.

This enhances the business’s financial flexibility, as it can access the funds it needs without negatively impacting its debt-to-equity ratio. As a result, invoice discounting allows companies to maintain a healthy financial profile while meeting liquidity needs.

7. Speed and Efficiency

The approval process for invoice discounting is typically faster than traditional loans, making it ideal for businesses that need quick access to funds.

As long as the company has a reliable invoicing system and creditworthy customers, it can access funds quickly, often in days. This speed makes invoice discounting an efficient option for managing urgent cash flow needs.

8. Improves Credit Management

Invoice discounting lenders often evaluate the creditworthiness of the business’s customers before approving financing. This allows companies to improve their credit management processes by focusing on working with reliable, creditworthy customers.

Over time, this can lead to better credit control and fewer issues with late or non-payment, strengthening the business's overall financial health.

Also Read: Small Business Equipment Financing Options

Disadvantages of Invoice Discounting

Invoice discounting can seem like a great way to improve cash flow, but there are several downsides you need to be aware of.

Here, take a look at some of the possible disadvantages of invoice discounting in the Philippines -

1. Higher Costs Compared to Traditional Loans

Invoice discounting typically comes with higher costs than traditional bank loans or lines of credit. Lenders charge interest or fees based on the value of the discounted invoices, which can add up, primarily if the business relies on invoice discounting regularly.

The higher cost structure can negatively impact profit margins, particularly for companies with lower margins.

2. Limited to Invoice Value

The amount of funding a business can access through invoice discounting is directly tied to the value of its invoices. The financing potential is limited if a company has few receivables or low-value invoices.

This can restrict the business’s ability to access sufficient working capital, especially during periods of low sales or when fewer invoices are generated.

3. Impact on Profit Margins

Similar to factoring, invoice discounting reduces the business's overall revenue due to the fees or interest charged by the lender.

This can significantly reduce profitability for companies operating with slim profit margins. Over time, these fees can accumulate, making invoice discounting less sustainable as a long-term financing solution.

4. Responsibility for Collections

Unlike invoice factoring, where the lender takes over the responsibility of collecting customer payments, invoice discounting allows the business to retain complete control over its receivables.

While this can be an advantage for companies wanting to maintain customer relationships, it also means the industry is still responsible for chasing payments, managing credit risks, and dealing with late payers, which can strain internal resources.

5. Eligibility Depends on Customer Creditworthiness

Just like with factoring, the lender’s decision to offer invoice discounting and the terms they provide are often based on the creditworthiness of the business’s customers. If a business deals with customers who have poor credit or are slow to pay, it may be more difficult to obtain favorable terms.

This means that even if the business is in good financial health, its financing options may be limited by the quality of its customer base.

6. Potential for Increased Debt

Invoice discounting involves borrowing against receivables, increasing the business’s debt levels. Although the loan is tied to invoices, the company is still responsible for repayment, whether or not customers pay on time.

If invoices remain unpaid, the business may need to repay the loan out of its own cash reserves, increasing financial strain and potential debt burden.

7. Limited Flexibility

Invoice discounting is tied to specific invoices, meaning the business's access to funds is limited by the number and value of outstanding invoices.

Unlike other forms of credit, such as a business line of credit, which provides more flexible financing options, invoice discounting is restricted to the value of accounts receivable, making it less adaptable in varying business scenarios.

8. Potential Perception of Financial Weakness

While invoice discounting is generally less visible to customers compared to invoice factoring, some stakeholders, such as investors or partners, may perceive the use of discounting as a sign of financial weakness or cash flow issues.

This perception could potentially affect the company’s reputation, relationships with suppliers, or ability to secure future investment.

Also Read: Simple Steps to Prepare a Cash Flow Statement Model

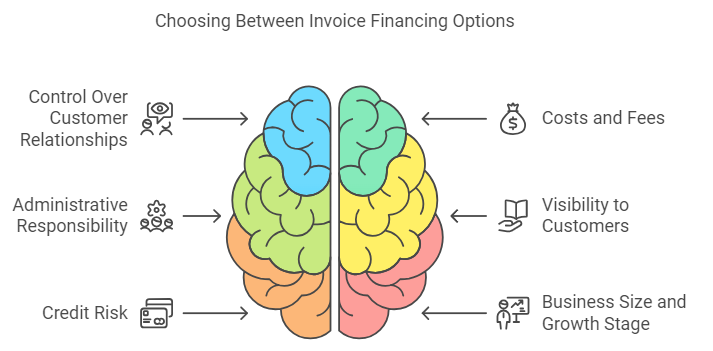

How To Choose Between Invoice Factoring And Invoice Discounting in Philippines

When deciding between factoring and invoice discounting, you must first consider your firm's unique characteristics and your business's size.

Here, check out some of the crucial criteria to consider when trying to decide between invoice factoring and invoice discounting in the Philippines -

1. Control Over Customer Relationships

- Factoring: In factoring, the factoring company takes over collecting payments from your customers. Factoring may be a good option if you don’t mind outsourcing this task and want to reduce your administrative burden.

- Invoice Discounting: If maintaining direct relationships with your customers is a priority, invoice discounting allows you to retain control over collections. This helps preserve customer trust and keeps the financing arrangement confidential.

2. Costs and Fees

- Factoring: Factoring tends to be more expensive because the factoring company charges fees for both financing and managing collections. Factoring may be suitable if you’re willing to pay extra for the convenience of outsourcing collections.

- Invoice Discounting: Invoice discounting usually has lower fees than factoring since you manage the collections process. Businesses looking to minimize costs may find invoice discounting to be a more economical option.

3. Administrative Responsibility

- Factoring: Since the factor takes over the responsibility for collecting payments, it reduces your team's administrative workload. Factoring may be better if you prefer to focus on your core operations and let a third party handle receivables.

- Invoice Discounting: With invoice discounting, your business still handles collecting payments from customers. Invoice discounting offers more flexibility without needing a third party if you have the resources to manage your accounts receivable effectively.

4. Visibility to Customers

- Factoring: In factoring, customers often know you’ve sold their invoices to a third party. Factoring may not be ideal if you’re concerned about how this might affect their perception of your business.

- Invoice Discounting: Customers need to be aware of invoice discounting because you retain control over collections. This option lets you keep your financing arrangement confidential, which is beneficial if maintaining a stable business image is essential.

5. Credit Risk

- Factoring: Factoring companies assess and take on the credit risk of your customers, particularly in non-recourse factoring, where the factor assumes the risk of non-payment. If your customer base includes companies with questionable creditworthiness, factoring provides an added layer of protection.

- Invoice Discounting: In invoice discounting, your business retains the credit risk. If a customer doesn’t pay an invoice, you are still responsible for repaying the amount to the lender. Choose this option if you’re confident in your customers’ ability to pay on time.

6. Business Size and Growth Stage

- Factoring: Small or growing businesses that need immediate cash flow and lack a solid internal credit control system may benefit from factoring. The service helps them bridge the gap between invoicing and payment without needing considerable internal resources.

- Invoice Discounting: More established businesses with a strong credit control team aa and a steady customer base may prefer invoice discounting. It offers flexibility without impacting customer relationships and keeps financing discreet.

Conclusion

To wrap up, both invoice factoring and invoice discounting offer unique advantages and come with their own set of challenges. Invoice factoring can be a lifeline for smaller businesses struggling with irregular cash flow, offering instant liquidity and the benefit of outsourced credit management.

On the other hand, invoice discounting provides a practical, discreet way to unlock cash from unpaid invoices while retaining control over customer relationships and collections. This option is often more suitable for larger companies with stable and reliable customer bases, as it maintains the autonomy that invoice factoring does not.

Hence, you need to weigh your business's specific needs before deciding. Whether you choose factoring or discounting, the choice should align with your cash flow requirements, customer interactions, and operational capacities.

Frequently Asked Questions (FAQs)

1. What is the difference between factoring and invoicing discounting?

The critical difference between factoring and invoice discounting lies in who manages the collection of payments. In factoring, a business sells its invoices to a third-party factor, which takes over the responsibility of collecting payments from customers and assumes some or all of the credit risk.

In invoice discounting, the business retains control of its customer relationships and continues to manage the collection of payments. The invoices serve as collateral for a loan or credit line, with the business repaying the lender once payments are received.

To conclude, factoring is more visible to customers, while invoice discounting remains confidential.

2. How does factoring differ from bill discounting and short-term financing?

Factoring involves selling unpaid invoices to a factor who collects payments, while bill discounting provides immediate funds by using invoices as collateral without transferring collection responsibility. Short-term financing offers quick loans for various needs unrelated to specific invoices.

To summarize, Factoring transfers credit risk and collection duties, while bill discounting and short-term financing keep these responsibilities with the business.

3. What is the difference between invoice discounting and reverse factoring?

The critical difference between invoice discounting and reverse factoring is who initiates the financing. In invoice discounting, the supplier uses unpaid invoices as collateral to get early payment from a lender.

However, in reverse factoring, the buyer arranges with a finance provider to pay suppliers early, improving the supplier's cash flow. The buyer ultimately repays the finance provider.

4. Is invoice discounting a loan?

Yes, invoice discounting is considered a loan because it allows businesses to borrow money using their unpaid invoices as collateral.

Once the customer pays the invoice, the lender provides a percentage of the invoice value upfront, and the business repays the loan, along with any interest or fees. Unlike traditional loans, it’s directly tied to accounts receivable.