It is no secret that businesses of all sizes face the same crucial task of securing the right type of finance to fuel their business’s growth and operational needs. Fortunately, the financial landscape of the Philippines offers them a wide range of options to choose from.

Today, Filipino entrepreneurs have the option to select the most suitable source of funding for their businesses to achieve their strategic objectives and drive sustainable growth. Each option is designed to cater to specific business requirements, from startup capital to expansion funds and working capital solutions to much more.

So, at the end of the day, it doesn’t really matter whether you're a startup seeking seed capital or an established enterprise aiming for expansion; you must understand all the elements of business finance. Why? Because it is the key to unlocking new opportunities and developing long-term success for you and your business.

So, to help you in your business financing journey, in this article, we will dive deeper into the different types of business financing options available in the Philippines.

Additionally, we will also discuss other alternative financing options such as traditional bank loans, alternative lending solutions, equity financing, and government support programs.

What Are Short-Term, Mid-Term, And Long-Term Financing Options in Philippines - Definition And Different Types

Short-Term Financing

Short-term financing refers to funding solutions that are designed to meet immediate financial needs and are typically repaid within a year. These types of financing are crucial for managing cash flow, covering operational expenses, and addressing unforeseen financial demands.

Short-term financing options provide businesses with the liquidity needed to maintain smooth operations without disrupting long-term financial stability.

Common options for short-term financing in the Philippines include -

1. Business Lines of Credit

A business line of credit provides a flexible financing option that allows businesses to borrow up to a certain limit and only pay interest on the amount borrowed.

This revolving credit line can be used for various short-term needs, such as managing cash flow, purchasing inventory, or covering unexpected expenses. Businesses can draw funds as needed, repay them, and borrow again, offering a continuous source of working capital.

Approval is typically based on creditworthiness and financial health, and it provides a safety net for businesses to handle fluctuating cash flow.

2. Short-Term Loans

Short-term loans are lump-sum loans that businesses must repay within a year. These loans are typically used for immediate financial needs, such as bridging gaps in cash flow, making payroll, or covering temporary operational costs.

The approval process for short-term loans is often quicker than for long-term financing, and the interest rates may be higher due to the shorter repayment period.

On the other hand, repayment schedules can be daily, weekly, or monthly, depending on the lender’s terms and the borrower’s cash flow situation.

3. Trade Credit

Trade credit is an arrangement where suppliers allow businesses to purchase goods or services and pay for them at a later date, usually within 30 to 90 days. This form of financing helps businesses manage cash flow by delaying outlays of cash while still maintaining inventory and operations.

Trade credit terms often include a discount for early payment to encourage prompt settlements. This type of credit is crucial for maintaining relationships with suppliers and ensuring a steady supply chain without causing any immediate financial strain.

4. Invoice Financing

Invoice financing, also known as accounts receivable financing, allows businesses to borrow money against their outstanding invoices.

This option provides immediate cash flow by advancing a percentage of the invoice amount, typically 70-90%, from a lender. Once the customer pays the invoice, the lender releases the remaining balance minus a fee.

This financing option is particularly useful for businesses that have long payment cycles and need to convert receivables into working capital quickly.

5. Merchant Cash Advances (MCA)

Merchant cash advances provide businesses with a lump sum of capital in exchange for a percentage of future credit card sales. They are popular for their ease of access and the rapid disbursement of funds, making them ideal for urgent short-term financial needs.

This financing option is suitable for businesses with consistent credit card transactions, such as retail stores and restaurants. Repayment is directly tied to daily sales, making it a flexible option that adjusts to business performance.

On the flip side, however, MCAs often come with high fees and can be expensive compared to traditional loans.

Also Read: Top Legit Loan Apps for Long-Term Borrowing with Low Interest

Mid-Term Financing

Mid-term financing refers to funding solutions that are designed to meet business needs over a period typically ranging from one to five years. These financing options are ideal for projects and investments that have a medium-term horizon, such as expanding operations, purchasing equipment, or developing new products.

Mid-term financing helps businesses bridge the gap between short-term operational requirements and long-term strategic goals.

Common options for mid-term financing in the Philippines include -

1. Term Loans

Term loans are a common mid-term financing option where businesses borrow a lump sum amount that is repaid over a set period, typically between one to five years. These loans usually come with fixed interest rates, allowing businesses to plan their repayments with predictability.

Term loans can be used for various purposes, such as purchasing equipment, expanding operations, or funding specific projects.

Its application process often involves submitting detailed financial statements and business plans to demonstrate the borrower’s creditworthiness and repayment capacity.

2. Equipment Financing

Equipment financing is specifically designed to help businesses acquire necessary machinery or equipment without having to pay the full cost upfront.

This type of financing allows businesses to spread the cost of expensive equipment over a period of one to five years. The equipment itself often serves as collateral for the loan, which can result in more favorable interest rates and terms.

Equipment financing is particularly beneficial for manufacturing, construction, and other capital-intensive industries that require significant investment in machinery to enhance productivity and operational efficiency.

3. Leasing

Leasing provides an alternative to purchasing equipment outright by allowing businesses to use the equipment in exchange for regular lease payments over a specified term. There are two main types of leases: operating leases and finance leases.

Operating leases are shorter-term and do not transfer ownership of the equipment to the lessee. In contrast, finance leases are longer-term and may include an option to purchase the equipment at the end of the lease period.

Leasing helps businesses manage cash flow by avoiding large upfront costs and offering flexibility in equipment management.

4. Trade Credit

Trade credit is an arrangement where suppliers allow businesses to purchase goods or services and defer payment to a later date, usually within 30 to 90 days. While typically considered a short-term financing option, extended trade credit terms can serve mid-term financial needs.

This type of financing helps businesses manage cash flow by aligning payment schedules with revenue cycles. Moreover, trade credit can also strengthen relationships with suppliers and provide the necessary time to convert inventory into sales before payments are due.

5. Invoice Financing

Invoice financing, also known as accounts receivable financing, allows businesses to borrow money against their outstanding invoices.

This financing option provides immediate cash flow based on the value of invoices issued to customers, typically repaid within a few months to a year.

Invoice financing can be structured as invoice factoring, where the financier purchases the invoices at a discount, or invoice discounting, where the business retains control of the invoices and uses them as collateral.

This type of financing helps businesses bridge gaps in cash flow, especially during periods of rapid growth or seasonal fluctuations.

6. Revolving Credit Facilities

A revolving credit facility is a flexible financing option that provides businesses with access to a predetermined amount of capital, which they can draw upon as needed over a set period, typically one to five years.

In this type of financing option, businesses pay interest only on the amount borrowed, and once the borrowed amount is repaid, it becomes available for future use. This type of financing is ideal for managing working capital, covering unexpected expenses, and supporting ongoing operational needs.

Additionally, revolving credit facilities offer flexibility and quick access to funds without the need for multiple loan applications.

Also Read: 6 Things You Need for Small Business Loan Requirements

Long-Term Financing

Long-term financing refers to funding solutions designed to support significant investments and projects that span more than five years. These financing options are essential for substantial capital expenditures, such as purchasing real estate, large-scale infrastructure projects, and comprehensive business expansions.

Long-term financing enables businesses to undertake transformative initiatives that drive sustained growth and competitiveness.

Common options of long term financing in the Philippines include -

1. Long-Term Loans

Long-term loans are a common financing option offered by banks and financial institutions, typically with repayment periods extending beyond five years. These loans are suitable for significant capital investments such as real estate purchases, large-scale equipment, and business expansions.

Long-term loans can come with fixed or variable interest rates, and the repayment schedule usually involves monthly or quarterly installments over the life of the loan.

The collateral for these loans often includes the assets purchased with the loan proceeds or other substantial business assets. Borrowers benefit from predictable repayment terms and the ability to spread the cost of large investments over a longer period.

2. Bonds

Issuing bonds is a way for businesses to raise capital by borrowing from investors. Bonds are debt securities that obligate the issuer to pay back the principal amount along with periodic interest payments over a specified period.

In the Philippines, businesses, particularly large corporations and government entities, issue bonds to finance long-term projects. Bonds can be classified into various types, such as corporate bonds, municipal bonds, and government bonds, each with different risk profiles and interest rates.

The advantage of bonds is that they often provide lower interest rates than conventional loans, and they allow issuers to access a broad investor base. However, issuing bonds requires a solid credit rating and may involve significant regulatory compliance with concerned authorities.

3. Equity Financing

Equity financing involves raising capital by selling shares of the company to investors. This method provides long-term funding without the obligation of repaying a loan. In exchange for their investment, investors receive ownership stakes in the company, which can lead to profit-sharing through dividends and potential capital gains if the company grows.

In the Philippines, businesses can raise equity through private placements, initial public offerings (IPOs), or venture capital.

Equity financing is particularly beneficial for businesses because it does not require regular interest payments or principal repayment, thus reducing their overall financial strain. On the downside, however, it dilutes ownership and control as new shareholders gain voting rights and influence over company decisions.

4. Lease Financing

Lease financing involves acquiring the use of assets through leasing rather than purchasing them outright. Long-term leases, such as capital leases or finance leases, allow businesses to use assets like machinery, equipment, or real estate while paying for their use over an extended period.

Lease financing can be extremely advantageous for Filipino entrepreneurs and businesses as it preserves cash flow, provides tax benefits, and often requires lower initial costs compared to buying.

In the Philippines in particular, lease financing is a viable option for businesses needing access to expensive equipment without the burden of large upfront payments. However, long-term lease agreements can be quite complex and may carry higher overall costs compared to outright purchases.

5. Development Bank Loans

Development banks, such as the Development Bank of the Philippines (DBP) and the Land Bank of the Philippines (LBP), offer long-term financing solutions specifically aimed at supporting the economic development and growth of businesses in the Philippines.

These banks provide loans for infrastructure projects, agricultural development, renewable energy projects, and other initiatives that contribute to national development goals.

Development bank loans often come with favorable terms, such as lower interest rates and extended repayment periods, making them one of the most attractive options for businesses involved in strategic sectors.

Also Read: Differences and Types of Commercial and Business Loans

Don’t wait for opportunities to pass by. Unlock Quick Funding for Your Philippine SME! Apply for N90’s fast financing solutions and get the funds you need in no time. Explore Today!

Alternative Financing Options Available in The Philippines

Traditional bank loans are no longer the sole avenue for securing business capital in the Philippines for Filipino entrepreneurs, as small businesses and entrepreneurs now have access to a wide selection of alternative financing options. These options provide them with flexible, quick, and innovative solutions tailored to meet their unique needs.

These non-traditional funding sources are reshaping the way businesses manage their finances, offering viable alternatives that address the limitations and challenges of conventional banking.

From peer-to-peer lending and microfinance to crowdfunding and venture capital, alternative financing options empower businesses to access the capital required to grow, innovate, and compete in a dynamic market.

Here, take a look at the various alternative financing avenues available in the Philippines that businesses can utilize to achieve their financial goals and drive long-term success -

1. Crowdfunding

Crowdfunding allows businesses to raise capital from a large number of people, typically via online platforms. There are different types of crowdfunding, such as reward-based, equity-based, and donation-based.

Reward-based crowdfunding offers backers a product or service in return for their investment, while equity-based crowdfunding gives investors shares in the company.

Platforms like The Spark Project and Spark! Philippines are popular options available in the Philippines that enable Filipino entrepreneurs to gather funds from broad audiences.

2. Peer-to-Peer (P2P) Lending

P2P lending platforms connect borrowers directly with individual lenders, completely bypassing traditional financial institutions in the process. These platforms, such as Kiva Philippines and Lenndo, offer more flexible terms and quicker access to funds compared to traditional loans.

Borrowers benefit immensely from its streamlined application process and also the ability to secure loans based on their creditworthiness and business potential rather than according to strict and rigid banking criteria.

3. Microfinance

Microfinance institutions provide small loans and financial services to underserved and low-income Filipino entrepreneurs.

Organizations like ASA Philippines Foundation and CARD MRI focus on promoting financial inclusion by offering loans, savings accounts, and insurance products to small businesses and individuals who lack access to traditional banking services.

These microloans help entrepreneurs start or expand their businesses and develop financial growth at the grassroots level.

4. Invoice Financing

Invoice financing allows businesses to borrow money against their outstanding invoices. This option provides immediate cash flow by advancing funds based on unpaid invoices, helping businesses manage their working capital more effectively.

Companies like First Circle offer invoice financing solutions in the Philippines, enabling businesses to access funds without waiting for their clients to pay.

5. Merchant Cash Advances (MCA)

Merchant cash advances provide businesses with a lump sum of capital in exchange for a percentage of future credit card sales. This financing option is suitable for businesses with steady credit card transactions, offering quick access to funds and flexible repayment terms tied to daily sales.

MCAs are immensely advantageous for businesses needing immediate capital without the constraints of fixed repayment schedules.

6. Business Lines of Credit

A business line of credit offers flexible access to funds up to a predetermined limit, allowing businesses to draw and repay as needed. This revolving credit facility helps manage short-term financial needs, such as inventory purchases or unexpected expenses.

Banks and financial institutions in the Philippines, such as BPI and Metrobank, offer business lines of credit tailored to the needs of Philippine SMEs.

7. Equity Financing

Equity financing involves raising capital by selling shares of the company to investors. This method provides long-term funding without the obligation of repaying a loan.

In exchange for their investment, investors receive ownership stakes in the company, which can lead to profit-sharing through dividends and potential capital gains.

In the Philippines, in particular, businesses can raise equity through private placements, initial public offerings (IPOs), or venture capital firms like Kickstart Ventures and IdeaSpace.

8. Venture Capital

Venture capital firms provide funding to startups and early-stage companies with high growth potential. In exchange for equity, VC firms offer capital, strategic guidance, and networking opportunities.

Firms like Kickstart Ventures and IdeaSpace are active in the Philippines, supporting innovative startups and helping them scale their operations.

9. Government Grants and Programs

The Philippine government offers various grants and funding programs to support small businesses and startups. Programs like the Department of Trade and Industry's (DTI) Pondo sa Pagbabago at Pag-asenso (P3) and the Small Business Corporation's (SB Corp) financing programs provide financial assistance, training, and support to entrepreneurs.

The primary motive of these initiatives is to encourage and facilitate economic development and innovation by providing accessible funding to businesses located all across the country.

Also Read: Finding Low-Interest Business Loans in the Philippines

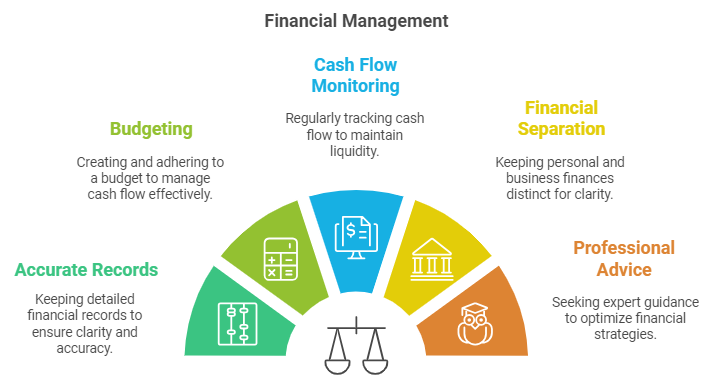

Tips To Manage Business Finances in The Philippines - Key Points To Remember

Effective financial management is crucial for the success and sustainability of any business, and it is even more evident in the Philippines.

Here, the business landscape is both vibrant and challenging, but the crucial difference between a thriving business and one that is merely surviving comes all the way down to how efficiently they manage their finances.

Whether you're a startup entrepreneur or a seasoned business owner, understanding the intricate do’s and don’ts of financial management can help you not only navigate through the numerous challenging economic fluctuations but also allow and enable you to seize growth opportunities to ensure your business’s long-term stability.

To aptly prepare you for this entrepreneurial journey, in this article, we will provide essential tips for managing business finances in the Philippines, that every business in the Philippines should remember.

From maintaining accurate records and budgeting wisely to leveraging technology and understanding local regulations, these strategies will equip you with the tools needed to make the right financial decisions for your business.

1. Maintain Accurate Financial Records

Keep detailed and accurate financial records for effective business management, and use accounting software to track income, expenses, and cash flow.

It is also a good habit to regularly update your records to ensure you have a clear picture of your financial health, which will help you make the right financial decisions, especially when preparing for the tax season.

2. Create and Stick to a Budget

Develop a comprehensive budget to help plan for future expenses and manage cash flow by outlining your expected income and expenses. This will help you monitor your budget regularly to stay on track.

Additionally, adjust your budget as needed to reflect changes in your business environment or financial status.

3. Monitor Cash Flow Diligently

Always ensure that you have enough cash on hand to cover expenses by monitoring your cash flow regularly.

Use cash flow forecasts to anticipate shortages and take proactive measures, such as securing a line of credit or adjusting payment terms with suppliers.

4. Separate Personal and Business Finances

Mixing personal and business finances can lead to confusion and complicate financial management, so open a separate business bank account and use it exclusively for business transactions.

This separation simplifies accounting, improves financial transparency, and helps protect your assets.

5. Understand Local Tax Obligations

Complying with local tax laws is essential to avoid penalties and legal issues, so always stay informed about the tax regulations in the Philippines, including value-added tax (VAT), income tax, and other business-related taxes.

Moreover, consider consulting with a tax professional to ensure that you are complying with all rules and regulations, which will help you in optimizing your long-term tax strategy.

4. Leverage Technology

Utilize technologically advanced financial management tools and software to streamline your accounting processes. Tools like QuickBooks, Xero, and Wave can automate processes like invoicing, payroll, and expense tracking, thereby saving you precious time and reducing the risk of fatal financial errors from occurring.

5. Maintain an Emergency Fund

Setting aside an emergency fund can help your business weather unexpected financial challenges, so it is always a good idea to save enough to cover at least three to six months of operating expenses.

This financial cushion can provide stability during economic downturns or unforeseen events.

6. Regularly Review Financial Performance

Conduct regular financial reviews to assess your business’s performance by analyzing key financial statements, such as the income statement, balance sheet, and cash flow statement, to identify popular trends and potential areas for improvement.

Regular reviews like these enable you to make strategic adjustments whenever necessary and stay aligned with your business goals.

7. Seek Professional Advice

Don't hesitate to seek advice from financial professionals, such as accountants, financial advisors, or business consultants, as their expertise can provide valuable insights into optimizing your financial management practices, improving profitability, and achieving long-term success.

8. Plan for Growth

Develop a financial strategy that includes plans for business growth and expansion by considering potential funding sources, such as reinvesting profits, securing loans, or seeking investors. A well-thought-out growth plan ensures you have the resources needed to seize business opportunities and scale your business effectively.

Conclusion

The landscape of business finance in the Philippines offers a wide range of options to cater to the varying needs and stages of a company, all the way from short-term cash flow management strategies to long-term expansion opportunities.

This is the reason why Filipino entrepreneurs need to understand these diverse financing options carefully, as they could potentially be crucial for the long-term financial success of their Philippine businesses.

Traditional bank loans, while still relevant, have been complemented by a surge in alternative financing sources like crowdfunding, peer-to-peer lending, and invoice factoring.

Each of these options comes with its very own set of advantages and disadvantages, including factors such as interest rates, repayment terms, and the degree of ownership dilution.

To reach the best outcome, Filipino entrepreneurs need to carefully evaluate their business’s objectives, financial health, and risk tolerance capacity and select the most suitable financing approach for their businesses.

A balanced combination of debt and equity financing, coupled with effective financial management, can propel a business toward sustainable growth and profitability, so effective research and planning is mandatory.

Frequently Asked Questions (FAQs)

1. What are the different types of business finance?

Business finance primarily comprises two main types -

- Debt financing: This involves borrowing money that must be repaid with interest. This includes bank loans, bonds, and other forms of credit.

- Equity financing: Raising capital by selling ownership shares in the company. This can involve issuing shares to investors, venture capital, or crowdfunding.

2. What are the 8 sources of business finance in the Philippines?

The 8 sources of business financing in the Philippines include -

- Retained earnings

- Equity financing

- Debt financing (loans, debentures)

- Trade credit

- Commercial paper

- Public deposits

- Financial institutions

- Venture capital

3. What is the concept of business finance?

The main concept of business finance in the Philippines is to effectively manage a company's financial resources to achieve its objectives.

This involves acquiring funds through various sources like loans, investments, or retained earnings, allocating these funds efficiently, and making sound financial decisions to maximize profitability and minimize risk.

It also involves financial planning, analysis, and control to ensure the business's long-term financial health and sustainability.

4. What is the nature and scope of business finance in the Philippines?

Business finance in the Philippines involves the management of a company's financial resources to achieve its objectives. This process involves acquiring funds, allocating them efficiently, and making sound investment decisions.

The scope of business finance is to cover aspects like financial planning, analysis, and control, including essential activities like budgeting, forecasting, cash flow management, and risk assessment.

In essence, business finance aims to optimize the company's financial performance to ensure its long-term success and economic sustainability.