Positive cash flow is the lifeblood of any business, indicating that a company has more money coming in than going out over a specific period. This financial mechanism is crucial for maintaining daily operations, investing in growth opportunities, and ensuring long-term sustainability.

Without positive cash flow, even profitable businesses can struggle to cover expenses and face potential insolvency. That is why, in this article, we will dive deeper into the meaning and significance of positive cash flow and highlight why it is essential for any business’s overall health and success.

Additionally, to help you grasp the entire concept of positive cash flow, we will also explore practical strategies to implement in order to generate and maintain positive cash flow.

This article aims to provide Filipino entrepreneurs and business owners with access to all the vital tools needed to enhance their financial management and achieve stability in an ever-changing economic landscape. So, without much ado, let us get down to it.

What is Positive Cash Flow, And Why is it Important For Philippine Businesses?

Positive cash flow occurs when a business's cash inflows exceed its cash outflows during a specific period. This means that the company has more money coming in from its operations, investments, and financing activities than it is spending on expenses, debts, and other financial obligations.

Positive cash flow is a crucial indicator of financial health, as it ensures that the business has the necessary liquidity to cover its immediate expenses, reinvest in growth opportunities, pay dividends to shareholders, and build a buffer against future uncertainties.

In essence, positive cash flow enables a business to maintain smooth operations and supports long-term sustainability. It reflects the company's ability to generate cash from its core activities, manage its investments wisely, and secure favorable financing.

Here, take a look at the ways in which positive cash flow proves to be important for Philippine businesses -

1. Ensures Operational Continuity

Positive cash flow is vital for the day-to-day operations of Philippine businesses as it ensures that companies have sufficient funds to cover operational expenses such as salaries, rent, utilities, and inventory purchases.

2. Facilitates Growth and Expansion

With positive cash flow, businesses have the liquidity needed to invest in growth opportunities. This could include expanding product lines, opening new locations, upgrading equipment, or increasing marketing efforts.

Having a steady cash flow enables businesses to take advantage of growth opportunities without the need for excessive borrowing, which can lead to financial strain.

3. Improves Creditworthiness

Businesses with positive cash flow are more attractive to lenders and investors as they demonstrate the ability to generate sufficient cash to meet their obligations, thereby making them low-risk options for creditors.

This improved creditworthiness can lead to better loan terms, lower interest rates, and increased access to financing when needed.

4. Enhances Financial Flexibility

Positive cash flow provides businesses with the financial flexibility to respond to unexpected challenges and opportunities.

Whether it’s dealing with an economic downturn, addressing sudden expenses, or capitalizing on a market opportunity, having ample cash on hand allows businesses to navigate uncertainties and make strategic decisions more confidently.

5. Supports Long-Term Sustainability

Maintaining positive cash flow is essential for the long-term sustainability of a business. It enables companies to build a financial cushion that can be used during tough times, reducing reliance on external financing.

This financial resilience helps businesses withstand economic fluctuations and remain competitive over the long term.

6. Enables Strategic Planning

Positive cash flow gives business owners the ability to plan for the future with greater accuracy and confidence.

With a clear understanding of cash inflows and outflows, businesses can develop strategic plans, set realistic goals, and allocate resources effectively.

Also Read: Leveraging Invoice Financing for Business Growth in the Philippines

Positive Cash Flow Vs. Negative Cash Flow - Key Differences To Remember

Understanding the distinction between positive and negative cash flow is crucial for assessing a business's financial health.

At a glance, positive cash flow occurs when a company’s cash inflows exceed its outflows during a specific period, indicating a healthy liquidity position that supports operational efficiency, growth, and financial stability.

In contrast, negative cash flow happens when cash outflows surpass inflows, signaling potential liquidity issues that can jeopardize a business's ability to meet its financial obligations and sustain its operations.

Here, take a look at the key differences between positive and negative cash flow in greater detail. These distinctions will help business owners to recognize the implications of each type of cash flow and take appropriate actions to manage their cash flow effectively -

1. Cash Inflows vs. Cash Outflows

Positive cash flow occurs when a business's cash inflows exceed its cash outflows over a specific period. This indicates that the company is generating more cash than it is spending, which is crucial for maintaining liquidity, paying off debts, and investing in growth opportunities.

Conversely, negative cash flow happens when cash outflows surpass cash inflows, suggesting that the business is spending more money than it is bringing in. This imbalance can lead to liquidity problems, making it difficult for the company to cover its expenses and meet financial obligations.

2. Operational Sustainability

Positive cash flow is a sign of operational sustainability, as it shows that a business can generate sufficient cash from its core activities to support its ongoing operations. It enables the company to pay for daily expenses such as salaries, rent, and utilities, ensuring smooth and uninterrupted operations.

On the other hand, negative cash flow raises concerns about a business's ability to sustain its operations, as a persistent negative cash flow can lead to cash shortages. This can force the business to seek external financing or cut costs drastically, which can then disrupt its operations and harm its reputation.

3. Investment and Growth Opportunities

With positive cash flow, a business has the financial flexibility to pursue investment and growth opportunities as it can use surplus cash to expand operations, develop new products, upgrade equipment, or enter new markets.

Positive cash flow provides the necessary resources to invest in the future without relying heavily on external financing.

On the other hand, negative cash flow limits a business's ability to invest in growth. A company with negative cash flow may struggle to finance new projects or take advantage of market opportunities, hindering its long-term growth prospects and competitiveness.

4. Financial Stability and Risk Management

Positive cash flow contributes to a business's financial stability and ability to manage risks effectively. It provides a cushion against unexpected expenses or economic downturns, allowing the company to navigate challenges without compromising its financial health.

Businesses with positive cash flow are better positioned to weather financial uncertainties and maintain stability.

Conversely, negative cash flow increases the financial vulnerability and risk of a business. Companies with negative cash flow may face difficulties in managing unforeseen expenses or downturns, increasing the likelihood of financial distress and potential insolvency.

5. Creditworthiness and Investor Confidence

Positive cash flow enhances a business's creditworthiness and attractiveness to investors. Lenders and investors view positive cash flow as a sign of financial health and operational efficiency, making the business a lower-risk investment.

This can lead to more favorable loan terms, lower interest rates, and greater access to capital.

In contrast, negative cash flow can undermine a business's creditworthiness and deter investors. Persistent negative cash flow signals financial instability, raising concerns about the company's ability to repay debts and generate returns, which can result in higher borrowing costs and reduced investment interest.

Also Read: Top 5 Legit Online Loan Apps in the Philippines

Transform Your Philippine SME with N90’s Fast Financing Solutions! Apply online and get approvals within 24 hours! Explore Today!

Types Of Cash Flow in The Philippines

For Filipino entrepreneurs and financial managers, understanding the different types of cash flow is essential to make the best financial decisions for their businesses and ensure its long term sustainability.

To begin with, cash flow in the Philippines is broadly categorized into three main types: operating cash flow, investing cash flow, and financing cash flow.

Moreover, each cash flow type reflects different aspects of a business’s financial activities, thereby offering businesses a comprehensive view of how cash is generated and utilized.

Here, take a look at the 3 main types of cash flows in the Philippines that help Filipino entrepreneurs better manage their resources, plan for growth, and navigate the complexities of their financial environment -

1. Operating Cash Flow

Operating cash flow (OCF) represents the cash generated or used by a business from its core operations. It includes cash receipts from sales of goods and services, as well as cash payments for expenses like salaries, rent, utilities, and inventory.

OCF is a crucial indicator of a company's ability to generate sufficient cash to maintain and grow its operations without relying on external financing. In the Philippines, businesses monitor OCF to ensure they have enough liquidity to cover day-to-day expenses and sustain their operational activities.

2. Investing Cash Flow

Investing cash flow (ICF) involves cash transactions related to the acquisition and disposal of long-term assets and investments. This includes cash outflows for purchasing property, plant, and equipment (PPE), investments in other businesses, and cash inflows from selling these assets.

ICF provides insights into how a business allocates its resources towards growth and expansion. For Philippine businesses, understanding ICF is essential, as it helps them evaluate their long-term investment strategies and potential future revenue streams.

3. Financing Cash Flow

Financing cash flow (FCF) involves cash movements related to raising and repaying capital. This includes cash inflows from issuing shares, borrowing funds, and cash outflows for repaying loans, paying dividends, and buying back shares.

FCF reveals how a business funds its operations and growth through equity and debt. Philippines businesses analyze FCF to understand their capital structure and financing strategies to ensure they always maintain an optimal balance between debt and equity.

Also Read: Financial Planning for Small Businesses: Navigating Debt and Cash Flow Management

Strategies To Implement To Generate Positive Cash Flow in The Philippines

Generating positive cash flow is crucial for the financial health and sustainability of any business as it not only ensures that a company can cover its immediate expenses but also provides the necessary resources for growth, investment, and resilience against economic fluctuations.

Hence, that is why in this section of the article, we will explore the various strategies to implement to generate positive cash flow by offering practical insights and actionable steps for Filipino business owners.

Whether you're looking to optimize receivables, manage expenses, or leverage financing options, these strategies will help you achieve and maintain a positive cash flow, ensuring your business remains robust and competitive.

Here, take a look at the effective strategies for Filipino entrepreneurs to implement in their businesses to develop a positive cash flow -

1. Optimize Receivables Management

Ensuring timely collection of receivables is critical for maintaining positive cash flow this is why it is important to implement strict credit policies and clear payment terms with customers. Moreover, use invoicing software to automate billing and send reminders to customers for due payments.

Consider offering discounts for early payments to encourage prompt settlement. Regularly review your accounts receivable and follow up on overdue accounts to prevent cash flow disruptions.

2. Manage Inventory Efficiently

Holding excessive inventory ties up cash that could be used elsewhere in the business, so conduct regular inventory audits to identify slow-moving or obsolete items and implement strategies to liquidate them, such as discounts or promotions.

Adopt inventory management systems that provide real-time data to optimize stock levels to ensure you have enough inventory to meet demand without overstocking.

3. Control Operating Expenses

Review and streamline operating expenses to improve cash flow. You can do this by negotiating better terms with suppliers, reducing unnecessary overhead costs, and finding more cost-effective ways to operate.

Additionally, you can implement energy-saving measures to cut utility costs and consider outsourcing non-core functions to reduce labor expenses. Regularly assess your expenses to identify areas where you can save money.

4. Increase Sales Revenue

Boosting sales is a direct way to improve cash flow. One of the best ways is to diversify your product or service offerings to attract new customers and increase revenue streams.

You can also invest in marketing and sales initiatives to drive growth, such as social media campaigns, promotions, and partnerships.

Finally, enhance customer satisfaction and retention by providing excellent service and building strong relationships.

5. Utilize Short-Term Financing

Short-term financing options, such as lines of credit or business loans, can provide immediate cash flow support. Use these funds to bridge gaps during slow periods or to finance short-term operational needs.

Ensure you have a clear repayment plan to avoid accumulating high-interest debt, so always compare different financing options to find the most favorable terms before finally settling with one.

6. Implement Effective Cash Flow Forecasting

Regularly forecast your cash flow to anticipate future needs and plan accordingly. One of the best ways you can do this is by using financial modeling tools to create detailed projections based on historical data and expected business activities.

Cash flow forecasting helps you identify potential shortfalls and allows you to take corrective measures, such as adjusting expenses or securing additional funding.

7. Improve Payment Terms with Suppliers

Negotiate extended payment terms with suppliers to improve your cash flow. For example, if you can secure 60-day payment terms instead of 30 days, you have more time to generate revenue before paying suppliers.

It is always a good habit to establish good relationships with suppliers you regularly deal with. Doing so will help you negotiate favorable terms and gain flexibility during tight cash flow periods.

8. Utilize Technology and Automation

Make use of technology to streamline financial processes and improve efficiency by using accounting software to track cash flow, automate invoicing, and manage expenses. Automation reduces manual errors and frees up time for strategic financial planning.

Moreover, adopting technology can also provide real-time insights into your cash flow status, helping you make informed financial decisions regarding your business.

9. Review Pricing Strategies

Regularly review and adjust your pricing strategies to ensure they align with market conditions and cost structures. Avoid underpricing your products or services, which can reduce profit margins and cash flow.

One of the best strategies to employ is to conduct thorough market research to understand competitive pricing and adjust your rates accordingly. Doing so will reflect the true value of your business and its services to the customers, which will go a long way in ensuring you maintain healthy profit margins.

Also Read: What is a Business Loan, and How Does it Work?

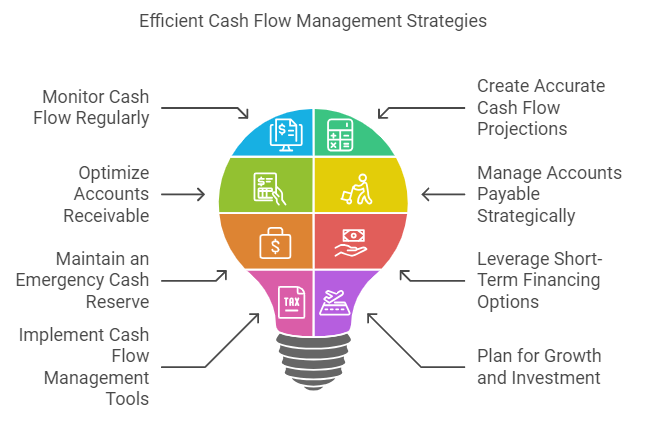

How To Manage Cash Flow Efficiently in The Philippines - Key Steps To Remember

Maintaining a healthy cash flow ensures that a company can meet its financial obligations, invest in opportunities, and weather economic fluctuations. However, efficient cash flow management involves careful planning, monitoring, and strategic decision-making to ensure that cash inflows consistently exceed cash outflows.

Filipino entrepreneurs can enhance their business’s financial stability, optimize its operational efficiency, and secure its long-term success in a competitive market by carefully understanding and implementing these key points.

Here, take a look at the essential tips that Philippine businesses need to remember if they want to manage their cash flows efficiently -

1. Monitor Cash Flow Regularly

Regularly tracking your cash flow is essential for understanding your financial position. Use accounting software to maintain up-to-date records of all cash inflows and outflows.

By monitoring cash flow on a daily, weekly, or monthly basis, you can quickly identify trends and detect potential issues to ensure your business remains financially healthy.

2. Create Accurate Cash Flow Projections

Develop detailed cash flow projections to forecast future cash positions. Use historical data and consider factors such as seasonal sales variations, market conditions, and upcoming expenses.

Accurate projections help you anticipate cash shortages or surpluses and plan accordingly, enabling you to take proactive measures like securing financing or adjusting spending.

3. Optimize Accounts Receivable

Improve your accounts receivable processes to ensure timely collection of payments. Implement clear payment terms and send invoices promptly. Moreover, follow up on overdue accounts regularly and consider offering discounts for early payments.

Using automated invoicing systems can streamline this process and reduce the time it takes to receive payments.

4. Manage Accounts Payable Strategically

Carefully manage your accounts payable to maintain good supplier relationships while optimizing cash flow. Take advantage of favorable payment terms and consider negotiating longer terms with suppliers.

Prioritize payments based on due dates and take advantage of any early payment discounts offered by suppliers to save on additional costs.

5. Maintain an Emergency Cash Reserve

Build an emergency cash reserve to provide a financial cushion during unexpected downturns or cash flow gaps. One of the best ways to do this is by trying to set aside enough cash to cover three to six months of operating expenses.

This reserve can help you manage unforeseen expenses, economic fluctuations, or slow periods without disrupting your business operations.

6. Leverage Short-Term Financing Options

Utilize short-term financing options like lines of credit, business credit cards, or short-term loans to manage cash flow gaps, as these financing tools can provide quick access to cash when needed.

Doing so will allow you to cover urgent expenses or take advantage of opportunities without depleting your cash reserves.

7. Implement Cash Flow Management Tools

Use cash flow management tools and software to automate and streamline your financial processes. These tools can provide real-time insights into your cash flow status, automate invoicing and payment reminders, and generate detailed financial reports.

8. Plan for Growth and Investment

Plan for future growth and investment by carefully managing your cash flow. You can do this by Identifying potential growth opportunities and assessing their financial impact.

Additionally, ensure you have the necessary cash reserves or financing options in place to support expansion activities without compromising your financial stability. Strategic planning enables you to balance short-term cash flow needs with long-term growth objectives.

Conclusion

Market conditions in the exciting yet volatile business landscape of the Philippines tend to be quite unpredictable, so mastering cash flow management is even more critical for Filipino entrepreneurs.

Due to these conditions, businesses should look to enhance their financial status and position themselves for long-term success. Still, they will only be able to do that by carefully understanding the importance of positive cash flow and implementing effective strategies to generate it.

Strategies such as optimizing receivables, controlling expenses, leveraging short-term financing, and maintaining accurate cash flow projections are vital elements that can help a business achieve and maintain positive cash flow.

Additionally, these intricate measures not only allow businesses to counter financial challenges effectively but they also enable them to take advantage of potential growth opportunities.

Ultimately, it is fair to conclude that apart from having a thorough understanding of positive cash flow, Philippine businesses must also implement strategic financial management practices to prosper and stay ahead of the competition for the long term.

Frequently Asked Questions (FAQs)

1. How is the understanding of the cash flow important and useful to making strategic decisions?

Understanding cash flow is crucial for strategic decision-making. It helps in:

- Predicting liquidity: Assessing if the business can meet short-term obligations.

- Investment planning: Determining available funds for growth and expansion.

- Financial planning: Budgeting and forecasting future cash needs.

- Risk management: Identifying potential cash flow shortages and taking corrective actions.

- Investor relations: Demonstrating financial health and attracting investors.

2. Why is it important for a company to generate positive cash flow from operating activities?

Positive cash flow from operating activities is crucial for a company's financial health and sustainability. It indicates the core business is generating sufficient cash to cover ongoing expenses and reinvest in growth.

A consistent positive operating cash flow enhances a company's ability to pay debts, and dividends, and fund future projects without relying heavily on external financing. Moreover, it also strengthens investor confidence and improves overall business resilience.

3. What is the most important factor in successfully managing your cash flow?

The most important factor in successfully managing your cash flow is accurate forecasting and budgeting. By anticipating income and expenses, businesses can effectively manage cash inflows and outflows.

This enables them to make timely decisions, avoid cash shortages, and take advantage of future business opportunities.

4. Which strategy is the best to improve cash flow for a Philippine business?

Improving cash flow often involves a combination of strategies. The most effective approach depends on your specific business situation. Some key strategies include:

- Accelerating cash inflows: Offering discounts for early payments, implementing efficient invoicing, and pursuing outstanding receivables aggressively.

- Delaying cash outflows: Negotiating better payment terms with suppliers, optimizing inventory levels, and reducing unnecessary expenses.

- Securing additional financing: Exploring options like short-term loans or lines of credit to bridge cash flow gaps.

- Cash flow forecasting: Regularly predicting future cash inflows and outflows to anticipate potential shortfalls.