Finding the proper financial support for small business owners in the Philippines can be challenging, especially in an uncertain economic climate. However, the Department of Trade and Industry (DTI) has stepped in to relieve this pain point by offering Philippine businesses tailored loan programs through its financing arm, Small Business Corporation (SB Corp).

So, to help Philippine small businesses thrive and prosper in the long term, this blog will provide a comprehensive overview of these DTI loans, including the types of loans available, the application process, necessary requirements, and startup development programs.

Understanding these aspects will help you better navigate the complexities of securing financing in the Philippines, boosting your business growth and resilience. So, without any more delays, let us look at them.

What Are DTI Loans for Small Businesses, And Why Are They Important?

DTI Business Loans are financing programs offered by the Department of Trade and Industry (DTI), primarily through its financing arm, the Small Business Corporation (SBCorp).

These loans are designed to support Micro, Small, and Medium Enterprises (MSMEs) in the Philippines by providing accessible and affordable funding options.

Here, take a look at how DTI business loans help businesses thrive in the Philippines -

1. Affordable Financing

DTI loans come with low interest rates, making it easier for businesses to access capital without high debt costs.

2. Working Capital Support

The loans provide necessary working capital, helping businesses cover operational expenses, inventory purchases, or payroll.

3. Expansion and Growth

DTI loans can be used for business expansion, allowing MSMEs to invest in new equipment, open additional locations, or enter new markets.

4. Accessible to Small Businesses

Designed for MSMEs, DTI loans have simpler application processes and eligibility requirements, making it easier for smaller businesses to qualify for funding.

5. Crisis Recovery Assistance

Through programs like the Pondo sa Pagbabago at Pag-asenso (P3), DTI offers financial support to businesses recovering from economic crises, helping them rebuild and stabilize.

These loans provide essential financial resources to help MSMEs in the Philippines grow, innovate, and contribute to the country's economic development.

Do small businesses really require a DTI loan to begin operations in the Philippines? To find out more, check out this Reddit thread.

Also Read: Small Business Startup Funding for Women

Top Available DTI Loans in The Philippines

The Department of Trade and Industry (DTI) offers various loans under the RISE UP program. These loans are geared towards micro, small, and medium enterprises (MSMEs) and aim to provide the financial boost necessary for growth and sustainability.

Here’s a closer look at the available DTI loans -

1. RISE UP Micro Multi-Purpose Loan

The RISE UP Micro Multi-Purpose Loan is tailored for microenterprises that have been operating for at least one year. This loan offers: -

Loan Amount: Up to PHP 300k

Loan Term: Payable monthly for up to 3 years

Interest Rate: 12% per annum

2. RISE UP Multi-Purpose Loan for SME First-Time Borrowers

This loan, designed for multi-sectoral SMEs and first-time borrowers, aims to help businesses take their first steps toward acquiring credit.

Loan Amount: Up to PHP 2 million

Loan Term: Payable monthly for up to 3 years

Interest Rate: 12% per annum

3. RISE UP Multi-Purpose Suki Loan

The RISE UP Multi-Purpose Suki Loan helps small retailers expand their operations by focusing on sari-sari stores with fast-moving consumer goods (FMCG) accreditation.

Loan Amount: Up to PHP 5 million for unsecured loans and up to PHP 10 million for secured loans

Loan Term: Payable monthly for up to 5 years

Interest Rate: 12% per annum

4. RISE UP Tindahan Loan

This loan provides enhanced support through higher loan amounts, catering to a broader spectrum of retail businesses, including sari-sari stores, retail stores, dealers, and distributors with FMCG accreditation.

Loan Amount: Up to PHP 300k for microenterprises and up to PHP 5 million for SMEs

Loan Term: Payable monthly for up to 3 years

Interest Rate: 10% per annum for microenterprises and 8% per annum for SMEs

Special Features and Considerations

- The RISE UP Tindahan Loan stands out because it offers higher loan amounts to SMEs in the retail sector. This can significantly support businesses such as sari-sari stores, dealers, and distributors, which often need more capital to handle bulk FMCG transactions.

- While the interest rates of DTI loans are generally more favorable than private lenders, borrowers should be aware of possible additional fees. A typical example is a one-time processing fee, which can be as high as 8% of the loan amount.

- Understanding the repayment terms is also crucial. These loans typically have a 3-year repayment period with monthly payments, which should be managed to maintain financial stability.

Also Read: Startup Business Loans: How to Get Them for Your Business Needs

How To Apply For DTI Business Loans in The Philippines - Key Points For Filipino Entrepreneurs To Follow

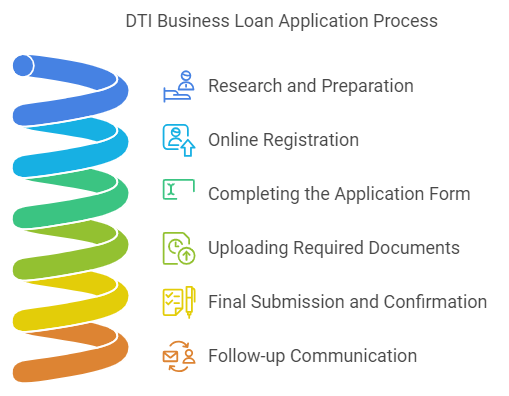

Going through the DTI loan application can initially seem a little confusing and complicated, but understanding the steps will make the journey smoother. Here’s how to apply for a DTI loan for your small business -

1. Research and Preparation

Before applying, do your homework. Familiarize yourself with the different DTI loan programs, like P3 and RISE UP, to identify which best suits your business. Also, look into the specific requirements for each program.

Ensure you have all necessary documents ready, such as business permits, financial statements, and project proposals. Gathering everything beforehand saves time and stress during the actual application.

2. Online Registration

All DTI loan applications are conducted online through the SB Corp Borrower Registration System (BRS) website:

- Register Online: Visit the SB Corp BRS website and register for an account.

- Verify Account: Verify your account to prevent any delays in the process.

3. Completing the Application Form

Once your account is set up, fill out the application form with precision and honesty:

- Accurate Information: Provide comprehensive and accurate business details, including your business name, registration details, and the loan program you've chosen.

- Double-check Details: Reviewing all the information is essential—errors can lead to delays or even rejection of your application.

4. Uploading Required Documents

Organize and upload all necessary documents clearly and concisely:

- Document Checklist: Prepare critical documents, which may include proof of sales, proof of asset value, and corporate documents.

- Follow Guidelines: Ensure compliance with the specified guidelines and be mindful of the 3 MB maximum file size limit per document upload.

5. Final Submission and Confirmation

Once all the information and documents are in place:

- Submit Application: Complete the form and submit it through the BRS website.

- Receive Confirmation: You will receive a confirmation indicating that your application has been successfully received. This usually includes a tracking number or a way to monitor your application status on the BRS platform.

6. Follow-up Communication

The process doesn’t end with submission:

- Wait for Contact: An SB Corp officer will eventually contact you, possibly requesting additional information or clarification.

- Prompt Response: Monitor your email regularly and respond promptly to any inquiries to avoid delays in processing your application.

Also Read: Top Legit Loan Apps for Long Term Borrowing with Low Interest

Elevate your business operations with N90’s hassle-free, fast financing solutions. Apply now and get loan approvals quickly within 24 hours to drive your Philippine SME forward! Avail today!

DTI Business Loan Requirements - Key Points For Philippine Businesses To Remember

Understanding the specific requirements for DTI business loans for small businesses in the Philippines can be instrumental in securing the financial support you need. Standard and additional documentation might be requested depending on the loan magnitude you're applying for.

Here are certain loan requirements that Philippine businesses must satisfy to avail of a DTI business loan -

Mandatory Requirements

To start with, standard requirements for any DTI loan include the following -

1. Valid ID: A government-issued identification card, such as a passport or driver’s license, to verify the legitimacy and identity of the loan applicant.

2. DTI Loan Application Form: This form is essential and can usually be obtained from the DTI website or local DTI offices. It details your request and purpose for the loan in a structured format.

3. Business Permits: Proof of your business's legitimacy through permits like your Business Permit or Mayor's Permit, which are required to officially operate within your local municipality.

4. Proof of Business Operations and Assets: Documentation such as photos, videos, and other evidence clearly shows your business's current activities, properties, machinery, and other assets.

5. Corporate Documents for Business Duration: Papers such as your business's General Information Sheet or Articles of Partnership/Incorporation that demonstrate the age and structure of your business.

For larger loans exceeding amounts of PHP 100k or more, additional documents may be needed:

6. Barangay Permit, Mayor’s Permit, or BMBE Certificate: These documents ensure your business operates legally within the barangay and municipality or is registered as a Barangay Micro Business Enterprise (BMBE).

7. Secretary’s Certificate or Board Resolution: A secretary's Certificate or Board Resolution must be submitted for partnerships or corporations. These documents authorize the loan application according to the business's governance rules.

8. General Information Sheet or Articles of Partnership: Comprehensive details about your business, including ownership and structure, are required.

Additional Documentation Requirements

Additional essential elements to consider include the following documents -

1. Income Tax Returns (ITRs): ITRs from the past two to three years are critical as they demonstrate your business’s compliance with tax obligations and financial history.

2. Audited Financial Statements: These provide deeper insights into your financial health, showcasing your balance sheet, income statement, and cash flow statements.

3. Bank Statements: Bank statements showcase transactions over recent months and help illustrate your business’s liquidity and finance management practices.

4. Business Plan: An in-depth plan outlining your business's strategic goals, financial projections, and growth strategies. This shows lenders your foresight and preparedness in running and expanding your business.

5. Proof of Billing: Recent utility bills to confirm your business address and verify that operational costs like electricity and water are managed sustainably.

Being well-prepared with all these documents speeds up the review process and demonstrates your professionalism.

Do you still need to figure out what documents you must present to obtain DTI loans in the Philippines? Check out this video from anneTrep. It provides a detailed checklist of documentary requirements for applying for a DTI loan in greater detail.

Also Read: How Does A Bridge Loan Work For a Small Business?

DTI Business Loan Requirements for Startups

Understanding the core requirements can significantly streamline the entire loan process for Philippine businesses. Here’s a detailed rundown of what you need to prepare -

Registrations and Key Documents

1. DTI Business Name Registration: This is the first step in legitimizing your business. This registration ensures that your business name is unique and legally recognized.

2. BIR Registration: Registering with the Bureau of Internal Revenue (BIR) is mandatory for tax reporting. You will receive a Tax Identification Number (TIN) and must file all necessary tax documentation regularly.

3. SEC Registration for Corporations and Partnerships: If your business is a corporation or a partnership, you must register with the Securities and Exchange Commission (SEC). This not only validates your business entity but also provides corporate and partnership structures with legal protections.

4. Barangay and Mayor’s Permits: These local permits are crucial for operating legally within your municipality. They confirm that your business complies with local regulations and is in good standing with community guidelines.

5. Comprehensive Business Plan: A well-detailed business plan is essential. It should outline your business goals, target market, financial forecasts, and operational strategies. Lenders must see that you have a clear roadmap and plan for success.

6. Corporate Documents: Depending on your business structure, you may need additional documents such as a Secretary’s Certificate or Board Resolution for partnerships and corporations. These documents demonstrate decision-making processes and authority within your business.

7. Proof of Operations and Assets: This includes any operational permits and documentation of business assets. It helps validate the existence and scale of your business activities.

Financial Documentation

1. Income Tax Returns (ITRs): Lenders typically look for your ITRs from the past two to three years. This provides insight into your business’s profitability and tax compliance history.

2. Audited Financial Statements: These statements, including the Balance Sheet, Income Statement, and Cash Flow Statement, give a detailed view of your financial health and stability.

3. Bank Statements: Provide at least the past few month's banking statements to illustrate your cash flow and financial transactions. This will help assess your liquidity and financial management practices.

Also Read: Understanding Working Capital: How to Calculate and its Importance

DTI Startup Development Programs For Businesses in The Philippines

The Department of Trade and Industry (DTI) in the Philippines offers a suite of startup development programs tailored to nurturing the growth of small businesses. Each program has its own unique themes, objectives, and requirements.

Here's an overview of some essential programs offered to Philippine businesses under DTI -

1. SMART Link

SMART Link is designed to create a robust ecosystem for technology startups by fostering stronger links between innovators and potential investors. The primary objective is to help tech startups gain the necessary visibility and capital to scale up their operations.

Participants typically need to offer equity in their business in exchange for the program's benefits, which include networking opportunities, mentorship, and exposure to potential funding sources.

2. startupAID

startupAID aims to provide comprehensive assistance to early-stage startups, particularly those grappling with initial funding issues. This program offers seed capital in exchange for a small percentage of equity.

One of the critical themes is social impact—startups focusing on solving pressing societal issues are given preference. Alongside financial aid, startups receive business development services, including strategic counseling and marketing support.

3. ILEAP for Startups

The Innovative Leap (ILEAP) program targets high-growth potential startups looking to make a significant technological leap. This program's objective is to transform innovative concepts into commercially viable products.

Equity exchange is a prerequisite, but in return, participants benefit from advanced R&D facilities, access to cutting-edge technology, and collaboration with leading tech firms. ILEAP also facilitates partnerships with academic institutions for research and development purposes.

4. Global Acceleration Program

The Global Acceleration Program (GAP) focuses on startups that can expand internationally. Its objective is to prepare Filipino startups for the global market.

This includes mentorship on international business strategies, assistance finding overseas markets, and opportunities to present to international venture capitalists. Startups must commit equity in exchange for resources like seed capital, mentorship, and global exposure.

These partnerships between DTI and various venture capitalists or non-profit organizations bring multiple benefits but require startups to comply with certain obligations, such as regular progress reporting and active participation in program initiatives.

Also Read: Small Business Equipment Financing Options

Potential Challenges and Alternatives of DTI Loans For Businesses in The Philippines

When considering financial support for your small business, exploring the various challenges and alternatives is crucial. While DTI loans have numerous benefits, they also have challenges.

Here, take a look at some of the potential challenges Philippine businesses face when availing of DTI loans -

Potential Challenges

1. Stringent Eligibility Requirements

Some businesses, especially new or micro-enterprises, may need help meeting eligibility criteria, such as minimum operational years or revenue thresholds.

2. Limited Loan Amounts

DTI loans, particularly under programs like P3, may offer relatively small loan amounts, which must be increased for more extensive expansion or operational needs.

3. Lengthy Approval Process

While DTI aims to streamline the process, some businesses need more time to get approval due to documentation requirements and processing times, which may not suit businesses needing immediate funds.

4. Sector-Specific Focus

DTI loan programs may prioritize specific sectors, such as agriculture or manufacturing, leaving businesses in other sectors with fewer financing options.

5. Collateral Requirements

Although many DTI loans do not require significant collateral, businesses may still need help providing guarantees or security for more substantial loan amounts.

Now that we have a fair idea of the challenges businesses face when applying for DTI loans in the Philippines, let's look at some compelling alternatives.

Alternatives to DTI Loans

1. Private Bank Loans

Banks like BDO, BPI, and Metrobank offer various business loans with higher loan amounts, flexible terms, and quicker processing times, though they may come with higher interest rates.

2. Microfinance Institutions

Microfinance lenders like CARD Bank provide smaller, quick-access loans with fewer requirements, catering to micro and small businesses that may not qualify for DTI loans.

3. Peer-to-Peer (P2P) Lending

Online P2P platforms connect businesses directly with investors, offering flexible loan terms and competitive rates without the strict requirements of traditional lenders.

4. Venture Capital or Angel Investors

Securing venture capitalists or angel investors' funding is an alternative for startups or growing businesses. These investors provide capital in exchange for equity, avoiding the need for loan repayments.

5. Government Grants

Businesses can explore other government programs offering grants or incentives, such as Go Negosyo or sector-specific support from government agencies.

Conclusion

Throughout this blog, we've explored the numerous benefits and opportunities the Department of Trade and Industry (DTI) offers small businesses in the Philippines. We've discussed loan programs like RISE UP and P3, which provide affordable financing for MSMEs.

Essentially, these programs reduce reliance on high-interest lenders and promote sustainable business growth.

So, to conclude this article, it is safe to say that if you own a small business in the Philippines, applying for a DTI loan is a wise financial and strategic decision. With significantly lower interest rates than private loans, these programs present an accessible way to obtain the funds needed to scale your operations.

Moreover, the DTI has simplified the loan application process to ensure businesses of all sizes can easily apply. Whether you're in agriculture, retail, or a tech startup, the broad range of sectors covered by these loans makes them versatile for virtually any business need.

So, if you’re a business owner still deciding whether to take out DTI loans in the Philippines, now would be an excellent time to enrol if it suits your business’s long-term goals.

Frequently Asked Questions (FAQs)

1. Do small businesses need to register in DTI?

Yes, small businesses operating as sole proprietorships in the Philippines must register with the Department of Trade and Industry (DTI).

Registering with DTI provides legal recognition, helps protect the business name, and is required to secure business permits and licenses from local government units. It also enhances the business's credibility and legitimacy.

2. How can DTI help small businesses in the Philippines?

The Department of Trade and Industry (DTI) helps small businesses in the Philippines by providing various forms of support, such as business registration, access to affordable loans through programs like Pondo sa Pagbabago at Pag-asenso (P3), training and mentorship through the SME Roving Academy, and market access opportunities.

DTI also offers assistance with product development, innovation, and government incentives to promote growth.

3. Who are exempted from DTI registration?

Businesses that are partnerships, corporations, or cooperatives are exempt from DTI registration, as they must register with the Securities and Exchange Commission (SEC) instead.

Additionally, professionals practicing under their own names, such as doctors and lawyers, and businesses using their owner’s full name without alterations, like Juan Dela Cruz Bakery, are also exempt from DTI business name registration.

4. Can I apply online for DTI?

Yes, you can apply for DTI business name registration online through the DTI Business Name Registration System (BNRS). The platform allows you to search for available business names, submit your application, and pay the registration fees electronically.

This online service simplifies the process, making it convenient and accessible for entrepreneurs across the Philippines.