Understanding loan interest rates is vital to managing personal finances, as they directly impact how much you repay on borrowed funds. Many borrowers are puzzled by the various interest rate types and calculations, leading to anxiety over potential financial pressures.

Hence, this blog will aim to clarify these concepts, starting with the basics of interest rates and how they're defined in the Philippines. It will guide you through the working mechanics of loan interest rates, illustrate the different interest rate types, and explain their impact on personal loans and the broader economy.

By the end of this comprehensive article, you'll understand how to utilize loans to your advantage when availing a loan in the Philippines, whether for your personal needs or your small business’s requirements.

What Are Loan Interest Rates in The Philippines?

Loan interest rates in the Philippines refer to the cost of borrowing money, expressed as a percentage of the loan amount. These rates vary depending on the type of loan, lender, and borrower’s credit profile.

Interest rates for personal loans range from 1% to 3% per month, while secured loans like home or car loans have lower annual rates, typically between 3% and 6% per annum. Online and microfinance lenders may charge higher rates due to higher risk profiles.

For example, a PHP 10k loan at a 3% interest rate would cost PHP 300 annually.

These rates allow lenders to compensate for the risk of lending and the opportunity cost of parting with their money. There's always a risk that the borrower might default, i.e., failing to repay the loan.

Also Read: What is Invoice Financing, and How Does it Work?

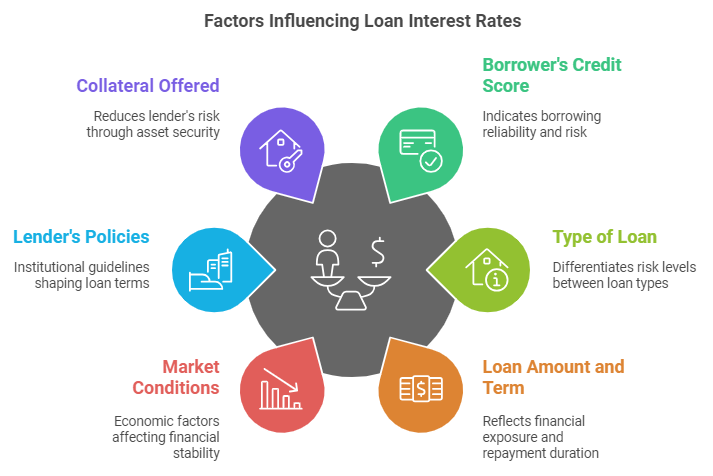

Factors Influencing Loan Interest Rates in Philippines

Several key factors must be considered when determining loan interest rates, as they not only detail how much you'll pay over time but also reflect the risk assessment performed by lenders.

Here are key factors influencing loan interest rates in the Philippines -

1. Borrower’s Credit Score

A higher credit score generally results in lower interest rates, as it indicates responsible borrowing behavior and a lower risk of default. A credit score of 650 and above is considered a good score.

2. Type of Loan

Secured loans, such as home or car loans, usually have lower interest rates than unsecured loans, such as personal loans, as lenders face less risk.

3. Loan Amount and Term

More significant loan amounts or longer repayment terms may come with higher interest rates due to increased risk and exposure for the lender.

4. Market Conditions

Economic factors influence loan interest rates, such as inflation and central bank policies, like the ones set by the Bangko Sentral ng Pilipinas. Higher inflation or financial instability may result in higher rates.

5. Lender’s Policies

Different financial institutions, such as banks or microfinance lenders, have their own lending policies and risk assessments, which can lead to variations in interest rates.

6. Collateral Offered

Offering collateral, such as property or assets, can lower interest rates by reducing the lender’s risk.

Also Read: How to Sell Your Invoices to Improve Cash Flow

Types of Interest Rates Offered in The Philippines

Philippine financial institutions offer different types of interest rates on loans, depending on the borrower’s profile and the nature of the loan.

Therefore, by thoroughly understanding these interest rate types, borrowers can make the right financial decisions when applying for a loan to meet their or their business’s needs.

Here are the most prominent types of interest rates offered in the Philippines -

1. Fixed Interest Rate

A fixed interest rate remains constant throughout the loan term. Borrowers benefit from predictable monthly payments, making it ideal for long-term loans like mortgages.

However, fixed rates are often slightly higher to account for market fluctuations.

2. Variable Interest Rate

Variable rates change over time, depending on market conditions or a benchmark rate, such as the BSP's policy rate. While they can start lower than fixed rates, they carry the risk of rising, leading to increased repayments during the loan term.

3. Effective Interest Rate (EIR)

The EIR represents the actual cost of borrowing, including all fees, charges, and compounding interest. Compared to nominal rates, this rate provides a more accurate picture of the total loan cost, helping borrowers understand the full financial commitment.

4. Add-On Rate

The add-on rate applies interest to the original loan amount throughout the repayment period, regardless of the reduced balance. It’s commonly used in personal and consumer loans but can result in higher overall costs than other interest rate types.

Are you unclear on how mortgage loans work? Check out this Reddit thread. Here, a user shared their struggle to effectively pay off their mortgage loans. Using the information in this thread, you’ll get insight into the workings of mortgage loans and what it takes to pay them off.

Also Read: Creating A Cash Flow Budget In 5 Steps

Accelerate your Philippine SMEs' growth exponentially! Apply today for N90’s fast financing solutions and get potential loan approvals within 24 hours! Unleash your business’s full potential today! Get in touch with us to learn more.

Impact of Interest Rates on Loans in The Philippines

Interest rates play a crucial role in determining the affordability and overall cost of loans in the Philippines. Moreover, fluctuations in rates can significantly affect borrowers’ financial commitments and repayment strategies.

Here’s how interest rates impact loans in the Philippines -

1. Loan Affordability

Higher interest rates increase the cost of borrowing, leading to higher monthly payments. This makes loans less affordable for borrowers, particularly for large amounts or long-term commitments like mortgages.

2. Borrowing Power

With low interest rates, borrowers can afford to take out more significant loan amounts because monthly repayments are more manageable. Higher rates reduce borrowing capacity, limiting access to larger loans.

3. Business Loans and Investments

Higher rates can deter businesses from taking out loans for expansion as the cost of financing increases. Conversely, lower rates encourage investments and stimulate business growth by making financing cheaper.

4. Impact on Repayment Duration

Loans with higher interest rates can lead to longer repayment periods, as borrowers may struggle to pay off the principal and interest, leading to higher total costs over time.

5. Economic Influence

Central bank policies, like the Bangko Sentral ng Pilipinas (BSP) adjusting rates, impact consumer behavior. Higher interest rates may cool down borrowing and spending, while lower rates encourage borrowing, potentially driving economic growth.

Also Read: How to Finance an Existing Business: Guide to Business Loans

Examples of Loan Interest Calculations in The Philippines

Loan interest calculations in the Philippines vary depending on the type of interest rate, whether fixed, variable, or add-on, and the loan terms.

Below are examples illustrating how interest is calculated for different loan types in the Philippines -

1. Fixed Interest Rate Example

A borrower takes out a PHP 500k personal loan with a fixed annual interest rate of 6% for 5 years.

- Interest Calculation: Interest = Principal × Rate × Time

- Interest = PHP 500k × 6% × 5 = PHP 150k

In this case, the total interest over 5 years is PHP 150k. The monthly payment is based on the principal and interest, divided over 60 months.

2. Variable Interest Rate Example

A home loan of PHP 1 million is taken at a 4% variable interest rate, adjustable annually. The first-year interest is calculated as follows -

- First-Year Interest Calculation: Interest = Principal × Rate

- Interest = PHP 1 million × 4% = PHP 40k

If the interest rate increases to 5% in the second year, the interest for that year would be -

- Second-Year Interest Calculation: Interest = PHP 1 million × 5% = PHP 50k

In this case, the interest fluctuates yearly, affecting the total loan cost.

3. Add-On Rate Example

A borrower takes out a PHP 200k car loan at an add-on rate of 10% per annum, with a term of 3 years.

- Interest Calculation: Interest = Principal × Rate × Time

- Interest = PHP 200k × 10% × 3 = PHP 60k

This PHP 60k is added to the principal for a total repayment amount of PHP 260k. The monthly payments would be divided over 36 months.

These examples help illustrate how interest rates impact the total loan repayment amount, making it crucial to understand the terms before borrowing.

Are you still unclear on how interest rates are calculated? Check out this video. It clearly explains how to calculate interest on any loan or credit card. This will give you a good idea of how to plan your finances effectively.

Also Read: Legalities and Operations of Online Lending in the Philippines

Economic Influence of Loan Interest Rate Changes in The Philippines

Loan interest rate changes significantly shape the Philippine economy, primarily if they are influenced by factors such as the central bank policies. Adjustments in these rates have far-reaching effects on borrowing, spending, and overall economic activity.

Here, take a look at the critical impact interest rate changes have on various aspects of the Philippine economy and society -

1. Consumer Borrowing and Spending

When interest rates rise, borrowing becomes more expensive, leading to reduced demand for loans like mortgages, auto loans, and personal credit. This, in turn, lowers consumer spending, which can slow economic growth.

2. Business Investment

Higher interest rates discourage businesses from taking out loans for expansion, reducing investment in capital projects and stalling business growth. Conversely, lower rates stimulate investment borrowing, driving economic activity and job creation.

3. Inflation Control

The Bangko Sentral ng Pilipinas (BSP) adjusts interest rates to manage inflation. Higher rates help curb inflation by reducing money circulation, while lower rates boost spending, potentially driving prices up if demand exceeds supply.

4. Housing and Real Estate Sector

Changes in interest rates directly affect housing affordability. Higher rates make home loans more expensive, slowing down property purchases, while lower rates can lead to a boom in real estate as borrowing becomes cheaper.

5. Foreign Investment and Currency Value

Rising interest rates can attract foreign investment in local bonds and securities, strengthening the Philippine peso. Lower rates may lead to capital outflows as investors seek better returns elsewhere, weakening the currency.

Conclusion

In conclusion, interest rates are pivotal in shaping the overall Philippine economy by influencing consumer spending, business investments, and inflation control. High interest rates tend to slow borrowing and spending, while lower rates encourage economic activity and investments.

Therefore, Philippine businesses and individuals need to know how interest rates work. This knowledge will help them make the correct financial choices and allow policymakers to regulate economic growth and stability effectively.

They can do this by thoroughly understanding the different types of interest rates, such as fixed, variable, effective, and add-on rates. This is essential for both individuals and businesses mainly because each type has its own implications on how interest is calculated and the total cost of borrowing, ultimately affecting the borrower’s financial decision-making.

Moreover, as the article shows, interest rates in the Philippines are determined by various factors, such as borrower creditworthiness, economic conditions, and policies set by the Bangko Sentral ng Pilipinas (BSP). So, borrowers are advised to consider these aspects before opting for solutions to solve their monetary needs.

Frequently Asked Questions (FAQs)

1. How are interest rates determined in the Philippines?

In the Philippines, interest rates are primarily determined by the Bangko Sentral ng Pilipinas (BSP) through its monetary policies, such as adjusting the benchmark interest rate (overnight lending rate).

Factors like inflation, market demand for credit, and the borrower’s creditworthiness also influence the rates set by financial institutions. Economic stability and global market conditions further impact rate adjustments.

2. What are the different types of interest rates?

The different types of interest rates include the following -

- Fixed Interest Rate: Remains constant throughout the loan term, providing predictable payments.

- Variable Interest Rate: Fluctuates based on market conditions or benchmark rates.

- Effective Interest Rate (EIR): Reflects the actual cost of borrowing, including fees and compounding.

3. How do you compute loan interest rates in the Philippines?

To compute a loan interest rate in the Philippines, use this basic formula - Interest = Principal × Rate × Time.

For example, if you borrow PHP 100,000 with an annual interest rate of 5% for 2 years, the interest is - Interest = PHP 100,000 × 5% × 2 = PHP 10,000.

This formula calculates simple interest, but lenders use specific methods based on loan terms for more complex loans, such as variable or compounding interest.

4. What bank in the Philippines has the lowest interest rate?

In the Philippines, BPI and Security Bank are known for offering some of the lowest interest rates for personal loans.

BPI offers rates as low as 1.20% per month, while Security Bank offers 1.39% per month, depending on the borrower’s profile and loan terms.

.png)