In the Philippines, enhancing efficiency in business processes is crucial for maintaining competitiveness and achieving sustainable growth, as the processes involved not only reduce the operational costs of a business but also improve its financial accuracy, ability to comply with regulations, and decision-making capabilities.

Thanks to the rapid advancement of technology and the increasing complexity of financial regulations, businesses must continuously adapt and innovate their financial operations to ensure they always stay ahead of their competition and also get the best out of their systems, in the process as well.

To help Philippine businesses clearly understand what it means to improve efficiency in finance business processes, let us dive deeper and explore the importance of streamlining it in the Philippines.

By doing so, apart from knowing about its importance, we can also highlight certain key strategies that can help Philippine businesses to enhance their financial efficiency, as well as, their overall performance.

What Does It Mean To Improve Efficiency in Finance Business Processes?

Improving efficiency in finance business processes refers to optimizing the methods and procedures a business uses in financial operations to achieve better outcomes with fewer resources.

This usually involves streamlining workflows, reducing redundancies, and utilizing technology to enhance speed, accuracy, and productivity in financial tasks.

Implementing certain tried-and-tested, efficient finance processes enables businesses to manage their financial resources more effectively, thereby minimizing errors, ensuring complete compliance with regulations, and making quicker, more informed financial decisions.

Ultimately, these processes will not only lead to further cost savings for the business, but they will also improve its overall financial performance and provide it with a strong foundation for future growth.

Also Read: Types and Methods of Inventory Management Systems with Examples

What Are the Key Benefits of Improving Efficiency in Finance Business Processes in The Philippines?

For Philippine businesses, improving their efficiency in finance business processes is crucial if they wish to stay competitive and ensure their long-term success, as streamlining their financial operations will not only reduce their overall costs and minimize errors from occurring but will also enhance their business agility.

Here, take a look at some of the key benefits of optimizing finance processes for Philippine businesses to demonstrate how efficiency can drive growth, improve profitability, and support sustainable business development -

1. Cost Reduction

Streamlining financial processes reduces operational costs by eliminating repetitions, automating manual tasks, and improving resource allocation. Businesses can achieve significant cost savings, which can be reinvested in growth and innovation, by minimizing inefficiencies present in their systems.

2. Enhanced Accuracy

Improving efficiency in finance processes reduces the likelihood of errors in financial reporting, budgeting, and accounting. Accurate financial data is crucial for maintaining compliance with regulatory requirements and building trust with stakeholders.

3. Faster Decision-Making

Efficient finance processes enable quicker access to financial data and insights, supporting faster decision-making. This agility is essential in the fast-paced Philippine market, where timely decisions can provide a business competitive edge over its rivals.

4. Improved Compliance

Streamlined finance processes help businesses in the Philippines maintain compliance with local and international regulations. In essence, companies can reduce the risk of non-compliance, avoid penalties, and ensure transparency by automating the reporting process and implementing accurate data management systems.

5. Better Cash Flow Management

Efficient financial processes improve cash flow management by optimizing the timing of receivables, payables, and budgeting. This ensures that businesses have the liquidity needed to meet their obligations, invest in opportunities, and sustain operations, especially during economic fluctuations.

6. Enhanced Employee Productivity

By automating routine tasks and reducing manual work, employees can focus on higher-value activities that contribute to business growth. This not only boosts productivity but also increases job satisfaction and retention.

7. Scalability and Growth

Improving efficiency in finance processes makes it easier for businesses to scale operations, as efficient processes are more adaptable to growth, allowing businesses to expand without facing operational bottlenecks or financial strain of any kind.

Also Read: Understanding Cash Flow: Its Importance and How It Works in Business

Common Challenges Faced By Businesses When Trying To Streamline Their Financial Processes

Streamlining financial processes is a critical step for businesses aiming to improve efficiency, reduce costs, and enhance decision-making. However, this task is often easier said than done.

This is mainly due to the fact that many businesses encounter a range of challenges that can hinder their efforts to optimize financial workflows.

Here, check out some common challenges faced by Philippine businesses, such as resistance to change and lack of skilled personnel, when trying to streamline their financial processes -

1. Resistance to Change

One of the most significant challenges businesses face is resistance to change from employees and management. Financial processes that have been in place for years may be deeply ingrained in the company culture, making it difficult for teams to adapt to new methods or technologies.

2. Inadequate Technology Integration

Many businesses struggle with integrating new financial technologies into their existing systems and still utilize legacy systems that are outdated or incompatible with modern software, which can create serious bottlenecks and inefficiencies for them.

Without seamless integration, businesses may face data silos, manual data entry errors, and delays in financial reporting.

3. Complexity of Financial Processes

Financial processes can be inherently complex for a business to follow as they involve managing multiple departments, overseeing extensive data management systems, and complying with numerous regulatory norms.

Simplifying these processes without losing essential details or accuracy is a challenging task, so the best possible solution for Philippine businesses is to carefully analyze their existing processes, identify areas of inefficiency, and implement effective solutions that will help them streamline their workflows.

4. Lack of Skilled Personnel

Streamlining financial processes often requires specialized skills in areas such as data analysis, automation, and financial software management, and many businesses struggle to find or develop the necessary talent to implement and maintain streamlined processes.

This chasm of a skill gap can hinder the business from adoption any new technologies and prevent them from optimizing their financial workflows.

5. Data Accuracy and Consistency

Ensuring data accuracy and consistency across all financial processes is critical but challenging, especially in large organizations with multiple data sources, as having inaccurate or inconsistent data can lead to errors in financial reporting, budgeting, and decision-making.

6. Regulatory Compliance

Complying with the diverse yet complex, ever-changing regulatory landscape of the Philippines is a significant challenge for most businesses, particularly when they are trying to streamline their financial processes.

These compliance requirements add a layer of complexity to the financial operations of a business, thereby making it extremely difficult for them to simplify the finance processes without risking non-compliance.

7. Cost of Implementation

The initial cost of implementing new financial technologies or overhauling existing processes can be a barrier for many businesses. While streamlining processes can potentially lead to long-term cost savings, the upfront investment in technology, training, and integration can be quite substantial, especially for medium to small-scale businesses.

8. Maintaining Flexibility

While streamlining financial processes aims to create efficiency, there is a risk of it becoming too rigid and making it difficult for businesses to adapt to changing business needs or market conditions.

Also Read: Unsecured Business Loans: Secured vs Fast

Apply for N90's fast financing solutions and watch your business soar. Quick online applications and get approvals within 24 hours! Fuel Your Business Success Today!

How To Improve The Financial Efficiency of a Philippine Business - Key Points For Filipino Entrepreneurs To Remember

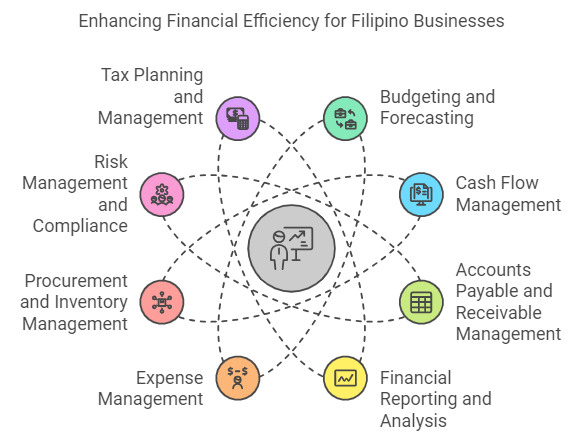

Enhancing financial efficiency is essential for the long-term success and sustainability of any business, so by focusing on key finance processes, businesses can streamline their operations and reduce costs.

These core finance processes, ranging from budgeting and cash flow management to expense tracking and risk management, act as essential building blocks of effective financial management that current or aspiring Filipino entrepreneurs must remember if they wish to build a durable business in the Philippines.

Here, take a look at some of the essential finance processes that, when optimized, can significantly improve a business's financial efficiency and overall performance -

1. Budgeting and Forecasting

Accurate budgeting and forecasting allow businesses to plan for future financial needs, allocate resources effectively, and anticipate potential financial challenges. So, it is fair to say that by regularly updating budgets and forecasts, Philippine businesses can stay on track to meet financial goals and adjust accordingly to changing market conditions.

2. Cash Flow Management

Effective cash flow management ensures that a business has sufficient liquidity to meet its short-term obligations and invest in growth opportunities. It involves monitoring cash inflows and outflows, optimizing payment terms, and managing working capital.

3. Accounts Payable and Receivable Management

Importance: Efficient management of accounts payable and receivable is crucial for maintaining positive cash flow and ensuring timely payments. Streamlining these processes can reduce errors, prevent late payments, and improve relationships with suppliers and customers.

4. Financial Reporting and Analysis

Accurate financial reporting and analysis provide insights into a business’s financial health, performance, and areas for improvement. Conducting regular financial analysis helps businesses make data-driven decisions and ensures compliance with regulatory requirements.

5. Expense Management

Controlling and managing business expenses is essential for maximizing profitability. Effective expense management involves tracking spending, setting budgets, and identifying cost-saving opportunities.

6. Procurement and Inventory Management

Efficient procurement and inventory management processes ensure that businesses maintain optimal stock levels, avoid overstocking, and minimize procurement costs. This is particularly important for businesses with significant supply chain operations.

7. Risk Management and Compliance

Managing financial risks and ensuring compliance with regulations is critical for protecting a business from potential financial losses and legal issues. Effective risk management involves identifying, assessing, and eliminating financial risks while maintaining regulatory compliance.

8. Tax Planning and Management

Effective tax planning and management ensure that businesses comply with tax regulations while minimizing their tax liabilities, as proper tax management helps a business not only optimize its financial structure but also avoid penalties.

Also Read: Simple Steps to Prepare a Cash Flow Statement Model

Important Strategies For Filipino Entrepreneurs To Implement To Improve The Financial Efficiency of Their Businesses

For Filipino entrepreneurs, having financial efficiency is a critical factor for the success and sustainability of their businesses. That is mainly because by implementing the right strategies, they can significantly enhance their business’s financial health to allow them to compete effectively with their business rivals and achieve long-term growth.

Here, take a look at some important strategies for Filipino entrepreneurs to consider to improve their business’s financial efficiency -

1. Implement In-Depth Budgeting and Forecasting

Accurate budgeting and forecasting are fundamental to financial efficiency, so Filipino entrepreneurs should regularly update their budgets and financial forecasts to reflect changes in the market and their business operations.

By doing so, they can allocate resources effectively, anticipate financial challenges, and make informed decisions. Moreover, utilizing budgeting software can further streamline this process by providing real-time data to improve overall accuracy.

2. Optimize Cash Flow Management

Managing cash flow effectively is essential for a business to maintain its liquidity and to ensure that it can meet its short-term obligations. To do this, entrepreneurs should closely monitor their cash inflows and outflows and also optimize their payment terms with suppliers and customers, to maintain an adequate cash reserve with them at all times.

Additionally, by implementing cash flow forecasting tools into their systems, businesses can provide better visibility into future cash needs, thereby helping them to prevent liquidity issues from arising in the future and enabling smooth flow of operations.

3. Utilizing Technology for Financial Processes

Embracing technology is key to improving financial efficiency, so Filipino entrepreneurs should adopt financial management software to automate routine tasks such as invoicing, payroll, and expense tracking, as it reduces errors, saves time, and allows business owners to focus on strategic activities that drive growth.

Additionally, using integrated financial systems ensures that data is consistent and accessible across all business functions.

4. Streamline Accounts Receivable and Payable

Efficient management of accounts receivable and payable is crucial for optimizing working capital, so entrepreneurs should implement strategies to accelerate receivables collection, such as offering early payment discounts and sending regular payment reminders.

As for payables, negotiating favorable payment terms with suppliers can help manage cash outflows better. Moreover, automation tools can further streamline these processes by ensuring payments are made in a timely manner and by reducing the manual workload of employees.

5. Control and Monitor Expenses

Entrepreneurs should regularly review and analyze their business expenses to identify areas where costs can be reduced without compromising quality, as it can help them maximize the business’s profitability.

Moreover, implementing an expense management system can also help businesses track their overall spending in real-time, enforce budget controls, and provide insights into spending patterns to allow the business to employ more strategic cost management methods.

6. Enhance Inventory Management

Entrepreneurs should use inventory management systems to track stock levels, forecast demand accurately, and avoid overstocking or stockouts to improve the financial efficiency of their businesses.

By optimizing inventory turnover, businesses can free up capital tied in stock and reduce holding costs, leading to better cash flow management.

7. Regularly Review Financial Performance

Entrepreneurs should regularly review their financial statements and key performance indicators (KPIs) to assess the health of their business, as this ongoing analysis helps them identify business trends, spot potential financial issues early, and make data-driven decisions.

Additionally, utilizing financial dashboards and analytics tools can provide a business with a clear and comprehensive view of its financial performance, thereby allowing it to make required adjustments to its strategy and operations before anything drastic occurs.

8. Invest in Financial Education and Expertise

Filipino entrepreneurs should invest in financial education, either through courses or by consulting with financial experts, to improve their financial knowledge and expertise to stay competitive in the market.

Understanding financial principles and staying updated on market trends enables business owners to make the right financial decisions while also enabling them to optimize financial processes and go through the potential financial challenges they may face more effectively.

Also Read: Types of Business Loans: Comparing Different Financing Options

What Role Does Technology Play in Improving The Financial Efficiency of a Business?

Technology plays a pivotal role in enhancing the financial efficiency of businesses by streamlining processes, improving accuracy, and providing real-time insights into financial performance.

Here, take a look at the role technology plays in improving and streamlining the financial efficiency of a Philippine business -

1. Automation of Financial Processes

Technology enables the automation of various financial processes such as invoicing, payroll, accounts payable and receivable, and tax calculations to reduce manual tasks, minimize errors, and speed up operations, thereby allowing businesses to process transactions more quickly and accurately.

This efficiency frees up time for employees to focus on more strategic activities rather than routine tasks, ultimately improving their productivity and reducing operational costs.

2. Real-Time Financial Reporting

Financial management software provides real-time access to financial data to enable businesses to generate up-to-date financial reports and monitor key performance indicators (KPIs).

Real-time reporting allows decision-makers to quickly identify trends, spot potential issues, and make the right financial decisions at the most appropriate time. This timely access to financial information is critical for businesses to maintain market agility in a fast-paced business environment.

3. Enhanced Data Accuracy and Compliance

Technology improves data accuracy by reducing the likelihood of human errors that can occur during manual data entry or calculations. Financial software ensures that data is consistently recorded and processed according to predefined rules, leading to more reliable financial statements and reports.

Additionally, technology helps businesses stay compliant with regulatory requirements by automating tax filings, generating compliance reports, and keeping track of changes in regulations, which in turn reduces the risk of them suffering from non-compliance penalties and legal issues.

4. Improved Cash Flow Management

Cash flow management tools integrated into financial software allow businesses to track inflows and outflows in real time, forecast future cash needs, and optimize working capital.

By providing a clear picture of cash positions, technology helps businesses make better decisions about when to invest when to borrow, and how to manage receivables and payables effectively.

This forethought approach to cash flow management reduces the risk of liquidity problems and ensures that businesses always have the necessary funds on them that are needed to operate the finance processes smoothly.

5. Cost Reduction and Efficiency Gains

Technology significantly lowers the operational costs associated with financial management by automating processes, reducing errors, and improving accuracy,

Businesses can save on labor costs by reducing the need for manual data entry and paper-based processes.

Furthermore, the efficiency gains from using financial technology enable businesses to handle larger volumes of transactions without a corresponding increase in overhead, allowing for scalable growth.

6. Enhanced Security and Data Protection

Financial technology solutions offer advanced security features, such as encryption, access controls, and automated backups, to protect sensitive financial data from unauthorized access and cyber threats.

These security measures are critical in safeguarding a company’s financial information, ensuring that data is not compromised or lost.

7. Better Decision-Making through Analytics

Technology enables advanced financial analytics, providing businesses with deep insights into their financial performance. Companies can easily analyze historical data, identify patterns, and forecast future trends by utilizing data analytics tools.

This analytical capability supports businesses to make more strategic decisions while also helping them optimize their pricing, budgeting, and investment strategies based on data-driven insights.

8. Scalability and Flexibility

As businesses grow, their financial needs become more complex; that is where technology comes in. Technology provides the scalability and flexibility that a business requires to manage increased transaction volumes, expanded operations, and more intricate financial reporting requirements.

Cloud-based financial systems, for example, allow businesses to easily scale their financial operations as they grow without the need for significant additional investment in infrastructure or personnel.

Also Read: Choosing the Right Business Loan for Your Company's Growth

Top Ways To Ensure a Business’s Financial Processes Are Always Working Efficiently

Maintaining efficient financial processes is critical for the success and sustainability of any business as these processes help reduce costs, improve accuracy, and ensure timely decision-making, all of which contribute to developing a strong financial foundation for a Philippine business.

As businesses grow and face new challenges, keeping financial processes streamlined and effective becomes increasingly important. Hence, that is why, in this section of the article, we will explore some top strategies that Philippine businesses can implement to ensure their financial processes are always working efficiently.

Here, take a closer look at the top strategies -

1. Regularly Review and Update Financial Processes

Regularly reviewing and updating your financial processes is essential to keeping them efficient and relevant. As your business grows and evolves, your financial processes need to adapt to new challenges, technologies, and regulatory requirements.

This is where conducting periodic reviews will help you identify financial inefficiencies, outdated practices, and potential risks that may arise, allowing you to implement necessary changes as soon as possible to streamline the business’s important operations.

2. Implement Automation Where Possible

Automation is a key driver of efficiency in financial processes because by automating routine tasks such as invoicing, payroll, expense tracking, and financial reporting, businesses can significantly reduce the time and effort required to manage these activities.

Additionally, automation also minimizes the risk of human error, improves accuracy, and frees up employees to focus on higher-value tasks that contribute to business growth.

3. Invest in Financial Management Software

Investing in elaborate and extensive financial management software is critical for businesses as it helps them maintain efficient financial processes.

Modern software solutions offer a range of features, including real-time reporting, analytics, budgeting, and cash flow management. These tools provide businesses with comprehensive insights into their financial health, thereby enabling them to make better financial decisions and employ more effective resource allocation methods.

4. Ensure Accurate Data Entry and Management

Accurate data entry is fundamental to efficient financial processes, mainly because errors in data entry can lead to significant discrepancies in financial reports, budgeting, and forecasting, which can have serious implications for decision-making and compliance.

To ensure data accuracy, businesses should establish clear data entry protocols, provide training for staff, and use validation tools that detect and correct errors in real-time.

5. Conduct Regular Financial Audits

Regular financial audits are essential for ensuring that financial processes are functioning efficiently and in compliance with regulations, as audits help in identifying areas of inefficiency, potential fraud, and inconsistencies in financial records.

By conducting internal or external audits on a regular basis, businesses can gain valuable insights into their financial operations, address any issues promptly, and implement corrective measures to improve efficiency. Additionally, audits also assure stakeholders that the business's financial processes are completely transparent and trustworthy.

6. Provide Ongoing Training for Financial Staff

Continuous training for financial staff is important for a business to maintain its efficiency in financial processes. As financial regulations, technologies, and best practices evolve, your finance team must also be well-equipped to stay up-to-date with the latest developments.

Regular training sessions help employees sharpen their skills, learn new tools, and adapt to changes in financial processes. Additionally, a well-trained team is also useful because it is more capable of identifying inefficiencies in the finance processes, implementing improvements accordingly, and ensuring that the financial processes are executed accurately and efficiently.

7. Monitor Key Financial Metrics

Tracking key financial metrics regularly allows businesses to measure the effectiveness of their financial processes and identify areas for improvement. Metrics such as cash flow, profit margins, accounts receivable turnover, and expense ratios provide insights into how well financial processes are supporting business operations.

8. Develop And Encourage a Culture of Continuous Improvement

Encouraging a culture of continuous improvement within your finance team is essential for maintaining efficiency in financial processes, as this type of culture motivates employees to regularly seek out ways to optimize workflows, reduce costs, and improve accuracy.

Businesses can create an environment where financial processes are constantly evolving and improving by promoting open communication, encouraging feedback, and recognizing innovative ideas.

Conclusion

As we have explained in this article, improving efficiency in finance business processes is essential for a business to maintain a competitive edge in the market and achieve long-term success.

With proper implementation, businesses can easily reduce costs and enhance financial accuracy by attentively streamlining operations, embracing the use of automation, and utilizing modern technology in their day-to-day operations.

Moreover, efficient financial processes not only support better cash flow management and compliance but also enable businesses to adapt quickly to market changes and seize growth opportunities.

So, it is fair to conclude that by focusing on continuous improvement and regularly reviewing financial processes, Philippine businesses can ensure they remain agile, resilient, and well-positioned for sustainable growth.

However, as good as streamlining business finance processes sounds, businesses must also be wary of the potential challenges faced by them when trying to implement these strategies, as they can add unwanted stress on their employees as well as their finances.

Frequently Asked Questions (FAQs)

1. What are the key finance processes in business?

In a Business, some of the key finance processes include budgeting, forecasting, financial reporting, accounting, accounts receivable, accounts payable, cash flow management, and tax compliance.

These processes ensure that a business not only has access to accurate financial records but also supports its decision-making capabilities and optimizes the resources it has at its disposal for future business activities.

2. What is P2P, O2C, R2R?

- P2P (Procure-to-Pay) is the process of acquiring goods or services from requisition to payment.

- O2C (Order-to-Cash) is the process of selling goods or services, from order to payment collection.

- R2R (Record-to-Report) is the process of recording financial transactions and generating financial reports.

3. What are the five steps of the financial process?

The five key steps in a financial process typically include the following -

- Planning: Setting financial goals, budgeting, forecasting revenue and expenses.

- Execution: Implementing financial plans, managing cash flow, and making payments.

- Monitoring: Tracking financial performance and analyzing financial data.

- Reporting: Creating financial statements and providing insights to stakeholders.

- Analysis: Evaluating financial performance, identifying trends, and making recommendations.

4. How to increase productivity in finance?

Boosting finance productivity in the Philippines usually involves -

- Automation: Utilize technology to streamline tasks like data entry and report generation.

- Process Improvement: Optimize workflows, eliminate redundancies, and standardize processes.

- Data Analysis: Make use of data to identify inefficiencies and make the right financial decisions.

- Collaboration: Foster teamwork and communication across departments.

- Skill Development: Invest in employee training for advanced financial tools and analysis.