The restaurant industry is dynamic and challenging, often requiring significant capital to navigate its various phases, whether for opening a new outlet, upgrading existing equipment, or managing day-to-day operational costs.

However, as lucrative as this industry sounds, it isn’t without its challenges. Many restaurant owners face the common challenge of securing the right financial resources tailored to their unique needs and market conditions.

Hence, it is vital to know about the various sources from which you can get the funding your Philippine restaurant needs to grow. In this comprehensive guide, we'll explore everything from the basics of restaurant business loans to the different types available, common uses, qualification criteria, and critical comparisons.

So, without much ado, let’s start because discovering the right loan option could be the very catalyst that helps your restaurant thrive.

What Are Small Business Loans For Restaurants?

At their core, small business loans for restaurants provide the capital necessary to start, maintain, or expand a restaurant. They specifically tailor these loans to the needs of the restaurant industry, considering the high operational costs, seasonal revenue fluctuations, and the market's competitive nature.

Small business loans for restaurants are divided into two categories: short-term loans and Long-term loans. Here, take a look at them in greater detail -

1. Short-Term Loans

- Short-term loans are outstanding for immediate needs, such as covering cash flow gaps, paying insurance premiums, handling payroll, and settling invoices with vendors.

- Use these loans as emergency funds for unexpected expenses like equipment repairs or sudden ingredient price spikes.

- The restaurant industry commonly faces seasonal fluctuations. Use short-term loans to bridge these revenue gaps, ensuring smooth operations during slower periods.

2. Long-Term Loans

- Using long-term loans, you can plan for significant investments like purchasing real estate, upgrading kitchen equipment, or expanding your restaurant.

- Use them for strategic initiatives like refining your menu, hiring additional staff, and opening new locations.

- Use long-term financing to consolidate existing debts, potentially lowering the overall interest cost and simplifying financial management.

Also Read: Steps to Get a Small Business Loan Without Collateral

Types of Restaurant Business Loans Available in The Philippines

Opening or expanding a restaurant in the Philippines often requires significant capital, and various loan options are available to support this. Whether you need funds for equipment, renovations, or working capital, restaurant business loans can provide the financial boost necessary for success.

Here are the key types of loans available for restaurant businesses in the Philippines -

1. Secured Business Loans

Offered by banks like BDO and BPI, secured loans require collateral such as property or equipment and typically offer lower interest rates and longer repayment terms.

2. Unsecured Business Loans

These loans, provided by banks or microfinance institutions, do not require collateral but may have higher interest rates. SB Corporation offers unsecured loans for MSMEs, including restaurants.

3. Franchise Financing

If you're opening a restaurant franchise, banks or financial institutions offer franchise loans with flexible payment terms tailored explicitly for buying into established franchises.

4. Microfinance Loans

For smaller restaurant businesses or startups, microfinance institutions offer loans with minimal collateral requirements and flexible terms, targeting entrepreneurs with limited financial history.

5. Government-Backed Loans

Programs like the Pondo sa Pagbabago at Pag-asenso (P3) Program by DTI and SB Corp. provide low-interest loans to MSMEs, including restaurant businesses, especially those in underserved regions.

Also Read: Top Banks for Small Business Startup Loans in 2024

Accelerate your Philippine SMEs' growth exponentially! Apply today for N90’s fast financing solutions and get potential loan approvals within 24 hours! Unleash your business’s full potential today! Get in touch with us to learn more.

Common Uses of Small Business Loans For Restaurants in The Philippines

Small business loans are essential for restaurant owners in the Philippines to manage startup costs, grow operations, and stay competitive in the dynamic food industry. These loans provide much-needed capital for various business needs, from day-to-day expenses to long-term investments.

Here, take a look at the common uses of small business loans for restaurants in the Philippines -

1. Purchasing Equipment

Loans help buy essential kitchen equipment, such as ovens, refrigerators, stoves, furniture, and dining area POS systems.

2. Renovations and Expansion

Financing can be used for restaurant remodeling, expanding dining spaces, or opening new locations to accommodate growing customer demand.

3. Inventory Management

Loans provide working capital to purchase bulk ingredients and supplies, ensuring that restaurants have the inventory needed to meet customer demand.

4. Marketing and Advertising

Restaurants use loans to fund promotional campaigns, both online and offline. These campaigns help attract new customers and boost sales through targeted marketing efforts.

5. Hiring and Training Staff

Loans enable restaurants to hire additional staff or invest in employee training programs to improve service quality and efficiency.

6. Cash Flow Management

Loans are often used to maintain steady cash flow, particularly during off-peak seasons, ensuring that restaurants can cover operational expenses such as rent and utilities.

Also Read: Improving Efficiency in Finance Business Processes

How to Qualify for Small Business Loans For Restaurants in The Philippines

Qualifying for a small business loan is essential for restaurant owners looking to start or expand their operations in the Philippines. This is mainly because lenders generally require specific criteria to ensure that businesses can repay the loan.

Here, take a look at how you can qualify for small business loans for restaurants in the Philippines -

1. Registered Business

The restaurant must be legally registered with government agencies such as the DTI or SEC and have the necessary permits to operate.

2. Good Credit History

Lenders typically require a solid credit score for both personal and business accounts to assess creditworthiness and repayment ability.

3. Stable Financial Records

You must provide financial statements such as income statements, balance sheets, and tax returns to prove your business's profitability and stability.

4. Detailed Business Plan

A clear and well-drafted business plan outlining your restaurant's growth strategy, revenue projections, and loan utilization improves your chances of approval.

5. Collateral (for Secured Loans)

For secured loans, lenders may ask for collateral such as property, equipment, or other assets to minimize their risk in case of default.

6. Length of Business Operation

While startups can still qualify for loans, many lenders prefer businesses that have been operating for at least 2 years, as this demonstrates stability.

Also Read: 10 Strategies to Increase Your Business Cash Flow

Essential Steps To Apply For Small Business Loans For Restaurants in Philippines

Applying for a small business loan for your restaurant in the Philippines can help cover startup costs, expansion, or operational expenses. However, understanding the process and preparing the necessary documents are crucial for a successful application.

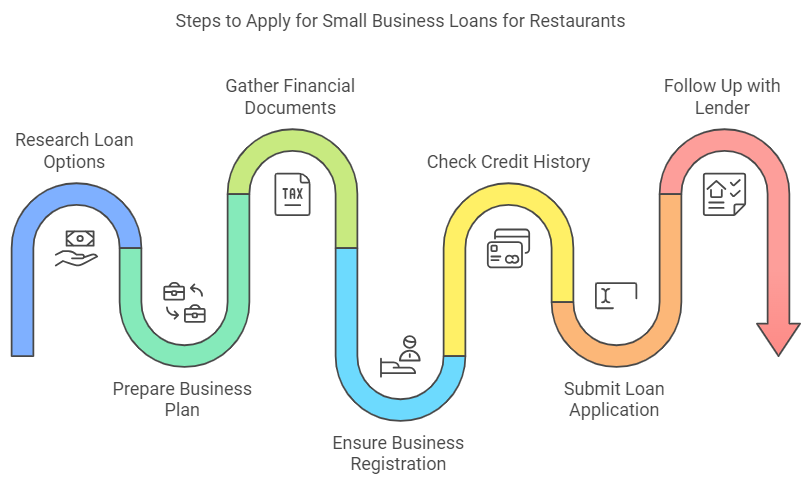

Here are the key steps to follow when applying for small business loans for restaurants -

1. Research Loan Options

Explore the various loan types banks offer, microfinance institutions, and government programs. Choose one that suits your restaurant’s needs, such as a secured, unsecured, or microfinance loan.

2. Prepare Your Business Plan

Develop a detailed business plan outlining your restaurant’s goals, market analysis, financial projections, and loan utilization. A strong business plan improves your chances of approval.

3. Gather Financial Documents

Collect your financial statements, such as income statements, balance sheets, tax returns, and cash flow reports. Lenders will assess these documents to gauge your business’s economic health.

4. Ensure Business Registration

Ensure your restaurant is legally registered with the DTI, SEC, or relevant local government units. Secure necessary operating permits and licenses to demonstrate compliance with regulations.

5. Check Credit History

Review your credit score and history to ensure it meets the lender’s criteria. Address any outstanding debts or issues that may affect your application.

6. Submit the Loan Application

Fill out the loan application form provided by the lender. Attach all required documents, including your business plan, financials, and proof of registration.

7. Follow Up with the Lender

After submitting your application, maintain open communication with the lender and respond promptly to any requests for additional information or clarification.

Conclusion

In 2024, restaurant owners in the Philippines will have various loan options to choose from, including secured and unsecured loans, microfinance options, government-backed programs, and franchise-specific financing.

Each option offers unique benefits depending on the business's needs, size, and growth stage. So, by thoroughly understanding the requirements, advantages, and terms of each loan, restaurant owners can select the most suitable financing solution to help grow or sustain their business.

Moreover, careful preparation, such as creating a solid business plan and gathering financial documentation, will improve the chances of securing the best loan for your restaurant’s success. Remember that while short-term loans might offer quick funding, they often come with higher interest rates and shorter repayment terms, which can impact your cash flow over time.

Frequently Asked Questions (FAQs)

1. What is the best source to get small business loans for restaurants in the Philippines?

The best sources for small business loans for restaurants in the Philippines include BDO and BPI for traditional bank loans with competitive rates. For more accessible options, the DTI P3 Program and SB Corp. offer government-backed loans with low interest rates for MSMEs.

Moreover, microfinance institutions like CARD Bank are ideal for small or startup restaurants seeking flexible financing.

2. How much capital is required to start a restaurant business in the Philippines?

The capital required to start a restaurant business in the Philippines typically ranges from PHP 500k to PHP 5 million or more, depending on factors like location, size, and concept.

Small, local eateries can start with lower capital, while mid-sized or franchise restaurants require higher investment in equipment, renovations, staffing, and permits. The final cost ultimately depends on the business's scale and market.

3. What is the standard business loan lending rate in the Philippines?

The standard business loan lending rate in the Philippines typically ranges from 7.80% per annum, depending on the lender, loan type, and borrower’s creditworthiness. Business loan rates can vary across different financial institutions, so it is a good idea to thoroughly check their fine details before taking out a loan.

In contrast, government-backed loans, such as those from SB Corp., may offer lower rates, around 6.5% per annum, while unsecured loans from private banks usually come with higher interest rates, around 12% per annum or more, due to increased lending risk.

4. How do you raise capital for a small business in the Philippines?

To raise capital for a small business in the Philippines, consider options like personal savings, government loans from DTI's P3 Program or SB Corp., and bank loans from institutions like BDO or BPI.

You can also explore microfinance loans, seek funding from angel investors, or use crowdfunding platforms to gather public support for your business idea.