Securing a business loan in the Philippines can be a boon for your company's growth and sustainability. This is because it can provide your company with the necessary financial boost to achieve your business goals, regardless of whether you are looking to expand your operations, purchase new equipment, or improve cash flow,

However, as enticing as it sounds, going through the application process can be quite daunting without the right knowledge, especially for first-time Filipino entrepreneurs.

To help you in this journey, in this article, we will explain how to ask for a business loan and outline all the six essential steps you need to know about before applying for and successfully obtaining a business loan in the Philippines.

Here’s a brief glimpse of the 6 steps required -

- Assess Your Financial Needs

- Research Credible Lenders and Loan Options

- Check Your Eligibility

- Prepare Your Business Plan

- Gather Required Documentation

- Submit Your Business Loan Application

Now that you have access to the full list of steps required to apply for and obtain a business loan in the Philippines, let us explore each of those steps in greater detail.

1. Assess Your Financial Needs

First, begin by conducting a thorough assessment of your financial needs. This step is essential to avoid borrowing more or less than you need, which can either burden your business with unnecessary debt or leave you underfunded.

Identify Your Business Objectives

Start by clearly defining the purpose of the loan. Are you aiming to expand your business, purchase new equipment, increase working capital, or open a new location?

Having specific goals in mind from the outset will help you determine the exact amount of funding you need and how it will be utilized.

Estimate the Costs Involved

Create a detailed list of all the costs associated with your business objectives. This includes direct expenses like equipment purchases, inventory, and renovations, as well as indirect costs such as marketing, hiring new staff, and utility expenses.

Accurately breaking down these costs will give you a clearer picture of your total financial requirement.

Evaluate Your Current Financial Position

Review your current financial statements, including your balance sheet, income statement, and cash flow statement. This analysis will help you understand your business's financial health, existing liabilities, and available resources.

Knowing your current financial position is crucial for determining how much additional funding you actually need.

Calculate the Loan Amount Needed

Based on the breakdown of your expenses and current financial position, create financial projections for the next 12 to 24 months and use these projections to calculate the precise loan amount required to achieve your business objectives without over-borrowing.

These projections should include expected revenue, expenses, and cash flow to calculate the loan amount required accurately.

Consider Contingency Funds

It is always a wise decision to include a contingency fund in your loan amount to cover unexpected expenses or financial shortfalls. Typically, a contingency fund is about 10-20% of your total estimated costs.

This buffer ensures that you have enough funds to handle any surprises without risking any of your business operations.

Assess Your Repayment Ability

Carefully analyze your projected cash flow to ensure that you can comfortably meet the loan repayment terms by considering different scenarios, including best-case and worst-case situations, to assess your ability to make timely repayments.

Thoroughly understanding your repayment capacity helps prevent financial strain and reduces the risk of default.

Also Read: Startup Business Loans: How to Get Them for Your Business Needs

2. Research Credible Lenders and Loan Options

Take the time to research various lenders and the loan products they offer. Consider traditional banks, credit unions, online lenders, and government-backed loan programs.

Each type of lender has different strengths and may offer different terms, interest rates, and fees, so do your research.

Research Different Types of Lenders

- Traditional Banks: Start by looking at traditional banks, as they often offer a variety of business loan products. Major Philippine banks like BDO, BPI, and Metrobank provide different loan options tailored to various business needs.

- Credit Unions and Cooperatives: These financial institutions can offer more personalized service and competitive rates. Research local credit unions and cooperatives that support small businesses.

- Online Lenders: Consider online lenders for quick and convenient loan applications, as these lenders often have faster processing times and more flexible requirements.

- Government Programs: Explore government-backed loan programs designed to support small and medium enterprises (SMEs). Agencies like the Department of Trade and Industry (DTI) and the Small Business Corporation (SB Corp) offer loans with favorable terms.

Verify Lender Credibility

- Check Regulatory Compliance: Ensure that the lender is registered with the Bangko Sentral ng Pilipinas (BSP) or the Securities and Exchange Commission (SEC). This registration ensures that the lender complies with Philippine banking regulations.

- Read Reviews and Testimonials: Look for reviews and testimonials from other business owners who have used the lender's services. Websites, forums, and social media can provide valuable insights into the lender’s reputation and reliability.

- Seek Recommendations: Ask for recommendations from your business network, including fellow entrepreneurs, industry associations, and financial advisors. Personal referrals can also lead you to trustworthy lenders with proven track records.

Compare Loan Products

- Interest Rates and Fees: Compare the interest rates, processing fees, and other charges across different lenders. Lower interest rates and minimal fees can significantly reduce the overall cost of your loan.

- Repayment Terms: Evaluate the repayment terms, including the loan tenure and repayment frequency. Choose a loan with terms that align with your business’s cash flow and repayment capacity.

- Loan Amount and Flexibility: Consider the maximum loan amount offered and the flexibility of the loan terms. Ensure that the lender can meet your financial needs and provide terms that can adapt to your business’s growth.

Evaluate Customer Service and Support

- Accessibility: Assess the accessibility and responsiveness of the lender’s customer service. A reliable support system to fall back on is crucial if you encounter issues or have questions during the loan application process.

- Transparency: Choose lenders who are transparent about their terms, conditions, and fees. Avoid lenders who have hidden charges or unclear terms, as this can lead to potential financial complications down the road.

- Additional Services: Some lenders offer additional services such as financial advice, business tools, and resources. These additional services can sometimes provide added value and support for your business.

Utilize Financial Marketplaces

- Online Platforms: Use online financial marketplaces and comparison websites to quickly compare loan options from multiple lenders. These platforms often provide detailed information about loan products, making it easier to find the best fit for your business.

- Loan Brokers: Consider working with loan brokers who specialize in connecting businesses with suitable lenders. Brokers can offer expert advice and help you go through the loan application process efficiently.

Attend Financial Workshops and Seminars

- Industry Events: Participate in financial workshops, seminars, and industry events where lenders often present their products and services. These events provide opportunities to meet lenders, ask questions, and gather detailed information about their offerings.

- Networking Opportunities: Use these events to network with other business owners and industry professionals who can share their experiences and recommendations regarding credible lenders.

Also Read: How Does A Bridge Loan Work For a Small Business?

3. Check Your Eligibility

Requiring a business loan is one thing, but actually being eligible for them is another. Take a look at the following aspects to find out if you’re eligible for the type of loan you are looking for -

Review Basic Eligibility Requirements

- Business Registration: Ensure your business is legally registered with the appropriate Philippine authorities, such as the Department of Trade and Industry (DTI) for sole proprietorships or the Securities and Exchange Commission (SEC) for corporations and partnerships.

- Business Age: Most lenders require your business to be operational for a minimum period, typically ranging from 6 months to 2 years. Check the specific requirements of each lender to confirm your business meets the minimum operational age before applying.

Analyze Your Financial Health

- Revenue and Profitability: Lenders often require proof of consistent revenue and profitability, so gather your financial statements, including income statements and balance sheets, to demonstrate your business's financial stability. Moreover, some lenders have a minimum revenue threshold of PHP 2.3 million that your business must meet.

- Cash Flow: Strong cash flow is crucial for loan repayment. Prepare cash flow statements to show your business's ability to manage expenses and service debt. Having a positive cash flow indicates that your business can handle additional financial obligations

Check Your Credit Score

- Personal Credit Score: Many lenders consider the personal credit score of the business owner, especially for small businesses. Obtain your credit report from credit bureaus and check your score. A higher credit score improves your chances of loan approval and of receiving better terms. A minimum credit score of 500 is usually required.

- Business Credit Score: If your business has a separate credit history, review your business credit score. Maintain a good credit history by paying bills on time and managing debts responsibly.

Understand Specific Lender Requirements

- Collateral Requirements: While applying for unsecured loans may not require collateral, some lenders might still ask for a personal guarantee or other forms of security. So, verify the collateral requirements for each lender and prepare the necessary documentation if needed.

- Debt-to-Income Ratio: Lenders assess your debt-to-income ratio to determine your ability to repay the loan. Calculate your ratio by dividing your total monthly debt payments by your monthly gross income. A lower ratio indicates better financial health and higher eligibility.

Also Read: Choosing the Right Business Loan for Your Company's Growth

Don’t let financial hurdles slow you down. Drive Your Business Forward with N90’s Fast Financing Solutions and receive quick approvals for your Philippine SME within 24 hours! Apply Today!

4. Prepare Your Business Plan

A well-crafted business plan is a critical component of your loan application as it should provide a clear and comprehensive overview of your business, including its goals, target market, competitive landscape, and marketing strategies.

Here is what a business plan should include -

Provide a Summary of Your Business And The Business Plan

- Overview: Start with a concise overview of your business. This should include your business name, location, and a brief description of what your business does.

- Mission Statement: Clearly state your business’s mission and vision. This gives lenders insight into your long-term goals and the purpose behind your business.

- Loan Request: Specify the amount of the loan you are requesting and the purpose of the loan. Explain how the funds will be used and how they will contribute to your business’s growth and profitability.

Give Business Description

- Company Information: Provide detailed information about your business, including its legal structure, whether it’s a sole proprietorship, partnership, or corporation, ownership status, and history.

- Products or Services: Describe the products or services your business offers. Highlight what makes them unique and how they meet the needs of your target market.

- Market Needs: Explain the market needs your business addresses and how your products or services fulfill these needs.

Conduct Market Analysis

- Industry Overview: Provide an overview of the industry in which your business operates. Include trends, growth potential, and key players in the market.

- Target Market: Define your target market, including demographic details, geographic location, and specific needs or preferences.

- Competitive Analysis: Analyze your competitors, detailing their strengths and weaknesses, and highlight how your business differentiates itself from the competition and any competitive advantages you have.

Explain Your Organization’s Structure and Management Roles

- Organizational Structure: Outline your business’s organizational structure, including key management roles and responsibilities. Include an organizational chart if applicable.

- Management Team: Provide detailed profiles of your management team and highlight their experience, skills, and qualifications. Emphasize how their expertise contributes to the success of your business.

- Advisors: Mention any external advisors or consultants you work with, such as accountants or legal advisors, and their roles in supporting your business.

Marketing and Sales Strategy

- Marketing Plan: Describe your marketing strategies, including how you plan to attract and retain customers by discussing your pricing strategy, advertising and promotion practices, and sales tactics.

- Sales Strategy: Explain your sales process and how you plan to achieve your sales goals. Include details on sales channels, salesforce, and sales targets.

- Customer Relationship Management: Highlight how you will manage customer relationships and ensure customer satisfaction and loyalty.

Product Line or Services

- Product Description: Provide detailed descriptions of your products or services, including their benefits and any unique features.

- Product Lifecycle: Explain the lifecycle of your products or services, from development to market introduction, growth, and eventual decline.

- Research and Development: Discuss any ongoing or planned research and development activities, including new product development and innovation.

Financial Projections

- Income Statements: Include projected income statements for the next 3 to 5 years, which detail your expected revenue, cost of goods sold, gross profit, operating expenses, and net profit.

- Cash Flow Statements: Provide projected cash flow statements, showing how cash will flow in and out of your business over the same period. Highlight any significant cash inflows and outflows that have occurred so far, if needed.

- Balance Sheets: Include projected balance sheets detailing your business’s assets, liabilities, and equity.

- Break-Even Analysis: Conduct a break-even analysis to show the point at which your business will cover all its expenses and start generating a profit.

- Assumptions: Clearly state the assumptions behind your financial projections, such as expected sales growth, pricing strategy, and market conditions.

Funding Request

- Loan Amount: Specify the exact amount of the loan you are requesting.

- Use of Funds: Explain how you will use the loan funds by breaking down the expenses into categories such as equipment, inventory, marketing, and working capital.

- Repayment Plan: Outline your plan for repaying the loan. Include details on the repayment schedule, interest rate, and sources of repayment.

- Funding Needs: Discuss any other funding needs you have and how you plan to meet them, whether through additional loans, investment, or other means.

Provide Additional Documentation And References

- Supporting Documents: Include any supporting documents that add credibility to your business plan. This may include resumes of key management, product photos, market research data, legal documents, and contracts.

- References: Provide references or testimonials from customers, suppliers, or partners who can vouch for your business’s credibility and performance.

Also Read: 6 Things You Need for Small Business Loan Requirements

5. Gather Required Documentation

Prepare all the necessary documentation for a smooth loan application process. Common documents required by lenders include financial statements, such as income statements, balance sheets, and cash flow statements; tax returns for the past two to three years; and recent bank statements.

Business Registration Documents

- Business License and Permits: Provide copies of your business license and any relevant permits issued by local government units or regulatory bodies.

- Certificate of Registration: For sole proprietorships, provide the Certificate of Registration from the Department of Trade and Industry (DTI). For corporations and partnerships, submit the Articles of Incorporation or Partnership and Certificate of Registration from the Securities and Exchange Commission (SEC).

Financial Statements

- Income Statement: Provide your business’s income statements for the past 2 to 3 years, showing revenue, expenses, and net income.

- Balance Sheet: Balance sheets for the same period detailing your business’s assets, liabilities, and equity.

- Cash Flow Statement: Cash flow statements that show the inflows and outflows of cash over the past 2 to 3 years. These documents help lenders assess your business’s liquidity and ability to manage cash.

Tax Returns

- Business Tax Returns: Present copies of your business’s tax returns for the past 2 to 3 years, as they are essential for verifying your income and tax compliance.

- Personal Tax Returns: Some lenders may also request personal tax returns of the business owners for the same period to assess overall financial stability.

Bank Statements

Provide bank statements for your business accounts for the past 6 months to 1 year. These statements provide a picture of your business’s cash flow and banking habits.

Business Plan

Present a concise and comprehensive business plan that outlines your business model, market analysis, competitive landscape, marketing strategy, and financial projections. The plan should also include how the loan funds will be used and the impact it will have on your business.

Legal Documents

- Contracts and Agreements: Provide copies of any significant contracts or agreements, such as leases, supplier contracts, or customer agreements. These documents demonstrate the stability and reliability of your business’s relationships with other business entities and lenders.

- Ownership Documents: Provide proof of ownership, such as shares certificates or partnership agreements, clearly detailing the ownership structure of your business.

Identification Documents

Present Government-issued identification documents for the business owners, such as a passport, driver’s license, or national ID card. These are used to verify the identity of the applicants.

Credit Reports

- Personal Credit Report: Provide a recent copy of your personal credit report. Lenders use this to assess your creditworthiness and financial responsibility.

- Business Credit Report: If applicable, present a business credit report showing your business’s credit history and current credit status.

Collateral Documentation

If the loan requires collateral, provide documentation related to the assets being pledged. This could include property titles, vehicle registration, or equipment invoices. Ensure the documents clearly indicate ownership and value of the collateral being offered.

Proof of Address

- Utility Bills: Provide recent utility bills, such as electricity, water, or internet bills for your business premises to confirm your business address.

- Lease Agreement: If you lease your business premises, provide a copy of the lease agreement.

Personal Financial Statements

A personal financial statement detailing your assets, liabilities, income, and expenses. This document provides an overview of your personal financial health.

Employment Information

Provide updated resumes or CVs for business owners and key management personnel to showcase whether they possess the relevant experience and qualifications to work in the business.

Also Read: Best Short-Term Business Loans for Fast Financing

6. Submit Your Loan Application

Once you have chosen a lender, it's time to complete the loan application form and submit it along with all the required documentation.

- Ensure that all the information provided is accurate, complete, and consistent with your supporting documents, and avoid any discrepancies or missing information, as they can potentially delay the entire process and result in rejection.

- Be prepared to explain any unusual financial situations or recent changes in your business, as lenders may have questions about your financial history or projections.

- After submitting your application, be responsive to any follow-up questions or requests for additional information from the lender. However, some lenders may even ask for an in-person meeting or interview as part of the application process.

- Stay attentive and calmly cooperative throughout this phase to ensure a smooth and timely approval process. Keep in mind that the process of securing a business loan can take time, so patience and diligence are essential.

Also Read: Non-Collateral Startup Business Loans in the Philippines

Important Tips for First-Time Business Loan Applicants To Remember in The Philippines

Applying for a business loan for the first time can be a challenging process for Filipino entrepreneurs, especially when they have to go through the entire financial process all on their own in the Philippines.

However, as a first-time applicant, understanding the critical aspects of loan applications can prove to be quite beneficial, as it can significantly increase your chances of approval and can also ensure you secure favorable terms.

In this section of the article, we will aim to provide all aspiring Filipino entrepreneurs with essential tips to help them prepare, apply, and manage their business loans effectively, setting their business on a path to growth and success.

Here, take a look at the important tips for Filipino entrepreneurs when applying for a business loan in the Philippines -

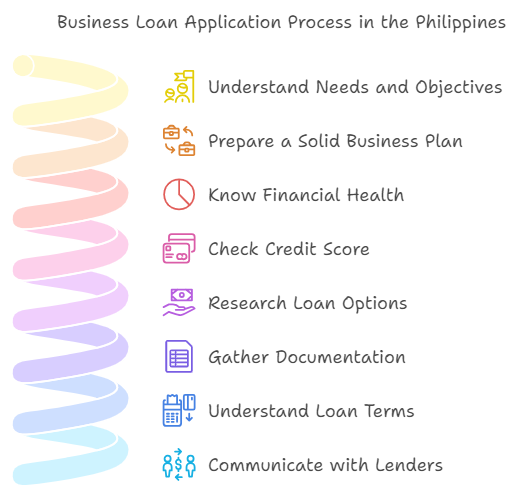

1. Understand Your Needs and Objectives

Clearly define why you need the loan and how it will benefit your business. Whether it's for expansion, purchasing equipment, or increasing working capital, having a well-defined purpose helps in selecting the right loan product and convincing lenders of your plan’s chances of success.

2. Prepare a Solid Business Plan

A comprehensive business plan should outline your business model, market analysis, competitive landscape, and financial projections. This plan should demonstrate to lenders that you have a clear strategy for growth and repayment, thereby enhancing your credibility.

3. Know Your Financial Health

Ensure your financial statements, including income statements, balance sheets, and cash flow statements, are accurate and up-to-date. These documents are crucial for lenders to assess your business's financial stability and repayment capability.

4. Check Your Credit Score

Lenders will evaluate both your personal and business credit scores. Obtain your credit reports, review them for accuracy, and address any issues. A higher credit score can improve your chances of loan approval and better terms.

5. Research Loan Options and Lenders

Different lenders offer various loan products with differing terms, interest rates, and fees. Research and compare multiple lenders, including traditional banks, credit unions, online lenders, and government-backed programs, to find the best fit for your business’s needs.

6. Gather All Required Documentation

Ensure you have access to all necessary documents, such as business registration certificates, tax returns, financial statements, bank statements, and personal identification. Having these ready and organized beforehand can accelerate the application process.

7. Understand the Loan Terms

Carefully review the loan terms, including interest rates, repayment schedules, fees, and any collateral requirements, as they will allow you to understand all the intricate details of the business loan and help you avoid unexpected costs.

8. Maintain Open Communication with Lenders

Respond promptly to any requests for additional information or clarification received from your lender. Open and timely communication between you and your potential lender demonstrates professionalism and commitment, which can positively influence your application’s outcome.

9. Plan for Loan Repayment

Develop a clear plan for repaying the loan by carefully considering your business’s cash flow and financial projections. Ensure you can meet repayment obligations promptly, as it is crucial to maintaining good credit and lender relationships.

10. Seek Professional Advice

If you're unsure about any aspect of the loan application process, consider consulting with financial advisors, accountants, or business mentors. Their expertise can provide valuable guidance and increase your chances of securing the loan.

11. Be Prepared for Rejection

Loan applications can sometimes be rejected. If this happens, don’t be discouraged. Ask for feedback from the lender to understand the reasons for rejection and work on improving those areas, or explore alternative financing options if necessary.

12. Stay Informed about the Market

Stay informed about the latest trends and developments in the financial market, as they help you understand the current interest rates, loan products, and economic conditions of the financial market, which can help you make better borrowing decisions.

Conclusion

Applying for and securing a business loan can be a transformative step for your business, providing it with the necessary capital to fuel growth, enhance operations, or stabilize finances.

However, this can only happen if businesses and entrepreneurs follow the 6 essential steps mentioned in the article, i.e., assessing your financial needs, preparing a solid business plan, checking your credit score, gathering required documentation, researching lenders and loan options, and submitting your loan application.

Always remember that having a thorough understanding of each step will not only increase your chances of approval but also help you secure the most favorable terms for your loan. So proceed with the right approach and preparation, and you’ll be able to obtain the financial support your business needs in no time to drive long-term success.

Frequently Asked Questions (FAQs)

1. Challenges in qualifying for loans with less-than-ideal credit

Individuals with less-than-ideal credit scores often face significant hurdles when applying for loans. These challenges include:

- Limited Loan Options: Lenders are more selective, reducing the available loan options.

- Higher Interest Rates: To compensate for increased risk, lenders charge higher interest rates.

- Stricter Loan Terms: Shorter repayment periods and lower loan amounts are common.

- Difficulty in Obtaining Larger Loans: Securing substantial loan amounts is challenging due to perceived higher risk.

- Potential for Loan Denial: There's a higher likelihood of loan applications being rejected outright.

2. What are the six phases of a business loan process?

The six phases of a business loan process typically include -

- Pre-qualification: Assessing eligibility and determining a potential loan amount.

- Loan application: Submitting a formal loan application with required documents.

- Loan processing: Verifying information and gathering necessary paperwork.

- Underwriting: Evaluating creditworthiness and determining loan terms.

- Closing: Finalizing loan terms, signing documents, and disbursing funds.

- Loan servicing: Managing loan payments and customer accounts.

3. What are the 6 C's of loans in the Philippines?

The 6 C's of loans in the Philippines are -

- Character: The borrower's credit history and repayment track record.

- Capacity: The business's ability to generate sufficient income to repay the loan.

- Capital: The borrower's investment in the business and financial resources.

- Collateral: Assets pledged as security for the loan.

- Conditions: The economic environment and industry conditions.

- Credit score: A numerical representation of creditworthiness.

Lenders use these factors to assess business loan applications in the Philippines and all around the world.

4. What is EMI?

EMI stands for Equated Monthly Installment. It's a fixed amount paid by a borrower to a lender on a specific date each month to cover both principal and interest on a loan that they owe.