Securing startup financing can be a significant hurdle for many minority Filipino entrepreneurs despite their businesses' critical economic contributions, including job creation and local economic development. These business owners often face systemic challenges such as limited access to capital, credit barriers, and systemic biases.

Hence, understanding the different financial assistance programs available to them is crucial, as it will enable them to overcome these obstacles effectively. This comprehensive guide aims to do just that by providing an in-depth look into various startup loan programs specifically designed for minority businesses in the Philippines.

Together, these insights aim to bridge the financial gap and empower minority-owned Philippine businesses to thrive by detailing their benefits, eligibility criteria, and additional supportive resources. So, without further ado, let's discuss all the details regarding small business loans for minorities in the Philippines.

What Are Minority-Owned Businesses And Why Are They Important?

Minority-owned businesses are enterprises primarily owned, operated, and controlled by individuals from underrepresented or marginalized groups, such as Indigenous peoples, women, or ethnic minorities.

Here, take a look at why they are essential for the country -

1. Promotes Economic Inclusivity

Minority-owned businesses empower underrepresented communities, ensuring broader economic participation and reducing inequality.

2. Job Creation

These businesses generate employment opportunities, especially in marginalized regions, contributing to local economic growth.

3. Diversity in Innovation

Minority entrepreneurs bring unique perspectives and ideas, fostering innovation and creating diverse products and services in the market.

4. Regional Development

They often operate in rural or underserved areas, driving development in regions that may otherwise lack business opportunities.

5. Empowers Marginalized Communities

Supporting minority-owned businesses helps uplift marginalized groups, giving them financial independence and the means to contribute to national growth.

Also Read: Types of Collateral for Secured Business Loans

Impact of Increased Business Diversity on the Philippine Business Landscape

Increased business diversity in the Philippines positively impacts the business landscape by promoting innovation, fostering competition, and driving economic inclusivity. When businesses from various sectors, regions, and backgrounds participate in the economy, it encourages new ideas, perspectives, and products, enriching the market.

Moreover, diversity also promotes job creation, especially in underrepresented communities, contributing to poverty reduction and regional development.

Additionally, a diverse business environment strengthens the economy's resilience by creating a broader base of industries and entrepreneurs, reducing dependence on a few dominant sectors, and enhancing long-term economic stability.

Also Read: Getting a Small Business Loan in The Philippines

Benefits of Small Business Loans For Minorities in the Philippines

Targeted startup loan programs for minority-owned businesses in the Philippines are designed to empower underrepresented groups by providing financial assistance tailored to their unique needs.

These programs aim to reduce barriers to entry, stimulate economic growth, and promote inclusivity. Here, take a look at the 5 key benefits of these programs in the Philippines -

1. Improved Access to Capital

Minority-owned businesses often face difficulties accessing traditional loans. Targeted programs offer more accessible, more flexible financing options, enabling these businesses to secure the funds needed to start and grow.

2. Lower Interest Rates

These loan programs typically offer lower interest rates, making borrowing more affordable and allowing minority entrepreneurs to invest more in business operations and expansion.

3. Capacity Building and Mentorship

Many targeted programs include training, mentorship, and business development services, helping minority business owners build crucial skills and knowledge for long-term success.

4. Economic Empowerment

By supporting minority-owned businesses, these programs contribute to economic inclusivity, creating jobs and fostering entrepreneurship in underserved communities, leading to regional development.

5. Increased Entrepreneurial Opportunities

Targeted loan programs remove financial barriers, making it easier for minority entrepreneurs to start their businesses. Thus, they increase diversity and innovation in the Philippine business landscape.

Also Read: DTI in Tagalog: National Action Plan and SMEs Sales Record

Fast-track your Philippine SME’s success with N90’s fast financing solutions. Apply today and get potential loan approvals within 24 hours. Secure the quick funding your business urgently needs today! Avail now!

Challenges of Small Business Loans for Minorities in The Philippines

Despite their contributions, minority entrepreneurs in the Philippines, such as women, indigenous peoples, and those from marginalized communities, often encounter significant hurdles when seeking startup financing.

These challenges stem from economic inequalities, lack of access to resources, and systemic barriers that make it difficult for minority-owned businesses to thrive.

Here, take a look at some of the critical challenges minority-owned businesses face in the Philippines -

1. Limited Access to Capital

Minority entrepreneurs often have difficulty accessing traditional loans due to insufficient collateral, lack of credit history, or perceived higher risk by financial institutions.

2. Discrimination and Bias

Systemic bias or discrimination can impact funding opportunities, with minority entrepreneurs facing additional scrutiny or lower trust from lenders, hindering their ability to secure loans.

3. Lack of Financial Literacy

Many minority entrepreneurs have limited exposure to financial literacy programs, making it challenging to navigate the complex loan application processes or manage financial planning effectively.

4. Insufficient Networking Opportunities

Networking is crucial for business success, but minority entrepreneurs often lack access to business networks, mentorship, and investor circles that are essential for securing startup capital.

5. Higher Costs of Borrowing

Due to perceived higher risk, minority entrepreneurs may face higher interest rates or more stringent loan terms, making it more expensive to secure financing than their mainstream counterparts.

Also Read: Understanding the Features, Importance, and How Microfinance Works

Types of Loans Available for Minority-Owned Startups in the Philippines

Minority-owned startups in the Philippines can access various loan programs designed to support their entrepreneurial journey. These loans, provided by government agencies, private financial institutions, and microfinance organizations, offer tailored solutions to help underrepresented entrepreneurs secure the needed capital.

Here are the key types of loans available for minority-owned startups in the Philippines -

1. Government-Backed Loans (DTI and SB Corp.)

Programs like the Pondo sa Pagbabago at Pag-asenso (P3) and Go Negosyo Loan offer affordable loans with low-interest rates and flexible terms, focusing on micro, small, and medium enterprises (MSMEs), including minority-owned businesses.

2. Microfinance Loans

Microfinance institutions provide small-scale loans with minimal requirements, making them accessible for minority entrepreneurs lacking collateral or a formal credit history.

3. Private Bank Loans

Some private banks in the Philippines offer SME-focused loans tailored to minority-owned businesses. These loans typically require collateral but come with competitive rates and longer terms.

4. Crowdfunding and Peer-to-Peer (P2P) Lending

Platforms facilitating crowdfunding or P2P lending allow minority-owned startups to raise funds from individual investors, bypassing traditional banking restrictions.

5. Women-Specific Loan Programs

Targeted loans for women entrepreneurs, offered by both government and non-government organizations, provide minority female entrepreneurs with capital, mentorship, and business development support.

6. Angel Investors

Minority-owned startups can seek angel investors—individuals or groups willing to invest capital in exchange for equity. This option provides both funding and valuable mentorship, helping minority entrepreneurs grow their businesses.

Are you looking to take your Philippine business to the next level? Check out this video. Here, you will learn about the top 5 small business loan providers in the Philippines that will give your business the financial boost it needs to survive and thrive in the competitive Philippine business market.

Also Read: Getting a $100K Business Loan: Steps and Guide.

Eligibility Criteria For Small Business Loans For Minorities in The Philippines

Several loan programs in the Philippines offer financing tailored explicitly to minority-owned businesses' needs to promote inclusivity and support them. However, to access these loans, entrepreneurs must meet specific eligibility criteria set by lenders or government-backed programs.

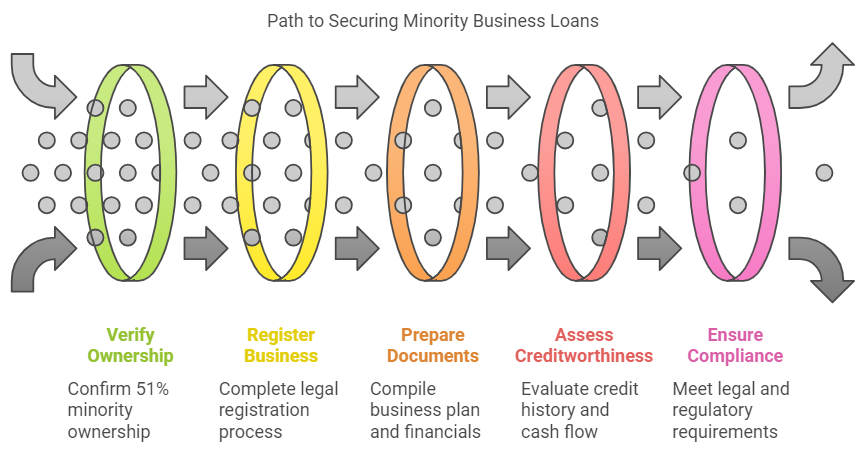

Here, take a look at the critical eligibility criteria for minority-owned businesses to secure a small business loan in the Philippines -

1. Minority Ownership

The business must be at least 51% owned and controlled by individuals from minority groups, such as women, indigenous peoples, or marginalized communities.

2. Legal Business Registration

The business must be registered with relevant Philippine government agencies, such as the Department of Trade and Industry (DTI), Securities and Exchange Commission (SEC), or local government units (LGUs).

3. Business Plan and Financial Statements

Lenders often require a clear business plan and basic financial statements demonstrating the business’s economic health and growth potential.

4. Creditworthiness

While minority-owned businesses may access special programs, lenders still assess creditworthiness, including a credit history check or proof of stable cash flow, though requirements are often more flexible.

5. Compliance with Government Regulations

To be considered for loan approval, the business must comply with all relevant legal and regulatory requirements in the Philippines, such as tax filings and labor laws.

Also Read: Best Lenders for Quick Cash Loans and Instant Same-Day Approval

Grant Options for Minority-Owned Small Business Startups in The Philippines

Minority small business startups in the Philippines often face barriers to accessing traditional financing options. Fortunately, several grant programs are designed to support underrepresented groups, such as women, indigenous peoples, and marginalized communities.

Essentially, these grants offer funding without the need for repayment, empowering minority entrepreneurs to grow their businesses without taking on debt.

Here, take a look at the prominent grant options for minority small business startups in the Philippines -

1. DTI - Pondo sa Pagbabago at Pag-asenso (P3) Program

Administered by the Department of Trade and Industry (DTI), this program provides micro-loans and grants to small businesses, particularly marginalized ones, to promote inclusive growth.

2. SB Corp. MSME Funding

Small Business Corporation (SB Corp.) offers various funding programs for minority-owned businesses, including grants and low-interest loans to help startups, especially in rural areas.

3. UN Women’s Empowerment Grants

This program, targeted specifically for women entrepreneurs, provides grants to minority women-owned businesses, focusing on economic empowerment and gender equality in business.

4. Go Negosyo Kapatid Mentor ME (KMME) Program

While not a direct grant, this government-supported initiative offers minority entrepreneurs access to funding opportunities, mentorship, and training that can lead to grants and financing.

5. NGO and International Development Programs

Non-government organizations (NGOs) and international development agencies, such as the United Nations Development Programme (UNDP) and USAID, offer grants to support minority-owned businesses, especially in rural and underserved areas.

Conclusion

This article shows that numerous funding options are available for minority business startup loans, each designed to provide more equitable access to capital. Exploring these resources is crucial, so take the time to understand what each program offers and which aligns best with your business needs.

Moreover, preparing a robust business plan and an impeccable credit profile is equally important. This is because a clear, well-prepared application package can significantly increase your chances of loan approval.

For a successful application, ensure your business plan includes detailed financial projections, market research, and a clear outline of how the loan will be used and repaid. This shows lenders that your business idea is viable and that you have a solid plan for success.

Lastly, thoroughly examine the available loan and grant options and understand their pros and cons before selecting them. Conducting due diligence will ensure you choose only the financing options that benefit your business in the long term.

Frequently Asked Questions (FAQs)

1. Which loan is best to start a business in the Philippines?

The Pondo sa Pagbabago at Pag-asenso (P3) Program is often considered the best loan option for starting a business in the Philippines. Offered by the DTI and SB Corp, it provides micro-loans with low interest rates and flexible terms designed explicitly for small businesses and startups.

Other options include BPI SME loans and BDO SME loans, which also offer competitive terms for entrepreneurs.

2. What is the processing time for an SB Corporation loan?

The processing time for an SB Corporation loan typically takes around 7 to 15 business days, depending on the completeness of the application and required documents.

However, it may take longer, up to a month, during peak periods or for more complex applications. Hence, SB Corp. advises applicants to submit all necessary documents correctly to accelerate the overall application process.

3. How do you get money to start a business in the Philippines?

To get money to start a business in the Philippines, consider government loans like the DTI P3 Program or apply for bank loans from institutions like BDO or BPI. You can also explore microfinance options, seek funding from angel investors, or try crowdfunding platforms.

Additionally, personal savings and grants from organizations can help fund your startup.

4. How do you find an investor for a startup in the Philippines?

To find an investor for a startup in the Philippines, attend networking events like PhilDev or Geeks on a Beach, where investors and entrepreneurs connect. Explore angel investor networks like Manila Angels and apply to venture capital firms like Kickstart Ventures.

Additionally, using online platforms like LinkedIn and AngelList can help find potential investors.