Small business owners in the Philippines often struggle to maintain a steady cash flow to keep operations running smoothly. Fortunately, cash flow loans offer a critical lifeline by providing quick and flexible funding when needed.

Hence, to help Philippine businesses make the right financial choices, this blog will explore the fundamentals of cash flow loans, explaining how they work, when to use them, and what you need to qualify for.

Additionally, we'll also explore the advantages and disadvantages of other financing options and the different types available to find the best fit for your business needs. So, without further ado, let us get started.

What is a Cash Flow Loan?

A cash flow loan is a type of financing that allows businesses to borrow money based on their anticipated future cash flows. Unlike traditional loans that often require physical assets as collateral, such as real estate or equipment, cash flow loans are typically unsecured.

Critical Uses of Cash Flow Loans For Small Businesses in The Philippines

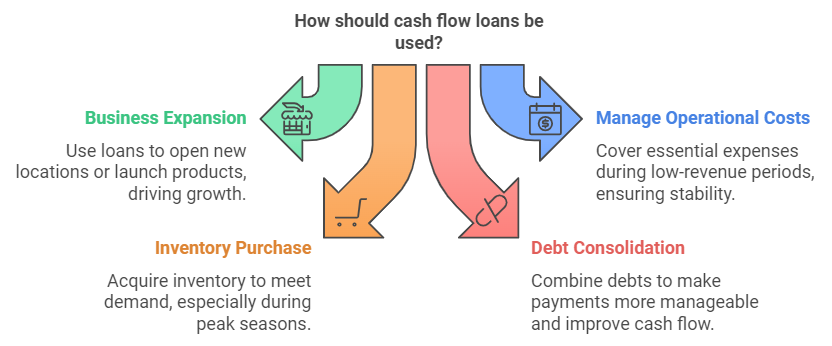

Cash flow loans are versatile and can be employed for various business needs, especially those that require a quick infusion of capital.

Here are some common uses of cash flow loans for businesses in the Philippines -

1. Business Expansion

Cash flow loans are commonly used to expand operations, open new locations, or launch new products.

2. Managing Operational Costs

These loans help businesses cover day-to-day expenses like payroll, rent, and utility bills during low-revenue periods.

3. Inventory Purchase

Businesses can use cash flow loans to purchase inventory, especially during peak seasons, or to meet large orders.

4. Debt Consolidation

Cash flow loans help consolidate existing debts, make payments more manageable, and improve cash flow.

5. Marketing and Advertising

Businesses often use these loans to invest in marketing campaigns that drive growth and increase revenue.

Also Read: Startup Funding and Angel Investors in the Philippines

How Do Cash Flow Loans Work in The Philippines

Cash flow loans operate on a unique premise compared to traditional loans: instead of focusing heavily on credit scores or collateral, they emphasize your business’s revenue streams and financial health.

Here's how they typically work in the Philippines -

1. Application Process

Businesses apply by submitting financial records, such as bank statements and cash flow reports, for lender evaluation.

2. Approval Based on Cash Flow

The lender assesses the business's cash flow to determine its ability to repay the loan, focusing on revenue and expenses rather than assets.

3. Loan Disbursement

Once approved, the loan amount is disbursed, which can be used for operational costs, debt consolidation, expansion, or other needs.

4. Repayment

Repayments are made over time, usually through monthly installments, and can be flexible depending on the lender and the business's cash flow stability.

Cash flow loans are ideal for businesses with steady revenue streams but limited assets for traditional collateral-based loans.

Are you still unclear about how cash flow works and what it encompasses? Check out this Reddit post. Here, you’ll get great insight into what cash flow and cash flow lending is, as well as what cash flow underwriting is all about.

Also Read: Applying for a Safe and Legit Personal Loan Online in the Philippines

When to Use a Cash Flow Loan in The Philippines

Cash flow loans can be essential for small businesses. Here are scenarios where they are beneficial -

1. Avoid Using Working Capital for Growth Initiatives

Using readily available working capital to fund long-term growth initiatives is tempting, but this might not be the best financial strategy. Cash flow loans generally come with higher interest rates and are best suited for short to medium-term needs, not long-term investments.

It’s often better to look into traditional loans that offer more favorable terms for growth initiatives.

2. Positive Cash Flow but Near Credit Limit

Picture this: your business generates positive cash flow but is perilously close to hitting its credit limit. In such cases, a cash flow loan can provide the required working capital to manage immediate expenses without maxing out your credit cards or lines of credit.

This lets you maintain a healthy credit profile while ensuring you have funds for day-to-day operations.

3. Rapid Growth or New Product Development

Periods of rapid growth or introducing new products bring financial needs that can strain your resources. Whether hiring new staff, ramping up production, or investing in marketing, a cash flow loan can bridge the economic gap.

For instance, launching a new product line could come with costs that a quick injection of funds can efficiently cover, helping you stay on course with your growth plans.

4. Taking Advantage of Supplier Discounts

Suppliers often offer significant discounts for bulk purchases, but taking advantage of these deals requires upfront capital. A cash flow loan can enable you to secure these discounts even if your current cash reserves are insufficient. Securing a significant discount on bulk purchases can justify the loan cost.

5. Buying Inventory to Meet Demand Spikes

A cash flow loan can help purchase inventory during seasonal spikes or unexpected demand surges. This strategy ensures that you capitalize on sales opportunities and maintain customer satisfaction by not running out of stock when it matters most.

6. Customers Delaying Invoice Payments

Delayed invoice payments can create a disruptive cash flow gap. Cash flow loans can bridge these gaps, ensuring uninterrupted operations. Invoice factoring, where you receive a portion of the invoice value upfront, is another valuable type of cash flow loan to consider in such scenarios.

Also Read: Exploring Microfinance: Definition, Purpose, and Examples

What Do You Need To Qualify For a Cash Flow Loan in The Philippines

When it comes to qualifying for a cash flow loan, lenders dive deep into various aspects of your business. Here’s what they look for and why it matters -

1. Stable Cash Flow

Lenders require proof of consistent business cash flow through bank statements or financial records to assess the company’s ability to repay the loan.

2. Business Operating History

Most lenders prefer businesses with a track record of at least 2 years of successful operations.

3. Good Credit Score

A solid credit score (either personal or business) helps in securing better loan terms and approval.

4. Financial Documents

Businesses must provide financial documents such as balance sheets, profit and loss statements, and tax returns.

5. Legal Business Registration

To demonstrate legitimacy, proof of business registration and compliance with government regulations is required.

Also Read: Successful Managed Funds and Investments in the Philippines

Don’t let cash flow slow you down. Apply for N90’s fast financing solutions and propel your Philippine SME forward! Get potential loan approvals within 24 hours to accelerate your business’s growth promptly. Contact us to learn more.

Advantages and Disadvantages of Cash Flow Loans in The Philippines

It is crucial to weigh the pros and cons when considering whether to take a cash flow loan. Understanding both sides can help you make an informed decision that aligns with your business's needs.

Here, take a look at the potential advantages and possible disadvantages of availing cash flow loans in the Philippines -

Advantages of Cash Flow Loans

1. Easier Qualification

Cash flow loans are often easier to qualify for compared to traditional loans. They focus on your business’s future cash flow projections rather than a lengthy financial history or high credit score. This is particularly helpful for newer businesses or those with limited credit.

2. Less Stringent Credit Checks

These loans don't rely heavily on credit scores. Lenders prioritize potential future earnings, making cash flow loans accessible to businesses with lower credit ratings. A better credit score might still secure you better terms, but it’s not a rigid requirement.

3. Fast Access to Funds

One key advantage is the speed of access to funds. Lenders can approve applications quickly, sometimes in as little as five minutes, and disburse funds within 1-3 business days or even the same day. This rapid access can be crucial for urgent financial needs.

4. No Collateral Required

Most cash flow loans are unsecured, meaning no physical assets are needed as collateral. This benefits small businesses or startups that may not have substantial assets and reduces the risk of high-value assets.

Disadvantages of Cash Flow Loans

1. Higher Interest Rates

The ease of getting a cash flow loan comes with higher interest rates than traditional options. Since these loans are based on projected earnings, lenders take on more risk, which they offset with higher rates, often ranging from 11.9% to 90%.

2. Additional Fees

Cash flow loans can come with various fees, such as high origination fees and penalties for late payments. These can add up, increasing the total cost of the loan. It's crucial to understand all associated costs before committing.

3. Potential Personal Guarantees

Even though these loans don't require physical collateral, lenders might ask for a personal guarantee from the business owner. If your business defaults, you could be personally responsible for repaying the loan, adding a level of personal risk.

4. Automatic Payment Requirements

Many cash flow loans require automatic payments. This could be a problem for businesses with irregular cash flows. If you don’t maintain enough balance to cover costs, you might incur extra fees, potentially harming your credit score.

Also Read: Top Venture Capital Firms in The Philippines in 2024

Cash Flow Loans vs. Other Financing Options - A Brief Comparison

When considering financing options for your small business, it's crucial to understand the differences between cash flow loans, asset-based lending, and working capital loans. Each has its unique features, benefits, and risks.

Here, take a look at how cash flow loans compare to other prominent financing options available in the Philippines -

1. Collateral Requirements

Cash Flow Loans do not require physical collateral, making them more accessible for businesses that lack significant assets. The approval is based on projected cash flow, allowing companies to secure funds based on their revenue generation potential.

In contrast, traditional loans, such as secured business loans, typically require substantial collateral, such as property or equipment, which can be a barrier for smaller or newer businesses.

2. Approval Speed

Cash Flow Loans are usually approved faster than other financing options. Lenders can assess applications more quickly since they rely on cash flow and revenue projections rather than asset valuation.

Conversely, secured loans and other traditional financing options often involve longer approval processes due to the need for collateral appraisals and extensive credit evaluations.

3. Loan Terms and Flexibility

Cash Flow Loans tend to offer more flexible repayment terms, often aligned with a business’s revenue cycle. This flexibility helps companies to manage repayments during fluctuating income periods.

In contrast, traditional loans may have more rigid terms, with fixed monthly payments, which could strain cash flow, especially for businesses with seasonal revenue variations.

4. Interest Rates

Cash Flow Loans typically have higher interest rates than secured loans. Since lenders assume more risk without collateral, they offset this by charging higher rates.

In comparison, secured loans generally offer lower interest rates as the risk is minimized by the collateral provided, making them more cost-effective for businesses with the necessary assets.

5. Use Cases

Cash Flow Loans are ideal for covering operational costs, managing seasonal revenue gaps, or supporting short-term growth needs like purchasing inventory or expanding operations.

In contrast, term loans or equipment financing are better suited for long-term investments, such as buying machinery or real estate, where businesses need extended repayment periods and lower interest rates.

Also Read: Getting a Loan Using Land as Collateral in the Philippines

Types of Cash Flow Loans Available in The Philippines

Understanding the various types of cash flow loans available can help you determine which one best suits your business needs.

Here are some of the most common types available in the Philippines -

1. Invoice Factoring

Invoice factoring involves selling your unpaid invoices to a factoring company for immediate cash. This process frees up capital tied up in those invoices, allowing you to meet immediate financial needs.

Typically, you receive 70% to 90% of the invoice’s value upfront. When your customer pays the invoice, the factoring company forwards you the balance minus their fees, which range between 1% and 5%.

2. Merchant Cash Advance

A Merchant Cash Advance (MCA) offers an upfront sum of money against your future sales, particularly credit card transactions. The MCA provider assesses your past sales to determine the advance amount and then regularly deducts sales from your account to repay the advance and any fees.

MCAs offer quick cash access and are relatively easy to qualify for, but they can be expensive, and the automatic deductions can strain cash flow during slow sales periods.

3. Revolving Credit Facility

A revolving credit facility functions similarly to a line of credit. Here, businesses are approved for a maximum credit limit and can draw and repay funds as needed, and lenders charge interest only on the amount you borrow, not the total limit, offering flexibility in managing cash flow.

This option can be handy for businesses with fluctuating revenue streams, allowing them to access funds during lean periods and repay when sales improve.

4. Unsecured Business Loans

Unsecured business loans provide short-term financing without requiring collateral. They are ideal for businesses with solid credit but limited assets, and they have a quick application process and fixed repayments. However, these loans often come with higher interest rates due to the lack of collateral.

5. Term Loans

Term loans offer a lump sum that is repaid in regular installments over a set period, usually up to 24 months. This structured repayment schedule provides predictability, which can be valuable for planning. Term loans can fund equipment purchases and business expansion.

6. Lines of Credit

A line of credit operates as a revolving credit option where funds can be drawn as needed and repaid as the business generates cash. This flexibility makes it ideal for ongoing operational needs.

Interest is only paid on the amount borrowed, not the total credit limit, providing cost efficiency.

7. Invoice Financing

Similar to invoice factoring, invoice financing involves borrowing against outstanding invoices. Unlike factoring, you retain control over the invoices and continue to manage customer payments.

This option also provides quick access to cash but still requires you to manage the administrative aspects of accounts receivable.

8. Revenue-Based Financing

In revenue-based financing, repayments are based on your monthly revenue. This structure offers flexibility, as the repayment amount adjusts in line with your revenue, making it easier to manage during slower periods.

This type of financing does not typically require collateral but may be more expensive due to the increased risk to the lender.

Conclusion

Cash flow loans can be a real lifeline for small businesses. They're fast and flexible, which makes them perfect for situations where you need money quickly. Cash flow loans help seize opportunities, manage seasonal variances, or cover unexpected bills.

However, just like with any loan, thinking things through first is essential. Make sure you understand your business's financial situation inside and out. Look at your cash flow projections, read the terms and conditions of different loans carefully, and ensure you can handle the repayments without risking your business.

Moreover, finding the right loan isn't just about solving the problem you have today. It's also about ensuring your business is set up for long-term success. Take the time to compare lenders, explore different loan options, and understand what taking on this debt means for your future.

Frequently Asked Questions (FAQs)

1. How much cash flow is suitable for a small business?

A cash flow ratio of 1.5 or higher is often considered healthy, indicating strong liquidity and financial stability.

A small business's cash flow depends on its industry, size, and growth stage, but generally, a positive cash flow is essential. Ideally, your company should generate more cash inflow than outflow to cover operating expenses, investments, and unexpected costs.

2. How do you calculate cash flow for a business loan?

To calculate cash flow for a business loan, subtract operating expenses from total revenue. Use the formula: Cash Flow = Net Income + Depreciation/Amortization + Changes in Working Capital.

This figure shows your business's available cash for loan repayment. Lenders use this to assess your ability to handle monthly loan payments, ensuring the company can cover both operational costs and debt obligations.

3. Why do small businesses commonly struggle with cash flow?

Small businesses often struggle with cash flow due to delayed customer payments, seasonal fluctuations in revenue, and unforeseen expenses. Inconsistent cash inflows make it challenging to cover operating costs, such as payroll and rent.

Also, poor financial management, lack of forecasting, and insufficient working capital can exacerbate cash flow issues, leading to payment delays and difficulty meeting obligations.

4. How to analyze the cash flow of a business?

Review your cash flow statement to analyze cash flow, which tracks inflows and outflows from operating, investing, and financing activities. Focus on net cash flow to ensure positive cash generation.

Moreover, compare inflows (sales, investments) and outflows (expenses, debt payments) to identify trends. Use metrics like the cash flow ratio or free cash flow to assess liquidity, operational efficiency, and overall financial health.