A cash flow statement is a financial document that provides a snapshot of a company's cash inflows and outflows over a specific period. It reveals how much cash a business generates from its operations, investments, and financing activities.

Unlike the income statement, which focuses on revenue and expenses, a cash flow statement specifically tracks the movement of cash.

Creating a model is crucial for several reasons. Firstly, it provides a clear overview of the business's liquidity position, helping identify potential cash shortages or surpluses. Secondly, it aids in financial planning and budgeting by enabling businesses to anticipate cash needs and make necessary adjustments.

Thirdly, a cash flow statement is essential for securing loans and investments as it demonstrates the company's ability to generate cash and meet financial obligations.

Ultimately, it is fair to say that it serves as a vital tool for making important financial decisions for a business in the Philippines, apart from making other decisions about business operations, investments, and overall financial health.

Still unclear why cash flow statements are prepared? Don’t worry because, with the help of this detailed guide, you will have a complete understanding of what it is, how it is prepared and what its importance is to Philippine businesses.

What Are The Key Components of a Cash Flow Statement

The cash flow statement is typically divided into three main sections: operating activities, investing activities, and financing activities, with each section providing detailed information about the sources and uses of cash within different areas of the business.

Filipino entrepreneurs can make the right financial decisions to match their business’s needs by carefully examining these 3 elements. By doing so, they will not only ensure sustainable growth and stability of their business but also gain a clearer picture of its financial health and identify new business trends in the process as well.

Here, take a look at the key components of a cash flow statement that offer Philippine businesses a foundation for better financial management and planning -

1. Operating Activities

The operating activities section of a cash flow statement details the cash inflows and outflows related to a company’s core business operations. This indicates how much cash is generated from the company’s products or services and is a crucial indicator of the company's financial health.

Key components include -

- Cash Receipts from Sales: This includes all cash received from customers for the sale of goods or services.

- Cash Payments to Suppliers and Employees: These are the cash outflows for purchasing inventory, raw materials, and services, as well as payroll expenses.

- Other Operating Cash Payments: Includes cash paid for operating expenses such as rent, utilities, and taxes.

- Interest Paid: Cash paid for interest on loans and other financing activities.

- Income Taxes Paid: Cash payments for income taxes.

- Adjustments for Non-Cash Items: Depreciation, amortization, and other non-cash expenses are added back to the net income since they do not involve actual cash outflow.

The net result from operating activities shows whether the core business operations are generating sufficient cash to sustain and grow the business.

2. Investing Activities

The investing activities section captures the cash flows related to the acquisition and disposal of long-term assets and investments. This section provides insights into a company’s growth strategy and its investments in future operations.

Key components include -

- Purchase of Property, Plant, and Equipment (PPE): Cash outflows for buying physical assets such as buildings, machinery, and equipment.

- Proceeds from the Sale of PPE: Cash inflows from selling physical assets.

- Purchase of Investments: Cash outflows for buying securities, bonds, or other investment vehicles.

- Proceeds from Sale of Investments: Cash inflows from selling investments.

- Acquisition of Subsidiaries or Businesses: Cash paid for acquiring other companies.

- Proceeds from Disposal of Subsidiaries or Businesses: Cash received from selling part or all of a business.

The net cash from investing activities indicates whether the company is investing in its long-term capabilities and how these investments are being financed.

3. Financing Activities

The financing activities section details the cash flows related to a company’s funding structure, including transactions with the company's owners and creditors. This section reflects changes in the size and composition of the company’s equity capital and borrowings.

Key components include -

- Proceeds from Issuing Shares: Cash inflows from the sale of stock or equity.

- Proceeds from Borrowing: Cash inflows from taking out loans or issuing bonds.

- Repayment of Borrowings: Cash outflows for repaying loans or redeeming bonds.

- Dividends Paid: Cash outflows for paying dividends to shareholders.

- Repurchase of Shares: Cash outflows for buying back the company's own stock.

The net cash from financing activities provides insights into how the company finances its operations and growth, and its financial strategy regarding debt and equity.

Also Read: Getting a Fast Loan in 15 Minutes in the Philippines

Why Do You Need a Cash Flow Statement? Importance of Preparing A Cash Flow Model For Filipino Entrepreneurs

Preparing a cash flow model is particularly important in the dynamic and often unpredictable business environment of the Philippines since it equips entrepreneurs with the insights needed to navigate economic fluctuations, secure financing, and optimize their operational efficiency.

So, in this section of the article, we’ll be taking a closer look at the significance of developing an effective and impactful cash flow statement model for Filipino entrepreneurs and how it helps them develop financial stability and drive more business.

Here, take a look at why preparing an effective cash flow statement is important for businesses in the Philippines -

1. Ensures Financial Stability

A cash flow model helps Filipino entrepreneurs maintain financial stability by providing a clear picture of their cash inflows and outflows.

Entrepreneurs can identify periods of potential cash shortages and take proactive measures to address them by forecasting future cash positions, such as securing short-term financing or adjusting payment schedules.

This foresight is crucial in avoiding liquidity crises that could jeopardize the business's operations.

2. Facilitates Informed Decision-Making

Having a detailed cash flow model allows entrepreneurs to make the right financial decisions regarding investments, expenditures, and growth opportunities.

Business owners, in particular, can prioritize spending, allocate resources more effectively, and avoid overextending their finances by understanding the timing and magnitude of cash flows.

This strategic approach helps ensure that decisions are financially viable and aligned with the company’s long-term goals.

3. Supports Effective Financial Planning

A cash flow model is an essential tool for financial planning as it helps entrepreneurs set realistic budgets and financial targets.

In essence, it provides businesses with a framework for monitoring actual cash flows against projections, allowing for timely adjustments and better financial management.

Effective financial planning ensures that businesses can meet their obligations, such as paying suppliers, employees, and taxes, while also setting aside funds for future growth.

4. Enhances Investor Confidence

For Filipino entrepreneurs seeking external funding, a well-prepared cash flow model can enhance investor confidence. Investors and lenders often require detailed cash flow projections to assess the viability and financial health of a business.

Hence, a comprehensive model demonstrates that the entrepreneur has a thorough understanding of their financials and a solid plan for managing cash flow, making the business more attractive to potential investors and financial institutions.

5. Improves Operational Efficiency

Filipino entrepreneurs can identify inefficiencies and areas for improvement within their operations by regularly updating and reviewing their business’s cash flow model. These improvements can lead to better cash management and increased profitability.

6. Helps Navigate Economic Uncertainty

The cash flow model serves as a crucial tool for navigating uncertainty since it allows entrepreneurs to run various scenarios and assess the potential impact of changes in market conditions, such as fluctuations in demand, exchange rates, or interest rates.

By preparing for different outcomes, businesses can develop various contingency plans to counter uncertainty in the market and remain resilient in the face of economic challenges.

7. Assists in Growth and Expansion Planning

For businesses planning to grow or expand, a cash flow model provides essential insights into the financial requirements of these initiatives.

It helps entrepreneurs assess whether they have sufficient cash flow to support expansion activities or if additional funding will be necessary.

Also Read: Understanding and Solving Common Cash Flow Problems

Apply for N90's fast financing solutions and watch your business soar. Quick online applications and approvals within 24 hours! Fuel Your Business Success Today!

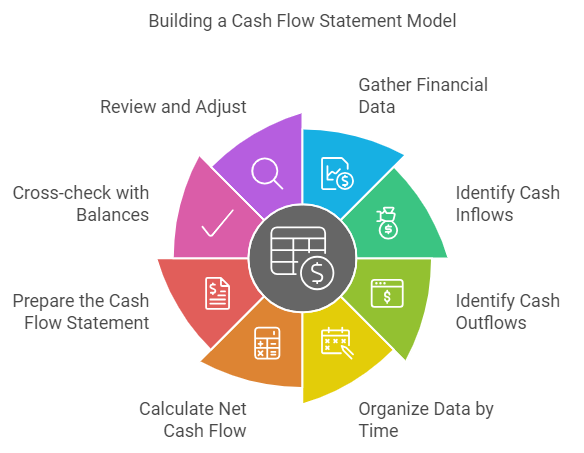

How To Build Cash Flow Statement Model For Philippine Businesses - Simple Steps To Use

Now that we have a fair understanding of what a cash flow statement model is and why it is important for businesses, let us take a look at some actionable steps to implement in order to build a capable cash flow statement model tailored to meet the needs of Philippine businesses.

By following these steps, Filipino entrepreneurs can develop an effective tool to track and manage their cash flows. This will enable them to carefully navigate through the numerous financial challenges that they might face and also help them take advantage of new business opportunities.

Here, take a look at the simple steps to implement to develop an effective and efficient cash flow statement model in the Philippines -

1. Gather Financial Data

Start by collecting all relevant financial data, including income statements, balance sheets, and transaction records. Ensure you have accurate and up-to-date information on your business’s cash receipts, payments, and any other financial activities.

2. Identify Cash Inflows

List all sources of cash inflows, such as sales revenue, receivables collections, loans, and other income streams. Categorize these inflows by operating, investing, and financing activities to get a clear picture of where your cash is coming from.

3. Identify Cash Outflows

Document all cash outflows, including operating expenses, such as salaries, rent, and utilities; capital expenditures, such as equipment purchases, etc.; and financing costs, such as loan repayments and dividends. Categorize these outflows similarly to your inflows to maintain consistency.

4. Organize Data by Time

Break down your cash inflows and outflows into relevant periods, such as monthly or quarterly intervals. This time-based organization helps in understanding cash flow patterns and identifying periods of cash surplus or deficit.

5. Calculate Net Cash Flow

For each period, calculate the net cash flow by subtracting total cash outflows from total cash inflows. This calculation provides insight into whether your business is generating or consuming cash during each period.

6. Prepare the Cash Flow Statement

Using the accumulated data, prepare the cash flow statement by dividing it into three sections: Operating Activities, Investing Activities, and Financing Activities. Summarize the cash inflows and outflows in each section and calculate the net cash flow for each category.

7. Cross-check with Opening and Closing Balances

Add the net cash flow to the opening cash balance for the period to determine the closing cash balance. Ensure that the closing cash balance matches the cash position reflected in your balance sheet for accuracy.

8. Review and Adjust As Needed

Regularly review the cash flow statement to ensure it reflects your business’s current financial situation. Adjust your cash flow projections based on actual performance and updated financial information to maintain accuracy.

9. Use Effective Software Tools

Consider using accounting software or spreadsheet templates designed for cash flow management. These tools can simplify the process, automate calculations, and provide visual representations of your cash flow trends.

10. Analyze and Plan

Use the cash flow statement model to analyze your financial performance and plan for the future. Identify areas where you can improve cash management, reduce costs, or optimize revenue streams. Develop strategies to address cash flow challenges and seize growth opportunities.

Also Read: Benefits and Disadvantages of Small Business Loans

Example of Cash Flow Statement Model Utilized in The Philippines

Here's a basic outline of a cash flow statement model for a small business in the Philippines -

Also Read: Choosing the Right Business Loan for Your Company's Growth

Cash Flow Statement vs. Other Financial Statements - A Brief Comparison

For Philippine businesses, understanding the differences between various financial statements is crucial for comprehensively assessing their business's financial health.

Among these essential documents, the cash flow statement, the income statement, and the balance sheet each provide unique insights into different aspects of a company's financial performance.

While the income statement focuses on profitability and the balance sheet highlights financial position, the cash flow statement offers a detailed view of liquidity and cash management.

Here, take a look at the brief comparison of a cash flow statement versus other financial statements in the Philippines -

Cash Flow Statement Vs. Income Statement

The cash flow statement focuses on the actual inflows and outflows of cash within a business over a specific period, providing insights into liquidity and cash management.

It categorizes cash movements into operating, investing, and financing activities, highlighting how cash is generated and used.

In contrast, the income statement, also known as the profit and loss statement, measures a company’s financial performance by summarizing revenues, expenses, and profits or losses during a given period.

It shows profitability by accounting for all income and expenses, including non-cash items like depreciation, but it does not indicate the actual cash flow.

Cash Flow Statement Vs. Balance Sheet

The cash flow statement provides a detailed account of a company's cash inflows and outflows over a specific period, highlighting how effectively the business manages its liquidity and cash resources.

It is divided into three sections: operating activities, investing activities, and financing activities, offering insights into cash generated from day-to-day operations, investments, and financing actions.

In contrast, the balance sheet presents a snapshot of the company's financial position at a particular point in time, detailing assets, liabilities, and shareholders' equity.

It shows what the company owns and owes, as well as the invested capital, thereby providing a static view of financial health and stability.

In essence, while the cash flow statement focuses on the movement of cash, the balance sheet emphasizes the company's overall financial standing.

Cash Flow Statement Vs. Profit And Loss Statement

The cash flow statement focuses on the inflows and outflows of cash within a business over a specific period, highlighting the company's liquidity and cash management practices.

It categorizes cash movements into operating, investing, and financing activities, providing a clear view of how cash is generated and used.

On the other hand, the profit and loss statement details the company's financial performance by summarizing revenues, expenses, and profits or losses during a period.

It reflects the company's ability to generate profit through its operations but does not account for non-cash items or the timing of cash flows.

Conclusion

Creating a cash flow statement model is a fundamental step in effective financial management. By following the outlined steps and understanding the components of a cash flow statement, businesses can gain valuable insights into their liquidity position.

This financial tool empowers decision-makers to anticipate cash flow challenges, make informed investment choices, and ultimately enhance the overall financial health of the organization.

So, it is safe to conclude that regularly updating and analyzing your business's cash flow statement will ensure it stays in peak financial condition and performs well. Moreover, it can even enable you to take proactive measures whenever necessary to maintain a healthy cash balance.

Frequently Asked Questions (FAQs)

1. What are the 7 steps to prepare a statement of cash flows?

The seven important steps to prepare a statement of cash flows are -

- Gather financial data: Collect income statements, balance sheets, and other relevant documents.

- Determine starting cash balance: Identify the beginning cash balance for the period.

- Calculate operating activities: Determine cash inflows and outflows from core business operations.

- Calculate investing activities: Identify cash flows from asset purchases or sales.

- Calculate financing activities: Determine cash flows from borrowing, repaying debt, or issuing equity.

- Calculate net increase/decrease in cash: Sum up cash flows from all activities.

- Determine ending cash balance: Add the net increase/decrease to the starting cash balance.

2. How do you prepare simple cash flow in the Philippines?

Preparing a simple cash flow statement involves these steps -

- List income sources: Include all anticipated revenue, such as sales, investments, and loans received.

- List expenses: Detail all expected costs, including rent, salaries, utilities, and loan repayments.

- Calculate net cash flow: Subtract total expenses from total income to determine net cash inflow or outflow.

- Analyze cash position: Assess the resulting cash balance to determine if it's sufficient to cover future obligations.

- Regularly update: Continuously monitor and adjust the cash flow statement to reflect changes in income and expenses.

3. How do you project a cash flow statement?

Projecting a cash flow statement involves forecasting future cash inflows and outflows.

Here’s how you can do it -

- Start by analyzing historical data to identify trends.

- Estimate sales, expenses, and other cash-related activities for the projected period.

- While making the estimates, consider factors like seasonal variations, economic conditions, and planned investments.

- Create a detailed projection using a spreadsheet or financial software, breaking down cash flows into operating, investing, and financing activities.

- Regularly review and adjust the projection based on actual results and changing circumstances.

4. What is the basic cash flow model?

A basic cash flow model is a simplified representation of a company's cash inflows and outflows.

It typically includes three main components -

- Operating activities: Cash generated from core business operations, such as sales and expenses.

- Investing activities: Cash used for purchasing or selling assets, like equipment or property.

Financing activities: Cash raised through borrowing, issuing equity, or repaying debt.