Obtaining a small business loan without collateral is an attractive option for entrepreneurs in the Philippines, especially those who need funding but don’t have access to significant assets to offer as security in exchange.

These types of loans, often referred to as unsecured loans, allow businesses to access capital based on their creditworthiness, business performance, and other factors rather than relying on physical assets.

However, while the process of securing a small business loan without collateral can prove to be more challenging for Philippine businesses than securing a traditional loan, it is still entirely possible for them to do so, but only if they can approach it strategically and by possessing the proper knowledge.

So, to help Philippine businesses secure the right kind of funding to suit their business’s financial needs, in this article, we will guide them through the essential steps required to apply for one and help them grow their enterprises successfully.

Moreover, we will also explore the various types of small business loans without collateral available in the Philippines, as well as the top providers and eligibility criteria for applying for one. So, without much ado, let us explore all the relevant details.

What is a Small Business Loan Without Collateral, And How Does it Work in The Philippines?

A small business loan without collateral is a type of financing that allows entrepreneurs to borrow money without the need for them to pledge assets in return, such as property or equipment, as security for the loan.

Also known as an unsecured loan, this financial product is particularly beneficial for businesses that lack significant assets but still require capital to fund their business’s operations, expansion plans, or any other business needs, either major or minor.

In the Philippines, small business loans without collateral work by assessing the borrower's creditworthiness, business performance, and financial history rather than relying on collateral. This is because, in this case, lenders typically evaluate factors such as the business’s revenue, cash flow, and credit score to determine its eligibility and loan terms.

These loans usually charge slightly higher interest rates than secured loans, mainly because they pose a greater risk to the lender. However, aside from the high interest rate, they provide Philippine businesses with ample advantages, most notably by allowing them to access the funds they need without requiring them to risk any of their valuable assets.

Also Read: Understanding Cash Flow: Its Importance and How It Works in Business

Essential Steps To Follow To Get a Small Business Loan Without Collateral in The Phillippines

Securing a small business loan without collateral is a vital step for entrepreneurs in the Philippines who want to fund their business ventures without risking personal or business assets. However, they can make the entire process more effortless by carefully understanding the specific requirements and following the necessary steps to significantly improve their chances of approval.

Here, we will examine the essential steps Philippine businesses and entrepreneurs need to follow to successfully apply for a small business loan without collateral, which will give them the financial support they need to grow their businesses and achieve their goals -

1. Assess Your Financial Situation

Before applying for a small business loan without collateral, it is crucial for you to have a clear understanding of your financial situation. If not, start by evaluating your business’s economic health, including your cash flow, revenue, and expenses. This self-assessment will help you determine how much you need to borrow and whether your business can comfortably handle the loan repayments.

Additionally, consider your business’s current debts and obligations to ensure that taking on additional debt will not strain your finances further. This step is vital as it sets the foundation for your loan application and helps you avoid borrowing more than your business can repay.

At this stage, you should also review your personal and business credit scores, as these will be critical factors in the lender’s decision-making process. A strong credit score can significantly improve your chances of securing an unsecured loan, as it demonstrates your creditworthiness and ability to manage debt responsibly.

If your credit score is lower than the desired threshold of 600, take practical steps to improve it before applying for a small business loan without collateral, such as paying down existing debts and ensuring all bills are paid on time. This is primarily because possessing a solid financial footing will not only increase your chances of loan approval today but may also help you secure more favorable loan terms in the future as well.

2. Research and Choose the Right Lender

Researching and selecting the right lender is a crucial 2’nd step in obtaining a small business loan without collateral in the Philippines.

Here, take a look at a few critical steps to keep in mind before selecting a loan lender and go through the entire process more effectively -

- Identify Reputable Lenders

Start by creating a list of potential lenders that offer unsecured small business loans, and look for banks, microfinance institutions, online lenders, and government-backed programs that cater specifically to small businesses.

Always ensure that each lender is licensed and regulated by the appropriate authorities in the Philippines.

- Compare Loan Terms and Conditions

Examine the loan terms offered by different lenders carefully, including interest rates, repayment periods, fees, and any additional requirements. Since unsecured loans often come with higher interest rates, comparing multiple options is essential to find the most favorable terms for your business.

- Assess Eligibility Requirements

Review each lender's eligibility criteria to ensure your business meets the necessary qualifications. Factors such as business age, revenue, and credit score can vary between lenders, so choose a lender whose requirements perfectly align with your business’s financial profile.

- Read Customer Reviews and Testimonials

Check online reviews, ratings, and testimonials from other business owners who have borrowed from these lenders, as this can provide businesses with valuable information regarding the lender’s reliability, customer service, and overall lending experience.

- Seek Recommendations

See recommendations from fellow entrepreneurs, business associations, or financial advisors who have already had experience with unsecured loans because their insights can help you identify trustworthy lenders and avoid potential scammers.

- Evaluate the Application Process

Consider the ease and speed of the application process, as some lenders may offer more streamlined online applications, while others may require more extensive documentation and in-person visits.

It is always a good idea to opt for lenders that provide a more convenient and transparent loan application process that suits your business’s financial needs.

3. Prepare Your Documentation

Preparing your documentation is crucial when applying for a small business loan without collateral in the Philippines, primarily because lenders will closely examine your financial records, business performance, and credit history to assess your creditworthiness since you won’t be offering any assets as security before they agree to provide a loan.

Here, take a look at the essential documents you need to present for a seamless and hassle-free loan approval process -

- Business Registration Documents

Ensure your business is legally registered with the appropriate government agencies, such as the Department of Trade and Industry (DTI) or the Securities and Exchange Commission (SEC) because you’ll need to provide your business registration certificate, business permits, and licenses.

- Financial Statements

Prepare detailed financial statements, including income statements, balance sheets, and cash flow statements. Depending on the lender's requirements, these documents should cover at least the past 2 years.

Doing this is important because providing accurate financial statements demonstrates your business’s economic health and financial stability, which, in turn, strengthens your loan application.

- Bank Statements

Gather your recent bank statements, usually for the last 6 months to 1 year, as these statements will help lenders assess your cash flow and understand how money moves in and out of your business. Displaying a consistent and positive cash flow will strengthen your loan application.

- Tax Returns

Provide copies of your business’s tax returns for the past one to two years. This will give lenders a clear picture of your business’s profitability and tax compliance status, which are critical factors in the overall loan approval process.

- Business Plan

Although only sometimes required, a well-prepared business plan can significantly boost your chances of securing a loan. Your business plan should clearly outline your business goals, market analysis, growth strategies, and how you intend to use the loan funds.

- Proof of Identity and Residency

Have your government-issued IDs, such as a passport, driver’s license, or national ID, ready, along with proof of residency like utility bills or lease agreements, as these documents play a crucial role in verifying your identity and address.

- Credit Report

It is beneficial to check your personal and business credit reports before applying because knowing your credit score beforehand and addressing any issues promptly can greatly improve your chances of approval.

4. Strengthen Your Loan Application

Strengthening your loan application is crucial when applying for a small business loan without collateral in the Philippines since applying for unsecured loans is riskier for lenders, as in this case, lenders rely heavily on the strength of your application to determine your creditworthiness more than anything else.

Here’s how you can enhance your loan application when applying for a small business loan without collateral in the Philippines -

- Prepare Detailed Financial Statements

Ensure your business’s financial records are up-to-date, accurate, and well-organized because lenders will closely examine your income statements, balance sheets, and cash flow reports to assess your business’s financial stability.

- Showcase Strong Revenue and Cash Flow

Demonstrating consistent revenue and positive cash flow is crucial, as lenders want to see that your business generates enough income to cover loan repayments without needing collateral.

- Highlight a Solid Business Plan

A well-prepared business plan that outlines your growth strategy, market analysis, and how you intend to use the loan can significantly boost your application, as it will show lenders that you have a clear plan for success already laid out

- Maintain a Good Credit Score

Your personal and business credit scores significantly influence your loan approval success rate. One of the best ways to approach this is to pay off your existing debts diligently, avoid late payments, and manage your credit utilization, as these can improve your credit score and make your application more attractive to potential lenders.

- Provide Strong Supporting Documents

To avoid delays, include all necessary documentation, such as business permits, tax returns, bank statements, and identification. Providing all the vital documentation supports your overall loan application and reassures lenders that you need financial assistance.

5. Submit Your Application and Follow Up

After preparing a solid loan application, the final step is to submit it to your chosen lender and stay engaged throughout the approval process. Ensure that all required documents are attached and that the application is filled out accurately and completely.

Missing information or making errors at this stage can delay your loan application, so double-check everything before submitting it. Once submitted, it is important to keep track of your application’s status and be available to provide any additional information or clarification the lender may request.

Following up with the lender is crucial, especially if you have not received a response within the expected timeframe. Doing so will demonstrate your commitment and seriousness about securing the loan.

Also Read: What is Invoice Financing, and How Does it Work?

Don’t let financial hurdles slow you down your Philippine SME’s journey. Apply for N90’s fast financing solutions and receive quick approvals within 24 hours! Start Today And Drive Your Business Forward with N90!

Types of Small Business Loan Without Collateral Available in The Philippines

For small businesses in the Philippines, securing a loan without collateral is a viable option, especially for those who may not have significant assets to pledge.

Here are the common types of small business loans without collateral available in the Philippines that businesses can utilize to give their businesses the necessary financial boost -

1. Unsecured Term Loans

Unsecured term loans are straightforward loans provided by banks and financial institutions that require no collateral. These loans offer a lump sum amount that is repaid over a fixed period, usually with monthly installments, and are ideal for businesses needing funds for expansion, working capital, or other long-term projects.

2. Business Credit Lines

A business credit line is a flexible financing option that allows businesses to borrow up to a specific limit as needed rather than receiving a lump sum. Interest is only charged on the amount drawn, and once repaid, the credit becomes available again, thereby making it an excellent option for businesses looking to manage cash flow fluctuations or handle unexpected expenses.

3. Invoice Financing

Invoice financing, also known as accounts receivable financing, allows businesses to borrow money against their outstanding invoices. This type of loan is particularly useful for businesses that need immediate cash flow but are waiting for customers to pay their invoices.

4. Online Business Loans

Fintech companies and online lenders offer online business loans, which provide fast and easy access to funding without collateral. These loans often have a quick approval process, making them suitable for businesses that need funds instantaneously.

5. Credit Card Loans

Business credit cards are unsecured loans that allow businesses to borrow money up to a set credit limit. They are ideal for managing minor, short-term expenses and offer the flexibility of revolving credit, allowing businesses to earn rewards or cashback on any purchase they make.

6. Merchant Cash Advances

Merchant cash advances provide businesses with a lump sum of cash in exchange for a percentage of future sales, and they are particularly suitable for companies with steady credit card sales, such as retail or hospitality businesses. They are a fast and flexible option, although it must be noted that they typically come with higher fees than traditional loans.

7. Peer-to-Peer Lending

P2P lending platforms connect businesses directly with individual lenders who are willing to provide loans without requiring collateral in exchange. These platforms often have more lenient eligibility criteria and offer flexible loan terms, making them excellent alternatives for businesses that may not qualify for traditional bank loans.

Also Read: Finance in Business: Basics, Role, and Importance

Best Small Business Loan Without Collateral Options For Businesses in Philippines

For many entrepreneurs in the Philippines, accessing capital without the need for collateral can be a crucial factor in expanding or sustaining their businesses. Thankfully, several loan options are available that do not require collateral, making it easier for small businesses to secure the funding they need.

Here, take a look at some of the best small business loan without collateral options available in the Philippines that will help Philippine businesses to find the right financial solution to support their business growth -

1. UnionBank Business Loan

UnionBank offers unsecured business loans to SMEs. The loan process is straightforward, and the repayment terms are flexible and competitive. This option is ideal for businesses looking for quick access to funds without the need for collateral.

2. BDO Unibank SME Loan

BDO Unibank provides SME loans that do not require collateral, making it easier for businesses to obtain financing, as these loans are designed for various business needs, including working capital, expansion, or equipment purchases.

3. Security Bank SME Business Express Loan

Security Bank’s SME Business Express Loan is an unsecured loan option for small businesses. The application process is fast and easy, and loan approval is possible within a few days, making it suitable for companies that require immediate funds to support their growth or manage their cash flow.

4. RCBC SME Business Loan

RCBC provides unsecured loans for SMEs with flexible terms and competitive rates. These loans are designed to help businesses finance their operational needs, purchase inventory, or expand their operations, making them well-suited for companies looking for quick financing without the added burden of collateral.

5. EastWest Bank Business Loan

EastWest Bank offers unsecured business loans that cater to the financing needs of small businesses in the Philippines. These loans have competitive interest rates and flexible repayment terms.

6. Philippine Business Bank (PBB) SME Loan

Philippine Business Bank offers SME loans without collateral, targeting small businesses needing working capital or funds for expansion. PBB provides fast processing and flexible terms, making it an accessible option for companies with strong financial performance.

7. First Circle

First Circle is an online lending platform that specializes in providing unsecured loans to small and medium enterprises in the Philippines. Their loans are particularly useful for businesses that need quick access to funds for inventory purchases, supplier payments, or other short-term needs.

Also Read: Understanding Positive Cash Flow: Meaning, Importance, and Strategies to Generate It

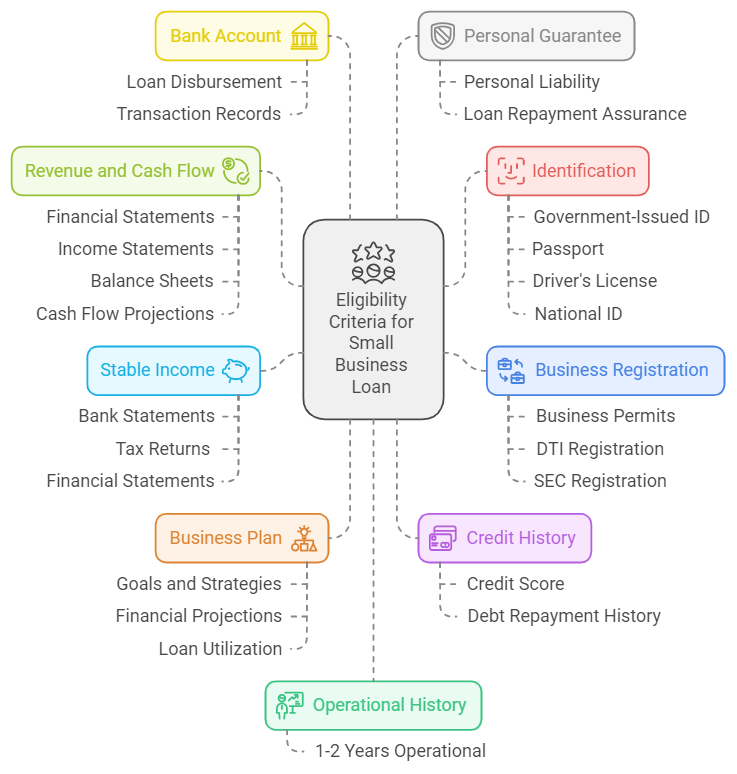

Eligibility Criteria For a Small Business Loan Without Collateral in The Philippines

Applying for and getting a small business loan without collateral in the Philippines is possible, but it requires meeting specific eligibility criteria set by lenders.

Here are a few essential eligibility requirements that Philippine businesses need to consider before applying for a small business loan without collateral in the Philippines

1. Business Registration and Legal Compliance

Your business must be legally registered and compliant with Philippine regulations. This includes having the necessary business permits, licenses, and registration with the Department of Trade and Industry (DTI) for sole proprietorships or the Securities and Exchange Commission (SEC) for corporations and partnerships.

2. Minimum Operational History

Lenders typically prefer businesses that have been operational for at least 1 to 2 years because possessing a proven track record of business performance assures lenders of your ability to generate revenue and repay the loan promptly.

3. Stable Revenue and Cash Flow

Demonstrating a consistent revenue stream and healthy cash flow is crucial, as lenders will evaluate your financial statements, including income statements, balance sheets, and cash flow projections, to ensure your business can comfortably handle loan repayments.

4. Good Credit History

Having a strong personal and business credit history will significantly improve your chances of loan approval. Lenders will review your credit score to assess your creditworthiness, and a good credit score indicates that you have a reliable history of repaying debts on time.

5. Proof of Stable Income

Proof of stable income is essential for businesses applying for unsecured loans in the Philippines, as lenders may require documents such as bank statements, tax returns, and financial statements to verify that your business has a steady flow of income coming in that can support the entire loan repayment process.

6. Solid Business Plan

A well-prepared business plan can strengthen your loan application, as it not only outlines your business’s goals, strategies, financial projections, and how the loan will eventually be utilized but also demonstrates to potential lenders that you have a clear roadmap regarding your business’s growth and loan repayment structure.

7. Active Bank Account

Having an active business bank account is usually required for loan disbursement and repayment, as apart from storing the disbursed loan amount, this account also provides a record of your business’s financial transactions, which can support your overall loan application.

8. Valid Identification

To verify your identity, you must provide valid government-issued identification, such as a passport, driver’s license, or national ID. This is a mandatory requirement for all loan applications.

9. Personal Guarantee

Some lenders may require a personal guarantee, especially for unsecured loans, to provide them with additional assurance. This basically means that if the business fails to repay the loan, the business owner will be personally liable for the debt.

Conclusion

As this article has shown, obtaining a small business loan without collateral in the Philippines can be achieved by following the proper steps and ensuring that you meet the necessary eligibility criteria.

From preparing a strong business plan and maintaining a solid credit history to choosing the right lender and carefully completing your application, each step is crucial for increasing your chances of approval.

So, it is fair to say that by taking a strategic approach and taking care of all the minute details, you can effectively secure your business's funding to grow and thrive, even without offering collateral and subsequently putting your valuable assets at risk.

Frequently Asked Questions (FAQs)

1. Can I get approved for a loan without collateral?

Yes, it's possible to get approved for a loan without collateral. While collateral can improve your chances of approval and potentially secure lower interest rates, it's not always a requirement, as factors like your credit score, income, and business history also play a significant role.

Many lenders, especially online lenders and microfinance institutions, offer loans without requiring collateral. However, before committing to one, it is essential to compare offers from different lenders and consider their potential impact on your overall financial situation.

2. What is a loan with no collateral called?

A loan without collateral is often referred to as an unsecured loan, and these loans are typically offered based on the borrower's creditworthiness rather than requiring assets as security. Unsecured loans can include personal loans, credit card cash advances, and small business loans.

3. What is the interest rate for a collateral-free loan?

Interest rates for collateral-free loans vary widely depending on several factors, including the following -

- Lender: Different lenders have varying interest rate policies.

- Borrower's credit score: A higher credit score generally leads to lower interest rates.

- Loan amount: Larger loan amounts might have different interest rates.

- Repayment terms: Longer repayment terms often result in higher interest rates.

According to multiple reputable sources on the web, the interest rate for a collateral-free loan can range, on average, from 8.3% to 36% per annum.

4. How is the collateral amount calculated?

The collateral amount is typically calculated based on the market value of the asset offered as security. This value can be determined through appraisals or other valuation methods, and lenders usually do this to assess the collateral's value to ensure it adequately covers the loan amount completely and is free from potential risks.