A down payment is an essential aspect of securing a small business loan, yet it frequently confuses many aspiring entrepreneurs. The main challenge lies in understanding its significance and how it affects your borrowing process.

To help you understand everything about down payments for small business loans in the Philippines, this blog will explore the concept and explain why it's crucial for both borrowers and lenders. Moreover, you'll also discover the typical down payment requirements, types of loans that require them, and strategies for affording this essential upfront cost.

It is fair to assume that by the end of this post, you'll have a comprehensive understanding of how down payments influence your loan options and financial planning in the Philippines. So, without further ado, let us get down to all the critical details.

What is a Down Payment For a Small Business Loan, And Why is it Important?

A down payment for a small business loan is an initial sum of money paid upfront when securing financing. In the Philippines, it typically ranges from 10% to 30% of the total loan amount.

This payment reduces the lender's risk, demonstrates the borrower's commitment, and can result in more favorable loan terms, such as lower interest rates or better repayment conditions. It is essential because it shows financial stability and reduces the overall loan burden for small businesses.

Here, take a closer look at the importance of down payments regarding small business loans in the Philippines -

1. Reduces Lender’s Risk

A down payment decreases the loan-to-value ratio, minimizing the lender's risk in case of default.

2. Improves Loan Terms

Paying a larger down payment can result in more favorable loan terms, including lower interest rates and extended repayment periods.

3. Demonstrates Borrower Commitment

It shows the borrower's financial responsibility and commitment to repay the loan, increasing their credibility.

4. Reduces Loan Amount

The borrower lowers the loan amount by making a down payment, reducing monthly fees and the long-term interest burden.

5. Increases Approval Chances

A substantial down payment can improve the chances of loan approval, especially for small businesses with limited credit history.

Also Read: Low Interest Rate Personal Loans: What They Mean for Borrowers

Common Down Payment Requirements For Small Business Loans in The Philippines

When applying for a small business loan in the Philippines, most lenders require a down payment as part of the loan approval process. This upfront payment helps reduce the lender's risk and can influence the terms and conditions of the loan.

However, the down payment amount typically varies depending on the type of loan and lender. So, it's a good idea to check how much you need to pay before selecting a loan option.

Here, take a look at some of the typical down payment requirements for small business loans in the Philippines -

1. Percentage of Loan Amount

Typically, down payments range from 10% to 30% of the total loan amount, depending on the loan type and the borrower's financial profile.

2. Collateral-Backed Loans

For loans secured by collateral, such as real estate or equipment, the down payment may be lower, around 10%, as the collateral reduces the lender’s risk.

3. Unsecured Loans

For unsecured loans, lenders may require a higher down payment, often 20% to 30%, due to the increased risk of lending without collateral.

4. Business Credit History

Businesses with a strong credit history may qualify for lower down payment requirements, while new or less-established companies may face higher down payment demands.

5. Loan Amount and Terms

More significant loan amounts may require a higher down payment, while smaller loans or those with shorter repayment periods could have more flexible down payment requirements.

Are you still unclear about the role of a down payment concerning small business loans? Check out this video. Here, Paul Long discusses the down payment needed to purchase a business using an SBA 7a loan.

Also Read: Applying for DTI Loans in the Philippines for Small Businesses

Accelerate your Philippine SMEs' growth exponentially! Apply today for N90’s fast financing solutions and get potential loan approvals within 24 hours! Unleash your business’s full potential today! Get in touch with us to learn more.

Types of Small Business Loans Requiring Down Payments in The Philippines

In the Philippines, some small business loans typically require down payments, especially when the loan involves significant risk or when collateral is involved.

Below are the common types of loans that may require down payments in the Philippines -

1. Secured Business Loans

These loans require a down payment and are backed by collateral such as real estate or equipment. The down payment generally ranges from 10% to 30%.

2. Commercial Real Estate Loans

Used for purchasing or developing property, these loans often demand a sizable down payment, usually around 20% to 30%.

3. Equipment Financing Loans

These loans, used for purchasing machinery or vehicles, require a down payment to cover part of the equipment’s cost, often around 10% to 25%.

4. Franchise Loans

Financing for buying a franchise typically requires a down payment of 15% to 30%, depending on the franchise's size and brand recognition.

5. Term Loans

Long-term loans for business expansion or large purchases may require down payments ranging from 10% to 25%, depending on the lender's risk assessment.

Also Read: MSME Loan Guide for Startups and New Businesses

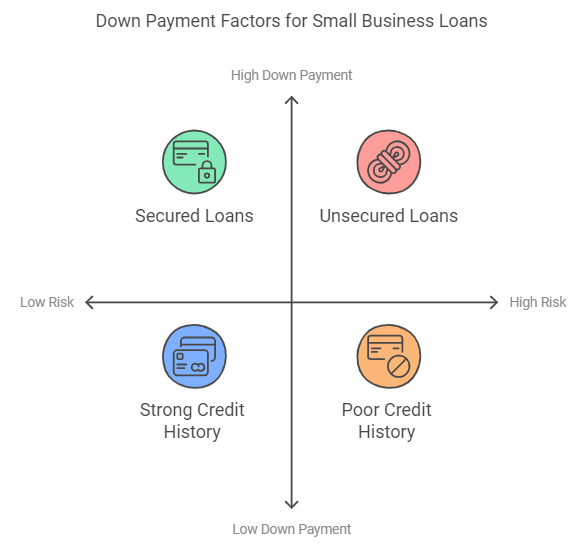

Top Factors Influencing Down Payments For Small Business Loans in The Philippines

When applying for a small business loan in the Philippines, the required down payment can vary based on several factors. Lenders assess multiple aspects of the business, loan type, and financial stability to determine the appropriate down payment.

Here, take a look at the top factors influencing down payments for small business loans in the Philippines -

1. Type of Loan

Secured loans generally require lower down payments, while unsecured loans tend to have higher down payment requirements due to increased risk for lenders.

2. Business Credit History

A strong credit history may reduce the required down payment, as lenders have more confidence in the borrower’s ability to repay. Poor credit history, on the other hand, can increase the down payment.

3. Collateral Availability

Businesses offering valuable collateral (e.g., property or equipment) typically benefit from lower down payments, as the collateral minimizes the lender’s risk.

4. Loan Amount and Term

Higher down payment requirements are often required for more significant loan amounts or longer repayment terms to eliminate the lender’s exposure over an extended period.

5. Business Financial Health

The business’s current financial health, including cash flow, assets, and liabilities, significantly influences down payment size. Lenders prefer financially stable companies and may offer lower down payment terms.

6. Industry Risk

Some industries, such as startups or businesses in volatile markets, are considered higher risk and may face higher down payment requirements to offset potential lending risks.

Also Read: Understanding Common Types of Bank Loans

How to Afford The Down Payment For a Small Business Loan in The Philippines - Key Strategies To Implement

Securing a small business loan often requires a down payment, which can financially challenge many entrepreneurs. However, several strategies can help businesses accumulate the necessary funds.

The strategies mentioned in this section will assist you in making the down payment more manageable while also positioning your business for future success by planning ahead and implementing intelligent financial practices.

Here, take a look at the essential strategies to implement to afford a down payment for a small business loan in the Philippines -

1. Save in Advance

Start setting aside a portion of your business's income regularly. Creating a dedicated savings account for your down payment will help you accumulate the required funds over time.

2. Use Personal Savings or Assets

Tapping into personal savings, liquidating assets, or using personal investments can provide the necessary capital to cover the down payment, especially if business savings are insufficient.

3. Seek Assistance From Investors

Consider bringing in investors or partners to contribute towards the down payment. Equity financing can reduce your financial burden and bring in additional expertise for the business.

4. Negotiate With Lenders

Some lenders may offer more flexible down payment options or negotiate terms based on your financial standing or collateral. It's worth discussing alternatives that suit your cash flow.

5. Utilize Government Grants And Subsidies

Look for government programs, grants, or subsidies designed to support small businesses in the Philippines. These funds can sometimes be used toward the down payment for a loan.

6. Crowdfunding

Explore crowdfunding platforms where you can raise money from supporters, customers, or interested parties who believe in your business idea. This can help you collect enough for the down payment.

7. Sell Unnecessary Business Assets

If your business has surplus equipment, inventory, or other assets, selling them can free up cash for the down payment.

Also Read: Accessing Best Unsecured Personal Loans Without Collateral in 2024

Down payments are sometimes unavoidable, but there are various ways to pay them. Check out this Reddit thread to know more. In this post, a Reddit user suggested considering hard money loans or personal financing alternatives, such as borrowing against personal assets like a home, to meet the down payment requirements.

Can You Get a Small Business Loan Without Down Payment in The Philippines?

Yes, it is possible to get a business loan without a down payment in the Philippines, but it depends on the type of loan and the lender. Some financial institutions offer unsecured business loans, which do not require collateral or a down payment.

However, it must be pointed out that these loans typically come with higher interest rates and shorter loan terms due to the increased risk for the lender.

Additionally, microfinance institutions and government programs, such as those offered by DTI or SB Corp, may also provide no down payment options for small businesses or startups, particularly for those in the MSME sector.

Conclusion

Understanding the various loan options available and their down payment is crucial for any business owner looking to finance their venture. The down payment for a small business loan varies greatly depending on several factors, such as the type of loan, the lender's requirements, and the business's financial health.

As we have seen from this article, typically, down payments range from 10% to 30% of the loan amount. Secured loans usually require lower down payments due to collateral, while unsecured loans demand higher percentages as they pose more risk to lenders.

Moreover, businesses can employ strategies to manage down payment requirements, such as saving in advance, using personal savings or assets, seeking investor support, or exploring government grants and subsidies.

By thoroughly understanding the loan terms and planning accordingly, businesses can ensure they can not only afford the down payment but also improve their chances of securing financing for their overall growth and sustainability.

Frequently Asked Questions (FAQs)

1. What are the 5 loan requirements of a bank?

The five standard loan requirements from a bank include -

- Credit Score: A good personal or business credit score.

- Business Plan: A solid business plan outlining objectives and financial projections.

- Collateral: Assets to secure the loan (for secured loans).

- Financial Statements: Proof of income, balance sheets, and cash flow statements.

- Proof of Identity and Business Registration: Legal documents proving identity and business legitimacy.

2. What is the maximum loan amount in BDO?

BDO (Banco de Oro) in the Philippines offers various loan products, and the maximum loan amount depends on the type of loan. For personal loans, the maximum amount is up to PHP 2 million, while home loans can go up to 80% of the property's appraised value.

However, the maximum loan amount for business loans is determined based on the business's financial capacity and collateral.

3. Which bank is best for business loans in the Philippines?

Several banks in the Philippines are highly regarded for business loans, with BDO, BPI, and LandBank often considered among the best.

BDO offers flexible business loan options, BPI provides competitive rates and a variety of loan packages, and LandBank is well-known for supporting small and medium enterprises (SMEs) with accessible financing. Each bank offers tailored options based on business needs.

4. Who is qualified to borrow money from BDO?

To borrow money from BDO, applicants must be Filipino citizens or foreigners with valid visa who are between 21 and 70 years old at loan maturity.

For personal and business loans, applicants must have a stable income, a minimum monthly income of PHP 15k, and regular employment or a stable business operation for at least 2 years. Additional documentation may be required for verification.