For Philippine entrepreneurs, understanding the basics, role, and importance of finance in business is not just about managing money; it's about planning, strategizing, and making the right financial decisions to ensure the long-term sustainability and growth of their businesses.

So, whether you're a budding entrepreneur or a seasoned business owner, carefully understanding all the important concepts regarding business financing can help you navigate through the financial landscape with confidence.

To give Filipino entrepreneurs and businesses a good idea of what business finance in business is all about, this article will dive a bit deeper into the fundamental concepts of business finance and take a look at its pivotal role in operations and why it is essential for Philippine businesses.

What is Business Finance, And What is Its Scope in Philippines?

Business finance is the management of money and other assets in a company. It involves planning, obtaining, and managing the capital necessary for business operations.

From daily expenses to long-term investments, business finance ensures that a company has all the necessary resources needed to achieve its goals.

Scope of Business Finance in the Philippines

In the Philippines today, the scope of business finance is broad and dynamic, largely thanks to the country's growing economy and evolving business landscape.

It offers numerous opportunities for businesses to access capital, invest wisely, and benefit from government support and technological advancements.

Here, take a look at the diverse scope of Business finance in the Philippines -

1. Access to Capital

The Philippine financial market offers various funding options to businesses, from traditional bank loans to venture capital and government grants, which they can utilize to fuel future growth and potential innovation opportunities.

2. Investment Opportunities

There are ample investment opportunities for Philippine businesses in sectors such as technology, manufacturing, and services; however, they must possess sound financial management understanding to not only identify but also capitalize on these business opportunities.

3. Micro, Small, and Medium Enterprises (MSMEs)

MSMEs play a vital role in the Philippine economy, and business finance helps these enterprises manage their finances and scale operations to contribute significantly to the economic development of the country.

4. Government Initiatives

The Philippine government supports business finance through programs aimed at improving financial literacy, providing financial assistance, and developing a conducive environment for business growth.

5. Financial Technology

The rise of FinTech in the Philippines is transforming how businesses manage their finances. Innovations in digital banking, mobile payments, and online lending are making financial services more accessible and efficient for businesses to avail than ever before.

6. Export and International Trade

Business finance is essential for companies engaged in export and international trade, as proper financial management ensures they remain competitive in the global market and it also helps them go through the complex trade regulations as well.

Also Read: Understanding Cash Flow: Its Importance and How It Works in Business

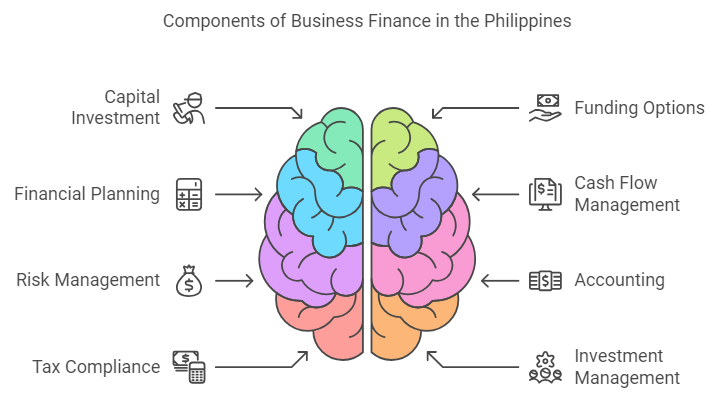

What Are The Key Components of Business Finance in Philippines?

Business finance involves various activities such as budgeting, forecasting, investing, and managing cash flow. However, the main purpose of business finance is always to help businesses make the right financial decisions about how to allocate their resources efficiently to maximize profits and ensure sustainability.

Here, take a look at the key components of business finance in the Philippines -

1. Capital Investment

Capital investment refers to the funds invested in acquiring and maintaining physical assets like machinery, technology, buildings, and equipment. Businesses must carefully plan and allocate capital investments to enhance their productivity and stay competitive in the market.

They can do this by analyzing potential returns, assessing risks, and ensuring that investments align with their business’s long-term objectives.

2. Funding and Financing Options

Securing adequate funding is crucial for any business, and in the Philippines, businesses have access to various financing options, including bank loans, venture capital, government grants, and microfinance.

3. Financial Planning and Budgeting

Financial planning and budgeting are the foundation of business finance, as they involve forecasting future financial performance, setting financial goals, and allocating resources accordingly.

Businesses need to create detailed budgets that consider local market conditions, regulatory requirements, and economic trends to ensure resources are utilized efficiently and subsequently provide them with financial stability.

4. Cash Flow Management

Effective cash flow management ensures that a business can meet its short-term obligations, as well as, invest in growth opportunities. This involves monitoring inflows and outflows, optimizing receivables and payables, and maintaining adequate cash reserves.

5. Risk Management

Risk management in business finance involves identifying, assessing, and eliminating financial risks that could impact the business. These risks can include market fluctuations, credit risks, and operational challenges.

6. Accounting and Financial Reporting

Accurate accounting and financial reporting are essential for tracking the financial performance of a business and ensuring it is complying with local accounting principles and international financial reporting standards.

This process involves maintaining detailed financial records, preparing financial statements, and conducting regular audits to provide transparency and build stakeholder confidence.

7. Tax Planning and Compliance

Tax planning and compliance are critical components of business finance in the Philippines. Businesses must navigate through a complex tax environment that includes taxes such as corporate income tax, value-added tax (VAT), and other local taxes.

8. Investment Management

Investment management typically involves managing the company’s portfolio of financial investments, such as stocks, bonds, and other securities.

In the Philippines, businesses need to balance risk and return by diversifying their investments and aligning them with their overall financial strategy because it will help them generate additional income.

Also Read: Exploring Different Types of Business Finance

Simplify your financing options and empower your Philippine SME with N90’s Fast Financing Solutions! Apply online in minutes and get potential approvals within 24 hours. Start now!

Types of Business Financing Options Available in Philippines

Looking to fund your business in the Philippines? There are various business financing options available to cater to different needs and stages of business growth. Hence, choosing the right financing option is crucial for the success and growth of your business.

Whether you opt for traditional bank loans, government programs, microfinance, venture capital, angel investors, crowdfunding, trade credit, factoring, or P2P lending, each option will offer unique benefits to your business.

Here, take a look at the different types of business financing options you can explore in the Philippines -

1. Bank Loans

Bank loans are a traditional and common source of financing for businesses in the Philippines. These loans can be secured or unsecured, but businesses must meet certain credit requirements and provide financial documentation beforehand to know if they qualify for them or not.

Banks offer various loan products, including term loans, working capital loans, and revolving credit lines.

2. Government Loans and Grants

The Philippine government provides several loan programs and grants to support businesses, particularly MSMEs.

Agencies like the Department of Trade and Industry (DTI) and Small Business Corporation (SB Corp) offer financial assistance through programs such as the Pondo sa Pagbabago at Pag-asenso (P3) and the COVID-19 Assistance to Restart Enterprises (CARES) program.

3. Microfinance

Microfinance institutions offer small loans to entrepreneurs and small businesses that may not qualify for traditional bank loans. These institutions provide financial services tailored to the needs of low-income individuals and micro-enterprises, helping them to start or expand their businesses.

Microfinance is particularly beneficial for businesses in rural and underserved areas.

4. Venture Capital

Venture capital is a form of private equity financing provided by investors to startups and small businesses with high growth potential. In exchange for funding, venture capitalists typically take an equity stake in the business.

VC funding is ideal for innovative and high-risk ventures that require significant capital to scale.

5. Angel Investors

Angel investors are wealthy individuals who provide capital to startups and small businesses in exchange for ownership equity or convertible debt. Unlike venture capitalists, angel investors often invest their own money and may offer mentorship and strategic advice.

This type of financing is suitable for early-stage businesses with high growth potential.

6. Crowdfunding

Crowdfunding platforms allow businesses to raise funds from a large number of people, typically through online campaigns. Businesses pitch their ideas to potential backers who contribute small amounts of money.

Popular crowdfunding platforms in the Philippines include Spark Project and Fundline. Crowdfunding can be reward-based, equity-based, or debt-based.

7. Trade Credit

Trade credit is an arrangement where suppliers allow businesses to purchase goods or services on credit, with payment due at a later date. This type of financing helps businesses manage cash flow and maintain inventory without immediate payment.

8. Factoring and Invoice Discounting

Factoring involves selling unpaid invoices to a factoring company at a discount in exchange for immediate cash. Invoice discounting, on the other hand, involves borrowing against the value of unpaid invoices.

Both options provide quick access to working capital and help businesses manage cash flow effectively.

9. Peer-to-Peer Lending

P2P lending platforms connect borrowers directly with individual lenders. Businesses can apply for loans through these online platforms, which often have more flexible terms and lower interest rates compared to traditional banks.

Also Read: Understanding Working Capital: How to Calculate and its Importance

What is Importance of Business Finance For Philippine Businesses?

Managing finances effectively is key to ensuring the sustainability and growth of any enterprise, and in the dynamic and competitive landscape of the Philippines, the role of business finance becomes even more critical.

Here, take a look at the importance of business finance for businesses in the Philippines -

1. Ensuring Adequate Capital

Business finance is essential for securing the capital needed to start and grow a business. Whether it's through loans, equity, or other financing methods, access to sufficient funds allows businesses to invest in necessary resources, infrastructure, and technology.

For startups and expanding businesses in the Philippines, having adequate capital is fundamental to seizing potential business opportunities and driving growth.

2. Managing Cash Flow

Effective cash flow management is vital for the day-to-day operations of any business. Business finance helps companies manage their inflows and outflows to ensure that they have enough liquidity to meet their obligations.

In the Philippines, where payment terms can vary widely, maintaining a healthy cash flow prevents disruptions in operations and helps businesses stay afloat during lean periods.

3. Investment and Growth Opportunities

With sound financial management, businesses can identify and capitalize on investment opportunities, and thankfully, business finance provides them with the tools to evaluate potential investments, assess risks, and allocate resources strategically.

In the fast-growing Philippine market, being able to invest in new projects, expand operations, and enter new markets is crucial for the long-term success of Philippine businesses.

4. Risk Management

Business finance plays a key role in identifying, assessing, and eliminating potential financial risks by managing credit risks, market fluctuations, and operational uncertainties.

For businesses in the Philippines, developing an in-depth risk management strategy is essential to protect against potential financial losses and to ensure business continuity.

5. Financial Planning and Forecasting

Financial planning and forecasting are integral components of business finance, as these processes help businesses set their financial goals, create budgets, and predict future financial performance.

For Philippine businesses, effective financial planning helps them set realistic targets, prepare for economic changes, and align business strategies with financial capabilities.

6. Improving Operational Efficiency

Proper financial management can lead to significant improvements in operational efficiency, and Philippine businesses can do this by analyzing financial data and performance metrics. Doing so will help them identify areas of inefficiency and implement cost-saving measures.

For Philippine businesses, optimizing operations can lead to better resource utilization, increased profitability, and enable them to command a stronger competitive position in the market.

7. Access to Funding and Financing Options

Understanding business finance opens up a variety of funding options, from traditional bank loans to innovative financing methods like crowdfunding and peer-to-peer lending.

For businesses in the Philippines, taking advantage of these options ensures that they can secure the necessary funds to support their operations and growth plans.

8. Compliance and Regulatory Compliance

Business finance ensures that companies comply with local tax laws, financial reporting requirements, and industry-specific regulations. Proper financial management helps in maintaining compliance, avoiding legal issues, and building trust with stakeholders.

Also Read: Top Legit Loan Apps for Long-Term Borrowing with Low Interest

Financial Management Strategies For Businesses To Implement To Optimize Their Finances in Philippines

Are you looking to optimize your business’s finances in the Philippines? Effective financial management is key for Philippine businesses to ensure they remain sustainable, have ample growth opportunities, and remain competitive.

Here, take a look at some of the tried-and-tested, essential strategies that can help businesses in the Philippines manage their finances more effectively -

1. Develop a Comprehensive Financial Plan

Creating a detailed financial plan is the foundation of sound financial management. This plan should outline your business goals, projected revenues, expenses, and cash flow. Regularly update your financial plan to reflect changes in the market and your business operations.

2. Implement Effective Budgeting Practices

Budgeting is crucial for controlling expenses and allocating resources efficiently. Develop annual and monthly budgets that cover all aspects of your business operations, including fixed and variable costs.

Moreover, monitor actual performance against your budget regularly and adjust as needed to ensure you stay on track.

Effective budgeting helps in identifying potential financial issues early and allows for timely corrective actions.

3. Manage Cash Flow Diligently

Cash flow management is vital for maintaining liquidity and ensuring that your business can meet its short-term obligations. Monitor your cash inflows and outflows closely and maintain a cash reserve to cover unexpected expenses.

Additionally, implement strategies such as prompt invoicing, offering early payment discounts, and negotiating favorable payment terms with suppliers to improve cash flow.

4. Optimize Working Capital

Efficiently managing your working capital is essential, so focus on optimizing your inventory levels, managing receivables and payables, and maintaining adequate liquidity.

Regularly review and adjust your working capital needs to align with your business operations and market conditions, as this will ensure that your business can operate smoothly without unnecessary financial strain.

5. Utilize Technology for Financial Management

Adopt financial management software and tools to streamline your financial processes. These tools can help automate tasks such as bookkeeping, invoicing, and financial reporting, and reduce the risk of errors and save precious time in the process as well.

Moreover, utilizing technology also provides real-time insights into your financial performance, which will enable you to make better financial decisions for your business.

6. Diversify Funding Sources

Relying on a single source of funding can be risky, so always explore various financing options available in the Philippines, such as bank loans, venture capital, angel investors, and government grants.

Diversifying your funding sources can provide your business with financial stability and flexibility, ensuring that you always have access to capital when you need it.

7. Conduct Regular Financial Analysis

Regularly analyze your financial statements, including income statements, balance sheets, and cash flow statements, since this will help you in understanding your business’s financial health and identify trends.

If needed, use financial ratios and key performance indicators (KPIs) to assess your business's performance and identify areas for improvement.

8. Implement Cost Control Measures

Control your expenses by implementing cost-saving measures and continuously monitoring your spending by identifying and eliminating unnecessary costs, negotiating better terms with suppliers, and looking for ways to increase operational efficiency.

9. Ensure Compliance and Risk Management

Complying with regulatory requirements and managing financial risks are critical aspects of financial management. So, it is always a good idea to stay updated on local tax laws, financial regulations, and industry standards in the Philippines.

Always develop a risk management strategy to identify, assess, and bypass financial risks to ensure your business remains compliant and protected against all potential threats.

Also Read: Applying for a Small Business Loan: 5 Steps to Get Approved

What is Future Scope of Business Finance in Philippines?

The field of business finance offers numerous opportunities for growth and development for Philippine businesses, primarily driven by the country’s evolving economic landscape, technological advancements, and the increasing complexity of financial markets.

Here's an in-depth look at the future scope and career prospects in business finance available in the Philippines -

Future Scope of Business Finance in Philippines

1. Growing Demand for Financial Expertise

The demand for financial professionals is expected to grow as businesses increasingly rely on financial expertise to navigate complex markets and economic conditions.

Companies need skilled finance professionals to manage investments, optimize capital structures, and ensure financial stability. This demand spans across various industries, including banking, investment firms, consulting, and corporate finance.

2. Technological Advancements

Technology is transforming the finance industry, creating new roles and opportunities. FinTech innovations, such as blockchain, artificial intelligence (AI), and data analytics, are reshaping how financial services are delivered and managed.

Finance professionals with expertise in these technologies are in high demand as businesses seek to utilize these tools for improved efficiency and decision-making.

3. Globalization of Financial Markets

Globalization has interconnected financial markets, increasing the need for professionals who understand international finance and can traverse through cross-border transactions and regulations.

Careers in global finance, such as international banking, trade finance, and foreign exchange management, are becoming more prominent in the Philippines as they offer exciting opportunities for those interested in working on a global scale.

4. Regulatory Changes and Compliance

The evolving regulatory environment continues to impact the finance industry, as top businesses now require finance professionals to ensure they comply with local and international regulations.

Careers in regulatory compliance, risk management, and internal auditing are critical for maintaining financial integrity and avoiding legal issues. These roles are becoming increasingly important as regulatory requirements become more strict as time goes by.

5. Sustainability and ESG Investing

Environmental, Social, and Governance (ESG) factors are gaining prominence in the finance industry as companies and investors are increasingly focusing on sustainable and responsible investing methods.

Finance professionals with expertise in ESG criteria and sustainable finance are in demand to help businesses integrate these considerations into their financial strategies and investment decisions.

Also Read: Finding Low-Interest Business Loans in the Philippines

Career Opportunities in Business Finance in Philippines

1. Corporate Finance Manager

Corporate finance managers oversee financial activities within a company, including capital budgeting, financial planning, and risk management. They ensure the company’s financial health and support its strategic objectives.

2. Investment Banker

Investment bankers assist companies in raising capital, managing mergers and acquisitions, and providing financial advisory services. This career path offers high earning potential and opportunities to work on complex financial transactions.

3. Risk Manager

Risk managers identify, assess, and eliminate financial risks faced by businesses. They develop risk management strategies to protect the company from potential financial losses and ensure long-term stability.

4. Chief Financial Officer

The CFO is responsible for managing a company’s overall financial activities, including financial planning, risk management, and financial reporting. This executive role requires extensive experience and offers significant influence over the company’s financial strategy.

5. Financial Planner/Advisor

Financial planners and advisors provide individuals and businesses with personalized financial advice. They help clients manage their finances, plan for the future, and achieve their financial goals.

Conclusion

As we have seen from this article, finance in business is the backbone that supports every aspect of a company’s operations and strategic growth. It equips business leaders with the tools to make the right decisions regarding their business’s resource allocation, investment opportunities, and risk management strategies.

The role of finance in business extends far beyond than just ensuring a business has adequate capital; it also knows how to manage its cash flow to optimize investments.

Moreover, its importance cannot be overstated as well, as effective financial management is crucial for the sustainability, competitiveness, and long-term success of Philippine businesses.

Frequently Asked Questions (FAQs)

1. What is the main role of finance in business?

Finance is the lifeblood of a business, as it involves managing a company's money, including acquiring funds, allocating resources, and controlling expenses.

Finance ensures a business has sufficient cash flow to operate, invests in growth opportunities, and makes informed decisions. It also assesses the financial performance of a business, manages potential risks, and communicates financial health to stakeholders.

2. What are the objectives of finance?

The primary objectives of finance are to ensure the availability of adequate capital, optimize the use of financial resources, maximize shareholder wealth, manage risks effectively, and maintain liquidity to meet short-term obligations.

These goals help businesses achieve sustainable growth, enhance their profitability, and maintain financial stability.

3. What are the top 3 roles of Finance Manager?

- Financial Planning and Analysis: Creating budgets, forecasting, and analyzing financial performance to guide a business to make key financial decisions.

- Financial Reporting: Preparing financial statements, ensuring accuracy, and communicating the financial health of the business to its stakeholders.

- Cash Management: Overseeing cash flow, managing investments, and optimizing financial resources at the business’s disposal.

4. What are instruments in finance?

Financial instruments are assets or contracts that have a financial value that can be traded or exchanged. Some good examples include stocks, bonds, derivatives, currencies, and commodities. These instruments are used for investments, borrowing, risk management, and other financial activities.