Maintaining a steady cash flow is one of the biggest challenges businesses face when customer payments are delayed. However, invoice factoring and debtor financing present innovative solutions to this common problem by converting outstanding invoices into immediate cash.

Instead of waiting for customer payments, with the help of these tools, businesses can access immediate cash by selling their invoices to a factoring company or using them as collateral for a loan. These options provide quick liquidity, enabling firms to meet operational needs, pay suppliers, and invest in growth while maintaining steady cash flow.

Hence, in this blog, we will explore the various features of these financial tools in greater detail, including their workings, advantages and disadvantages, and how both can be seamlessly integrated into a business strategy to allow businesses to make the right financial decisions to suit their needs.

So, without further ado, let us explore invoice factoring and debtor financing and how they can effectively improve Philippine businesses' cash flow nationwide.

Understanding Invoice Factoring and Debtor Financing in Philippines

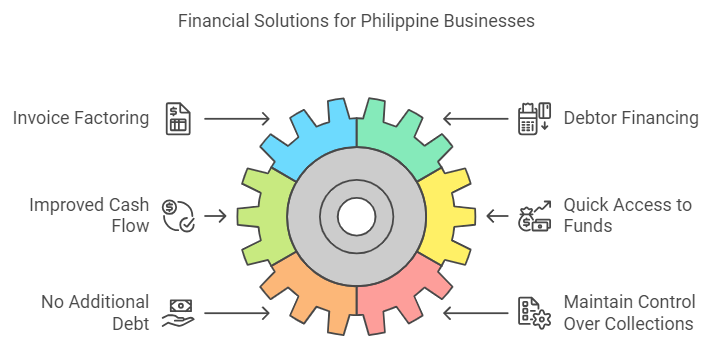

Invoice factoring and debtor financing are popular financial solutions in the Philippines. They are designed to help businesses improve cash flow by utilizing their receivables.

Here's how they work -

Invoice Factoring

This involves selling a company’s unpaid invoices to a factoring company at a discount. The business receives immediate cash, while the factoring company assumes responsibility for collecting payments from the company’s customers.

This provides businesses with liquidity without waiting for extended payment terms.

Debtor Financing

In debtor financing (also known as invoice financing), businesses use their outstanding invoices as collateral to secure a loan or line of credit.

The company retains ownership of the invoices and is responsible for collecting payments. On the other hand, the lender provides funding based on the value of the receivables, improving cash flow without selling the invoices.

Also Read: Improving Efficiency in Finance Business Processes

Invoice Factoring And Debtor Financing vs. Traditional Financing Options - Key Differences Between Them

Invoice factoring and debtor financing offer flexibility and can be tailored to fit a business’s needs. This is advantageous for companies with weak credit histories or those ineligible for conventional loans.

Here, take a look at the significant differences between invoice factoring and debtor financing against traditional financing options available in the Philippines financial market -

1. Ownership of Receivables

- Invoice Factoring and Debtor Financing: In factoring, the receivables are sold to the factoring company, while in debtor financing, the receivables are used as collateral but remain under the company’s control.

- Traditional Financing: Traditional loans do not involve selling or using receivables as collateral. They are based on creditworthiness and other assets.

2. Approval Process

- Invoice Factoring and Debtor Financing: Approval is based on the creditworthiness of the company’s customers (in factoring) or the value of the receivables (in debtor financing).

- Traditional Financing: Loan approval is based primarily on the company’s credit score, financial health, and collateral, which can make it harder for businesses with weaker credit.

3. Funding Speed

- Invoice Factoring and Debtor Financing: These options provide faster access to funds, often within days of submitting invoices or receivables, making them ideal for businesses needing quick cash flow.

- Traditional Financing: Traditional loans often have longer processing times, taking weeks or months for approval and disbursement.

4. Collateral Requirements

- Invoice Factoring and Debtor Financing: Factoring doesn’t require additional collateral beyond receivables, while debtor financing uses receivables as collateral.

- Traditional Financing: Traditional loans usually require collateral, such as property, equipment, or inventory, which could be more challenging for small businesses to provide.

5. Repayment Structure

- Invoice Factoring and Debtor Financing: Repayment is not a concern for factoring, as the factor is collected from customers. In debtor financing, businesses repay the lender as they collect from customers.

- Traditional Financing: Traditional loans follow a fixed repayment schedule, where businesses must repay the principal and interest over time, regardless of cash flow.

These differences show how invoice factoring and debtor financing offer more flexible and immediate solutions than traditional financing, which can be slower and more restrictive based on creditworthiness and collateral.

Also Read: Exploring Instruments for Alternative Finance Providers

How Does Invoice Factoring Work in The Philippines?

Invoice factoring is a practical financing mechanism that keeps your business running smoothly by utilizing unpaid invoices effectively.

Here's how it works -

1. Selling Outstanding Invoices to a Factoring Company

The business sells its unpaid invoices to a factoring company, which then collects customer payments.

2. Immediate Access to a Percentage of Invoice Value

In exchange for those invoices, the factoring company provides an upfront cash advance—typically between 75% and 95% of the invoice's face value. This cash injection helps meet operational expenses, payroll, or short-term financial needs.

3. Balance Payment After Customer Settlement Minus a Fee

Once your customer pays the invoice, the factoring company deducts a factoring fee and then releases the remaining balance to you. This fee usually ranges between 1% and 5% of the invoice amount, depending on factors such as the payment period and your customer's creditworthiness.

After deducting the fee, the factoring company transfers the remaining amount to you, further boosting your cash flow.

Do you still need more clarity on how invoice factoring works? Check out this Reddit thread. Here, a Redditor with ten years in the factoring industry explains that small businesses typically receive an 85% advance on invoices, with a 3-5% fee based on payment timing.

Also Read: Understanding Working Capital Needs For A Small Business

How Does Debtor Financing Work in The Philippines?

There are several types of debtor financing solutions, each catering to different needs. Here, take a look at how it functions in the Philippines -

1. Invoice Discounting

This option involves selling outstanding invoices to a financier at a discounted rate. The business gets the money upfront, minus a fee, while the financier collects the total amount from the customer.

Companies that wish to maintain control over their customer relationships and the collections process find this appealing.

2. Invoice Factoring

This is similar to invoice discounting, but here, the financier takes over collecting payments from the customer. The business receives a percentage of the invoice value in advance, with the financier handling the collection.

This allows companies to focus more on core operations, as labor-intensive accounts receivable management is outsourced.

3. Cash Flow Finance

This financing type provides businesses quick access to cash based on their outstanding invoices. It bridges the gap between the time of sale and the receipt of payment, making it particularly useful for businesses with seasonal or irregular cash flows.

4. Asset-Based Lending

In this scenario, a business's assets, including its invoices, are used as collateral for a loan. The loan amount is based on the value of these assets, offering another way to improve cash flow. This is beneficial for companies with a diverse range of assets that can be leveraged for financing.

Also Read: Finance in Business: Basics, Role, and Importance

Boost your business growth with the help of N90’s Fast Financing Solutions and get potential loan approvals within 24 hours! Apply now and see how fast your Philippine SME can reach its full potential!

Benefits of Invoice Factoring And Debtor Financing For Philippine Businesses

Invoice factoring and debtor financing offer crucial financial solutions for businesses in the Philippines facing cash flow challenges due to delayed customer payments. They allow companies to access immediate working capital by using their receivables without needing traditional loans or physical collateral.

Here, take a closer look at the key benefits of invoice factoring and debtor financing for Philippine businesses in greater detail -

Benefits of Invoice Factoring For Philippine Businesses

1. Improved Cash Flow and Liquidity

Invoice factoring converts outstanding invoices into immediate cash, allowing businesses to manage their operational expenses effectively and invest in growth opportunities.

2. Quick Access to Funds

Another benefit is the speed of fund availability—invoice factoring often provides cash within 24 hours, unlike traditional loans that take weeks or months. This is crucial for companies needing to seize emerging opportunities or promptly tackle urgent expenses.

3. No Additional Debt Incurred

Invoice factoring doesn't create balance sheet debt, allowing businesses to obtain funds without new liabilities. This type of financing maintains a healthy financial profile and enables strategic resource allocation while also offering flexibility and financial freedom without interest or collateral requirements.

Factoring companies often offer additional services such as credit checks, online reporting, and professional collection services. These perks can significantly help manage a company's cash flow more efficiently and free up administrative resources.

Benefits of Debtor Financing For Philippine Businesses

1. Improved Cash Flow

Debtor financing allows businesses to convert their outstanding invoices into immediate cash, helping to bridge cash flow gaps and meet operational expenses without waiting for customer payments.

2. No Need for Collateral

Unlike traditional loans, debtor financing uses receivables as collateral, meaning businesses do not need to pledge physical assets like property or inventory. This makes it accessible for small and medium-sized enterprises (SMEs).

3. Maintain Control Over Collections

Unlike factoring, debtor financing allows businesses to retain control over collecting customer payments, ensuring that client relationships remain unaffected.

4. Flexible Financing

The amount of financing a business can access grows as its receivables increase. This scalability makes debtor financing a flexible option for businesses experiencing growth or seasonal fluctuations in cash flow.

5. Faster Access to Funds

Debtor financing provides quicker access to capital than traditional bank loans, allowing businesses to take advantage of new opportunities or cover immediate expenses without delay.

Also Read: What is Invoice Financing, and How Does it Work?

How To Effectively Integrate Invoice Factoring and Debtor Financing with Your Business’s Strategy

To maximize the effect of both invoice factoring and debtor financing, you need to integrate them smoothly with your existing business strategy.

Here, take a look at the points below to know how to effectively integrate invoice factoring and debtor financing with your business’s strategy in the Philippines -

1. Assess Cash Flow Needs

Analyze your business’s cash flow to determine whether invoice factoring or debtor financing is necessary. If your company frequently faces delays due to customers' long payment terms, these options can provide immediate liquidity and support daily operations.

2. Choose The Right Type of Financing

Decide between invoice factoring and debtor financing based on your business's goals. Invoice factoring suits companies that prefer to offload collection responsibilities, while debtor financing is ideal for businesses wanting to maintain control over customer relations while securing short-term loans.

3. Align With Growth Objectives

Use these financing tools strategically to support business expansion, such as funding inventory, expanding operations, or taking on new contracts. Businesses can seize growth opportunities by leveraging immediate cash flow without waiting for customer payments.

4. Maintain Strong Customer Relationships

If using invoice factoring, ensure the factoring company handles collections professionally to protect your customer relationships. Communicate openly with customers about your financing strategy to avoid concerns about your financial stability.

5. Monitor Costs And Profit Margins

Monitor the costs associated with factoring or debtor financing. Review the impact on your profit margins and cash flow regularly to ensure that these financing methods enhance your business’s financial health without causing unnecessary strain.

6. Use For Short-Term Gaps

Consider integrating invoice factoring or debtor financing for short-term gaps in cash flow rather than as a long-term solution. Use these tools to bridge gaps during seasonal slowdowns, large customer orders, or extended payment terms.

7. Selecting The Right Factoring Partner

The choice of a factoring partner significantly impacts the effectiveness of your strategy. Select a reputable company with experience in your industry and terms that suit your business needs.

Look for partners with transparent fee structures and robust customer service. Also, check if they can scale their services as your business grows.

Several key factors to consider include the following -

- Industry Expertise: An experienced factoring company familiar with your sector can offer tailored services.

- Customization: Find a partner who provides services designed for your unique requirements.

- Scalability: Ensure the partner can keep pace with your company's growth.

- Customer Service: Strong, responsive customer service can ease the integration of these financial tools into your operations.

- Reputation: Research their reputation through reviews, referrals, and industry ratings.

- Contract Flexibility: Flexible agreements are crucial to adapt to changing business conditions.

- Hidden Fees: Scrutinize the agreement to avoid any unexpected charges.

- Security and Data Protection: Ensure robust security measures are in place to protect sensitive financial data.

Also Read: How to Sell Your Invoices to Improve Cash Flow

Challenges and Considerations To Consider When Utilizing Invoice Factoring and Debtor Financing in The Philippines

While invoice factoring and debtor financing can significantly enhance a business’s cash flow, it’s essential to be aware of the associated challenges and considerations.

Here, take a look at the potential challenges and considerations Philippine businesses face when utilizing invoice factoring and debtor financing -

1. Higher Costs

Invoice factoring and debtor financing often have higher fees than traditional loans. Factoring companies charge a percentage of the invoice value, and fees may increase if payments are delayed. Debtor financing also involves interest, which can affect overall profitability.

2. Impact on Customer Relationships

With invoice factoring, the factoring company assumes responsibility for collecting payments. This could potentially affect customer relationships, as clients may view the involvement of a third party as a sign of financial instability.

3. Creditworthiness of Customers

In invoice factoring, your customers' creditworthiness is crucial in approval and pricing. If your customers have poor credit or are slow to pay, factoring invoices may be more difficult or expensive.

4. Loss of Control Over Collections

In factoring, businesses lose control over the invoice collection process since the factor handles customer payments. This lack of control can concern companies that prefer to manage their receivables.

5. Limited Financing Potential

The amount of your receivables limits both factoring and debtor financing. If your invoices are low, your financing potential is capped. Additionally, not all invoices may be eligible, restricting the funds you can access.

Also Read: Creating A Cash Flow Budget In 5 Steps

Importance of Choosing Reputable Factoring Companies in Philippines

Choosing a reputable factoring company is essential for businesses in the Philippines to ensure smooth operations and safeguard their financial health.

Here are key reasons why choosing a reputable and reliable factoring company is essential in the Philippines -

1. Reliability And Trust

A reputable company ensures that your invoices are managed professionally, maintaining trust with your business and customers and safeguarding relationships.

2. Transparent Fees

Trusted factoring companies offer clear and transparent pricing, avoiding hidden fees that could impact your cash flow or profitability.

3. Efficient Cash Flow

Reputable factors provide quick and consistent funding, ensuring your business receives the capital to maintain operations without unnecessary delays.

4. Customer Relations Management

A credible factoring company will handle collections professionally, thus minimizing the risk of damaging customer relationships, a crucial factor for long-term business success.

5. Legal Compliance And Security

Working with a licensed and regulated factoring company protects your business from legal and financial risks. It also ensures that all transactions comply with local regulations and best practices.

Conclusion

Cash flow management is the cornerstone of any business's financial health. A steady flow of capital ensures a company can meet its obligations, seize growth opportunities, and maintain market competitiveness. It is fair to say that without it, businesses may face strained relationships with suppliers, financial instability, and even the risk of failure.

That is where invoice factoring and debtor financing come in. They offer practical solutions to these challenges by converting unpaid invoices into immediate cash, thereby providing the liquidity needed to optimize working capital.

This enhanced liquidity enables businesses to allocate funds more efficiently, ensuring operations run smoothly, and strategically substantial investments are noticed.

But that’s not all. Besides strengthening the business’s relationships with its suppliers, improved cash flow can also build stronger supplier partnerships by offering early payment discounts, which provide long-term benefits and preferential treatment.

Frequently Asked Questions (FAQs)

1. How does debt factoring improve cash flow?

Debt factoring improves cash flow by allowing businesses to sell their outstanding invoices to a factoring company for immediate cash. Instead of waiting for customer payments, the business receives a percentage of the invoice value upfront.

This provides quick access to working capital, helping the business cover operational expenses, pay suppliers, and invest in growth without cash flow delays.

2. How does an increase in debtors affect cash flow?

An increase in debtors negatively affects cash flow because it means more customers owe money to the business, delaying incoming payments. As a result, the company needs more available cash to cover operational expenses, pay suppliers, or invest in growth.

Doing so can lead to liquidity problems, forcing the company to seek alternative financing or extend credit lines to manage shortfalls.

3. How do you increase the cash-flow-to-debt ratio?

To increase your cash flow-to-debt ratio, improve cash inflows while reducing debt obligations. Strategies include boosting sales, improving invoice collection, lowering expenses, and managing inventory efficiently.

Additionally, you can also refinance high-interest debt to lower monthly payments. Increasing revenue and reducing debt enhances your cash flow-to-debt ratio, improving financial health and sustainability.

4. How does bad debt affect cash flow?

Bad debt negatively affects cash flow by reducing the amount of money a business can collect from its receivables. When customers fail to pay, the company experiences a cash shortfall, limiting its ability to cover operating expenses, pay suppliers, or invest in growth.

Moreover, bad debt also increases the need for additional financing, leading to potential cash flow strain and higher borrowing costs.