A loan agreement is a critical document in the Philippines that outlines the terms and conditions between a borrower and a lender. It serves as a legal contract that governs the loan process, ensuring that both parties understand their rights, responsibilities, and obligations.

Hence, understanding all the nuances regarding loan agreements in the Philippines is crucial for anyone navigating the financial landscape, whether you're a borrower or a lender.

Therefore, this article will explore all the key components of a loan agreement in greater detail, including conditions, penalties, and other important aspects, to ensure that both Filipino lenders and borrowers are well-informed before entering into any financial arrangement that involves making a loan agreement.

Moreover, this blog will also provide an in-depth look at different components, security provisions, key covenants, and what happens in cases of default, thereby offering individuals and businesses a comprehensive guide to understanding what Philippine loan agreements are all about.

Purpose and Importance of Loan Agreements in The Philippines

As briefly mentioned earlier, a loan agreement in the Philippines is a legal contract between a borrower and a lender, outlining the terms and conditions under which money is borrowed and repaid.

These agreements are crucial in both personal and business financing. They essentially provide clarity on the expectations, rights, and obligations of both parties involved.

Here, take a closer look at the importance of loan agreements for individuals and businesses in the Philippines:

1. Legal Protection

Loan agreements provide legal protection to both the borrower and the lender by clearly outlining their rights, responsibilities, and obligations, reducing the risk of misunderstandings or disputes.

2. Clear Terms and Conditions

They set out the terms of the loan, including interest rates, repayment schedules, and fees, ensuring transparency and preventing future conflicts.

3. Enforcement of Repayment Terms

Loan agreements act as enforceable contracts in court, allowing lenders to take legal action in case of default or non-payment.

4. Securing Collateral

If the loan is secured, the agreement details the collateral and the conditions under which it can be seized, providing security for the lender.

5. Credit Risk Management

Loan agreements help in assessing and managing credit risk, as they provide detailed financial terms that allow lenders to evaluate the borrower's ability to repay the loan.

Also Read: Top Lending Services in Cebu City, Philippines

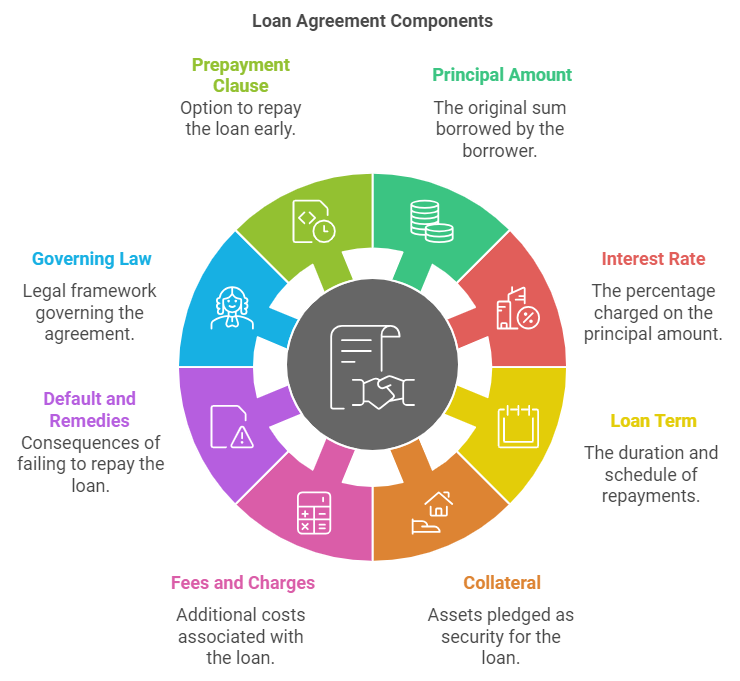

Key Components of Loan Agreements in The Philippines

A loan agreement is a vital document in the Philippines that governs the terms and conditions of a loan between a borrower and a lender. Whether it’s for personal, business, or commercial purposes, a well-structured loan agreement ensures that both parties are protected and that expectations are clear from the outset.

Here are the crucial components that typically constitute a loan agreement in the Philippines:

1. Principal Amount

This refers to the original amount of money being borrowed by the borrower from the lender.

2. Interest Rate

The loan agreement specifies the interest rate that will be charged on the principal amount, either fixed or variable.

3. Loan Term and Repayment Schedule

The agreement includes the duration of the loan and the frequency, such as monthly, or quarterly, and the number of repayments.

4. Collateral

If the loan is secured, the agreement outlines the collateral used as security for the loan, such as property or assets.

5. Fees and Charges

The agreement may specify additional fees, such as late payment penalties, origination fees, or processing fees.

6. Default and Remedies

The loan agreement outlines the consequences if the borrower defaults on the loan, including legal actions or repossession of collateral.

7. Governing Law

The agreement will specify that Philippine law governs the terms and conditions of the loan, ensuring both borrowers and lenders comply with local legal frameworks.

8. Prepayment Clause

Some agreements include a prepayment option, where the borrower can repay the loan earlier than scheduled, sometimes with conditions on prepayment penalties.

Also Read: Understanding the Role and Importance of MSME in The Philippine Economy

Are you looking to make a loan agreement in the Philippines but are unsure what it constitutes? Check out this video. It provides an example of a loan agreement in the Philippines, explores practical tips on modifying the agreement to suit your needs, and highlights the importance of notarization based on the loan amount borrowed or leased.

Security And Collateral Provisions Provided For Loan Agreements in The Philippines

Loan agreements in the Philippines often include security and collateral provisions to protect the lender in case the borrower fails to repay the loan. These provisions allow the lender to secure their investment by having assets pledged as collateral.

The terms and conditions of these provisions are crucial for both parties, as they ensure the lender’s interests are safeguarded. Here, check out some crucial aspects of security and collateral provisions in loan agreements in greater detail:

1. Types of Collateral

The borrower may pledge various types of collateral, including real estate, such as land, and houses, movable property in the form of vehicles, and equipment, or financial assets, such as cash deposits, and shares of stock.

2. Valuation of Collateral

Collateral must be appraised to determine its fair market value, ensuring it covers the loan amount. This process is usually carried out by a professional appraiser to get an accurate valuation.

3. Rights of the Lender

The agreement specifies the lender’s right to seize and sell the collateral if the borrower defaults on the loan, enabling the lender to recover the outstanding amount.

4. Collateral Documentation

Legal documentation is required to prove ownership and establish the lender’s legal claim on the collateral, such as property titles, vehicle registration, or certificates of deposit.

5. Insurance Requirement

The loan agreement may include a provision requiring the borrower to maintain insurance on the collateral to protect its value in case of damage, theft, or loss.

6. Release of Collateral

Once the loan is fully repaid, the agreement outlines the conditions for the release of collateral, ensuring that the borrower regains ownership of the pledged assets.

Also Read: Best Medical Practice Loans For Physicians in The Philippines

Philippines Loan Agreements - Key Borrower And Lender Responsibilities

When engaging in a loan agreement in the Philippines, both borrowers and lenders need to be well-versed in the responsibilities that come with such a financial undertaking. This is mainly because both the borrower and the lender have specific responsibilities outlined in the agreement to ensure that the transaction is fair and legally binding.

Check out the key responsibilities of both parties involved in the loan agreement process in the Philippines below:

Borrower Responsibilities

1. Repayment of Loan

The borrower is obligated to repay the loan amount, including interest, fees, and any additional charges, according to the agreed-upon schedule in the contract.

2. Provision of Accurate Information

The borrower must provide accurate and complete information regarding their financial situation, ensuring transparency throughout the loan process.

3. Maintaining Collateral

If the loan is secured by collateral, the borrower is responsible for maintaining the value of the collateral, including ensuring it remains in good condition and adequately insured.

4. Compliance with Terms

The borrower must comply with all terms outlined in the loan agreement, such as paying on time and complying with any restrictions placed on the loan, such as limitations on the use of funds, etc.

5. Notifying Lender of Default or Issues

If the borrower encounters financial difficulties or is unable to meet repayment terms, they are responsible for promptly notifying the lender and working out a solution, such as renegotiating the terms.

Also Read: Guide to Best Restaurant Business Loans for Small Businesses in 2024

Lender Responsibilities

1. Disbursement of Funds

The lender is responsible for providing the loan amount to the borrower as agreed in the loan contract, once all conditions have been met.

2. Clear Communication of Terms

The lender must ensure that all terms of the loan, including interest rates, repayment schedule, and fees, are clearly communicated to the borrower before finalizing the agreement.

3. Proper Management of Collateral

If the loan is secured, the lender is responsible for ensuring proper legal documentation and securely maintaining the collateral until the loan is repaid.

4. Fair Treatment of Borrower

The lender is required to treat the borrower fairly and transparently, without imposing unfair or predatory practices, following applicable Philippine laws and regulations.

5. Compliance with Regulatory Guidelines

The lender must comply with the regulatory requirements of the Bangko Sentral ng Pilipinas (BSP) and other government authorities, ensuring that the loan agreement and its practices are in sync with the Philippine financial regulations.

Also Read: Small Business Startup Loans for Minorities Guide

Don’t let cash flow issues slow you down. Apply for N90’s fast financing solutions and propel your Philippine SME forward! Get potential loan approvals within 24 hours to accelerate your business’s growth promptly. Contact us to learn more.

Step-By-Step Guide To Understand The Loan Default Procedure in The Philippines

When a borrower in the Philippines fails to meet the terms of a loan agreement, such as missing payments or defaulting on the debt, the lender is legally entitled to take certain actions to recover the funds.

Here, check out the step-by-step guide to completely understand the loan default procedure in the Philippines:

1. Missed Payment or Loan Breach

The default process begins when the borrower fails to make a scheduled payment, violates any loan condition, or falls behind in repaying the loan. This is generally considered the first step of default.

2. Demand Letter Issuance

Once the borrower defaults, the lender typically sends a demand letter to formally notify the borrower of the default. The letter outlines the outstanding amount, payment arrears, and a request for immediate repayment. It often includes a grace period for the borrower to rectify the situation.

3. Grace Period or Negotiation

The borrower is usually given a grace period, typically 15-30 days, during which they can pay the overdue amount. If the borrower is unable to pay, they may seek loan restructuring or negotiation with the lender to revise the repayment terms or extend the payment period.

4. Formal Demand for Payment

If the borrower still fails to repay the loan after the grace period or renegotiation, the lender can issue a final demand letter requesting the full loan balance to be paid immediately, which includes both principal and accrued interest.

5. Legal Action and Filing of Case

If the default persists, the lender can initiate legal action by filing a civil collection case with the regional trial court. The court will review the case and may issue a judgment for the borrower to pay the loan balance.

6. Foreclosure Process

If the loan is secured by collateral in the form of real estate, and vehicles, the lender can proceed with foreclosure. This may be done through a judicial or non-judicial process, depending on the terms of the loan agreement. At this stage, the court may order the sale of the collateral to satisfy the debt.

7. Seizure and Garnishment

In cases of court judgment, the lender can request the seizure of assets through garnishment, which may include taking control of bank accounts, wages, or other valuable assets to recover the outstanding amount.

8. Credit Report and Reputational Impact

The loan default is usually reported to credit bureaus such as the Credit Information Corporation (CIC), which can significantly affect the borrower’s credit rating, making it difficult to obtain future credit.

Also Read: Deferred Revenue: Accounting, Definition, and Journal Entry Examples

Legal Remedies Available For Lenders in The Philippines

When a borrower defaults on a loan in the Philippines, lenders have legal remedies available to recover the loaned amount. These remedies are designed to protect the lender’s interests and ensure they can recover funds.

Here, take a closer look at the key legal remedies available to lenders in case of defaults in the Philippines:

1. Civil Collection Suit

Lenders can file a civil collection suit in a regional trial court to recover the outstanding loan amount. If the court rules in favor of the lender, the borrower will be ordered to pay the principal amount, interest, penalties, and court costs.

2. Foreclosure of Collateral

For secured loans, lenders can initiate foreclosure proceedings on the collateral provided by the borrower (e.g., real estate, vehicles, or equipment). This allows the lender to sell the collateral and recover the loan balance.

3. Seizure of Assets

After obtaining a judgment, the lender can request a writ of garnishment to seize the borrower’s assets, including bank accounts, wages, or other personal property, to satisfy the debt.

4. Seizure of Real Property

If the loan is secured by encashing on real property, such as land or buildings, the lender may execute the court's judgment by seizing and selling the property through a foreclosure auction.

5. Personal Guarantee Enforcement

If a personal guarantee was provided by a third party, such as a business owner or co-signer, the lender can legally pursue that person to collect the debt. The lender can take the same legal steps as they would against the primary borrower, including filing a civil suit or garnishing wages.

In a scenario where a user wants to lend money to a friend but is concerned about legal remedies if the friend does not repay, it's advised to document the loan with a clear contract to safeguard both borrower and lender interests. Here, check out this Reddit thread to learn more about this.

Also Read: Understanding Cash Flow Loans for Your Small Business in The Philippines

Potential Penalties and Fees Involved in The Loan Agreement Process in The Philippines

In any loan agreement in the Philippines, penalties and fees are crucial for maintaining a fair balance between lenders and borrowers. As we are aware, loan agreements are legally binding contracts that specify the terms and conditions under which funds are borrowed and repaid.

However, when borrowers fail to meet these terms, penalties, and fees may be imposed as part of the agreement. These penalties aim to protect the lender's interests while encouraging timely repayment.

Here, take a look at the potential penalties and fees incurred by borrowers when involved in the loan agreement process in the Philippines:

1. Late Payment Penalties

If the borrower misses a payment deadline, a late payment fee is typically charged. This penalty is often calculated as a percentage of the overdue amount and may increase with the length of the delay.

2. Interest on Overdue Amounts

Loan agreements often include penalty interest rates for overdue amounts. This means that the borrower will be charged a higher interest rate on the outstanding balance if the loan is not repaid on time.

3. Prepayment Penalties

Some loan agreements impose a prepayment penalty if the borrower repays the loan early, particularly in the case of long-term loans. This fee compensates the lender for the lost interest income.

4. Default Fees

If the borrower defaults on the loan, that is they fail to make payments for a prolonged period, additional default fees may be charged. These fees are intended to cover the administrative costs incurred by the lender in managing the default.

5. Legal and Collection Fees

In case of legal action or if the lender needs to employ third-party collection agencies, the borrower may be liable for legal fees and collection costs. These expenses are usually passed on to the borrower once the loan is referred for legal proceedings.

Also Read: How Much Down Payment Is Needed for a Small Business Loan?

Terminating Loan Agreements in The Philippines

Terminating a loan agreement in the Philippines refers to the process of ending the contractual relationship between a borrower and a lender before the loan is fully repaid or under specific circumstances outlined in the agreement.

Here, take a closer look at the key reasons and conditions for terminating loan agreements in the Philippines:

1. Early Repayment or Prepayment

Borrowers can terminate the loan agreement by fully repaying the loan amount before the agreed-upon maturity date, although in some cases, agreements may involve prepayment penalties.

2. Mutual Agreement

Both the borrower and lender may agree to terminate the loan early, particularly in cases of refinancing or financial hardship.

3. Breach of Contract or Default

If the borrower fails to meet the loan terms, such as missing payments or failing to maintain collateral, the lender may terminate the agreement and initiate legal action.

4. Court-Ordered Termination

In some cases, the court may order the termination of the loan agreement through legal action, especially if fraud, duress, or invalid conditions exist.

Conclusion

As this article highlights, loan agreements in the Philippines are vital legal documents that establish the terms and conditions of borrowing and lending. They protect the interests of both parties, ensuring clear expectations regarding repayment, interest rates, penalties, and collateral.

Therefore, understanding all the key components of these agreements, such as the loan amount, interest rate, repayment schedule, and security provisions, is essential for both borrowers and lenders in the Philippines.

In case of default, various legal remedies, such as filing civil suits, foreclosure, and asset repossession, are available to lenders to recover their funds. Borrowers must be aware of the potential penalties and fees involved in the agreement, including late payment penalties, interest on overdue amounts, and default fees.

Furthermore, loan agreements can be terminated for various reasons, including early repayment, mutual agreement, or breach of contract. Borrowers and lenders must follow proper procedures for termination to avoid legal complications or additional costs.

Frequently Asked Questions (FAQs)

1. Does a loan agreement need to be notarized in the Philippines?

In the Philippines, a loan agreement does not need to be notarized to be valid. However, notarization can serve as evidence of the authenticity of the signatures and may be required for certain loans, especially if the collateral is involved or for additional legal protection.

2. What should be written in a loan agreement?

A loan agreement should include the following key elements:

- Loan Amount: The principal sum being borrowed.

- Interest Rate: The rate of interest to be charged.

- Repayment Terms: Schedule and amount of payments.

- Collateral: If applicable, details of any collateral.

- Loan Duration: The start and end date of the loan.

- Consequences of Default: Penalties or actions for missed payments.

3. What is the main difference between a promissory note and a loan agreement?

The main difference between a promissory note and a loan agreement lies in their complexity and purpose. A promissory note is a simple, written promise to repay a specified amount, often without detailed terms.

On the other hand, a loan agreement is more comprehensive, outlining detailed terms like repayment schedule, interest rates, penalties, and legal provisions, and may involve collateral.

4. What is not covered in a loan agreement?

A loan agreement typically does not cover non-financial arrangements such as personal obligations, emotional agreements, or unrelated business matters. It also may not include informal agreements outside the scope of the loan, such as promises not to engage in specific business activities.

Additionally, tax obligations or other legal obligations outside of loan repayment may also be excluded unless specified.