Securing financing is a crucial step for entrepreneurs looking to start or grow their small businesses, especially in 2024, where choosing the right bank for a small business startup loan can make a significant difference in terms of the terms, interest rates, and overall financial support available to them.

As the landscape of business lending continues to evolve, various banks offer tailored solutions to meet the unique needs of startups. Startups must select the best one that matches their needs; otherwise, it could lead to financial ruin and insolvency.

This article will explore some of the best banks for small business startup loans in 2024 in the Philippines. These banks will provide Filipino entrepreneurs with the right type of funding they need and how they can support new businesses in achieving their financial goals. So, without further ado, let us get down to it.

What is a Small Business Startup Loan, And Why is it Important For Philippine businesses?

A small business startup loan is a type of financing specifically designed to help new businesses start. These loans provide the necessary capital to cover initial expenses such as equipment purchases, inventory, marketing, and working capital.

Unlike other types of loans, startup loans are tailored to meet the unique needs and challenges businesses face in their early stages. So, for Philippine businesses, small business startup loans are crucial because they provide essential funding to determine a new venture's success or failure.

Starting a business often requires substantial upfront investment, and many entrepreneurs may need more personal savings to cover these costs. That is precisely where startup loans come in and offer a way to bridge this financial gap.

They allow entrepreneurs to invest in their business’s growth, build a strong foundation, and achieve long-term goals. Businesses can enhance their operational capacity, gain a competitive edge, and navigate the challenges of the Philippine market more effectively by accessing the right financing, and small business startup loans are one of them.

Also Read: Creating A Cash Flow Budget In 5 Steps

Best Banks For Small Business Startup Loans in 2024 - List of The Banks To Avail Loans From For Businesses in The Philippines

Securing a small business startup loan can be a pivotal step for entrepreneurs looking to turn their business ideas into reality in the Philippines. In 2024, several banks will offer specialized loan products to support new ventures, each with unique terms and conditions designed to meet various business needs.

Choosing the right bank can significantly impact your startup's success, providing the necessary capital and valuable financial guidance and support.

In this section of the article, we will explore some of the top banks in the Philippines that can help you obtain small business startup loans. While we are at it, we will also highlight their key offerings, eligibility criteria, and benefits for aspiring Filipino entrepreneurs.

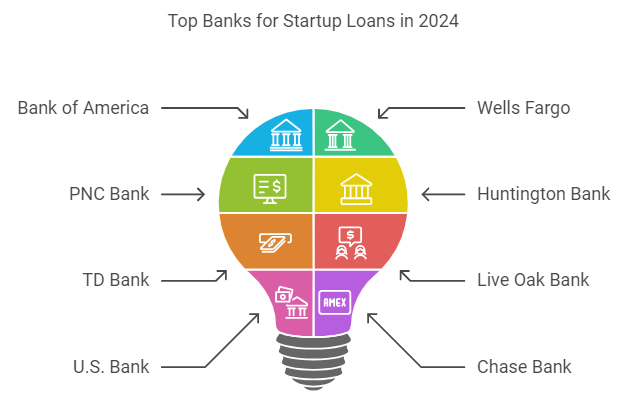

Here, take a look at the top banks for small business startup loans in 2024 in the Philippines at a glance -

1. Bank of America

2. Wells Fargo

3. PNC Bank

4. Huntington Bank

5. TD Bank

6. Live Oak Bank

7. U.S. Bank

8. Chase Bank

9. KeyBank National Association

10. Capital One Bank

Now that we have a fair idea of who the top banks for small business loans in 2024 in the Philippines are, let us explain each of their features in greater detail to help Filipino businesses select the best ones depending on their financial needs -

1. Bank of America

Bank of America is a leading American multinational financial institution headquartered in Charlotte, North Carolina. Founded in 1904, it is one of the world's largest banking and financial services organizations, offering a comprehensive range of products and services, including personal banking, business banking, wealth management, and investment banking.

With a significant presence in the U.S. and internationally, Bank of America provides services to millions of customers through its extensive network of branches, ATMs, and intuitive online and mobile banking platforms.

Additionally, it offers a variety of financial products and services designed to support growth and operational needs, which include business loans, lines of credit, and commercial real estate financing.

Moreover, the bank also provides tailored solutions such as cash management services, merchant services, and business credit cards, all of which aim to help businesses manage their finances efficiently and achieve their financial goals.

Also Read: What is Invoice Financing, and How Does it Work?

2. Wells Fargo

Wells Fargo is a major American financial services company headquartered in San Francisco, California. Founded in 1852, it is one of the largest and most established banks in the United States.

Wells Fargo offers various financial products and services, including personal and business banking, investment management, and insurance. It operates nationwide through a vast network of branches and ATMs and provides businesses with digital banking services.

It also offers various financial solutions, such as loans, lines of credit, and business credit cards, tailored to support different stages of business growth. Moreover, the bank is known for its comprehensive banking solutions, competitive interest rates, and expansive online and mobile banking platforms, which aim to assist entrepreneurs with their financial needs and contribute to their business success.

3. PNC Bank

PNC Bank is a major American financial institution headquartered in Pittsburgh, Pennsylvania. Founded in 1845, it is one of the largest banks in the United States and offers a wide range of financial services, including personal banking, business banking, investment management, and corporate finance.

It operates through an extensive network of branches and ATMs, primarily in the eastern and central United States, and provides comprehensive digital banking solutions.

Additionally, it offers several financial products and services designed to support business growth and operations, including business loans, lines of credit, cash management solutions, and merchant services. Moreover, PNC is also known for its customer service and innovative banking solutions, including tools that help businesses manage their finances more effectively.

Also Read: Finance in Business: Basics, Role, and Importance

4. Huntington Bank

Huntington Bank is a prominent American financial institution headquartered in Columbus, Ohio. Established in 1866, Huntington provides a wide range of banking services, including personal and business banking, mortgages, wealth management, and investment services.

Known for its strong regional presence, the bank operates primarily in the Midwest, with a network of branches and ATMs across several states.

Furthermore, it offers various financial products and services designed to support different aspects of business operations, which include business loans, lines of credit, and treasury management solutions.

But that’s not all; Huntington is also recognized for its customer-focused approach, which provides personalized service and financial solutions to meet the needs and economic demands of small and large enterprises.

5. TD Bank

TD Bank is a major North American financial institution headquartered in Cherry Hill, New Jersey. Part of the Toronto-Dominion Bank Group, TD Bank is one of the largest banks in the United States and operates as a full-service bank providing a wide range of financial products and services, including personal and business banking, mortgages, credit cards, and investment services.

Additionally, TD Bank is known for its extensive branch network and commitment to customer service, largely thanks to its significant presence along the East Coast of the United States.

Moreover, TD Bank provides convenient digital banking options to help businesses manage their finances effectively, support their growth, and improve operational efficiency. They do this by offering small businesses a variety of financial solutions tailored to their needs, including business loans, lines of credit, and specialized banking services designed to cater to their varied needs.

Also Read: Exploring Instruments for Alternative Finance Providers

6. Live Oak Bank

Live Oak Bank is a specialized financial institution based in Wilmington, North Carolina. It was founded in 2008 and operates primarily as an online bank, focusing on providing a range of financial products and services designed for individuals and businesses. It is famously known for its emphasis on digital banking, offering streamlined online processes for savings accounts, business loans, and other financial services.

Live Oak Bank offers tailored lending solutions for small businesses, including SBA loans, term loans, and equipment financing. Through its online platform, this bank ensures an efficient loan application process and management for clients, emphasizing customer service and specialized support for various industries.

In essence, the bank's approach combines modern digital convenience with personalized financial solutions to support business growth and operational needs.

7. U.S. Bank

U.S. Bank is a major American financial institution headquartered in Minneapolis, Minnesota. Founded in 1863, it is one of the largest banks in the United States and offers a wide array of financial products and services, including personal and business banking, investment management, mortgage services, and wealth management.

U.S. Bank operates primarily through an extensive nationwide network of branches and ATMs and a comprehensive suite of digital banking tools. It provides various financial solutions for small businesses, including business loans, lines of credit, and commercial banking services.

The bank’s offerings are designed to support business growth and operations with tailored solutions for managing cash flow, financing needs, and investment opportunities. In the U.S., they provide clients access to detailed online and mobile banking platforms that allow businesses to manage their finances efficiently.

8. Chase Bank

Chase Bank is a major financial services institution headquartered in New York City. It is part of JPMorgan Chase & Co., one of the world's largest and most influential banks. Founded in 1799, Chase offers a wide range of financial products and services, including personal banking, business banking, investment services, and wealth management.

With a significant presence across the United States and internationally, Chase provides comprehensive banking solutions through an extensive network of branches, ATMs, and advanced digital banking platforms.

It offers various financial products designed to support small businesses' growth and operational needs, including business loans, lines of credit, business credit cards, and specialized services like cash management and merchant services to help businesses manage their finances efficiently and effectively.

Also Read: Choosing the Right Business Loan for Your Company's Growth

9. KeyBank National Association

KeyBank National Association is a major American financial institution headquartered in Cleveland, Ohio. Established in 1825, it is one of the largest banks in the United States. It offers a diverse range of financial products and services, including personal banking, business banking, wealth management, and investment services.

It operates primarily through an extensive network of branches and ATMs in several states, primarily in the U.S.'s Northeastern, Midwestern, and Western regions.

KeyBank provides financial solutions for small businesses, such as business loans, lines of credit, and cash management services. Moreover, the bank also offers tailored support and financial advice to help companies manage their finances effectively and achieve their growth objectives while also enabling them to meet their clients' evolving needs.

10. Capital One Bank

Capital One Bank is a prominent American financial institution headquartered in McLean, Virginia. Established in 1994, it has grown to become one of the largest banks in the U.S., known for its diverse range of financial products and services.

Capital One offers personal and business banking, credit cards, loans, and investment services and operates through an extensive network of branches and ATMs, thereby providing small businesses with comprehensive online and mobile banking solutions.

It provides various financial products tailored to different financial needs, including small business loans, lines of credit, and business credit cards. It also maximizes its innovative approach to banking by allowing businesses to utilize technology to enhance customer experience and streamline financial management.

Conclusion

Choosing the right bank for a small business startup loan in 2024 is crucial for securing the necessary capital to launch and grow your Philippine business. Thankfully, the top banks in the country offer various loan products with competitive terms that meet the diverse needs of budding Filipino entrepreneurs.

So, by carefully analyzing and considering factors such as interest rates, loan amounts, repayment terms, and additional services, you can select a bank that aligns with your business goals and financial needs, as these banks not only provide funding but also offer valuable resources and support to help your business succeed for the long-term.

Frequently Asked Questions (FAQs)

1. Which bank is best for startup business loans?

Determining the best bank for a startup business loan depends on various factors, such as loan amount, business stage, and creditworthiness. However, banks like HDFC Bank, ICICI Bank, and SBI are often considered good options due to their extensive reach, startup-friendly products and services, and competitive interest rates.

2. Which loan is best for starting a new business?

The best loan for starting a new business depends on your specific needs and circumstances, but some standard options include business loans, equipment financing, SBA loans, and lines of credit.

So, when choosing the right loan, it is always a good idea to consider factors like loan amount, interest rates, repayment terms, and eligibility requirements.

3. Which bank is best for small business owners?

The best bank for small business owners depends on their specific financial needs. However, banks like HDFC Bank, ICICI Bank, and SBI in India, or Bank of America and Wells Fargo in the US, are often considered top choices.

4. How do I choose a bank for my startup?

Choosing a bank for your startup involves considering several factors, such as -

- Business needs: Identify your specific banking requirements.

- Fees: Compare account fees, transaction charges, and overdraft fees.

- Online banking: Evaluate the quality of online banking features and mobile apps.

- Customer service: Consider the bank's reputation for customer support.

- Loan options: Research available loan products and interest rates.

- Branch network: Determine the importance of physical branches for your business.

- Additional services: Explore other services like payroll, merchant services, and cash management.