Understanding and managing cash flow is crucial for the success and sustainability of any Philippine business. That is because a well-structured cash flow budget is an essential tool that helps businesses anticipate their cash needs and ensure they can meet their financial obligations.

With the help of a cash flow budget, businesses can monitor their financial health in real-time and make necessary adjustments by linking cash flow forecasting with actual cash flow reporting.

This not only impacts business liquidity but also enhances decision-making, allowing business owners to allocate resources efficiently and identify potential financial challenges before they arise.

What is Importance of a Cash Flow Budget for a Philippine Business?

Cash flow budgeting is crucial for maintaining the financial health of a business, as it enables Philippine businesses to anticipate and plan for cash inflows and outflows to ensure they can meet their financial obligations and avoid cash shortages.

In essence, a cash flow budget helps business owners allocate financial resources efficiently and identify potential financial challenges before they become critical by providing a clear picture of future financial needs. This proactive approach not only enhances liquidity management but also supports sustainable growth and stability.

Also Read: Getting a Fast Loan in 15 Minutes in the Philippines

What is the Link Between Cash Flow Forecasting And Actual Cash Flow Reporting?

The main link between cash flow forecasting and actual cash flow reporting lies in their complementary roles in financial management scenarios.

Cash flow forecasting involves predicting future cash inflows and outflows based on historical data, planned activities, and market conditions, helping businesses plan and allocate resources effectively. Actual cash flow reporting, on the other hand, records the real cash transactions that occur over a period.

By comparing forecasted cash flows with actual cash flows, businesses can identify discrepancies, understand the reasons behind variances, and refine their forecasting models.

This continuous feedback loop enhances accuracy in financial planning, supports better decision-making, and ensures more effective cash management practices for Philippine businesses.

Also Read: Financial Planning for Small Businesses: Navigating Debt and Cash Flow Management

What is Impact of a Cash Flow Budget on Business’s Liquidity And Its Decision-Making Capabilities?

A cash flow budget significantly impacts a business's liquidity and decision-making capabilities by providing a clear view of expected cash inflows and outflows. This foresight allows businesses to ensure they have sufficient liquidity to meet their obligations and avoid cash shortages.

Additionally, by anticipating cash needs and identifying potential financial challenges early, a cash flow budget enables business owners to allocate resources more efficiently, plan for investments, and respond proactively to financial fluctuations, thereby enhancing their overall financial stability.

Also Read: Leveraging Invoice Financing for Business Growth in the Philippines

Experience hassle-free applications and fast approvals with N90’s fast financing solutions. Apply today and take the next step in your business journey. Immediate Funds for Immediate Needs!

How To Do a Cash Flow Budget in Philippines - 5 Essential Steps Required

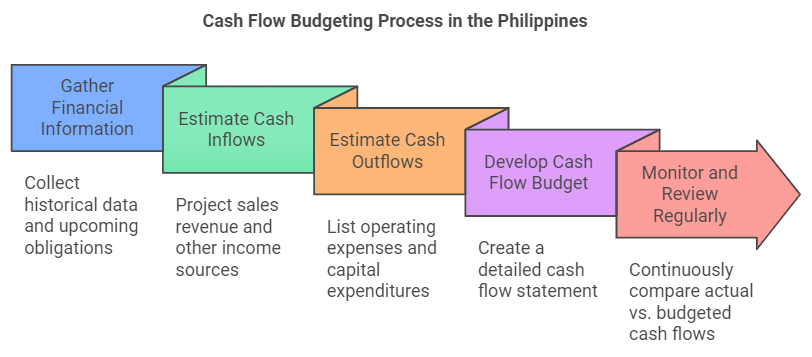

Now that we have a fair understanding of what a cash flow budget actually is and what its importance is to Philippine businesses let us now outline a straightforward, five-step process to create a cash flow budget to provide businesses with the vital tools needed to maintain a healthy cash flow and support their long-term success.

Here, take a look at how to do a cash flow budget in the Philippines -

1. Gather Financial Information

- Historical Data: Collect historical financial data, including past income statements, balance sheets, and cash flow statements. This data provides a foundation for understanding typical cash inflows and outflows and identifying trends and patterns.

- Upcoming Obligations: List all upcoming financial obligations such as rent, utilities, loan repayments, and payroll while also including both fixed and variable expenses to ensure a comprehensive view.

- Revenue Projections: Estimate future revenue based on historical sales data, market trends, and any known upcoming contracts or sales. It is important to be realistic and conservative in your projections to avoid overestimating cash inflows.

2. Estimate Cash Inflows

- Sales Revenue: Project your expected sales revenue for each period, e.g., monthly, quarterly, or annually, by considering elements such as seasonal variations, market conditions, and any planned marketing or sales initiatives.

- Other Income Sources: Identify other sources of cash inflows, such as interest income, investment returns, grants, or loans. Include any one-time or irregular cash receipts that may occur.

- Timing of Receipts: Determine when you expect to receive these cash inflows. Consider the typical payment terms of your customers and any delays that might occur in collecting receivables.

3. Estimate Cash Outflows

- Operating Expenses: List all operating expenses, such as rent, utilities, salaries, marketing, and supplies. Categorize expenses into fixed costs that stay constant throughout and variable costs which fluctuate with each business activity.

- Capital Expenditures: Include any planned capital expenditures, such as purchasing equipment, vehicles, or real estate. These are typically larger, infrequent expenses that need to be budgeted for separately.

- Debt Repayments: Account for all debt repayments, including principal and interest payments on loans, credit lines, and any other financing. Moreover, include the timing and amount of each repayment as well.

- Timing of Payments: Identify when each payment is due to help ensure you have enough cash on hand to meet obligations as they arise.

4. Develop the Cash Flow Budget

- Monthly Breakdown: Create a month-by-month breakdown of projected cash inflows and outflows. This detailed approach helps in identifying periods of surplus and deficit more accurately.

- Cash Flow Statement: Prepare a cash flow statement that outlines your beginning cash balance, total inflows, total outflows, and ending cash balance for each period. This statement provides a clear picture of your cash position over time.

- Adjust for Variances: Be prepared to adjust your budget for any variances between projected and actual cash flows. The best way to do this is by regularly comparing your budgeted figures to actual results and updating your projections as needed.

5. Monitor and Review Regularly

- Regular Monitoring: Continuously monitor your actual cash flows against your budget, as this helps in identifying any deviations early and allows for corrective actions to be taken promptly.

- Adjustments: Make adjustments to your cash flow budget based on actual performance and changing business conditions. Flexibility is key to managing cash flow effectively in the Philippines.

- Reporting: Prepare regular cash flow reports on a monthly, quarterly or annual basis to review with your management team. These reports should highlight significant variances and provide insights into cash flow trends.

- Strategic Planning: Use the insights gained from monitoring and reviewing your cash flow budget to make strategic decisions when needed. Understanding your cash flow patterns helps in making the right decisions regarding your investments, cost-cutting measures, and growth initiatives.

Conclusion

Creating a cash flow budget is essential for any business's financial health. This is because by following these five steps mentioned in this article, Philippine businesses will gain a clear picture of their income and expenses, which will allow them to manage their cash flow effectively and plan for future growth opportunities.

It is always worth remembering a cash flow budget is a living document that should be regularly reviewed and updated to reflect a business's changing needs. So, Philippine businesses should consistently monitor and make adjustments accordingly to their cash flow budget to help them not only maintain their financial stability but also achieve their coveted business goals.

Frequently Asked Questions (FAQs)

1. What are the 5 steps in developing a cash flow budget?

The 5 Steps to Developing a Cash Flow Budget are -

- Estimate Income: Project your revenue from sales, services, and other income sources for a specific period.

- Forecast Expenses: Identify and estimate fixed and variable costs, including operating expenses, payroll, taxes, and loan payments.

- Determine Net Cash Flow: Subtract total expenses from total income to calculate net cash flow.

- Create a Cash Flow Statement: Prepare a detailed monthly or quarterly overview of cash inflows and outflows.

- Analyze and Adjust: Regularly review your cash flow budget, compare it to actual performance, and make necessary adjustments to maintain financial stability.

2. What are the main characteristics of a cash flow budget?

Main characteristics of a cash flow budget:

- Focus on cash: It tracks actual cash inflows and outflows, unlike a profit and loss statement, which considers accrual accounting.

- Time-specific: It provides a detailed forecast for a specific period, typically monthly or quarterly.

- Detailed: It includes all significant cash transactions, such as sales, purchases, expenses, and loan payments.

- Prospective: It predicts future cash flows based on historical data and assumptions.

- Essential for planning: It helps businesses anticipate cash shortages or surpluses, allowing for detailed financial management.

3. What is the use of a cash flow budget?

A cash flow budget is crucial for business survival as it helps businesses predict cash availability, identify potential shortfalls, optimize cash usage, support decision-making, secure financing, and improve overall financial management.

Basically, a cash flow budget is a tool to ensure a business has enough cash to meet its obligations and seize potential business opportunities.

4. What is the difference between a cash flow budget and a cash budget?

Cash flow budget and cash budget are often used interchangeably. Both refer to a financial plan that predicts a business's cash inflows and outflows.

However, some might use cash flow budgets more broadly to include cash flow forecasting and management. In contrast, a cash budget might focus specifically on the numerical projections of cash receipts and payments.